Anti-Drone Market Report Scope & Overview:

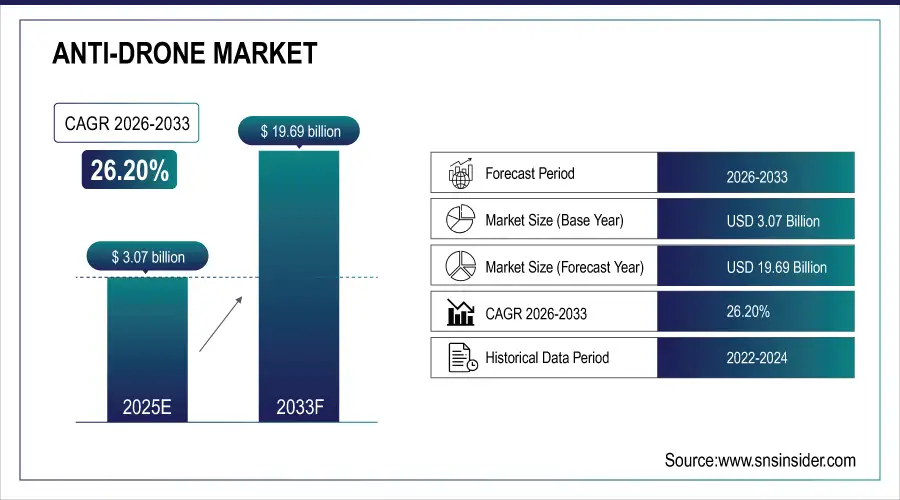

The Anti-Drone Market Size is valued at USD 3.07 Billion in 2025E and is projected to reach USD 19.69 Billion by 2033, growing at a CAGR of 26.20% during the forecast period 2026–2033.

The Anti-Drone Market analysis report offers a complete assessment of current technologies and deployment trends. Due to increased security risks from rogue drone usage in defense, government, and commercial, market demand for detection and neutralization alternatives is forecast to develop most significantly over the next seven years.

Anti-drone system deployments reached 48,000 units in 2025, driven by rising security threats and growing adoption across defense and critical infrastructure sectors.

Market Size and Forecast:

-

Market Size in 2025: USD 3.07 Billion

-

Market Size by 2033: USD 19.69 Billion

-

CAGR: 26.20% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Anti-Drone Market - Request Free Sample Report

Anti-Drone Market Trends:

-

AI and machine learning are becoming more integrated into real-time threat classification and drone detection.

-

Portable and handheld anti-drone systems are gaining more ground for tactical field operations.

-

RF and radar fusion technologies are being deployed more to improve the precision of detection.

-

Beyond the traditional military field, anti-drone systems are employed for commercial and airport security.

-

Governments heavily invest in counter-UAV defense programs for the borders and the public-building protection.

-

New multi-sensor and networked anti-drone systems with scalable and centralized control are under development or laboratory tests.

-

The private sector shows a surge in anti-drone protection demand for events, energy sites, and logistics hubs.

U.S. Anti-Drone Market Insights:

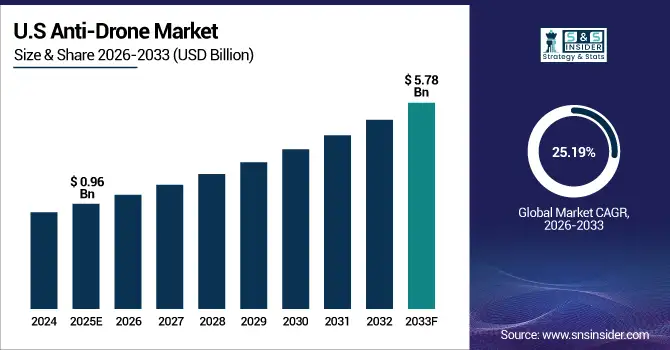

The U.S. Anti-Drone Market is projected to grow from USD 0.96 Billion in 2025E to USD 5.78 Billion by 2033, at a CAGR of 25.19%. Growth driven by rising defense modernization, increasing UAV threats near borders and airports, and expanding government investments in advanced counter-drone and surveillance technologies.

Anti-Drone Market Growth Drivers:

-

Growing incidents of unauthorized drone intrusions are accelerating demand for advanced detection and countermeasure technologies.

Growing incidents of unauthorized drone intrusions across borders, airports, and public venues are a major driver of Anti-Drone Market growth. Given increasing security concerns among defense agencies, governments, and private entities, investments in advanced detection and neutralization systems are growing. Meanwhile, a proven rise of the threat to critical infrastructure and rapid innovations in AI-based surveillance and countermeasure integration, is paving the way for largescale anti-drone solution adoption around the world.

Anti-drone system sales grew 27.5% in 2025, driven by rising cross-border drone incursions and expanding defense modernization programs.

Anti-Drone Market Restraints:

-

High development costs, complex regulations, and limited detection accuracy in dense environments are restraining Anti-Drone Market growth.

High development and deployment costs, coupled with complex regulatory frameworks, are major restraints for the Anti-Drone Market. The dependence on advanced sensors, AI algorithms, and the high-powered countermeasure systems drive the need for expensive production and maintenance. Besides, the technology operates less efficiently in crowded or urban environments, due to the limited detection accuracy. The restriction of jamming frequencies by regulation curb’s possible introduction, as this limits the potential of market scaling by manufacturers based on high costs of production.

Anti-Drone Market Opportunities:

-

Rising demand for integrated counter-drone solutions across defense and commercial sectors presents major growth opportunities.

Rising demand for integrated counter-drone solutions across defense and commercial sectors presents a major opportunity for market expansion. Governments and private enterprises are looking for integrated systems providing in real-time detection, tracking, and neutralization capabilities. The addition of AI, radar, and other RF technologies helps to improve precision and scalability. As the range of drone threats expands, vendors with flexible security arrangements can layer on enhanced capabilities to win new contracts and connect with world partners, accelerating long-term momentum.

Integrated counter-drone systems made up 32% of new deployments in 2025, driven by rising demand for unified detection and neutralization capabilities.

Anti-Drone Market Segmentation Analysis:

-

By Technology, Electronic Systems held the largest market share of 41.28% in 2025, while Hybrid Systems are expected to grow at the fastest CAGR of 29.37% during 2026–2033.

-

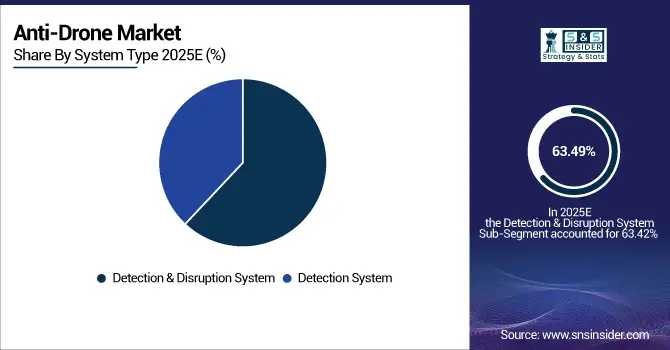

By System Type, Detection & Disruption Systems dominated with a 63.49% share in 2025, while Detection Systems are projected to expand at the fastest CAGR of 23.45% during the forecast period.

-

By Platform Type, Ground-Based Systems accounted for the highest market share of 52.86% in 2025, whereas UAV-Based Systems are anticipated to record the fastest CAGR of 30.41% through 2026–2033.

-

By Interception Type, Electronic Countermeasures held the dominant share of 46.95% in 2025, while Laser Countermeasures are forecast to witness the fastest CAGR of 28.94% during 2026–2033.

-

By Range, the Medium Range segment captured the largest market share of 44.76% in 2025, whereas the Long Range category is expected to register the fastest CAGR of 28.83% through the forecast period.

-

By End-Use, the Military & Defense segment led with a 58.34% share in 2025, while Critical Infrastructure applications are projected to grow at the fastest CAGR of 30.27% during 2026–2033.

By System Type, Detection & Disruption Systems Lead While Detection Systems Grow Swiftly:

Detection & Disruption Systems segment dominated the market. These systems provide spill protection due to they cannot only recognize but also defeat drones by electronic jamming or physical interception. The sector trends the most integrated solutions, which appear to represent a better option for protection of defense and homeland security. Detection Systems are the fastest growing segment due to they were inexpensive surveillance mechanisms for commercial development and the public safety area. In 2025, around 3,200 airports globally integrated standalone detection systems into their security infrastructure.

By Technology, Electronic Systems Dominate While Hybrid Systems Expand Rapidly:

Electronic Systems segment dominated the market, which has demonstrated substantial success in the ability to detect, track and jam unauthorized drones using radio frequency and radar technologies. With critical scalability and applicability for both military and commercial operations, the segment forms the core of any counter-UAV defense network. Hybrid Systems is the fastest growing segment are anticipated to see significant growth owing to the combination of the three main technologies and the resultant integrated solutions. In 2025, over 18,500 hybrid anti-drone units were deployed globally.

By Platform Type, Ground-Based Dominate While UAV-Based Accelerate Rapidly:

Ground-Based segment dominated the market due to its vast detection coverage, ideal power sources, and installation at border checkpoints, stadiums, and government zones. They became the forefront and the major sense for the national-level anti-drone defense platform. UAV-Based are the fastest-growing segment, with mobile aerial interceptors rising extensive popularity for active marksman actions and battlegrounds oscillations. In 2025, nearly 640 UAV-based anti-drone units were newly commissioned for defense applications.

By Interception Type, Electronic Countermeasures Dominate While Laser Countermeasures Advance Quickly:

Electronic Countermeasures segment dominated the market, as these can easily disrupt the drone communication links and its navigation systems without direct physical debris. The systems are used to counter the drones for defense and offensive purposes. Laser Countermeasures are the fastest growing segment, which is due to the precision targeting with less collateral damage to the personnel and equipment. In 2025, over 420 laser-based interception systems were operational across key defense and airport security networks.

By Range, Medium Range Dominates While Long Range Expands Rapidly:

Medium Range segment dominated the market due to optimal balance between detection capability and cost efficiency, which is ideal for urban security, border surveillance, and industrial cases; it still remains the basis in integrated defense systems. Long Range is the fastest growing segment due to cross-border surveillance and military sectors. In 2025, around 2,700 long-range anti-drone systems were deployed for national defense monitoring across hotspots.

By End-Use, Military & Defense Dominate While Critical Infrastructure Accelerates Strongly:

Military & Defense segment dominated the market due to the growing use of drones for reconnaissance and combat which require sophisticated countermeasures to protect the battlefield. Concurrently, major economies continue pumping finance to their defense modernization programs. Critical Infrastructure is the fastest-growing segment as energy plants, airports, and communication hubs are constantly increasing their layers of drone defense. In 2025, over 1,200 infrastructure facilities integrated anti-drone systems into security frameworks.

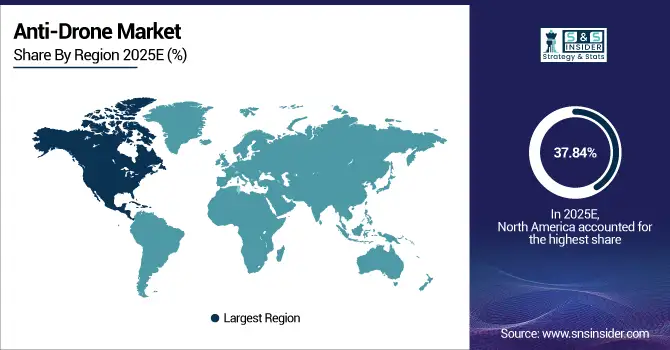

Anti-Drone Market Regional Analysis:

North America Anti-Drone Market Insights:

The North America Anti-Drone Market dominated the industry with a 37.84% share in 2025, owing to robust defense budgets and sophisticated security infrastructure in the U.S. and Canada. The region also enjoys a leadership position due to the early deployment of counter-drone solutions and the proliferation of homeland surveillance programs with significant investments toward AI-driven detection systems. Additionally, constant innovation by prominent defense contractors and government collaborations accentuate North America’s dominance in the anti-drone industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Anti-Drone Market Insights:

The U.S. Anti-Drone Market is driven by rising adoption of advanced detection and neutralization systems across defense, homeland security, and critical infrastructure. Further, the rise in drone incursions into airports and military sites has sparked a solid government reaction. The US remains a leader in counter-drone capacity due to the partnership between defense contractors and tech disrupters that drives innovation.

Asia-Pacific Anti-Drone Market Insights:

The Asia-Pacific Anti-Drone Market is the fastest-growing region, projected to expand at a CAGR of 29.24% during 2026–2033. Growth in Asia Pacific is driven by expanding defense budgets, heavy congestion of surveillance technologies, and growing security incidents related to drones in China, India, Japan, and South Korea. Increasing border control projects, smart cities security initiatives, and partnerships with international defense companies continue to boost the region’s leadership as an epicenter of advanced counter-drone technologies.

China Anti-Drone Market Insights:

The China Anti-Drone Market is propelled by swift defense modernization, developing border security concerns, and forward-looking improvements in radar and AI based detection systems. The government’s strong initiatives, the country’s expanding local manufacturing capacities, and increasing government investments in homeland surveillance have established China as a key member in the Asia-Pacific Anti-Drone industry’s technical and production backdrop.

Europe Anti-Drone Market Insights:

Europe Anti-Drone Market is characterized by strong defense interest, advanced capabilities in aerospace technologies, and comprehensive regulatory frameworks in support of airspace protection. The major consumers, including the U.K., France, and Germany, are rapidly adopting anti-drone technologies for cry infrastructure safety and counter-terrorism. Enhanced R&D, security expertise exchange projects, and joint ventures with international defense corporations are boosting Europe’s technological advancement and affirm its status as a leading hub for anti-drone technologies.

U.K. Anti-Drone Market Insights:

The U.K. Anti-Drone Market is becoming increasingly prominent fueled by the strong defense modernization programs, counter-terrorism efforts, and the growing necessity to protect the airports and public spaces. The country’s emphasis on AI-driven surveillance and radar systems integration, substantial government investments, and private defense sector collaboration enable the U.K. to secure its position as the European industry’s pioneer.

Latin America Anti-Drone Market Insights:

The Latin America Anti-Drone Market is picking up pace due to increasing security concerns, government defense modernization initiatives, along with safeguarding the critical infrastructures. Nations such as Brazil, Mexico, and Argentina are spending on developing advanced surveillance and countermeasure technologies. Furthermore, the growing partnerships with overseas defense companies and domestic manufacturing capacities are speeding up the market scope across the region.

Middle East and Africa Anti-Drone Market Insights:

The Middle East & Africa Anti-Drone Market will develop at a quick speed, as a result of growing protection budgets, counter-terrorism necessities and demanding infrastructure hazard. Increase investment in surveillance expertise and sensible frontier safety is driving the enlargement. Regional heavyweights, collectively with Saudi Arabia, the UAE and South Africa, characterize modernization efforts and nationwide defense Developments

Anti-Drone Market Competitive Landscape:

Lockheed Martin Corporation, headquartered in Bethesda, Maryland, is an aerospace and defense leader known for its cutting-edge technologies and advanced security solutions. The company is reigning the Anti-Drone Market with its experience in radar, directed-energy systems and electronic warfare. Their counter-UAS technology includes AI, sensor fusion and rapid response techniques. Moreover, Lockheed’s existing military contracts, R&D power and strong friendship with the U.S. military have confirmed its status as a leader and innovative defense firm.

-

In February 2025, Lockheed Martin introduced its Scalable Counter-Unmanned Aerial System (C-UAS) with AI-powered detection and multi-sensor tracking. The modular design enhances defense against drone threats, reinforcing Lockheed’s leadership and innovation in next-generation counter-UAV technology.

Raytheon Technologies Corporation, based in Arlington, Virginia, is a world-renowned defense and aerospace company excelling in missile systems, radar and air defense solutions. High-energy lasers and electronic jamming systems place the company in the lead of Anti-Drone Market, where it remains dominant. Additionally, defense portfolio, alliances and government partnerships also allow Raytheon to produce reliable and quickly scalable drone-neutralizing devices. Thus, the company remains one of the major participants in the national and battlefield airspace protection, as the systems have already been successfully applied.

-

In March 2025, Raytheon launched the Coyote LE SR variant for reconnaissance, electronic warfare and drone-swarm interception. With rapid deployment and adaptive capabilities, it strengthens Raytheon’s dominance in tactical anti-drone warfare globally.

Israel Aerospace Industries Ltd. (IAI), headquartered in Lod, Israel, is a leading innovator in aerospace, defense, and security technologies. The company has a proven track record of building military systems that have been exported all over the world, with an established counter-UAS response capability. IAI has long been considered a key partner for governments and military bodies that desire multifaceted detection and interception systems composed of radar, electro-optics, and cyber defense for the ultimate protection of their national airspace.

-

In September 2025, IAI unveiled the Elli-3312 HunterEye, a compact counter-drone system with radar and electro-optical sensors. Designed for real-time interception, it enhances IAI’s regional and leadership in UAV defense systems, strengthening protection for military bases and critical infrastructure.

Anti-Drone Market Key Players:

Some of the Anti-Drone Market Companies are:

-

Lockheed Martin Corporation

-

Raytheon Technologies Corporation

-

Israel Aerospace Industries Ltd. (IAI)

-

Thales Group

-

Leonardo S.p.A.

-

Rafael Advanced Defense Systems Ltd.

-

Saab AB

-

Northrop Grumman Corporation

-

DroneShield Ltd.

-

Dedrone Holdings, Inc.

-

Blighter Surveillance Systems Ltd.

-

Liteye Systems, Inc.

-

The Boeing Company

-

Airbus Group SE

-

SRC, Inc.

-

Hensoldt AG

-

Battelle Memorial Institute

-

QinetiQ Group plc

-

Elbit Systems Ltd.

-

ASELSAN A.S.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.07 Billion |

| Market Size by 2033 | USD 19.69 Billion |

| CAGR | CAGR of 26.20% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Laser Systems, Kinetic Systems, Electronic Systems, Hybrid Systems) • By System Type (Detection System, Detection & Disruption System) • By Platform Type (Ground-Based, Handheld, UAV-Based, Vehicle-Mounted) • By Interception Type (Electronic Countermeasures, Kinetic Countermeasures, Laser Countermeasures, Others) • By Range (Short Range, Medium Range, Long Range) • By End-Use (Military & Defense, Government, Commercial, Homeland Security, Critical Infrastructure, Public Venues, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Lockheed Martin Corporation, Raytheon Technologies Corporation, Israel Aerospace Industries Ltd. (IAI), Thales Group, Northrop Grumman Corporation, Leonardo S.p.A., Saab AB, Dedrone Holdings Inc., DroneShield Ltd., Liteye Systems Inc., Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., MBDA, Blighter Surveillance Systems Ltd., CACI International Inc., SRC Inc., Hensoldt AG, Rheinmetall AG, Aaronia AG, and Fortem Technologies Inc. |