Data Center Robotics Market Report Scope & Overview:

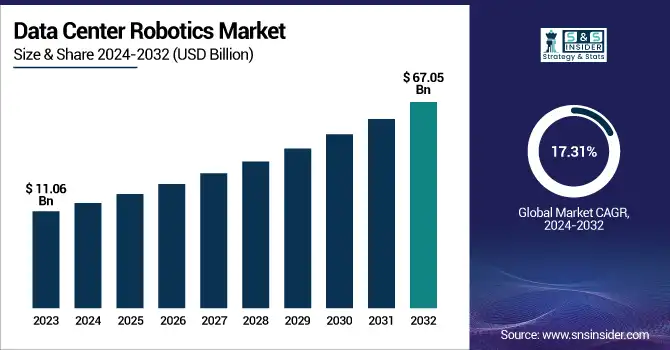

The Data Center Robotics Market was valued at USD 11.06 billion in 2023 and is expected to reach USD 67.05 billion by 2032, growing at a CAGR of 17.31% from 2024-2032.

To Get more information on Data Center Robotics Market - Request Free Sample Report

This report includes in-depth analysis of key metrics such as cost-benefit, performance, customization & scalability trends, lifecycle and maintenance, failure detection & response, and data security & compliance automation. The market is witnessing rapid adoption of robotics solutions to enhance operational efficiency, reduce downtime, and streamline data center management. With increasing demand for automation, scalable infrastructure, and improved reliability, robotics is becoming a strategic asset across data centers. Vendors are focusing on delivering customizable and compliant robotic systems to meet evolving data privacy and performance requirements. The integration of AI, ML, and automation further drives innovation, ensuring responsive maintenance and adaptive performance in complex data environments.

U.S. Data Center Robotics Market was valued at USD 3.02 billion in 2023 and is expected to reach USD 18.18 billion by 2032, growing at a CAGR of 22.07% from 2024-2032.

This significant growth is driven by the rising demand for efficient, automated data center operations amid increasing data traffic and digital transformation initiatives. Enterprises are investing in robotics to reduce human error, enhance uptime, and improve operational efficiency. The presence of leading tech companies, rapid cloud adoption, and stringent data security standards are accelerating robotic integration. Additionally, advancements in AI and machine learning are enabling smarter, autonomous systems capable of predictive maintenance and real-time monitoring, making robotics a vital component in next-generation U.S. data center infrastructure.

Data Center Robotics Market Dynamics

Drivers

-

Rising demand for automation to enhance data center efficiency is accelerating the adoption of robotics across operational workflows globally.

Rising demand for automation to enhance data center efficiency is fueling the growth of robotics solutions. As data centers scale up in complexity and size, manual operations are proving inadequate and error-prone. Robotics brings precision, consistency, and efficiency to tasks such as server installation, cable management, maintenance, and monitoring. The increasing need for 24/7 uptime and rapid deployment of digital services further necessitates automated systems. Robotics also minimizes human intervention in hazardous or high-density environments, improving safety and reducing operational costs. Additionally, integration with AI and machine learning enhances real-time decision-making and predictive maintenance. Enterprises and cloud providers are increasingly investing in robotics to gain a competitive edge, streamline operations, and reduce downtime, making automation a pivotal factor in driving the data center robotics market forward.

Restraints

-

Cybersecurity risks and data privacy concerns restrict the full-scale deployment of robotics in sensitive and regulated data center environments.

Cybersecurity and data privacy are critical concerns that limit the broader adoption of robotics in data centers. Robotics systems often require remote connectivity and access to critical infrastructure, making them potential vectors for cyber threats if not properly secured. As robotic platforms integrate with AI, IoT, and cloud-based systems, the attack surface increases. This poses challenges in highly regulated sectors like finance and healthcare, where data integrity and security are paramount. Additionally, compliance with global standards such as GDPR or HIPAA requires rigorous testing and certification processes for robotic solutions. Fears of unauthorized access, system manipulation, or data leakage can deter organizations from implementing robotics fully. Unless robust security frameworks and compliance-ready solutions are developed, these concerns will continue to act as key restraints to market growth.

Opportunities

-

Adoption of AI-driven robotics in predictive maintenance opens new horizons for proactive data center efficiency and cost reduction.

Adoption of AI-powered robotics is creating exciting opportunities in predictive maintenance for data centers. By integrating AI with robotics, operators can automate inspections, detect anomalies, and resolve issues before they escalate. These systems can monitor hardware for signs of wear, overheating, or misalignment, significantly reducing unplanned downtime and maintenance costs. Predictive maintenance also minimizes manual checks and service interruptions, improving uptime and energy efficiency. The ability of AI-driven robotics to learn from operational data and adapt to changing environments makes them a valuable asset. As AI technology matures and becomes more accessible, its convergence with robotics will unlock new functionalities, empowering data centers to shift from reactive to proactive infrastructure management. This evolution positions robotics as a core enabler of long-term cost savings and reliability.

Challenges

-

Shortage of skilled robotics and automation professionals limits the effective deployment and optimization of robotic systems in data centers.

Shortage of skilled professionals with expertise in robotics, automation, and AI is a key challenge for the data center robotics market. Deploying, configuring, and maintaining robotic systems requires specialized knowledge across mechanical engineering, control systems, machine learning, and IT infrastructure. However, the talent pool remains limited, and competition for these professionals is high across industries. Smaller data centers may struggle to attract or retain such talent, delaying automation initiatives. Additionally, the learning curve for existing IT staff to upskill in robotics can be steep and time-consuming. Without a qualified workforce, data centers risk inefficient deployments, increased downtime, or underutilization of robotic capabilities. Addressing this challenge requires investment in workforce development, training programs, and collaboration with educational institutions to build a skilled robotics talent pipeline.

Data Center Robotics Market Segment Analysis

By Deployment

The On-Premises segment accounted for the largest revenue share of around 52% in the Data Center Robotics Market in 2023 due to the high demand for enhanced data security, privacy control, and customized infrastructure management. Organizations with critical data operations prefer on-premise deployment to maintain complete ownership of their hardware and software assets. Furthermore, industries with stringent compliance requirements continue to rely on in-house data centers to avoid third-party risks, driving the strong dominance of this segment in the global market.

The Cloud-based segment is projected to grow at the fastest CAGR of approximately 23.22% from 2024 to 2032 due to increasing demand for scalability, flexibility, and cost-efficiency in data center operations. Cloud-based robotics solutions offer seamless remote management, automated software updates, and reduced infrastructure costs. This deployment model also supports rapid expansion and real-time collaboration, making it highly attractive for enterprises adopting digital transformation and distributed work environments, thereby fueling its rapid growth in the forecast period.

By Enterprise Size

Large Enterprises led the Data Center Robotics Market with a dominant revenue share of about 64% in 2023, primarily due to their substantial IT budgets and early adoption of automation technologies. These organizations require robust, scalable infrastructure to manage complex data center operations and ensure uptime. The need for enhanced efficiency, precision, and operational continuity in high-volume environments has driven large enterprises to adopt robotic solutions, further reinforcing their leadership in the market through strategic investments in advanced robotics systems.

The Small and Medium Enterprises (SMEs) segment is expected to expand at the fastest CAGR of around 23.35% from 2024 to 2032, driven by the growing accessibility of cost-effective robotic solutions and cloud-based automation tools. As SMEs increasingly digitize their operations and adopt smart technologies, robotics helps streamline data center functions while reducing overhead costs. The availability of scalable robotics solutions tailored for smaller infrastructures has also contributed to greater adoption among SMEs, positioning them as a key growth segment in the coming years.

By Vertical

The IT & Telecom segment held the largest revenue share of approximately 32% in 2023 within the Data Center Robotics Market, driven by massive data volumes, 24/7 uptime requirements, and complex IT infrastructures. This sector relies heavily on advanced robotic solutions for efficient server handling, maintenance, and monitoring. Robotics enhances operational speed, accuracy, and scalability, making it a vital asset in managing the dynamic and high-density environment typical of data centers in IT and telecom companies.

The Retail & E-commerce segment is projected to grow at the highest CAGR of about 24.47% from 2024 to 2032 due to increasing online transactions and the demand for seamless digital experiences. Retailers are leveraging robotics in data centers to improve infrastructure efficiency, support real-time inventory and customer data processing, and ensure high availability of services. As consumer expectations and e-commerce operations grow, retail firms are accelerating investments in robotic automation to gain competitive advantage and scale their digital ecosystems efficiently.

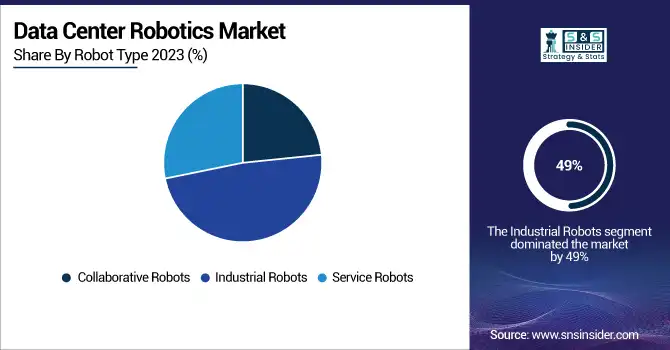

By Robot Type

The Industrial Robots segment dominated the Data Center Robotics Market in 2023, accounting for nearly 49% of total revenue. These robots are known for their high load capacity, durability, and precision, making them ideal for repetitive, labor-intensive tasks such as server rack handling and hardware installation in large-scale data centers. Their ability to work in demanding environments and execute complex automation tasks with consistency has made them the go-to solution for enterprises prioritizing efficiency and uptime in data operations.

The Collaborative Robots segment is projected to grow at the fastest CAGR of approximately 24.26% from 2024 to 2032 due to their flexibility, safety features, and ease of integration. These robots can work alongside human operators without safety cages, enabling efficient collaboration in data center environments. Their compact size, lower cost, and adaptability to various tasks make them an attractive choice for businesses seeking agile automation. As demand for human-machine synergy rises, collaborative robots are poised for rapid adoption across data center operations.

By Component

The Hardware segment held the largest revenue share of around 49% in the Data Center Robotics Market in 2023, primarily due to the substantial investment required for robotic arms, sensors, actuators, and automation systems. Hardware components form the physical foundation for robotic functionality in data centers, enabling precise execution of tasks like server handling and environmental monitoring. The continuous need for high-performance and durable equipment across large-scale facilities has sustained strong demand for hardware, securing its leading position in the market.

The Software segment is expected to register the fastest CAGR of about 23.96% from 2024 to 2032, driven by the growing need for intelligent control systems, predictive maintenance, and AI-powered decision-making in robotics. Software enables data-driven optimization, integration with data center management platforms, and real-time analytics. As robotics applications become more sophisticated, the demand for advanced software solutions that ensure operational flexibility, scalability, and automation intelligence is rising rapidly, making it the fastest-growing segment in the market.

Regional Analysis

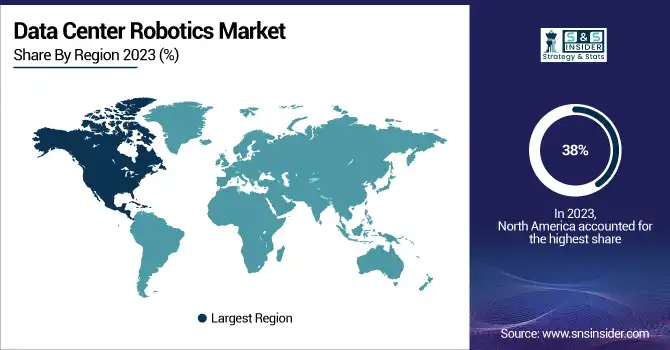

North America led the Data Center Robotics Market in 2023 with a revenue share of approximately 38%, primarily due to its advanced technological infrastructure, high concentration of data centers, and strong adoption of automation solutions. The region benefits from substantial investments by major cloud service providers and tech giants aiming to enhance operational efficiency through robotics. Moreover, strict regulatory standards and increasing demand for data security have driven enterprises in North America to integrate robotics for streamlined and secure data center management.

The Asia Pacific region is anticipated to witness the fastest CAGR of around 23.56% from 2024 to 2032, fueled by rapid digitalization, growing internet penetration, and the expansion of data center infrastructure across emerging economies. Governments and private players are heavily investing in automation and smart technologies to support economic growth and digital ecosystems. Additionally, the rising adoption of cloud services and AI-based operations is prompting enterprises in the region to deploy robotic solutions for efficient, scalable data center management, accelerating market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

365 Data Centers (Colocation Services, Cloud Storage Solutions)

-

ABB (IRB Series Robots, RobotStudio)

-

Amazon Web Services (AWS RoboMaker, AWS Outposts)

-

BMC Software, Inc. (BMC Helix, TrueSight Automation for Data Centers)

-

China Telecom (IDC Services, Cloud Managed Network Services)

-

Cisco Systems, Inc. (Cisco UCS, Cisco Intersight)

-

ConnectWise LLC (ConnectWise Automate, ConnectWise RMM)

-

Digital Realty (PlatformDIGITAL, ServiceFabric)

-

Equinix (Equinix Fabric, Equinix Metal)

-

Hewlett Packard Enterprise Development LP (HPE GreenLake, HPE OneView)

-

Huawei Technologies Co., Ltd. (FusionModule Data Center, iManager NetEco)

-

Microsoft Corporation (Azure Robotics, Azure Stack Hub)

-

NTT Communications (Nexcenter Data Centers, Smart Data Platform)

-

Rockwell Automation Inc. (FactoryTalk, Arena Simulation)

-

Siemens AG (SIMATIC Robot Library, TIA Portal)

-

Verizon (Verizon Colocation, Verizon Intelligent Edge)

-

Google (Google Cloud Robotics, Google Distributed Cloud)

Recent Developments:

-

In August 2024, ANYbotics and AWS partnered to integrate the AI-driven ANYmal robot into the AWS IoT Solutions hub, enhancing industrial inspections across sectors like energy and chemicals. This collaboration aims to improve safety, productivity, and operational efficiency by leveraging AWS's secure cloud infrastructure.

-

In September 2023, ABB launched the IRB 1090, an industrial education robot authenticated by STEM.org, designed to upskill students for future employment. It features ABB’s OmniCore controller and includes 100 free RobotStudio premium licenses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.06 Billion |

| Market Size by 2032 | US$ 67.05 Billion |

| CAGR | CAGR of 22.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Deployment (Cloud-based, On-Premises) • By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)) • By Robot Type (Collaborative Robots, Industrial Robots, Service Robots) • By Vertical (BFSI, Healthcare, Education, IT & Telecom, Government, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 365 Data Centers, ABB, Amazon Web Services, BMC Software, Inc., China Telecom, Cisco Systems, Inc., ConnectWise LLC, Digital Realty, Equinix, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Microsoft Corporation, NTT Communications, Rockwell Automation Inc., Siemens AG, Verizon, Google |