Contrast Media/Contrast Agent Market Report Scope & Overview:

Get More Information on Contrast Media/Contrast Agent Market - Request Sample Report

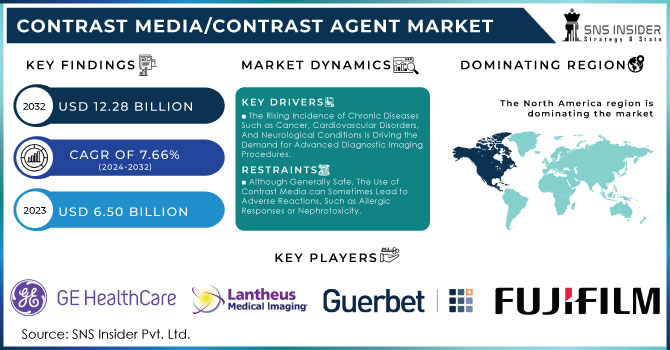

The Contrast Media/Contrast Agent Market Size was valued at USD 6.50 Billion in 2023, and is expected to reach USD 12.28 Billion by 2032, and grow at a CAGR of 7.66%.

The growing need for diagnostic and image-guided operations, technical developments in the contrast media market, rising cancer and heart disease incidence and death rates, and the development of medical imaging technologies in emerging economies are the industry's key growth drivers. Older people are more likely to have chronic diseases with many comorbidities. The National Council on Ageing estimates that by 2030, there will be nearly 79.0 million people in the United States who are 60 or older, with nearly 82% of those people having at least one chronic condition and nearly 72% of Medicare beneficiaries having more than two.

Furthermore, heart failure is one of the major causes of mortality in the United States and is becoming increasingly common there, according to a report from the American Heart Association. About 662,000 Americans passed away in 2020 as a result of cardiovascular disorders. According to estimates, there will be 48% more people suffering from heart disease by 2030. The demand for diagnostic imaging treatments and, consequently, contrast media has significantly increased as a result of the growing incidence of chronic illnesses worldwide. To provide new goods to the market and get the contrast media authorized for new indications, contrast media makers have been doing substantial R&D as a consequence of the rising demand for imaging operations.

MARKET DYNAMICS:

KEY DRIVERS:

-

The Rising Incidence of Chronic Diseases Such as Cancer, Cardiovascular Disorders, And Neurological Conditions Is Driving the Demand for Advanced Diagnostic Imaging Procedures.

-

Continuous Advancements in Imaging Technologies, such as the Development of More Precise and Efficient X-ray, CT, MRI, And Ultrasound Machines, Are Boosting the Use of Contrast Agents.

RESTRAINTS:

-

The High-Cost Associated with Contrast Agents and Diagnostic Imaging Procedures Can Be a Significant Barrier, Especially in Developing Regions with Limited Healthcare Budgets.

-

Although Generally Safe, The Use of Contrast Media can Sometimes Lead to Adverse Reactions, Such as Allergic Responses or Nephrotoxicity.

OPPORTUNITY:

-

The Ongoing Research and Development in the Field of Contrast Media Are Leading to New Applications and Formulations.

-

Emerging Economies in The Asia-Pacific, Latin America, And Middle East & Africa Regions Present Significant Growth Opportunities Due to Increasing Healthcare Awareness, Rising Disposable Incomes, and Improving Healthcare Infrastructure.

KEY MARKET SEGMENTATION:

By Procedure

The X-ray/CT segment accounted for more than 60% in 2023. X-ray contrast agents allow for 3D imaging of structures at a very high resolution. Barium- and Iodinated Contrast Media for X-ray & CT When it comes to barium and iodine contrast agents, they are substances that block X-rays from passing through after being administered/injected within the body. Therefore, their appearance in images with a temporary accumulation of barium-based (gastrointestinal tract) or iodinated contrast agents is different organs, blood vessels, and other structures. The growth of the market is expected to be driven by widespread applications not only for X-ray lightning but also in CT (Computed Tomography) rather than for a single disease. The increasing use of imaging devices is expected to drive the demand for contrast media. As per OECD, in the year 2022, nearly 44 CT machines were available out of all 1000,000 inhabitants IN Denmark; these factors accelerate the growth prospectus.

By Type

An Iodinated Contrast Media holds 65% in 2023 & it is used to improve the visibility of vascular structures and organs during radiographic procedures. Iodinated contrast has increased visibility in the diagnosis of cancer. For that reason, a rising amount of cancer cases is anticipated to boost such a segment. For example, in 2023 an estimated almost 20 million new cancer cases occurred worldwide based on a recently released update from the Pan American Health Organization. Developing cancer rates to rise almost 60% in the next two decades. The predicted worldwide burden will also rise to around 30 million new cancer cases by the year 2040, with large increases anticipated in low and middle-income nations. Hence, the increasing incidence of cancer is likely to propel the segment.

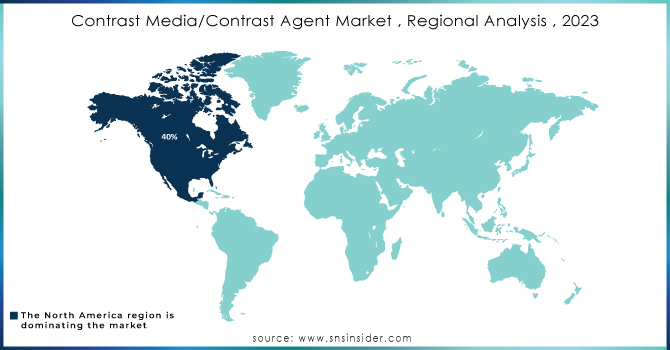

REGIONAL ANALYSIS:

In 2023, North America accounted for the largest market share at around 40%. Intended targeted patient subsets and strategic attempts for expansion by key manufacturers are anticipated to fuel market growth in this space. Major Industry Players– Bayer GE Healthcare, Guerbet Lantheus, Bracco Diagnostics, present in North America. Rising prevalence and diagnosis rates of respiratory diseases coupled with a growing number of diagnostic imaging procedures performed in hospitals are key factors contributing to its large share Nevertheless, healthcare reforms and appropriate use criteria may reduce the number of procedures.

Asia Pacific is likely to register the highest CAGR during the forecast period That is primarily due to the availability of as many renowned global & local producers in this area. GE Pharmaceuticals (Shanghai) is a subsidiary of GE in China and used to be the largest production base for contrast media of GE Healthcare worldwide. Demand is expected to be fueled by the economic growth of countries such as China and India, aiding in market penetration. Due to the larger population size and less per capita income in Asia Pacific, there is a high need for affordable treatment options.

APAC countries like India, which is in the developing stage globally attract international businesses to invest. As a result, many players in the market are entering into strategic and cooperative partnerships with regional participants. The contrast media industry is moving up with the rise in the elderly population of the region, enhanced penetration of chronic diseases among older people, and increasing prevalence of chronic and other deadly diseases over some time. Furthermore, the market is expected to be propelled throughout the forecast period due to improvements in healthcare infrastructure and an increase in diagnostic imaging examinations.

Need any customization research on Contrast Media/ Contrast Agent Market - Enquiry Now

KEY PLAYERS:

The key market players are Bayer AG, Bracco Diagnostic Inc., GE Healthcare, Guerbet Group, Lantheus Medical Imaging Inc., Spago Nanomedical AB, FUJIFILM Corporation, Beijing Beilu Pharmaceutical Co. Ltd., Taejoon Pharm Co. Ltd. & other players.

RECENT DEVELOPMENTS

Pixxoscan (gadobutrol), a non-ionic macrocyclic GBCA for MRI was launched by GE HealthCare in April 2023. Pixxoscan has undergone regulatory evaluation via the decentralized procedure (DCP) and will be available in multiple European markets by 2023 with a marketing authorization secured in Austria, and further EU countries pending. It was anticipated to drive the contrast media market over the forecasted period for the industry in this region.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 6.50 Billion |

|

Market Size by 2032 |

US$ 12.28 Billion |

|

CAGR |

CAGR of 7.66% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Iodinated Contrast Media, Gadolinium-based Contrast Media, Microbubble Contrast Media & Barium-based Contrast Media) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

American addiction Centres, Magellan Health Inc., Springstone, Universal Healthcare Services Inc., Behavioral Health Group, Peoples Care Holding Inc., Acadia HealthCare & Other players |

|

Key Drivers |

•The Rising Incidence of Chronic Diseases Such as Cancer, Cardiovascular Disorders, And Neurological Conditions Is Driving the Demand for Advanced Diagnostic Imaging Procedures. |

|

RESTRAINTS |

•The High-Cost Associated with Contrast Agents and Diagnostic Imaging Procedures Can Be a Significant Barrier, Especially in Developing Regions with Limited Healthcare Budgets. |