AI Voice Generators Market Report Scope & Overview:

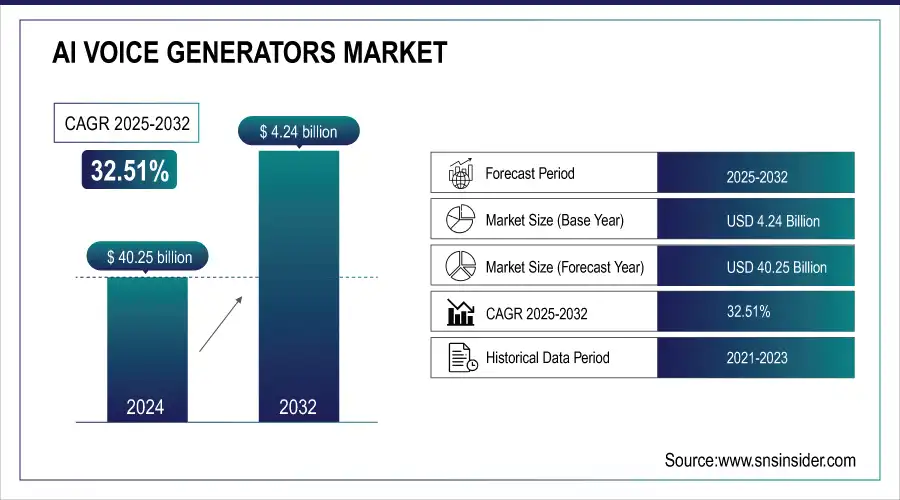

The AI Voice Generators Market was valued at USD 4.24 billion in 2024 and is expected to reach USD 40.25 billion by 2032, growing at a CAGR of 32.51% from 2025-2032.

To Get more information on AI Voice Generators Market - Request Free Sample Report

This report includes an in-depth analysis of various factors influencing market growth, such as adoption rates, user demographics, technological trends, investment and funding, and cost analysis. The increasing demand for personalized voice applications, advancements in natural language processing (NLP), and the integration of AI in diverse industries like healthcare, entertainment, and customer service are key drivers. Additionally, rising investments in AI research and development are contributing significantly to market expansion, with a growing focus on reducing costs and enhancing voice quality.

Key AI Voice Generators Market Trends:

-

Rising demand for realistic and human-like synthetic voices is driving adoption across media, entertainment, and customer service sectors.

-

Integration of AI voice technology into virtual assistants, chatbots, and smart devices is enhancing personalization and user experience.

-

Advancements in deep learning and natural language processing (NLP) are improving voice quality, emotion, and multilingual capabilities.

-

Growing use of AI-generated voices in gaming, audiobooks, podcasts, and video production is fueling market expansion.

-

Businesses are leveraging AI voice generators for cost-effective content creation, reducing reliance on traditional voiceover services.

-

Ethical and regulatory concerns regarding voice cloning and deepfakes are shaping development and responsible usage policies.

AI Voice Generators Market Drivers:

-

Advancements in AI and NLP Drive Adoption of Lifelike and Accurate AI Voice Generators Across Multiple Industries

Continuous advancements in AI and Natural Language Processing (NLP) technologies have greatly improved the performance of AI voice generators. These advances have produced more precise, natural-sounding, and expressive voice outputs, rendering AI-generated speech extremely realistic and versatile. Consequently, AI voice generators are now extensively used in many industries, such as customer service, entertainment, healthcare, and education. With the capability to replicate human intonation and emotion, such technologies give enterprises strong tools to craft more effective and efficient voice interactions. Ongoing innovation in AI and NLP also ensures that the demand for AI voice generators will increase, changing how we communicate with machines and content.

AI Voice Generators Market Restraints:

-

Privacy and Data Security Concerns Limit Widespread Adoption of AI Voice Generators Amid Growing User Protection Demands

The operation of AI voice generators depends almost entirely on huge volumes of individual data to produce real and personalized voice content. This causes serious issues of user privacy and data security, particularly since personal information may be compromised or abused. The increasing focus on data protection laws such as GDPR makes things even more complicated since organizations must maintain strict adherence to prevent fines. As these issues continue to mount, both businesses and consumers could become more reluctant to embrace AI voice technologies. The problem of guaranteeing strong data protection may hinder the general acceptance of AI voice generators since companies would be hesitant to invest without firm, secure data management procedures established.

AI Voice Generators Market Opportunities:

-

Integration with Smart Devices and IoT Drives Growth and Expands Use of AI Voice Generators in Consumer Electronics

Increased use of intelligent devices like speakers, wearables, and home automation systems is opening up new possibilities for AI voice generators. With these devices increasingly embedded in everyday life, natural, human-sounding voice interactions are in greater demand. AI voice generators have the potential to greatly improve the user experience by providing smooth, voice-operated features, including operating devices, answering questions, and providing personalized support. The support for IoT devices also enables more contextual, dynamic interactions, enhancing the convenience and efficiency of smart ecosystems. This move to connected spaces offers immense opportunity for AI voice generators to become the unavoidable part of the next generation of user interfaces, making them more ubiquitous in both consumer and enterprise markets.

AI Voice Generators Market Challenges:

-

Lack of Clear Regulations and Ethical Guidelines Creates Legal Uncertainty and Hinders Growth of AI Voice Generators Market

The absence of clear rules and regulations regarding AI-voice generation creates huge challenges for the market. With the expansion of AI voice technology, fears about its ill use for creating deepfakes, frauds, and other nefarious operations are increasing. The absence of unified rules could result in regulatory uncertainties and pose difficulties in executing AI voice solutions across sectors. In addition, ethical issues regarding consent, privacy, and biases in voice generation models could lead to caution among businesses and consumers. Without an overarching regulatory environment, businesses can struggle to maintain compliance and trust, which in turn would slow the development and uptake of AI voice generators across industries.

AI Voice Generators Market Segmentation Analysis:

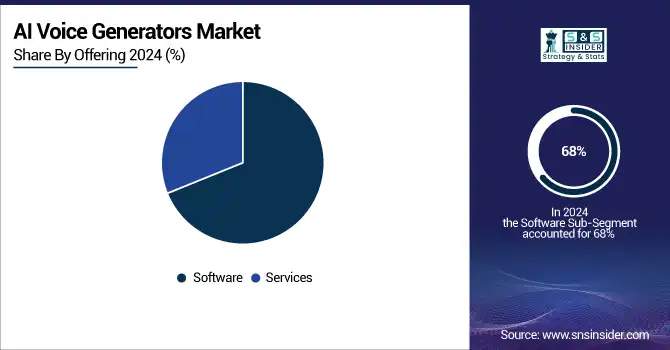

By Offering, Software Segment Dominates AI Voice Generators Market, While Services Segment Poised for Fastest Growth

The software segment led the AI Voice Generators Market with the largest revenue share of 68% in 2024 owing to the rising need for AI-powered voice generation tools across different industries. Such software solutions provide sophisticated features such as customization, scalability, and integration with legacy systems, rendering them critical for use in customer service, content creation, and personal assistants. Increased usage of AI technology to drive and improve voice interactions fuels the substantial revenue share in this category.

The services segment is expected to grow at the fastest CAGR of nearly 34.35% during 2025-2032, as more businesses look for tailored solutions, integration, and support for AI voice generators. Professional services such as system integration, consulting, and maintenance will see increased demand as businesses implement these technologies. With emphasis on enhancing user experiences and facilitating smooth deployment, the services segment is well-set for explosive growth with an increasing demand for expertise in deploying and fine-tuning AI voice solutions.

By Application, Audio and Speech Generation Leads AI Voice Generators Market, While Voice Cloning Set to Grow Rapidly

The Audio and Speech Generation segment captured the largest revenue share of 37% in 2024 in the AI Voice Generators Market because it is extensively being used across different applications, including virtual assistants, content creation, and customer service. These offerings ensure natural-sounding, high-quality voice outputs for interactive communications, rendering them indispensable for increasing user engagement. The growing need for realistic and dynamic voice generation in various industries has fueled the dominance of this segment in the market.

The Voice Cloning and Conversion segment is anticipated to grow at the fastest CAGR of approximately 34.74% from 2025-2032 due to the increased adoption of AI technology, which makes it possible to clone human voices accurately for diverse applications. The possibility of generating customized voice experiences, such as for entertainment, media, and accessibility devices, is driving the growth. Voice cloning technology is also becoming more valuable in applications such as gaming, movie making, and even healthcare, thus contributing to its high growth rate.

By End-use, Media & Entertainment Drives AI Voice Generators Market, With Customer Service Emerging as the Fastest-Growing Segment

The Media & Entertainment segment led the AI Voice Generators Market with the largest revenue share of around 31% in 2024 due to the increasing need for AI voiceovers in films, podcasts, audiobooks, and video games. AI voice generators allow studios to produce natural-sounding and varied voices quickly and at low costs. The rising demand for customized and dynamic audio content across different media platforms further reinforces the leadership of this segment in the market.

The Customer Service & Call Centers segment is expected to expand at the fastest CAGR of approximately 34.88% during 2025-2032, as AI voice generators are becoming more and more integrated into customer service operations in order to automate interactions and increase efficiency. Demand for 24/7 support, coupled with the need for cost-efficient solutions, fuels the growth. Virtual assistants with artificial intelligence can respond to queries, provide customized answers, and support a large number of interactions, and hence it is a fast-growing segment for AI voice usage.

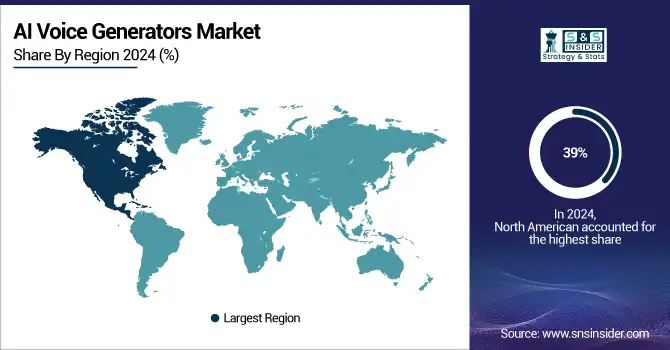

AI Voice Generators Market Regional Analysis:

North America Dominates the AI Voice Generators Market in 2024

North America is the dominant region in the AI Voice Generators Market, holding an estimated 39% market share in 2024. This leadership is driven by strong AI R&D investments, early adoption of advanced speech technologies, and widespread demand in entertainment, customer service, and enterprise applications, which accelerate innovation and large-scale deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

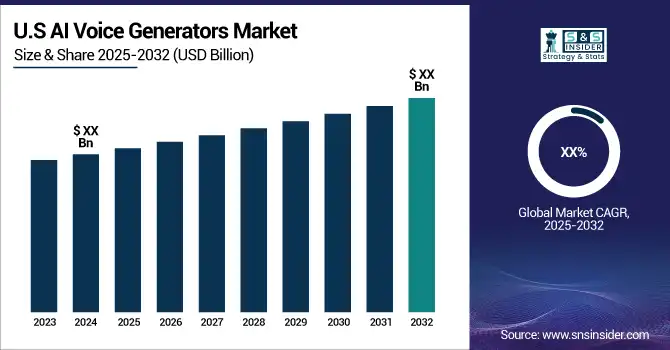

United States Leads North America’s AI Voice Generators Market

The United States dominates the region due to its advanced AI ecosystem, high venture capital funding, and strong presence of leading technology companies. Major industries, including media, customer service, and healthcare, are increasingly adopting AI-driven voice solutions for automation, content creation, and personalization. The U.S. benefits from innovation hubs, government support for AI initiatives, and growing demand for virtual assistants and voice-enabled devices. These factors establish the U.S. as the central hub for AI voice generator development and adoption in North America.

Asia Pacific is the Fastest-Growing Region in the AI Voice Generators Market in 2024

Asia Pacific is the fastest-growing region in the AI Voice Generators Market, with an estimated CAGR of 35% during 2024–2032. Growth is fueled by rapid digitalization, rising smartphone penetration, and strong demand for localized AI voice technologies across sectors such as e-commerce, education, and entertainment.

-

China Leads AI Voice Generators Market Growth in the Asia Pacific

China dominates the Asia Pacific market due to its vast internet user base, strong government support for AI innovation, and thriving technology companies. Industry giants like Baidu, Alibaba, and Tencent are investing heavily in AI-powered voice solutions for smart devices, customer service, and media applications. The rapid growth of e-learning, entertainment, and healthcare sectors is also driving adoption. With the increasing demand for Mandarin and regional language voice systems, China stands as the central hub, fueling the rapid growth of the Asia Pacific’s AI voice generators market.

Europe AI Voice Generators Market Insights, 2024

Europe holds a significant share of the AI Voice Generators Market, supported by demand for multilingual voice solutions in media, enterprise, and education sectors. Germany’s strong adoption of AI-enabled voice solutions in corporate training, entertainment, and smart devices accelerates market expansion across Europe. Germany dominates the region due to its advanced tech sector, strong industrial base, and focus on Industry 4.0 integration. The country’s commitment to ethical AI, innovation hubs, and research investments further strengthens its role, making Germany the central hub for AI voice adoption in Europe.

Middle East & Africa and Latin America AI Voice Generators Market Insights, 2024

The AI Voice Generators Market in the Middle East & Africa and Latin America is emerging, primarily driven by growing digital transformation and the need for localized solutions. Countries such as the UAE, Saudi Arabia, Brazil, and Mexico are investing in AI-powered voice technologies for entertainment, call centers, and education. Rising smartphone penetration, increasing demand for regional language support, and government-backed AI initiatives are fueling adoption. While still at an early stage compared to North America, Europe, and the Asia Pacific, both regions are expected to experience steady growth in the coming years.

Competitive Landscape for the AI Voice Generators Market:

Amazon Web Services, Inc.

Amazon Web Services (AWS) is a U.S.-based global cloud provider that supplies scalable infrastructure, developer tools, and machine learning services that power many AI voice generator solutions. AWS offers managed services for text-to-speech, speech-to-text, model hosting, and inference at enterprise scale, enabling vendors and developers to build, train, and deploy custom voice models while taking advantage of global regions, security/compliance controls, and consumption-based pricing. Its role in the AI voice generators market is foundational: AWS provides the cloud compute, storage, managed ML infra, and production-grade APIs that both startups and large enterprises use to deliver reliable, low-latency voice synthesis and voice-enabled applications.

-

In April 2025, AWS expanded its Amazon Polly service with new neural text-to-speech voices and enhanced multilingual support, enabling developers to generate more natural and expressive speech for global applications.

Cisco Systems, Inc.

Cisco Systems is a U.S.-based networking and collaboration technology leader that leverages its strengths in real-time communications, security, and enterprise collaboration platforms to participate in the AI voice space. Cisco integrates voice AI capabilities into contact center and unified-communications products—helping enterprises deliver natural-sounding automated responses, real-time transcription, voice analytics, and improved agent workflows. Its role in the AI voice generators market is largely enterprise-focused, emphasizing secure, compliant deployment of voice assistants and synthetic speech within contact centers, meeting platforms, and customer-facing systems.

-

In February 2025, Cisco introduced new AI-powered voice synthesis and transcription features in its Webex Contact Center platform, aimed at improving customer engagement and operational efficiency for enterprise clients.

ElevenLabs

ElevenLabs is a specialist AI voice company known for advanced neural voice synthesis, expressive and high-fidelity text-to-speech, and voice cloning capabilities aimed at content creators, publishers, and enterprises. The company focuses on realistic prosody, multi-language support, and fine-grained voice control that enable narration, dubbing, audiobooks, and character voices with minimal manual audio work. Its role in the AI voice generators market is as a product- and model-centric innovator, pushing voice quality and controllability for creative and commercial use cases while offering developer APIs, studio tooling, and licensing options for synthetic voices.

-

In May 2025, ElevenLabs launched new voice cloning tools within its creator platform, allowing publishers and media studios to generate highly realistic custom voices with improved emotion control and multilingual accuracy.

Google LLC

Google is a U.S.-based technology giant offering cloud, AI research, and consumer products; its contributions to voice generation include advanced neural TTS models (e.g., WaveNet and subsequent neural models), Cloud Text-to-Speech, and integrated tooling within Google Cloud’s AI/ML portfolio. Google’s strengths—research leadership, large-scale model training, and speech research—translate into high-quality, low-latency voice synthesis and extensive language coverage used by developers and enterprises. In the AI voice generators market, Google functions both as a platform provider (infrastructure + managed TTS APIs) and as a research-driven vendor advancing naturalness and expressivity in synthetic speech.

-

In March 2025, Google enhanced its Cloud Text-to-Speech service with expanded language coverage and more natural-sounding voices, supporting accessibility solutions, media dubbing, and enterprise-grade voice applications.

AI Voice Generators Market Key players:

AI Voice Generators Market companies are

-

Amazon Web Services, Inc.

-

Cisco Systems, Inc.

-

ElevenLabs

-

Google LLC

-

International Business Machines Corporation

-

Inworld AI

-

OpenAI

-

Resemble AI

-

SoundHound AI Inc.

-

NVIDIA

-

Meta

-

Voicemod

-

Descript

-

Soundful

-

DeepBrain AI

-

Samsung Group

-

Synthesia

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.24 Billion |

| Market Size by 2032 | USD 40.25 Billion |

| CAGR | CAGR of 32.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Services) • By Application (Audio and Speech Generation, Voice Cloning and Conversion, Music Composition and Generation, Audio Dubbing and Translation, Voice Restoration and Enhancement, Others) • By End-use (Media & Entertainment, Customer Service & Call Centers, Education & E-Learning, Healthcare, Advertising & Marketing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., Cisco Systems, Inc., ElevenLabs, Google LLC, International Business Machines Corporation, Inworld AI, Microsoft, OpenAI, Resemble AI, SoundHound AI Inc., NVIDIA, Meta, Voicemod, Descript, Simplified, Soundful, DeepBrain AI, Baidu, Inc., Samsung Group, Synthesia, Speechelo, Cerence Inc., WellSaid Labs, CereProc Ltd., Listnr AI, Respeecher, Speechki |