IoT Communication Protocol Market Report Scope & Overview:

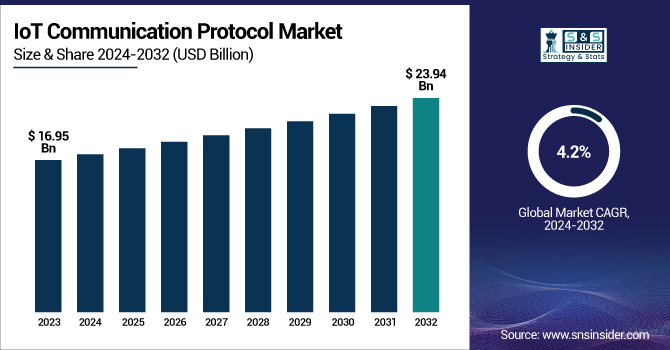

The IoT Communication Protocol Market Size was valued at USD 16.95 Billion in 2023 and is expected to reach USD 23.94 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032.

To Get more information on IoT Communication Protocol Market - Request Free Sample Report

The IoT Communication Protocol Market is witnessing rapid growth, driven by the surge in connected devices and the need for smooth data exchange. Protocols like Zigbee, NB-IoT, and Bluetooth Low Energy (BLE) are increasingly used in smart homes, healthcare, and industrial applications. BLE-enabled wearables now make up over 40% of healthcare devices, boosting real-time monitoring. LPWAN technologies such as LoRa have reduced smart city and agriculture costs by up to 25%. MQTT has enhanced mission-critical performance by lowering device-to-cloud latency by 15–20%. These advancements highlight the essential role of protocols in improving IoT efficiency, security, and scalability.

The U.S. IoT Communication Protocol Market size was USD 4.76 billion in 2023 and is expected to reach USD 6.0 billion by 2032, growing at a CAGR of 2.64% over the forecast period of 2024–2032.

The U.S. IoT Communication Protocol Market is witnessing rapid advancement, fueled by the growing number of connected devices and the rising need for smooth interoperability across diverse sectors. Progress in low-power wide-area networks (LPWANs) and the ongoing expansion of 5G infrastructure are significantly boosting communication efficiency, enabling broader adoption of IoT technologies in fields like healthcare, automotive, and smart home applications. The widespread use of smart devices and automation tools highlights the vital importance of reliable communication protocols to ensure fast, secure, and seamless data transmission across the expanding IoT ecosystem.

IoT Communication Protocol Market Dynamics

Key Drivers:

-

Rising Integration of IoT Devices Across Industries Drives IoT Communication Protocol Market Growth

The increasing use of IoT devices across industries such as healthcare, manufacturing, automotive, and smart homes is a major driver for the IoT Communication Protocol Market. As businesses and consumers demand real-time data and automated processes, the need for efficient communication between devices becomes critical. Protocols like Zigbee, NB-IoT, Bluetooth Low Energy (BLE), and MQTT are enabling seamless data exchange, energy efficiency, and low-latency communication across networks.

For example, in industrial settings, these protocols help reduce downtime through predictive maintenance, while in healthcare, they support continuous monitoring via connected wearables.

The ongoing rollout of 5G technology and the increasing popularity of edge computing further amplify this demand, allowing faster and more reliable connections. With the number of connected IoT devices expected to continue rising sharply, the communication protocol infrastructure supporting them becomes an essential pillar for ensuring smooth operation, thereby fueling market growth significantly.

Restrain:

-

Security Concerns and Data Privacy Issues Restrain IoT Communication Protocol Market Growth

Despite growing adoption, significant concerns around data privacy and security act as key restraints for the IoT Communication Protocol Market. As billions of connected devices share sensitive data, any vulnerability in communication protocols can lead to breaches, data theft, or system compromise. In sectors like healthcare and finance, where data sensitivity is paramount, this becomes even more critical. Many IoT devices have limited processing power, making it difficult to implement strong encryption and robust authentication protocols.

Additionally, inconsistent security standards across various communication technologies contribute to this issue, creating gaps that attackers can exploit. High-profile cyberattacks have already highlighted the risks of unsecured IoT networks, leading to stricter regulatory scrutiny. These challenges can delay adoption or increase implementation costs, especially for small and medium enterprises. Therefore, unless there is substantial improvement in protocol security standards, data protection remains a significant hurdle in the broader deployment of IoT communication solutions.

Opportunities:

-

Emerging Smart City and Infrastructure Projects Create New Opportunities in IoT Communication Protocol Market

The rise of smart cities and infrastructure modernization presents a significant growth opportunity for the IoT Communication Protocol Market. Governments and municipalities are increasingly deploying smart solutions for traffic management, energy optimization, public safety, and waste management, all of which rely heavily on interconnected devices. To ensure real-time communication and decision-making, these systems require robust and scalable communication protocols capable of handling large volumes of data with minimal latency. Protocols like LoRaWAN and NB-IoT are particularly valuable in this space due to their long-range capabilities and energy efficiency. The integration of AI and edge computing into these systems further necessitates precise, secure, and fast communication layers. With global investment in smart city initiatives rising, there is a growing need for communication infrastructures that can support large-scale deployments. As a result, protocol developers and IoT solution providers have a prime opportunity to innovate and offer solutions tailored to urban digital transformation.

Challenges:

-

Interoperability Challenges Among Diverse IoT Communication Protocols Pose Barriers in IoT Communication Protocol Market

The IoT Communication Protocol Market is achieving seamless interoperability among a wide range of devices and communication standards. With a multitude of protocols like Zigbee, Z-Wave, BLE, Wi-Fi, NB-IoT, and others in use, ensuring compatibility between them becomes complex and often requires additional hardware or middleware. This fragmentation can lead to increased system complexity, higher deployment costs, and reduced scalability. In industrial and commercial applications where multiple vendors and devices are involved, lack of standardization can delay integration and limit operational efficiency. Developers and integrators are often forced to choose between performance and compatibility, which can compromise the effectiveness of the overall IoT ecosystem. While some industry alliances are working toward unified frameworks, the slow pace of adoption and lack of consensus remain significant barriers. Overcoming these interoperability issues is crucial for unlocking the full potential of IoT and achieving truly interconnected environments.

IoT Communication Protocol Market Segment Analysis

By Type

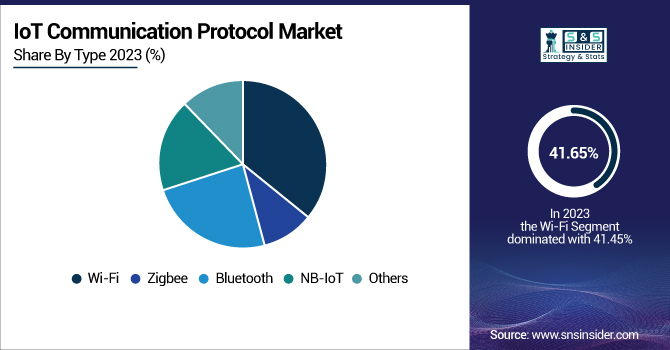

The Wi-Fi segment continues to dominate the IoT Communication Protocol Market due to its widespread availability, high data transfer rates, and increasing integration into smart devices. In 2023, Wi-Fi accounted for the largest share, particularly driven by its adoption in smart homes, consumer electronics, and enterprise IoT systems. The surge in smart home hubs, routers, and connected appliances has significantly increased the demand for robust and reliable Wi-Fi connectivity.

Additionally, Wi-Fi-based smart plugs, thermostats, and surveillance systems have seen rapid consumer adoption, reinforcing the protocol’s central role in the ecosystem. As more devices operate on higher frequencies and require stable broadband connections, Wi-Fi remains a cornerstone for seamless IoT communication across both residential and commercial environments.

Bluetooth technology, particularly Bluetooth Low Energy (BLE), is witnessing the fastest growth in the IoT Communication Protocol Market due to its low power consumption and seamless connectivity across short ranges. Its integration into wearable devices, health monitors, smart locks, and asset-tracking systems is expanding, fueling its high CAGR. With the rise in fitness trackers, smartwatches, and wireless medical sensors, Bluetooth is becoming essential for real-time data transmission with minimal battery usage.

Moreover, Bluetooth Mesh networking is being adopted in commercial buildings for smart lighting and HVAC systems, boosting efficiency in large-scale operations. As smart environments become more interconnected, the demand for scalable, secure, and lightweight communication protocols like Bluetooth continues to grow, establishing its role as a key driver in the evolving IoT landscape.

By Application

The Consumer Electronics segment holds the largest share in the IoT Communication Protocol Market due to the increasing use of connected devices in daily life. From smart TVs, speakers, and kitchen appliances to wearables and home security systems, the need for reliable communication protocols like Wi-Fi, Bluetooth, and Zigbee is more critical than ever. In 2023, the rapid deployment of voice assistants, smart thermostats, and IoT-enabled entertainment systems drove significant protocol integration to ensure real-time interaction and energy efficiency.

Additionally, the increasing preference for smart home ecosystems has boosted demand for devices that communicate seamlessly, strengthening the role of advanced protocols in the segment. As personalization, convenience, and automation become priorities for consumers, communication protocols remain the backbone enabling intuitive and responsive consumer electronics experiences.

The Automotive and Transportation segment is experiencing the fastest growth in the IoT Communication Protocol Market, fueled by the rising demand for connected vehicles, fleet management, and smart traffic systems. Advanced driver-assistance systems (ADAS), in-car infotainment, predictive maintenance, and real-time navigation rely heavily on efficient communication protocols like Bluetooth, Wi-Fi, and cellular-based solutions. Recent innovations in vehicle-to-everything (V2X) communication have encouraged automakers to integrate protocols that support rapid, secure, and low-latency data transmission between vehicles, infrastructure, and networks.

Moreover, commercial fleet operators are adopting IoT solutions for tracking, route optimization, and performance monitoring, boosting protocol utilization in logistics. As autonomous and electric vehicle adoption grows, the need for robust communication systems within and outside the vehicle will further accelerate, making the automotive sector a pivotal contributor to the expanding protocol market.

Regional Analysis

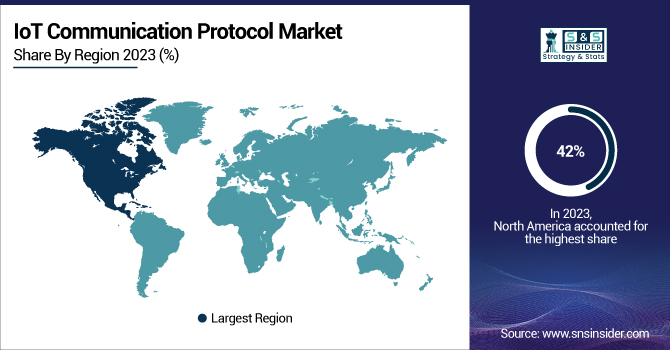

In 2023, North America accounted for the largest market share in the IoT Communication Protocol Market, estimated to be around 42%. This dominance is primarily attributed to the widespread adoption of connected technologies across industries such as healthcare, smart homes, manufacturing, and transportation. The region's early adoption of 5G infrastructure, along with the presence of leading tech companies and strong regulatory support for IoT security standards, has created a favorable environment for market growth.

For instance, the growing use of smart home devices like voice assistants, connected thermostats, and surveillance systems has amplified the need for reliable communication protocols such as Zigbee, Wi-Fi, and Bluetooth.

Additionally, industrial IoT (IIoT) solutions deployed in U.S. manufacturing plants and logistics operations rely heavily on robust and low-latency communication systems, further boosting the region's market dominance.

Asia Pacific is emerging as the fastest growing region in the IoT Communication Protocol Market, with an estimated CAGR of around 5.95% during the forecast period. The region's rapid urbanization, expanding smart city initiatives, and increasing industrial automation are key growth drivers. Countries like China, Japan, South Korea, and India are investing heavily in IoT infrastructure, leading to the widespread deployment of protocols such as NB-IoT, LoRa, and Zigbee.

For example, smart metering systems, traffic monitoring solutions, and agricultural IoT applications across the region are being equipped with low-power communication technologies to optimize energy usage and operational efficiency.

Moreover, the surge in smartphone penetration and wearable device usage in Asia Pacific is accelerating the demand for efficient, scalable communication standards. This dynamic market growth is further supported by government initiatives aimed at fostering digital transformation across sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Huawei Technologies (OceanConnect IoT Platform, LiteOS)

-

Arm Holdings (Mbed OS, Cortex‑M33 Processor)

-

Texas Instruments (SimpleLink CC3220 Wi‑Fi MCU, SimpleLink CC2652 Multiprotocol Wireless MCU)

-

Intel (XMM 7115 NB‑IoT Modem, XMM 7315 LTE‑M/NB‑IoT Modem)

-

Cisco Systems (Catalyst IR1101 Rugged Router, IoT Control Center)

-

NXP Semiconductors (LPC55S6x Cortex‑M33 MCU, EdgeLock SE050 Secure Element)

-

STMicroelectronics (STM32WL5x LoRaWAN Wireless MCU, SPIRIT1 Sub‑GHz Transceiver)

-

Thales (Cinterion TX62 LTE‑M/NB‑IoT Module, Cinterion ENS22 NB‑IoT Module)

-

Zebra Technologies (Savanna IoT Platform, SmartLens for Retail Asset Visibility)

-

Wind River (Helix Virtualization Platform, Helix Device Cloud)

-

Ericsson (IoT Accelerator, Connected Vehicle Cloud)

-

Qualcomm (IoT Services Suite, AllJoyn Framework)

-

Samsung Electronics (ARTIK Secure IoT Modules, SmartThings Cloud)

-

IBM (Watson IoT Platform, Watson IoT Message Gateway)

Recent Trends

-

March 2025: During MWC Barcelona 2025, Huawei unveiled a collaborative platform for the IEEE P2413.2 Power Distribution IoT (PDIoT) Reference Architecture Standards. This initiative aims to drive digital transformation in the power sector by promoting industry consensus and commercial deployment of a new core architecture in the 5G-Advanced era.

-

February 2025: Arm Holdings collaborated with Intel, Qualcomm, and other industry leaders to form the Ambient IoT Alliance (AIoTA). The alliance's mission is to promote and support the development of an open, harmonized, and aligned multi-standard ecosystem for ambient IoT solutions, enhancing interoperability and scalability in IoT communications.

-

February 2025: Intel joined forces with Qualcomm, Arm Holdings, and other companies to establish the Ambient IoT Alliance (AIoTA). This collaboration aims to scale up the ambient IoT ecosystem by developing an open and harmonized multi-standard framework, facilitating the seamless integration of IoT devices across various platforms.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.59 Billion |

| Market Size by 2032 | US$ 23.94 Billion |

| CAGR | CAGR of 4.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wi-Fi, Bluetooth, Zigbee, NB-IoT, Others) • By Application (Consumer Electronics, Automotive & Transportation, Building Automation, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Huawei Technologies, Arm Holdings, Texas Instruments, Intel, Cisco Systems, NXP Semiconductors, STMicroelectronics, Thales, Zebra Technologies, Wind River, Ericsson, Qualcomm, Samsung Electronics, and IBM. |