Control Valve Market Report Scope & Overview:

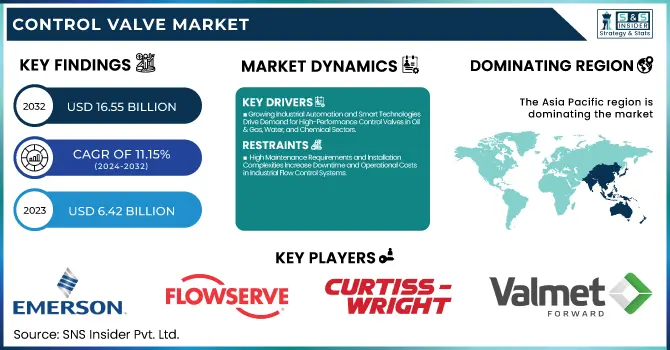

The Control Valve Market was valued at USD 6.42 billion in 2023 and is expected to reach USD 16.55 billion by 2032, growing at a CAGR of 11.15% from 2024-2032.

To Get more information on Control Valve Market - Request Free Sample Report

The Control Valve Market is experiencing strong expansion, fueled by the rising need for automation in multiple sectors, including oil and gas, power generation, chemicals, and water treatment. As sectors encounter the necessity to enhance processes for improved efficiency, the requirement for control valves is steadily increasing, rendering them vital for ensuring precise flow regulation. This transition to automation is additionally strengthened by the increasing demand for dependable and effective systems, driving sectors to implement advanced control valve solutions. As a result, the increasing industrialization in developing nations is crucial in fostering market growth. Aligned with this expansion, IMI revealed a USD 38 million investment in January 2025 to create a new control valve manufacturing plant in Lake Forest, California. This facility will improve the production of IMI CCI actuators and control valves, thereby aiding industry needs.

The increase in demand for control valves is linked to the swift implementation of smart control valves, which provide improved features like sensors and communication systems for superior performance monitoring and predictive maintenance. As sectors pursue more dependable and self-sufficient systems, intelligent valves offer the accuracy needed to satisfy their changing demands. The incorporation of IoT features into control valves has become crucial for enhancing operational efficiency, minimizing downtime, and guaranteeing dependable performance. Simultaneously, the increase in renewable energy sources boosts market expansion by necessitating specialized control valves for wind and solar power systems. Moreover, in 2024, Valmet revealed progress in valve technology, aiming to boost control valve efficiency through new features tailored for reliability and performance.

the control valve market holds substantial prospects, especially in industrial automation and smart grid innovations. As sectors shift towards Industry 4.0, the requirement for real-time data analysis and sophisticated manufacturing systems will increasingly drive the demand for automated control solutions. In the same way, the increasing emphasis on sustainable water management and intelligent water grids presents a fresh opportunity for market growth, as cities and industries work to tackle water shortages. As these trends progress, the control valve market is anticipated to flourish, propelled by innovation and a greater incorporation of intelligent technologies. In February 2024, Eaton unveiled new hydraulic control valves and power take-off units at the Work Truck Show, featuring Bezares 3960, 2500, and 500 series PTOs along with APSCO APV and APG valves, highlighting industry advancements.

Control Valve Market Dynamics

Drivers

-

Growing Industrial Automation and Smart Technologies Drive Demand for High-Performance Control Valves in Oil & Gas, Water, and Chemical Sectors.

The rapid advancement of industrial automation is changing industries such as oil and gas, water and wastewater management, and chemical processing. As sectors seek enhanced efficiency, safety, and operational accuracy, the demand for high-performance control valves is rising. Automated systems demand accurate flow regulation, pressure management, and fluid control to boost efficiency and reduce downtime. Furthermore, the combination of smart valve technologies with IoT and AI-based monitoring systems enhances real-time performance assessment and predictive maintenance, minimizing operational risks. More stringent regulatory requirements for process safety and environmental adherence are further speeding up adoption. The transition to Industry 4.0 and smart manufacturing is strengthening the dependence on sophisticated control valves, guaranteeing smooth operations in essential applications. These elements together propel market growth, establishing control valves as a vital part of the development of contemporary industrial infrastructure.

-

Smart Valves, Advanced Materials, and AI-Driven Systems Enhance Efficiency, Reliability, and Automation in Industrial Flow Control Applications.

Continuous innovations in valve materials, smart valve technologies, and actuator systems are transforming industrial flow control, making processes more efficient and reliable. The development of corrosion-resistant and high-durability materials extends valve lifespan, reducing maintenance costs and downtime. Smart valves equipped with sensors, IoT connectivity, and AI-driven monitoring enable real-time data analysis, predictive maintenance, and automated process adjustments, improving overall system performance. Advanced actuator systems, including electric and pneumatic variants, offer precise control, enhancing efficiency in critical applications such as oil and gas, chemical processing, and water treatment. Additionally, the integration of digital technologies is streamlining remote operation and diagnostics, increasing operational safety and reducing human intervention.

Restraints

-

High Maintenance Requirements and Installation Complexities Increase Downtime and Operational Costs in Industrial Flow Control Systems

Control valves play a critical role in regulating fluid flow, but their precise installation and ongoing maintenance present significant challenges for industries. Proper alignment, calibration, and integration with automation systems require skilled technicians, increasing labor costs and setup time. Once installed, these valves demand regular inspections, cleaning, and repairs to ensure optimal performance, especially in high-pressure or corrosive environments. Frequent maintenance leads to operational downtime, impacting productivity and efficiency in sectors like oil and gas, chemical processing, and water treatment. Additionally, advanced smart valves with IoT-enabled monitoring systems require specialized knowledge for troubleshooting, further complicating maintenance processes. For industries operating under tight production schedules, these complexities add financial strain and disrupt workflows. As automation adoption grows, addressing these challenges remains crucial to ensuring seamless industrial operations while minimizing unexpected costs and system failures.

-

Extreme Temperatures, Corrosive Substances, and High-Pressure Conditions Accelerate Wear and Increase Maintenance Costs for Control Valves

Industrial settings frequently subject control valves to severe conditions, greatly affecting their durability and function. Extreme temperatures, whether elevated or reduced, can result in the expansion, contraction, and deterioration of materials, potentially causing leaks or mechanical failure. In industries like chemical processing and wastewater treatment, corrosive materials slowly wear down valve parts, decreasing efficiency and necessitating regular replacements. High-pressure processes place additional stress on valve structures, heightening the chances of mechanical fatigue and unforeseen failures. These obstacles require the utilization of distinct materials and coatings, increasing expenses for producers and consumers. Moreover, ongoing exposure to harsh operating conditions demands increased maintenance frequency, leading to elevated operational costs and periods of production inactivity. Industries that depend on control valves for essential processes need to invest in robust, high-quality solutions to reduce these risks, yet the added expenses and complexities present continual obstacles.

Control Valve Market Segment Analysis

By Product

In 2023, the Linear segment dominated the Control Valve Market with a revenue share of approximately 69%, driven by its widespread use in industries requiring precise flow control. Sectors such as oil and gas, water and wastewater treatment, and power generation rely heavily on linear control valves, particularly globe and gate valves, for their superior throttling capabilities and ability to handle high-pressure and high-temperature conditions. Additionally, their established reliability and efficiency in critical applications contributed to their strong market presence, securing a dominant position.

The Rotary segment is projected to grow at the fastest CAGR of approximately 12.47% from 2024 to 2032, fueled by increasing demand for compact, cost-effective, and high-performance solutions. Rotary control valves, such as butterfly and ball valves, are gaining traction due to their quick operation, lower maintenance requirements, and suitability for automation. As industries move towards smart manufacturing and energy efficiency, the adoption of rotary valves in chemical processing, pharmaceuticals, and food & beverage sectors is accelerating, driving their rapid market expansion.

By Application

In 2023, the Oil & Gas segment led the Control Valve Market with a dominant revenue share of approximately 25%, driven by the sector’s high demand for precise flow regulation in critical operations. Control valves play an essential role in upstream, midstream, and downstream processes, ensuring safe and efficient handling of crude oil, natural gas, and refined products. With stringent safety regulations and the need for high-performance valves in extreme pressure and temperature conditions, the oil and gas industry continues to invest in advanced control valve technologies, reinforcing its market leadership.

The Water & Wastewater Treatment segment is set to grow at the fastest CAGR of approximately 14.48% from 2024 to 2032, propelled by rising global concerns over water scarcity and environmental regulations. Expanding urbanization, industrialization, and investments in smart water infrastructure are driving demand for highly efficient and automated control valves in treatment plants. Additionally, the growing need for sustainable water management solutions, including desalination and wastewater recycling, is accelerating the adoption of advanced valve technologies, positioning this segment for rapid growth.

By Component

In 2023, the Actuators segment led the Control Valve Market with a dominant revenue share of approximately 45%, driven by the increasing adoption of automation and smart control systems. Actuators are crucial for enhancing valve performance, enabling precise flow regulation, remote operation, and integration with industrial IoT networks. Industries such as oil and gas, power generation, and water treatment are investing heavily in electric, pneumatic, and hydraulic actuators to improve efficiency, safety, and reliability, securing this segment’s market leadership.

The Valve Body segment is projected to grow at the fastest CAGR of approximately 12.41% from 2024 to 2032, fueled by advancements in material technologies and the rising demand for durable, high-performance valves. As industries operate under extreme pressure, temperature, and corrosive conditions, the need for robust valve bodies made from stainless steel, alloys, and composite materials is increasing. Additionally, innovations in lightweight and cost-effective materials are driving widespread adoption across sectors, positioning the Valve Body segment for rapid expansion.

Control Valve Market Regional Outlook

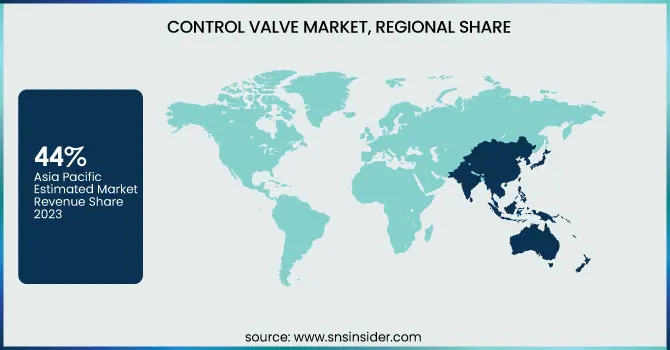

In 2023, Asia Pacific dominated the Control Valve Market with the highest revenue share of approximately 44%, driven by rapid industrialization, urbanization, and infrastructure development across key countries such as China, India, and Japan. The region’s strong presence in industries such as oil and gas, chemicals, and power generation has fueled the demand for high-performance control valves. Additionally, government initiatives to improve water and wastewater treatment, alongside large-scale manufacturing operations, continue to boost the adoption of advanced control valve technologies, reinforcing Asia Pacific's market dominance.

North America is projected to grow at the fastest CAGR of approximately 12.55% from 2024 to 2032, spurred by increased investments in automation, digitalization, and sustainable energy. The region’s shift towards Industry 4.0, smart manufacturing, and the modernization of critical infrastructure, including energy and water systems, is driving demand for advanced control valve solutions. Moreover, North America's strong focus on regulatory compliance, coupled with technological advancements in valve materials and actuator systems, is positioning the region for rapid growth in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Emerson Electric Co. (Fisher Control Valves, Fisher Valve Actuators)

-

Flowserve Corporation (Valtek Control Valves, Valtek Actuators)

-

IMI plc (IMI Pneumax Control Valves, IMI Norgren Valve Actuators)

-

Curtiss-Wright Corporation (Valves, Actuators)

-

Valmet (Control Valves, Flow Control Solutions)

-

SLB (SLB Control Valves, SLB Actuators)

-

Spirax Sarco Limited (Thermodynamic Steam Traps, Control Valves)

-

Crane Company (Crane Control Valves, Crane Fluid Control)

-

KITZ Corporation (KITZ Control Valves, KITZ Pressure Relief Valves)

-

Alfa Laval AB (Alfa Laval Control Valves, Alfa Laval Actuators)

-

AVK Holding A/S (AVK Control Valves, AVK Actuators)

-

Eaton (Eaton Control Valves, Eaton Actuators)

-

Honeywell International, Inc. (Honeywell Control Valves, Honeywell Pneumatic Actuators)

-

Velan Inc. (Velan Control Valves, Velan Valve Actuators)

-

Burkert Fluid Control System (Burkert Control Valves, Burkert Actuators)

-

Valvitalia SpA (Valvitalia Control Valves, Valvitalia Actuators)

-

Metso Corporation (Metso Control Valves, Metso Actuators)

-

KSB SE & Co. KGaA (KSB Control Valves, KSB Actuators)

-

SAMSON AKTIENGESELLSCHAFT (SAMSON Control Valves, SAMSON Actuators)

-

Schlumberger Ltd. (Schlumberger Control Valves, Schlumberger Actuators)

-

Christian Bürkert GmbH & Co. KG (Bürkert Control Valves, Bürkert Actuators)

Recent Developments:

-

Emerson's 2024 AVENTICS Series 625 Sentronic pressure control valves provide high-precision pneumatic control with flexibility and efficiency. These valves feature a control deviation of less than 0.5% and are equipped with data acquisition software for easy PC control and monitoring.

-

In August 2024, Flowserve announced its acquisition of MOGAS Industries for USD 290 million, with a potential USD 15 million earnout. This strategic move aims to expand Flowserve's severe service valve offerings, enhance its aftermarket opportunities, and support its 3D growth strategy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.42 Billion |

| Market Size by 2032 | USD 16.55 Billion |

| CAGR | CAGR of 11.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Valve Body, Actuators, Others) • By Size (Less than 1", Between 1" to 6", Between 6" to 25", Between 25" to 50", More than 50") • By Product (Linear, Rotary) • By Application (Oil & Gas, Chemicals, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Flowserve Corporation, IMI plc, Curtiss-Wright Corporation, Valmet, SLB, Spirax Sarco Limited, Crane Company, KITZ Corporation, Alfa Laval AB, AVK Holding A/S, Eaton, Honeywell International, Inc., Velan Inc., Burkert Fluid Control System, Valvitalia SpA, Metso Corporation, KSB SE & Co. KGaA, SAMSON AKTIENGESELLSCHAFT, Schlumberger Ltd., Christian Bürkert GmbH & Co. KG |

| Key Drivers | • Growing Industrial Automation and Smart Technologies Drive Demand for High-Performance Control Valves in Oil & Gas, Water, and Chemical Sectors. • Smart Valves, Advanced Materials, and AI-Driven Systems Enhance Efficiency, Reliability, and Automation in Industrial Flow Control Applications. |

| Restraints | • High Maintenance Requirements and Installation Complexities Increase Downtime and Operational Costs in Industrial Flow Control Systems • Extreme Temperatures, Corrosive Substances, and High-Pressure Conditions Accelerate Wear and Increase Maintenance Costs for Control Valves |