Aircraft Battery Market Report Scope & Overview:

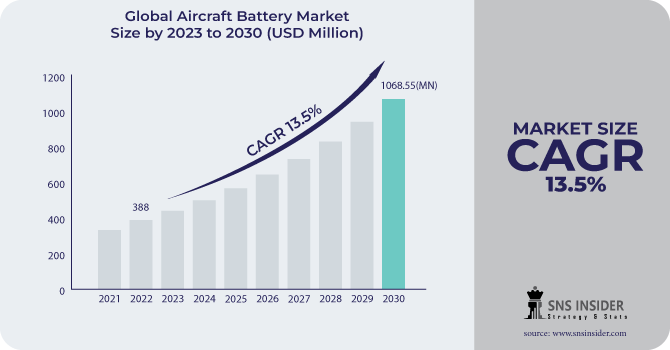

The Aircraft Battery Market size was valued at USD 388 Million in 2022 & is estimated to reach USD 1068.55 Million by 2030 and increase at a compound annual growth rate (CAGR) of 13.5% between 2023 and 2030.

Aircraft batteries are devices that convert chemical energy into electrical energy via one or more cells. Aircraft batteries are vital for starting the Auxiliary Power Unit and/or engines and powering up the electrical system during preflight. The APU or engine(s) power generators, give electricity to electrical circuits & recharge batteries as soon as they start up. When all generators fail or need to be isolated, battery power is available as a backup supply, while they ordinarily offer all of the usual electrical power when they are functioning.

To get more information on Aircraft Battery Market - Request Free Sample Report

Nickel-cadmium, Lithium-ion, and lead-acid batteries are among the most prominent aviation battery technologies. Some of the important criteria that battery makers strive for when developing aeroplane batteries and related goods include high-energy density, lightweight, low maintenance cost and portability. These batteries must be effective in a wide range of environmental situations while maintaining the highest level of safety. Aviation electrification is gaining popularity in the aviation sector and beyond. To overcome climate issues, new aeroplane technologies are being designed and developed.

They show immense promise for influencing an emissions-free flying future. New aircraft types, however, create challenges due to their reliance on battery technology, such as hybrid or electric designs. Due to the limited energy capacity of current batteries, only tiny aircraft can be powered. Significant developments in battery energy density will enable commercial aircraft electrification in the future. Furthermore, the sustainability of the battery supply chain is critical to ensuring the environmental integrity of the aviation industry's transition to an electric future, from raw material manufacturing to the disposal of end-of-life batteries.

The aerospace industry is currently confronted with the challenge of designing aeroplanes to meet performance and efficiency standards. Governments around the world are primarily defining these needs in their efforts to reduce CO2 emissions and rely less on oil. To do this, aerospace businesses must develop alternate energy sources, particularly hybrid electrification.

The introduction of More Electric aircraft (ME) is a recent market trend. Market competitiveness and global warming have prompted the aircraft industry to address environmental and economic issues. As a result, More Electric Aeroplanes (ME) are now available on the market. Many high-energy-density batteries have been developed as a result of the increase in aeroplane power requirements, notably in the last 20 years, as well as advancements in battery technology and materials. The aircraft industry has made important and well-known contributions to a more sustainable world. According to the Advisory Council for Aviation Research and Innovation in Europe (ACARE), quieter and cleaner aircraft should be available by 2020. Designers and engineers have placed a greater emphasis on embracing technology that can affect both total costs and fuel consumption in order to build a More Electric Aircraft (MA).

MARKET DYNAMICS

DRIVERS:

-

The increasing global demand for air travel has led to a growing commercial aircraft fleet.

-

Increased Use of Avionics is the driver of the Aircraft Battery Market.

Modern aircraft are equipped with sophisticated avionics systems that require reliable power sources. Aircraft batteries play a crucial role in providing power to avionics, communication systems, and cockpit instrumentation.

RESTRAIN:

-

Aircraft batteries must meet strict weight constraints to avoid negatively impacting the aircraft's overall weight and fuel efficiency.

-

Limited Energy Density is the restraint of the Aircraft Battery Market.

The energy density of current battery technologies, such as lithium-ion, may not be sufficient for long-haul or large commercial aircraft. This limitation can affect the range and performance of electric or hybrid aircraft.

OPPORTUNITY:

-

The shift toward electric and hybrid-electric aircraft presents a significant opportunity for the aircraft battery market.

-

Advanced Battery Technologies is an opportunity for the Aircraft Battery Market

Ongoing research and development efforts are leading to advancements in battery technology, such as higher energy density, longer cycle life, and improved safety features. These innovations open up opportunities for manufacturers to develop and supply cutting-edge aircraft batteries.

CHALLENGES:

-

Developing aviation-grade batteries that meet the rigorous requirements of the aerospace industry can be expensive.

-

Market Niche is the challenge of the Aircraft Battery Market.

The market for aircraft batteries is relatively small compared to other industries that use batteries, which can limit economies of scale and drive up production costs.

IMPACT OF RUSSIA-UKRAINE WAR

The Russian Aerospace Force (RuAF) appears to have launched a concerted attack on the Patriot battery, eliciting a response resembling an epileptic fit induced by fury. The much-touted long-range Patriot air defence (AD) system, which represents cutting-edge US anti-missile technology, launched over 30 missiles, each costing $5 million, in less than 2 minutes.

According to the missile launch trajectories, several distinct launchers were used in the retaliatory Patriot fire. Several shots were fired at the battery during the attack. Some Patriot missiles appear to have hit their intended targets. The targets, however, were at heights characteristic of cruise missile flight trajectories. A successful Kinzhal encounter is only achievable at extremely high altitudes when the missile has just left its launcher and is still travelling at supersonic speeds. Once the missile reaches hypersonic speeds, it begins to manoeuvre evasively and becomes extremely tough to target. In this war, the Aircraft Battery Market is gaining profit up to 2-3 %.

IMPACT OF ONGOING RECESSION

A mild US recession in 2023 would dampen aircraft production, resulting in a longer, but generally consistent, mid-single-digit climb towards 2018 delivery levels. In the context of recovering, healthy air travel demand and carriers' long-term approach to fleet planning, customers would balance new aircraft acquisitions with liquidity levels. Base case assumptions now include a faster rebound by 2024. Despite the forecast for a small US recession in 2023, Anticipate Boeing's major commercial aircraft deliveries (MAX, 787, & others) to increase to over 500 in 2022 and more than 600 in 2023, powered by strong narrow-body demand (80% of deliveries). Strong domestic air traffic demand and greater OEM production rates should help to continue the US aerospace recovery in terms of FCF generation, profitability, & revenue growth.

KEY MARKET SEGMENTATION

By Offering

-

Service

-

Product

By Aircraft Type

-

AAM

-

Rotary-wing

-

UAV

-

Fixed-wing

By End User

-

Aftermarket

-

OEM

.png)

Need any customization research on Aircraft Battery Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

North America: The North American region has the most aeroplane battery manufacturers of any location. North America also spends extensively on research and development of innovative battery technology essential for current and future aircraft technologies.

Asia Pacific: The Asia-Pacific area is predicted to develop at the fastest rate over the projection period, owing to the region's rebounding passenger traffic and carriers' robust acquisition of commercial aircraft. As part of fleet growth and modernization programmes, airlines in India, China, South Korea and Japan have large order books for narrow-body and wide-body aircraft from aircraft OEMs.

KEY PLAYERS

The Major Player are Kokam, EnerSys, GS Yuasa Corporation, Cella Energy, Concorde Batteries, Saft, Teledyne Battery Products, MGM Compro, EaglePicher Technologies, Custom cells and other players

Kokam-Company Financial Analysis

RECENT DEVELOPMENT

In 2022: Ampaire, a pioneer in electric aviation, has chosen Electric Power Systems (EP Systems) to supply the propulsion battery pack for its hybrid-electric upgrade of the Cessna Grand Caravan under an exclusive agreement. It is the FAA's first hybrid-electric aircraft to enter the certification process. The updated aircraft is projected to receive supplemental-type certification in 2024.

In 2022: Vertical Aerospace, a worldwide aerospace and technology firm pioneering zero-emissions aviation, has formed a strategic alliance with Molicel to supply high-power cylindrical cells for Vertical's VX4 VTOL aircraft.

| Report Attributes | Details |

| Market Size in 2022 | US$ 388 Million |

| Market Size by 2030 | US$ 1068.55 Million |

| CAGR | CAGR of 13.5 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Service, Product) • By Aircraft Type (AAM, Rotary-wing, UAV, Fixed-wing) • By End User (Aftermarket, OEM) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kokam, EnerSys, GS Yuasa Corporation, Cella Energy, Concorde Batteries, Saft, Teledyne Battery Products, MGM Compro, EaglePicher Technologies, Custom cells |

| Key Drivers | • The increasing global demand for air travel has led to a growing commercial aircraft fleet. • Increased Use of Avionics is the driver of the Aircraft Battery Market. |

| Market Challenges | • Developing aviation-grade batteries that meet the rigorous requirements of the aerospace industry can be expensive. • Market Niche is the challenge of the Aircraft Battery Market. |