Air-Cooled Heat Exchanger Market Report Scope & Overview:

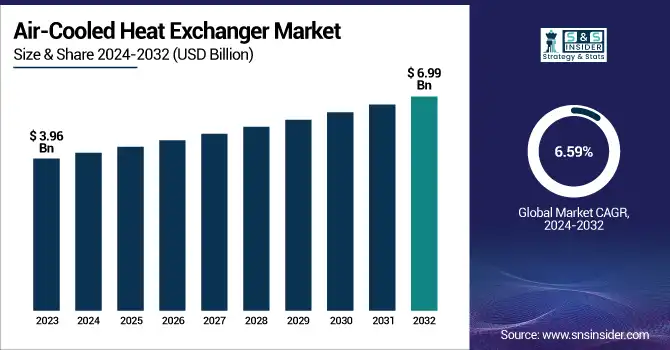

The Air-Cooled Heat Exchanger Market was valued at USD 3.96 Billion in 2023 and is expected to reach USD 6.99 Billion by 2032 at a CAGR of 6.59% during the forecast period of 2024-2032.

To Get more information on Air-Cooled Heat Exchanger Market - Request Free Sample Report

The Air-Cooled Heat Exchanger (ACHE) industry is witnessing steady growth due to rising energy efficiency requirements and strict environmental regulations in major industries like oil & gas, power generation, and food processing. These systems provide eco-friendly cooling solutions by avoiding the use of water, thus being well-suited for water-scarce areas. Advances in materials and design are improving operational efficiency and reliability. The competitive landscape of the market is characterized by companies emphasizing product development and strategic collaborations.

The U.S. Air-Cooled Heat Exchanger Market was USD 0.74 Billion in 2023 and is expected to grow to USD 1.10 Billion by 2032 at a CAGR of 4.58% from 2024 to 2032. The U.S. Air-Cooled Heat Exchanger (ACHE) market is set to grow steadily, driven by rising energy requirements, old thermal infrastructure, and tighter environmental standards. The transition towards sustainable, water-saving technologies in oil & gas, power generation, and chemical industries is driving demand for ACHE systems. As the U.S. grapples with rising issues of water scarcity and carbon emissions, ACHEs provide an effective, green alternative to conventional cooling systems.

Air-Cooled Heat Exchanger Market Dynamics

Key Drivers:

-

Increasing Demand for Green Products Across Industries Fuels the Air-Cooled Heat Exchanger Market Growth.

The increasing focus on sustainability and environmental conservation is compelling industries like oil & gas, chemical, and power generation to embrace green technologies. Air-cooled heat exchangers (ACHEs) do away with the use of water in cooling processes, drastically cutting water usage and wastewater discharge. As governments introduce stricter environmental policies and promote green industrial processes, ACHEs become more desirable substitutes for conventional water-cooled systems. This change supports corporate sustainability initiatives and worldwide climate action plans, and thus ACHEs become a smart investment for environmentally friendly businesses. The need for eco-efficient systems keeps the ACHE market growth pace moving faster. Restrain

-

High Initial Capital Investment Required for Installation Restains the Air-Cooled Heat Exchanger Market Expansion

Although there are long-term cost and environmental advantages, the high initial expense of air-cooled heat exchangers can be a barrier to market penetration due to its high capital requirements. ACHE systems frequently incorporate sophisticated materials, specialized design, and intricate installation procedures, and are therefore much more costly than traditional systems at the outset. This can discourage small and medium-sized businesses or facilities with limited budgets from implementing the technology. Additionally, if water resources are not a constraint, industries will choose less expensive alternatives. Long payback periods and price sensitivity can hinder adoption in cost-conscious markets, consequently limiting the total market growth potential of the ACHE market.

Opportunities

-

Growth of Industrial Infrastructure in Water-Scarce Areas Provides Attractive Opportunities for the Air-Cooled Heat Exchanger Market

The continuing industrial growth in arid and semi-arid areas, especially in the Middle East, Africa, and parts of the U.S. Southwest, holds a great market growth opportunity for the ACHE market. Those areas suffer severely from water shortage, rendering typical water-cooled systems inapplicable or unusable. Their governments and industries are keen on dry cooling as a solution that can aid expansion without degrading water resources beyond their limits. Air-cooled heat exchangers are perfect in such conditions, providing effective thermal control with no water consumption. With increased investment in power plants, petrochemicals, and manufacturing units in these geographies, demand for ACHE systems is likely to increase.

Challenges

-

Performance Limitations of Air-Cooled Systems in High Ambient Temperatures Challenge Market Growth and Application Efficiency

One of the major hurdles to the widespread use of air-cooled heat exchangers is their decreased efficiency in hot ambient temperatures. In contrast to water-cooled systems, ACHEs are cooled by ambient air, and their efficiency decreases substantially in severe heat. This hinders industries in hot climates from sustaining the best process temperatures, which could impact productivity and operational stability. To overcome this, businesses might need to spend on bigger or newer ACHE units, which also adds to the cost. These performance limitations are barriers in some geographies and present a technical and economic hurdle for the expansion of the market.

Air-Cooled Heat Exchanger Market Segments Analysis

By Type

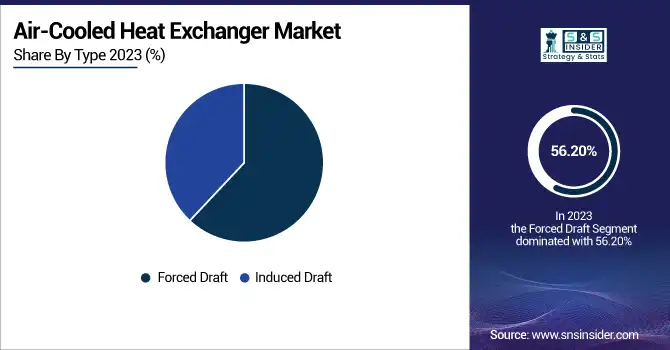

In 2023, the Forced Draft segment held the biggest share of the Air-Cooled Heat Exchanger (ACHE) market, with 56.20% of the revenue attributed to its extensive application in high-pressure use and compact industrial configurations. The systems are found more favorable in oil & gas and petrochemical facilities for their best air distribution and space savings. Dominant players such as SPX Technologies and Hamon Group have launched sophisticated forced draft systems with better thermal efficiency and corrosion resistance. SPX's newer Ecolaire FD series, released mid-2023, boasts modular designs and upgraded fan drives. Innovations like these further consolidate the segment's leadership in propelling overall ACHE market growth.

The Induced Draft segment is expected to expand at the highest CAGR of 7.30% over the forecast period, driven by increasing demand for energy-efficient and noise-optimized cooling systems. These systems are widely used in power generation and large-scale chemical processing plants because of improved heat dissipation and reduced energy consumption. In late 2023, Kelvion introduced a next-generation induced draft ACHE system optimized for high-temperature conditions that offer smart control systems for superior airflow. Likewise, Alfa Laval upgraded its induced draft portfolio with noise-reduction technology. These innovations are driving segment growth and enhancing its position in the shifting ACHE market landscape.

By Fin Type

The L-Fin segment dominated the Air-Cooled Heat Exchanger (ACHE) market in 2023 with a share of 45.69% revenue, thanks to its high thermal efficiency, low cost, and extensive applications in oil & gas and power generation industries. Its favorable resistance to moderate fouling and corrosive conditions makes it suitable for rigorous industrial operations. Players such as Kelvion and API Heat Transfer have broadened their product ranges with sophisticated L-Fin tube bundles, offering improved durability and efficiency. Upgrade of products in modular ACHE systems with L-Fin configurations has further contributed to increased demand.

The Extruded-Fin segment is expected to expand at the highest CAGR of 11.39% during the forecast period, owing to growing demand for high-efficiency, corrosion-resistant heat exchangers in aggressive environments. These fins provide better mechanical strength and long-term performance, particularly in offshore and chemical processing applications. Thermofin and XChanger are among the companies that have introduced sophisticated extruded-fin heat exchangers with enhanced aluminum and copper alloy options for greater heat transfer and longer life.

By Material

Stainless steel dominated the Air-Cooled Heat Exchanger (ACHE) market by material type in 2023, with a commanding revenue share of 36.54%, due to its high corrosion resistance, long lifespan, and extensive availability. It is used in preference in a host of industries like oil & gas, petrochemicals, and power generation where operations involve exposure to extreme conditions. Important developments, including Alfa Laval's introduction of stainless steel-based ACHE units for offshore use and Kelvion's modular stainless steel coolers, have further increased this segment. These developments enhance stainless steel's reliability, fueling its continued demand and making it the cornerstone of ACHE system construction globally.

The titanium market is growing with the highest CAGR of 12.92%, thanks to its outstanding strength-to-weight ratio, corrosion resistance in seawater and chemical-laden environments, and durability. It is also becoming increasingly popular in niche applications such as ship cooling systems and chemical processing. Examples of new releases such as SWEP's offering of brazed plate heat exchangers using titanium-based components for severe-corrosion applications and Tranter's new enhanced titanium core modules illustrate increased investment from industry players. While more expensive, titanium provides unparalleled performance in hostile environments, in line with the growing demand for high-performance, low-maintenance ACHE systems. This trend highlights titanium's growing position in sophisticated air-cooled systems, particularly in coastal and chemical-intensive installations.

By Construction

In 2023, the Vertical segment in the Air-Cooled Heat Exchanger (ACHE) market by construction type, held the largest revenue share of 54.79% and was the fastest-growing segment with a CAGR of 7.42%. The reason for growth is the rising need for compact and space-saving cooling systems, especially in power plants and petrochemical plants where vertical orientation provides improved airflow and thermal performance. Market leaders such as Alfa Laval and Kawasaki Heavy Industries have launched next-generation vertical ACHE systems with enhanced heat transfer capacity and modular constructions. These trends are consistent with increasing industrial needs for energy-saving and space-efficient cooling systems, further strengthening the segment's market leadership.

By End Use

In 2023, the oil & gas industry captured the greatest proportion of the Air-Cooled Heat Exchanger (ACHE) market, with 28.97% of overall revenue. Its dominance stems from increasing worldwide energy demand in conjunction with environmental regulations that encourage the use of waterless cooling systems. Large industry players such as SPX Technologies and Kelvion have introduced high-efficiency ACHE units custom-designed for use in upstream and midstream environments. For example, Kelvion launched its Fin Coil air coolers designed for gas compression stations. These innovations drive thermal performance and minimize operational risk, further validating the oil & gas sector's dependence on ACHEs to ensure safe and sustainable operations.

The food & beverage sector is becoming the most rapidly growing end-use segment of the ACHE market, poised to grow at a CAGR of 8.12%. This expansion is fueled by rising demand for sanitary and energy-saving cooling systems in processing and packaging. GEA Group and Frick by Johnson Controls are making investments in next-generation air-cooled systems to satisfy sanitation requirements and minimize water consumption. GEA's recent launch of its Freezer AirCooler (FAC), specifically designed for sanitary food environments, is a case in point. The increasing focus on sustainable operations and stringent food safety standards makes ACHEs a perfect cooling solution for this industry.

Air-Cooled Heat Exchanger Market Regional Outlook

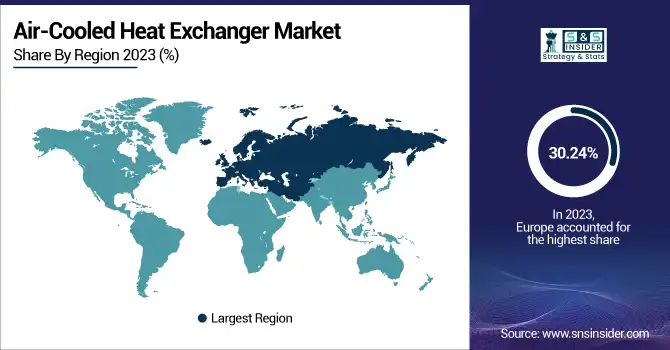

Europe dominated the Air-Cooled Heat Exchanger (ACHE) market in 2023 with a 30.24% share of worldwide revenue, fueled by stringent environmental regulations, increasing energy efficiency requirements, and upgrading old infrastructure. Germany, France, and the UK have pursued ACHEs aggressively to aid decarbonization targets. In June 2023, Alfa Laval launched its new energy-efficient ACHE series for industrial refrigeration in Europe, boosting demand in the food and chemical industries. In addition, GEA Group added capacity to its German ACHE production operations with a focus on modular designs. These developments demonstrate the region's active move toward sustainable thermal systems, securing Europe's market leadership.

Asia Pacific is experiencing the most rapid expansion in the Air-Cooled Heat Exchanger (ACHE) market with a strong CAGR of 8.80% over the forecast period. Accelerating industrialization, urbanization, and rising power generation requirements in China, India, and Southeast Asia are major catalysts. Hisaka Works Ltd. introduced a new compact ACHE system specific to high-density petrochemical complexes in Asia in August 2024 that is conducive to space-restricted environments. In the same vein, Kelvion increased its production plant in India to support increasing HVAC and process cooling needs. These strategic upgrades are speeding up ACHE adoption, positioning Asia Pacific as an important growth center for international market development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Air-Cooled Heat Exchanger Market Key Players are:

-

Chart Industries – (Air-X Extended Surface Coolers, Fin-Fan Air-Cooled Heat Exchangers)

-

Xylem – (Flygt Dry Coolers, Standard Xchange Air-Cooled Heat Exchangers)

-

Hayden Industrial – (Custom Engineered ACHE Systems, Modular Air-Cooled Heat Exchangers)

-

Kawasaki Heavy Industries, Ltd. – (Compact ACHE Units, High-Pressure Air-Cooled Heat Exchangers)

-

SPX Cooling Tech, LLC – (Air-Cooled Heat Exchanger Coil Systems, Marley DT Heat Exchangers)

-

SNT Energy Co., Ltd. – (High-Performance Air Coolers, Forced Draft ACHE Units)

-

Boldrocchi – (Plug & Play ACHE Systems, Dual Flow Air-Cooled Heat Exchangers)

-

Armstrong International Inc.– (Emech Air-Cooled Heat Transfer Systems, Packaged Cooling Solutions)

-

Baker Hughes Company – (Modular Air Coolers, NovaLT Heat Exchanger Series)

-

ALFA LAVAL – (AHE-FG Air Heat Exchanger, ALFA-V Dry Coolers)

-

Exchanger Industries Limited – (Forced Draft ACHE Units, Customizable Fin-Tube Exchangers)

Recent Developments

-

March 2024 – Kawasaki unveiled a modular air-cooled heat exchanger system with nano-coated fins designed to improve thermal dispersion in compact industrial environments. The new model is optimized for LNG and petrochemical applications in hot climates.

-

April 2023 - Aggreko launched two rental heat exchanger fleets for petrochemical and refinery use, including a large unit with the market’s largest surface area and a Hastelloy-C-based unit. Designed to boost efficiency and maintain production, they enable quick access while minimizing environmental impact in complex industrial operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.96 Billion |

| Market Size by 2032 | US$ 6.99 Billion |

| CAGR | CAGR of 6.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type – (Forced Draft, Induced Draft) • By Fin Type – (L-Fin, Embedded-fins, Extruded-fin, Others) • By Material – (Carbon steel, Stainless steel, Duplex stainless steel, Nickel & Nickel Alloys, Titanium, Others) • By Construction – (Vertical, Horizontal, Inclined) • By End Use – (Oil & Gas, Power Generation, Chemical & Petrochemical, HVAC & Refrigeration, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ALFA LAVAL, Kawasaki Heavy Industries, Ltd., Xylem, Exchanger Industries Limited, SPX Cooling Tech, LLC, Baker Hughes Company, Chart Industries, Armstrong International Inc., Hayden Industrial, SNT Energy Co., Ltd., Boldrocchi |