AI In Medical Writing Market Size Analysis:

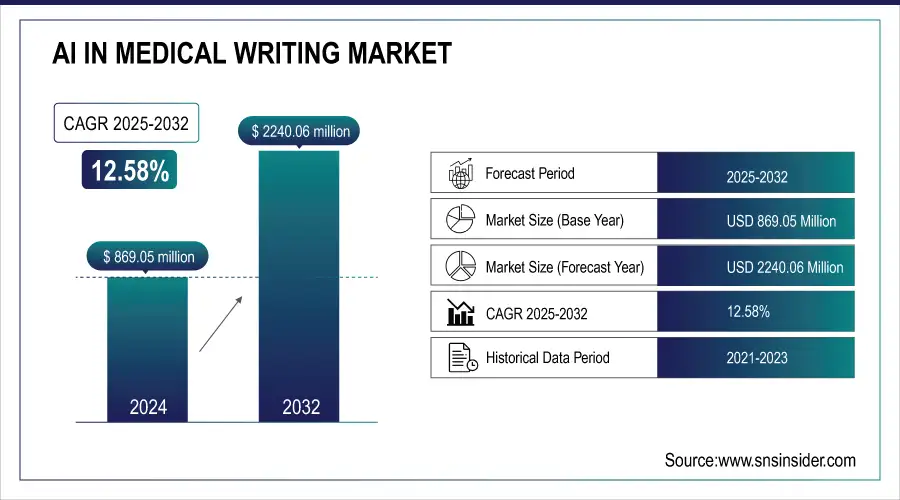

The AI In Medical Writing Market size was valued at USD 869.05 million in 2024 and is expected to reach USD 2240.06 million by 2032, growing at a CAGR of 12.58% over 2025-2032.

The AI in medical writing market trends include gaining traction due to the growing number of clinical trials globally, the increasing number of regulatory documents, and increased R&D spending in the pharmaceutical and biotechnology industries. AI technologies form the basis of interesting solutions, such as natural language processing (NLP), machine learning (ML), and generative AI, which are transforming the way clinical study reports, regulatory submissions, and scientific articles are authored.

To Get more information on AI In Medical Writing Market - Request Free Sample Report

In April 2025, Indegene augmented its AI technology with a proprietary generative AI platform for regulatory writing, which integrates real-time compliance checks and format uniformity into the solution.

With the pharmaceutical industry still spending tens of billions of dollars per year, more than USD 244 billion globally in 2024, according to Evaluate Pharma on drug discovery and clinical development, the amount of documentation generated in this area is increasing exponentially, and demand for effective AI-based writing solutions is increasing accordingly. Authorities are now recognizing structured AI-assisted documents for quicker approvals, enabling an easy and automated compliance process.

In addition, a lack of quality medical writers and the expense and time of manual documentation have led pharma and biotech companies to increasingly turn to AI platforms. AI in medical writing companies are also focusing on technological advancements, inorganic strategies, developments, and business operations toward the global AI in medical writing market share. Increasing research and development (R&D) activities, technological advancements in AI in the medical writing field, and new product launches are contributing to the future AI in medical writing market trends. The market is spurred by accuracy, speed, scalability, and compliance, which continue to drive its growth.

In May 2025, the primary end-point was met with the introduction by Parexel of an AI-driven clinical documentation suite that automates the generation of patient narratives and CSRs and reduces the time required for documentation by 40%.

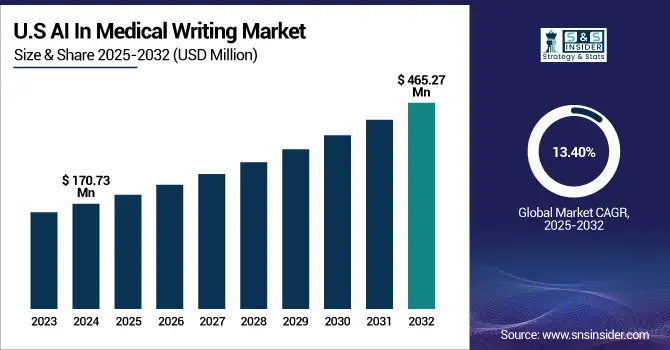

The U.S. AI in medical writing market size was valued at USD 170.73 million in 2024 and is expected to reach USD 465.27 million by 2032, growing at a CAGR of 13.40% over 2025-2032.

| Year | Key Innovation | Impact |

|---|---|---|

| 2021 | Introduction of NLP-based summarisation | Faster clinical report generation |

| 2023 | Integration with EHR systems | Real-time data access for writers |

| 2025 | Generative AI platforms (e.g., GPT-style) | Full draft automation of safety docs |

| 2027 (est.) | AI regulation by global health authorities | Streamlined cross-border compliance |

| 2030 (est.) | Autonomous report writing with/ minimal input | 70% reduction in production time |

AI In Medical Writing Market Dynamics:

Drivers:

-

Rising Demand for Automation, Regulatory Compliance, and Growing R&D Burden Propel Market Growth

The AI in medical writing market is largely driven by the growing need for the automation of scientific and clinical documentation and an increasing emphasis on the creation of high-quality medical documents in the pharmaceutical and biotechnology industry. The need to analyze thousands of pages of regulatory and clinical documentation per trial has led to an increased demand for AI-driven solutions.

Drug development costs on average over USD 2.6 billion, and documentation is a significant portion of both time and cost. Content creation time can be cut by 40% with AI-enabled platforms, accuracy is improved, and the platform supports compliance with highly complex regulatory standards, including ICH E3 and PMDA’s eCTD guidance specification are all factors which are contributing to the growth of the AI in medical writing market. The fusion of NLP and ML in writing processes is also enhancing consistency and data auditability.

Tech players and CROs are spending big, north of USD 4 billion in AI healthcare tools in 2024, on solutions that simplify protocol writing, investigator brochures, and CSR generation. Moreover, increasing preference for real-time analytics and AI-based editing solutions by AI in medical writing industry players, including BioLamina and HealthVerity, further contributes to the AI in medical writing market share. Such a high demand, investment, and regulatory needs, in turn, generate an increasing demand for the global AI in medical writing market.

Restraints:

-

Data Privacy Concerns, Validation Complexities, and Skill Gaps Hindering Market Expansion

The AI in medical writing market analysis is emerging, though it is hindered by macro-socio-economic factors, such as stringent data privacy laws, a lack of human supervision, and verification issues of AI-composed content. AI platforms heavily depend on large sets of data (such as patient files, trial results), and therefore, data protection becomes a major concern, especially when placed under global regulations like GDPR, HIPAA, and 21 CFR part 11. Such laws regulate strict data security control and have made it challenging for AI in medical writing companies to use scalable models without non-compliant risks.

In addition, AI-model outputs are typically unable to be easily interpreted and require extensive quality assurance before they can be considered for use in the regulatory filings, thereby delaying integration. More than 65% of clinical trial organizations highlighted a shortage of skills and training as one of the main problems in implementing AI, according to a 2024 study by McKinsey. There is also a lot of trepidation around AI replacing the subtlety of human medical writers, especially in difficult therapeutic areas.

The AI in medical writing market analysis also indicates a lack of medical professionals’ literacy in AI, which acts as a barrier to a wide deployment. Rising investment costs for initial investments for AI platforms and training of models, along with the absence of standardised validation frameworks, are a few of the factors that further impede the AI in medical writing market growth. These reasons combine to hinder the scale of the global AI in medical writing market despite its promise and potential.

AI In Medical Writing Market Segmentation Insights:

By Type

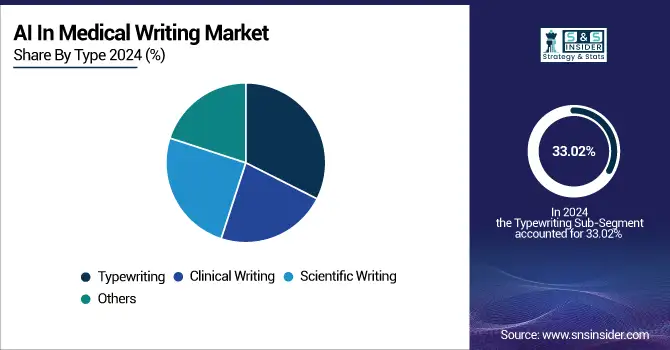

The typewriting type was the segment that covered the largest share of revenue, with 33.02% of the AI in medical writing market in 2024. This popularity is a consequence of the popular contemporary usage of AI-infused tools for the conversion of medical notes, reports, and other forms of documentation from voice to text, contributing towards the increased productivity and reduced manual labor in clinical settings. Healthcare SMEs and practitioners are also more commonly using typewriting systems that make use of AI, such as intelligent typewriting tools to ensure rapid TATs and more accurate documentation.

The clinical writing segment, however, is projected to register the highest CAGR owing to mounting complexity in clinical trials and increasing demand for AI-based support to develop clinical study reports (CSRs), investigator brochures, and patient narratives. This growth in automation is being driven by the use of AI tools in CROs and life sciences companies to create clinical content, as they improve consistency and adherence to regulatory requirements.

By End-Use

The pharmaceutical end-user type was the leading revenue-generating segment, accounting for 33.37% share in the AI in medical writing market in 2024, led by the high volume of regulatory submissions, labelling documents, and scientific publications in the industry. Pharma companies are increasingly implementing AI solutions to cope with the growing volume of documentation in drug development, from discovery to post-market surveillance.

In contrast, the medical devices segment is expected to experience the most rapid growth due to a rise in product innovations and global regulations that require accurate and timely technical documentation. AI is now used to create more efficient regulatory writing, particularly post-market surveillance reports, for medical device manufacturers who need to maintain both compliance and competitiveness in a changing world.

AI In Medical Writing Market Regional Analysis:

The Asia Pacific AI in medical writing market was the global market leader, in terms of revenue share, capturing close to 30.47% of the share in 2024, owing to rising clinical trial activity, higher outsourcing from the Western part of the globe and rapid implementation of AI solutions by regional pharmaceutical and biotechnology companies. The area has access to a rich pool of talented medical professionals and inexpensive AI development centres. India leads the game in this with a robust community of CROs and a growing number of AI healthcare startups, due to state-led digital health programmes. China also learnt from its near-total seizure of the SARS-CoV-2 market globally, due to massive investment in AI infrastructure and the large-scale expansion of its pharma sector. The rapidly growing APAC is experiencing increasing demand for AI-powered documentation tools, due to a rise in life sciences research, multilingual writing ability, and digitised healthcare systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North America AI in medical writing market size is growing substantially on account of excellent healthcare infrastructure, large AI R&D funding and adoption by leading pharmaceutical companies.

The U.S. accounts for the largest share of the regional market on the back of high R&D spending, more than USD 86 billion in biopharma R&D in 2024, and the presence of prominent AI in medical writing industry players, such as IBM Watson Health and Oracle Health Sciences. Regulatory leeway from organizations, including the FDA, for instance, which supports the integration of AI into clinical documentation, is another important ingredient. Canada is fast becoming a hub as it invests in AI ethics and regulatory tech standards. North America is second globally in growth because it has a mature market, regulatory frameworks, and a robust innovation pipeline.

Europe is growing at a steady pace in the AI in medical writing market, and the increasing adoption in pharmaceutical and academic research organizations is driving the market growth. The area benefits from pan-EU digital healthcare programmes and a solid clinical research infrastructure. The European market is led by Germany owing to the country's superior pharma manufacturing sector and growing AI usage in regulatory and scientific documentation. The U.K. is also noteworthy for the uptake of AI tools in the context of NHS-led research projects and clinical trials. Growth in Europe is driven by high EMA compliance and AI startups partnering with CROs on the rise. The next is the emphasis on multilingual AI, which also makes them more acceptable across the continent.

| Region | Adoption Level (2024) | Growth Status | Leading Country | Notes |

|---|---|---|---|---|

| North America | High | Moderate | United States | Strong pharma sector, early AI integration |

| Europe | Medium-High | High | UK & Germany | Regulatory alignment + AI R&D funding |

| Asia Pacific | High | Very High | China, India, Japan | Digital infrastructure and pharma expansion |

| Latin America | Moderate | Emerging | Brazil | Growing interest in bilingual documentation |

| Middle East & Africa | Emerging | Moderate | UAE, South Africa | Government AI health investments growing |

Key Players in the AI In Medical Writing Market:

Leading AI in medical writing companies in the market include Certara, Parexel International, Trilogy Writing & Consulting, Cactus Communications, Freyr, GENINVO, IQVIA Inc., ICON plc, Syneos Health, and Teladoc Health.

Recent Developments in the AI In Medical Writing Market:

In November 2024, Paris-based startup Biolevate secured USD 6.42 million in funding to enhance its AI-assisted medical writing platform, aimed at streamlining regulatory and clinical documentation in life sciences.

In May 2024, Indegene launched CORTEX.AI, an advanced AI platform tailored for the life sciences industry, enabling automation in medical writing, regulatory submissions, and commercial content creation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 869.05 million |

| Market Size by 2032 | USD 2240.06 million |

| CAGR | CAGR of 12.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Clinical Writing, Typewriting, Scientific Writing, and Others) • By End Use (Medical Devices, Pharmaceutical, Biotechnology, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Certara, Parexel International, Trilogy Writing & Consulting, Cactus Communications, Freyr, GENINVO, IQVIA Inc., ICON plc, Syneos Health, and Teladoc Health |