Workforce Management Market Size & Overview:

Get more information on the Workforce Management Market - Request Sample Report

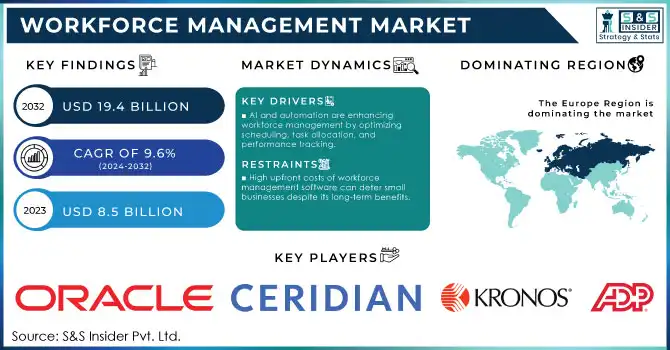

Workforce Management Market Size was valued at USD 8.5 Billion in 2023 and is expected to reach USD 19.4 Billion by 2032, growing at a CAGR of 9.6% over the forecast period 2024-2032.

The workforce management (WFM) market has gained increased traction, primarily due to the need for operational efficiency and optimized labour costs across the industrial segments. With the global change of businesses moving towards automation and digital transformation, there has been a significant demand for good workforce management. With governments across the world stressing on smooth labour functioning, many are turning to labour management technology to enhance labour productivity, labour planning and business outcome. For example, the Bureau of Labor Statistics (BLS) in the United States mentioned in its 2023 report that labour force participation has hit record highs, driving the uptake of WFM solutions that help a business manage a larger, more agile workforce. This increase in labour force participation is particularly relevant for industries like retail, healthcare, and manufacturing, where time, attendance, scheduling, and compliance are essential.

Moreover, according to the International Labour Organization (ILO), the global rates of employment are expected to keep advancing, and this translates into extra tension on companies to deliver good management of a growing workforce actively. The expansion of remote and hybrid work environments combined with rising compliance mandates will only continue to drive demand for sophisticated workforce management capabilities. Across the globe, policymakers from the EU’s digital transformation strategy to the UK’s plans to modernize the workforce are driving growth by advocating for archaic technology in the labour market. These factors are driving the workforce management market, as solutions assist organizations in managing labour costs, absenteeism, and productivity.

Workforce Management Market Dynamics

Drivers

-

Cloud-based workforce management software offers flexibility, scalability, and cost-efficiency, driving adoption especially among SMEs. This shift reduces the need for extensive infrastructure and offers easy access to data.

-

AI and automation are enhancing workforce management by optimizing scheduling, task allocation, and performance tracking.

-

Stricter labour laws and industry regulations are pushing businesses to adopt workforce management solutions. These tools help track working hours, overtime, and employee benefits to maintain compliance.

One significant driver for the workforce management market is the adoption of cloud-based solutions. Cloud technology has completely transformed how businesses manage their workforce as they are now being faced with scalable, flexible, and cost-effective solutions. It allows businesses to access data and apps from anywhere, streamlining operations and improving decision-making by providing real-time insights. Recent studies have shown that more than 60% of businesses are considering cloud solutions these days because of the reduced initial costs in comparison to conventional on-premise systems, which demand costly hardware and IT foundations. For instance, in the healthcare industry, Mayo Process employs cloud-based workforce management systems to direct personnel scheduling, time tracking, and regulatory compliance issues within the industry. This integration enhances efficiency and ensures that important data is available at multiple locations. Likewise, small and medium-sized enterprises (SMEs) are embracing cloud solutions to improve workforce efficiency without heavy capital expenditures, particularly in Asia-Pacific.

Cloud-based systems also provide businesses with the ability to scale quickly, supporting growth as they expand operations or enter new markets. On-demand access to workforce data ensures that whenever managers need to make an informed decision on whether changes to schedules or reallocation of resources are necessary, they have immediate access to the appropriate information. As businesses become increasingly dependent on remote work, the transition toward managing people via the cloud is probably going to happen faster, helping organizations stay competitive in a changing world.

Restraints:

-

Small businesses may find the high upfront costs of workforce management software prohibitive. While the long-term benefits are clear, the initial financial outlay can be a significant barrier.

-

Integrating modern workforce management software with existing legacy systems can be difficult and costly. Many businesses face challenges in ensuring smooth transitions and data synchronization.

-

Cloud-based workforce management solutions raise concerns about the security of sensitive employee data. Companies must invest in robust security protocols to mitigate the risks of data breaches.

One of the major factors hindering the workforce management market is the complex process of integration with legacy systems. Several organizations use legacy technologies that can be difficult to integrate with the latest 21st-century workforce management software. Legacy systems task integration into new solutions forces time, man-hours, and money since companies must ensure data is transferred and systems can function across platforms. These processes can also cause day-to-day operations to get disrupted, which may also reduce the speed of implementing workforce management solutions. The challenge is particularly prominent in large enterprises with intricate, customized legacy infrastructure. Businesses could have problems with data discrepancies or loss if these systems are not properly integrated, making the management process a whole lot more complex. This barrier prevents many companies from adopting newer, more efficient solutions, despite the growing demand for automation and data-driven workforce management.

Workforce Management Market Segment Analysis

By Solution

The time & attendance management segment held the largest revenue share of 34% in 2023. Businesses need to accurately track employee hours and ensure compliance with labour regulations, the latter being a major part of the continued dominance of labour management software. The U.S. Department of Labor (DOL) has repeatedly stated that violations of labour law such as failure to accurately record overtime and missed breaks amount to billions of dollars every year in costs to businesses. Consequently, time & attendance management has become an indispensable aspect of workforce management solutions, fueling the need for sophisticated software systems that enable real-time tracking, automatic updating of attendance records, and integration with payroll systems. With the rise of remote and hybrid work environments, businesses require time & attendance solutions that not only track in-office hours but also monitor virtual workforce activities. These tools help organizations maintain compliance with the Fair Labor Standards Act (FLSA) and avoid costly penalties.

The move to more flexible work schedules and the gig economy of course has only exacerbated the need for accurate time tracking. As highlighted in a recent report from the U.S. Bureau of Economic Analysis (BEA) in 2023, the gig itself has grown by 17% year on year, fuelling even further consistent demand for solutions that handle irregularities of non-traditional work weeks. In addition, since time & attendance systems eliminate errors, specify payroll, and help save time, they contribute to better satisfaction among employees, who can have access to transparent and easy-to-use systems to check their hours.

By Deployment

The on-premise segment dominated the market with the largest revenue share of 51% in 2023. On-premise deployment of workforce management solutions is preferred primarily because of the rising data security and privacy concerns. On-premise solutions provide businesses with maximum control over their systems and data, which is important when handling sensitive employee data, as is the case for many industries, such as healthcare, government, and finance. As a result, the U.S. Federal Trade Commission (FTC) and other global organizations have tightened data protection regulations, which has led organizations to choose either internal or sovereign solutions to have complete control over their data infrastructure. The NIST 2023 cybersecurity framework states that organizations with respect to sensitive information the main priority is on-premises that have very good security measures to prevent data breaches from occurring. Such recent changes have impacted larger enterprises and government agencies accustomed to tightly controlled data.

On-premise solutions are preferred by many businesses thanks to their ability to be tailored in full to meet the specific needs of the organization, while many organizations with legacy systems find it easier to integrate new solutions as part of a less disruptive IT infrastructure. Increasing Cyber Security Investments by Government & Enterprises for Data Protection further bolster demand for on-premise solutions. Organizations where data security, compliance, and control are a top priority, on-premise solutions remain the preferred choice for organizations where data security, compliance, and control are paramount.

By application

In 2023, the largest revenue share of about 21% was attributed to the BFSI (Banking, Financial Services and Insurance) segment. The BFSI industry is a huge and complex workplace in itself and has been one of the significant facilitators of the workforce management market. To keep up, banking institutions, insurance companies, and investment firms have also increased employee roles to keep up with the rapid adoption of digital banking services and the growing complexity of financial products. These integrated workforce management solutions allow organizations to make labour scheduling more efficient, improving the productivity of the workforce as well as meeting the requirements of financial compliance. The U.S. Federal Reserve told us earlier in 2023 that financial sector employment increased and the sector has added more than 1.5 million jobs since the start of the decade. The surge in employment is fueling demand for sophisticated workforce management tools that ensure employees are put to optimal use while meeting stringent compliance regulations.

In addition, the financial sector also has extensive regulations involving labour practices, including pay fairness, work hours, and employee benefits, which means that time & attendance, scheduling, and compliance features are imperative. Moreover, the adoption of hybrid work models in the BFSI sector due to the pandemic has increased the demand for solutions addressing a hybrid workforce, which includes in-office and remote employees. Banking and insurance as well would also look to have consistent employee satisfaction with retail analytics driving these systems which are mapped to input systems for workforce management and more flexible work tracking validation and performance with retention predictor.

By Enterprise size

In 2023, the large enterprises segment led the segment with the largest revenue share of 65%. Large enterprises, particularly in a global or national landscape need scalable and tailored workforce management solutions to deal with the complexities of managing thousands of employees across multiple sites. As per the report by the U.S. Small Business Administration (SBA) 2023, consider the rapidly growing demand for effective labour management, the rise of employees working around the globe, and the adoption of advanced WFM solutions by large enterprises to meet the recording success rate and compliance standards for their diverse employee labour pool. Enterprise businesses are more likely to invest in an integrated solution that involves time and attendance, payroll, performance management, and scheduling in one platform.

Additionally, larger firms routinely deal with more intricate labour regulations, union contracts, and industry regulations, all of which add to the demand for enterprise-grade workforce management solutions. These large enterprises have scale and diversity that demand systems capable of integrating with existing IT infrastructure and being able to satisfy varied organizational processes including unionized workers, multi-shift, and overtime rules. The continuous enforcement of wages and hours by the U.S. Department of Labor, along with several other government mandates, is also an important driver for the growing adoption of WFM systems in large enterprises due to the compliance features they offer in regard to federal and state regulations. For large enterprises, growth comes with its own set of challenges in handling complicated HR operations, to be specific and workforce management solutions are essential to overcoming them.

Regional Analysis

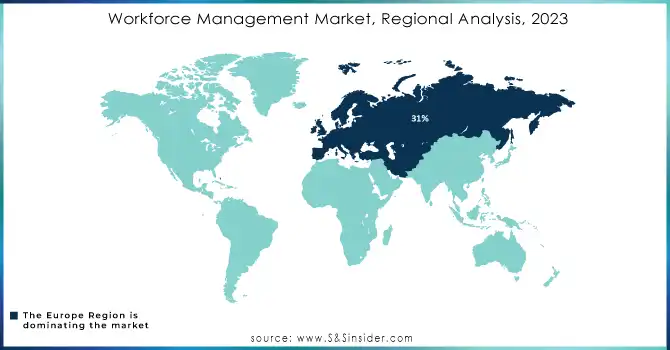

In 2023, Europe held the largest revenue share of the workforce management market at 31%. The region's penetration in this market can be attributed to the region's existing infrastructure, facilitating rapid adoption of advanced technologies, and an increasingly regulated labour environment. Eurostat reported that employment figures in Europe continued to grow this year and the EU employment rate reached a new high of 74.4%. This is especially due to the prevalence of manufacturers, healthcare providers, and retailers in Europe, where there is a strong demand for efficient workforce management solutions. Moreover, in light of the European Union's focus on labor laws and regulatory compliance, such as the General Data Protection Regulation (GDPR), organizations have been encouraged to seek secure and stable workforce management systems to comply with these strict regulations. Another factor causing the surge in the adoption of WFM solutions across sectors is the digital transformation that governments in Europe are promoting in the workplace. Additionally, the regional dominance of the market is based on the presence of key market players like ADP, SAP, and Kronos which provide businesses with integrated workforce management systems in the region.

In contrast, the Asia-Pacific (APAC) region is growing at the highest CAGR in the forecast period. Rapid expansion in the APAC Workforce Management Market is driven mainly by the digitalization of businesses, a large, diverse workforce, and growing demand for automation solutions. The rapid invention of tools for workforce management in countries like China, India, and Japan is a growing trend, as businesses in these countries look towards futuristic advancements in the tools necessary for operational excellence. With formal sector employment in Asia expected to increase at an annual rate of 6% according to the Asian Development Bank (ADB), there is a strong demand for workforce management solutions to ensure the efficient management of human capital. In addition, the increasing adoption of cloud-based solutions, especially in emerging markets, is another vital growth factor. The region is expected to witness the fastest growth rate in the workforce management market during the forecast period due to favorable government policies promoting digital transformation and automation across various sectors. Another factor fuelling the trend is the increasing move to a digital economy in nations like India and China with their governments focusing on digitization and technology capabilities to ensure efficient functioning of the workforces.

Do you need any customization research on Workforce Management Market - Enquiry Now

Key Players

Service Providers / Manufacturers:

-

ADP (Workforce Now, ADP Vantage HCM)

-

Kronos (now UKG) (UKG Pro, UKG Dimensions)

-

Ceridian (Dayforce HCM, Dayforce Workforce Management)

-

Workday (Workday HCM, Workday Scheduling)

-

SAP SuccessFactors (SuccessFactors Workforce Analytics, SuccessFactors Employee Central)

-

Oracle (Oracle Cloud HCM, Oracle Time and Labor)

-

Ultimate Software (now UKG) (UltiPro, UKG Ready)

-

Zenefits (Zenefits HR Software, Zenefits Payroll)

-

Cornerstone OnDemand (Cornerstone Learning, Cornerstone Performance)

-

Replicon (Replicon Time Tracking, Replicon Project Time Tracking)

Key Users of Workforce Management Products:

-

HSBC

-

Walmart

-

JP Morgan Chase

-

Ford

-

Toyota

-

Mayo Clinic

-

EDF Energy

-

McDonald's

-

Amazon

-

Target

Recent Developments

-

In August 2023, Kronos launched a more feature-rich version of its time & attendance app to let employees log their hours in real-time via mobile. Retail and healthcare were some biggest beneficiaries of this update that had remote or mobile workforce.

-

In October 2023, Ceridian, a global human capital management software company, announced its new workforce management platform designed to support both large and small enterprises. The platform provides an end-to-end workforce platform including scheduling, time tracking, and payroll, and targeting compliance with global labour laws.

| Report Attributes | Details |

| Market Size in 2023 | USD 8.5 Billion |

| Market Size by 2032 | USD 19.4 Billion |

| CAGR | CAGR of 9.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Workforce Scheduling, Time & Attendance Management, Embedded Analytics, Absence Management, Others) • By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs) • By Deployment (Cloud, On-premise) • By Application (Academia, Automotive & Manufacturing, BFSI, Government, Healthcare, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

ADP, Kronos (UKG), Ceridian, Workday, SAP SuccessFactors, Oracle, Ultimate Software (UKG), Zenefits, Cornerstone OnDemand, Replicon. |

| Key Drivers | • Cloud-based workforce management software offers flexibility, scalability, and cost-efficiency, driving adoption especially among SMEs. This shift reduces the need for extensive infrastructure and offers easy access to data. • AI and automation are enhancing workforce management by optimizing scheduling, task allocation, and performance tracking. • Stricter labour laws and industry regulations are pushing businesses to adopt workforce management solutions. These tools help track working hours, overtime, and employee benefits to maintain compliance |

| Challenges |

• Small businesses may find the high upfront costs of workforce management software prohibitive. While the long-term benefits are clear, the initial financial outlay can be a significant barrier |