AI Training Dataset Market Trends & Overview:

Get more information on AI Training Dataset Market - Request Free Sample Report

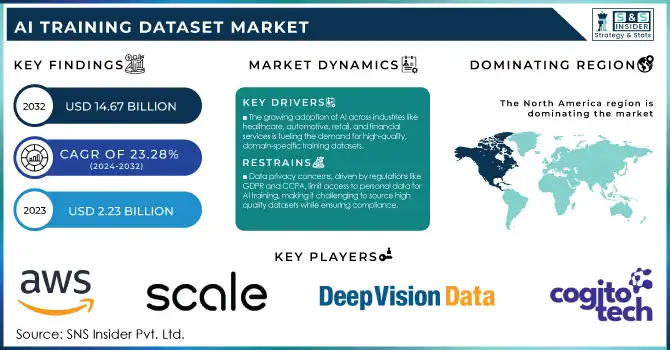

The AI Training Dataset Market was valued at USD 2.23 billion in 2023 and is expected to reach USD 14.67 billion by 2032, expanding at a CAGR of 23.28% between 2024 and 2032.

The Artificial Intelligence Training Dataset Market has emerged as a crucial enabler for the advancement of AI systems across various industries. As AI models demand vast amounts of high-quality data to train algorithms, the importance of curated and diverse datasets continues to grow. The market is witnessing increasing demand from sectors such as healthcare, automotive, retail, and finance, where AI is being integrated to enhance decision-making, automation, and personalized services. With the rise of machine learning and deep learning applications, the need for structured datasets, annotated data, and domain-specific data solutions is driving innovation and collaboration within this market. The market is experiencing robust growth due to trends like the proliferation of autonomous systems and the expansion of AI-based applications. Advances in natural language processing, computer vision, and speech recognition are boosting the demand for specific datasets, such as labeled images, text corpus, and audio samples. The increasing use of AI in predictive analytics, customer engagement, and automation is further fueling dataset requirements.

A notable trend is the adoption of synthetic data generation, which leverages AI to create artificial datasets that mimic real-world scenarios. This innovation addresses challenges such as data scarcity, privacy concerns, and the high costs of manual data annotation. Another growth driver is the rise of open data initiatives and partnerships, fostering collaboration between AI developers and data providers. Ethical concerns and regulatory compliance are shaping the market's dynamics, with greater emphasis on unbiased, privacy-compliant data. Providers are implementing advanced annotation techniques and employing AI to detect and reduce bias in datasets. The growing use of multilingual and cross-industry datasets highlights the market’s response to increasing global AI applications. As AI adoption accelerates, the AI training dataset market will remain integral to advancing AI capabilities and improving model performance.

AI Training Dataset Market Dynamics

Drivers

-

The growing adoption of AI across industries like healthcare, automotive, retail, and financial services is fueling the demand for high-quality, domain-specific training datasets.

The AI training dataset market is witnessing significant growth due to the rising adoption of AI across diverse industries such as healthcare, automotive, retail, and financial services. As organizations increasingly leverage AI for automation, predictive analytics, customer personalization, and operational efficiency, the demand for high-quality, domain-specific datasets continues to soar. In healthcare, for example, AI models rely on annotated datasets for applications like medical imaging analysis and diagnostic tools, while in automotive, training datasets are critical for developing autonomous driving systems. Similarly, retail companies use AI-powered recommendation engines and supply chain optimization tools that require vast amounts of labeled data.

The use of synthetic data to augment real-world datasets is becoming popular, reducing costs and addressing data scarcity challenges. Additionally, the focus on bias-free and ethically sourced data reflects an industry shift toward ensuring fairness and inclusivity in AI models. The rise of Big Data-as-a-Service (BDaaS) platforms enables businesses to access curated datasets tailored to their specific needs. As industries increasingly demand domain-specific solutions, customized datasets are becoming indispensable, while innovations in edge AI applications require lightweight, optimized datasets for real-time performance. These trends collectively underscore the market's rapid expansion and evolving dynamics.

Restraints

-

Data privacy concerns, driven by regulations like GDPR and CCPA, limit access to personal data for AI training, making it challenging to source high-quality datasets while ensuring compliance.

Data privacy concerns are a significant challenge in the AI training dataset market due to stringent regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations are designed to protect individuals' personal data, limiting how companies collect, store, and use such data. As AI models require large amounts of high-quality data for training, these laws restrict access to user data, especially personal and sensitive information, which is crucial for creating accurate and effective datasets. For instance, the GDPR mandates that personal data must be obtained with explicit consent, and individuals have the right to request data deletion, making it difficult for companies to utilize user data freely for AI training purposes. Similarly, the CCPA grants California residents the right to opt-out of the sale of their personal data, further limiting the pool of usable data. This creates challenges in sourcing sufficient, relevant datasets while ensuring compliance with privacy laws. To address these concerns, businesses are increasingly adopting privacy-preserving techniques like data anonymization, synthetic data generation, and secure data-sharing frameworks, but these methods still require careful implementation to maintain compliance and protect user privacy.

AI Training Dataset Market Segmentation

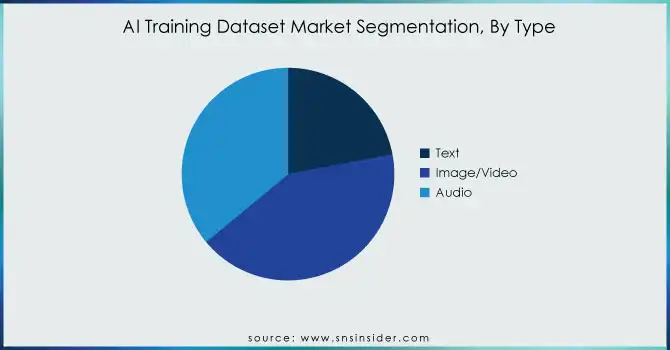

By Type

The Image/Video segment dominated with the market share over 42% in 2023, due to its central role in powering computer vision technologies. Image and video datasets are essential for training AI models to perform tasks like object recognition, facial recognition, and image classification. These tasks are foundational in a variety of AI applications, ranging from autonomous vehicles and healthcare diagnostics to security systems and retail analytics. With the increasing integration of AI in industries like healthcare, automotive, and entertainment, the demand for high-quality image and video datasets has surged. Additionally, advancements in deep learning and convolutional neural networks (CNNs) have further fueled the need for vast, diverse, and annotated visual datasets.

By Vertical

The IT sector segment dominated with the market share over 32% in 2023, due to its central role in the development and deployment of AI technologies. As the foundation for most AI applications, IT requires vast amounts of structured and unstructured data to train machine learning and deep learning models effectively. AI-powered innovations such as natural language processing, computer vision, and predictive analytics are increasingly dependent on high-quality datasets. The rapid expansion of cloud computing, data storage solutions, and the Internet of Things further fuels the demand for large-scale datasets. Additionally, the IT industry is involved in developing various software solutions, platforms, and tools that rely heavily on AI algorithms, driving an ongoing need for training data.

AI Training Dataset Market Regional Analysis

North America dominated the AI Training Dataset Market with a share of over 35% in 2023, driven by the substantial presence of tech giants like Google, Microsoft, and Amazon. These companies are investing heavily in AI and machine learning technologies, which require vast and high-quality datasets for training. The region’s advanced infrastructure supports the development and deployment of AI solutions, while its robust research and development investments foster innovation. Additionally, North America's favourable regulatory environment encourages the growth of AI technologies, enabling companies to explore new possibilities with fewer regulatory barriers. This combination of resources, financial investments, and a conducive ecosystem has led to North America's dominance in the market, making it a global leader in AI research, development, and commercialization.

Asia Pacific is the fastest-growing region in the AI Training Dataset Market, driven by the rapid adoption of AI technologies across key countries like China, India, and Japan. Government initiatives supporting AI development, such as funding for research and policies encouraging innovation, have significantly boosted the market. Additionally, the rise of AI startups in the region has contributed to the surge in demand for high-quality datasets. The growth is further fueled by the expansion of AI applications across various industries, including healthcare, automotive, and retail. In healthcare, AI is used for diagnostics and personalized medicine, while in the automotive sector, it supports autonomous driving technologies.

Need any customization research on AI Training Dataset Market - Enquire Now

Key Players

-

Amazon Web Services Inc. (Amazon SageMaker Ground Truth, Labeling Services)

-

Scale AI, Inc. (Data Labeling Platform, Sensor Fusion for Autonomous Vehicles)

-

Deep Vision Data (Custom AI Training Data Solutions)

-

Cogito Tech LLC (Image and Video Annotation, Text Data Labeling)

-

Google LLC (Google Cloud AutoML, Dataset Search)

-

Lionbridge Technologies, Inc. (AI Training Data Services, Multilingual Data Annotation)

-

Alegion (Data Labeling and Annotation Tools, Video Annotation for Autonomous Vehicles)

-

Microsoft Corporation (Azure Machine Learning, Custom Vision AI)

-

Samasource Inc. (Data Annotation and Validation Services for AI)

-

Appen Limited (Image and Speech Data Collection, Crowdsourced Annotation)

-

iMerit Technology Services (Image Annotation, NLP Training Data)

-

Figure Eight Inc. (Human-in-the-Loop Data Annotation Platform)

-

Reality AI (Sensor Data Labeling for Industrial Applications)

-

Playment (3D Bounding Boxes, Sensor Fusion Labeling for Autonomous Vehicles)

-

Mighty AI (Computer Vision Training Datasets for Autonomous Vehicles)

-

Trilldata Technologies (AI Data Engineering and Dataset Preparation)

-

Clarifai (AI Model Training, Image and Video Annotation)

-

Datasaur (Text Annotation and NLP Training Data)

-

Labelbox, Inc. (AI Data Labeling and Collaboration Platform)

-

V7 Labs (Image and Video Dataset Preparation, Automated Labeling Tools)

Suppliers

-

Amazon Web Services (AWS)

-

Google Cloud

-

Microsoft Azure

-

Kaggle

-

Appen

-

Scale AI

-

Lionbridge AI

-

Figure Eight (formerly CrowdFlower)

-

Data & Sons

-

Zooniverse

Recent Developments in the AI Training Dataset Market

-

In August 2024: Lionbridge Technologies, Inc. launched Aurora AI Studio, a platform aimed at helping businesses train datasets for advanced AI applications in response to the growing demand for high-quality training data. Lionbridge plans to leverage its expertise in data curation and annotation to support AI developers and improve commercial results.

-

In July 2024: Microsoft Research unveiled AgentInstruct, a multi-agent workflow framework designed to automate the creation of high-quality synthetic data for AI model training, greatly minimizing the need for human curation. The framework's success was proven by the Orca-3 model, which demonstrated significant improvements across various benchmarks.

-

In February 2024: Google and Reddit formed a partnership that granted Google access to Reddit’s data API for more efficient AI model training, while Reddit gained access to Google’s Vertex AI to enhance its search capabilities. This collaboration aids Reddit in monetizing its data and advancing its business offerings.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.23 Bn |

| Market Size by 2032 | US$ 14.67 Bn |

| CAGR | CAGR of 23.28% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Text, Image/Video, Audio) • By Vertical (IT, Automotive, Government, Healthcare, Audio, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Scale AI, Deep Vision Data, Cogito Tech, Google, Lionbridge Technologies, Alegion, Microsoft Corporation, Samasource, Appen, iMerit Technology Services, Figure Eight, Reality AI, Playment, Mighty AI, Trilldata Technologies, Clarifai, Datasaur, Labelbox, V7 Labs |

| Key Drivers | • The growing adoption of AI across industries like healthcare, automotive, retail, and financial services is fueling the demand for high-quality, domain-specific training datasets. |

| Market Restraints | • Data privacy concerns, driven by regulations like GDPR and CCPA, limit access to personal data for AI training, making it challenging to source high-quality datasets while ensuring compliance. |