Aircraft Electrical Systems Market Report Scope & Overview:

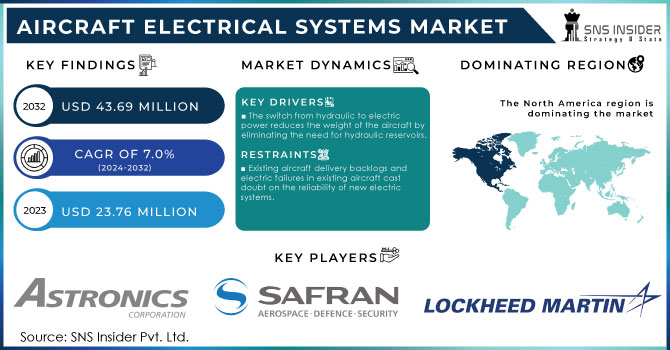

The Aircraft Electrical Systems Market Size was valued at USD 23.76 million in 2023 and is expected to reach USD 43.69 million by 2032 with a growing CAGR of 7.0% over the forecast period 2024-2032.

To get more information on Aircraft Electrical Systems Market - Request Free Sample Report

The aircraft electrical system market is being driven by factors such as improved airline networks, increased customer preference for air travel, increased defence spending, and a surged inclination toward all-electric and more-electric air crafts, as well as an increase in the use of drones for civil and defence purposes. On the contrary, existing aircraft delivery backlogs and electric failures within existing aircraft cast doubt on the reliability of new electric systems. This is expected to limit the growth of the global electrical system market. However, significant research is being conducted in the design and development of aircraft electrical systems. The increased demand for light-weight air crafts around the world is forcing electric system manufacturers to create electrical components that are lighter and more reliable. "More electric aircraft" are air crafts in which electrically powered systems replace mechanical, pneumatic, and hydraulic systems, resulting in improved performance and reliability as well as lower operating costs. Furthermore, collaboration between electrical system manufacturers and aircraft manufacturers to invest in electric power systems is increasing. Such collaborative projects are expected to provide lucrative opportunities for the growth of the aircraft electrical system market.

MARKET DYNAMICS

KEY DRIVERS

-

improved aircraft performance by incorporating more electric technology.

-

The switch from hydraulic to electric power reduces the weight of the aircraft by eliminating the need for hydraulic reservoirs.

RESTRAINTS

-

Existing aircraft delivery backlogs and electric failures in existing aircraft cast doubt on the reliability of new electric systems.

-

Leading Asian Economies Lack Aviation Infrastructure

OPPORTUNITIES

-

Electrical system technological advancements in aircraft

-

Reduced overall aircraft weight leads to increased fuel efficiency.

CHALLENGES

-

Efficiency and power density

-

Market participants face a significant challenge in replacing and introducing high-frequency switch-mode power supplies for aircraft.

IMPACT OF COVID-19

The unfriendly effect of Corona virus on the aviation and guard area is probably going to stop the development of the worldwide airplane electrical frameworks market over the course of the following couple of years. The aeronautics business has seen an exceptional decay starting from the start of the pandemic. The flare-up of the infection has fundamentally affected carrier organizations. The quantity of planned flights overall for the week beginning fourth January 2021 was 43.5% lower than that of the week beginning sixth January 2020. Because of this extreme reduction in air traveler traffic universally, the incomes of carrier organizations declined in 2020. The flying business has seen practically zero development when contrasted with the earlier year. The decrease in air traveler incomes is likewise expected to diminish the interest for new airplane by the carrier organizations during this year. Also, there will be postpones in airplane conveyances via airplane producers like Airbus SAS and Boeing. Hence, defers in airplane conveyance and a diminishing in airplane tasks are decreasing the interest for airplane electrical frameworks.

Regardless of the Corona virus emergency, the standpoint stays positive and compelled by a few elements, for example, the Corona virus bend, inoculation rate, and monetary recuperation. State run administrations across the world are working in close cooperation with the antibody makers for fast immunization roll-out. With these requirements being momentary in nature the drawn out development drivers actually being pertinent, the flight business is supposed to quickly return to pre-pandemic development levels in two or three years. Hence, the Corona-virus influence on the worldwide airplane electrical frameworks market is supposed to be present moment and recuperate in the following several years.

The commercial aviation industry has grown rapidly in recent years. This expansion can be attributed to factors such as increased air travel, rising middle-class disposable income, and increased international trade and tourism around the world. Strong growth in this sector has led to an increase in aircraft orders to meet rising air passenger traffic.

Generators are an essential component of aircraft electrical systems. They are the main source of electricity. Generators, which are found in light aircraft, convert mechanical energy into electrical energy. They are also powered by the engine via a belt system. At low engine RPM, aircraft with generators use battery power. Alternators are now used in most aircraft as a replacement for generators.

Power generation, power distribution, power conversion, and energy storage have all been classified as systems. The major players in the aircraft electrical systems market have been working on lightweight, high-quality energy storage systems. Aircraft manufacturers are collaborating closely with aircraft electrical system providers to improve the operational efficiency of energy storage systems in order to improve the operational performance of hybrid electric and fully electric aircraft. As a result, demand for aircraft electrical systems in the energy storage segment is expected to rise significantly during the study period.

The aircraft electrical systems market is expected to expand significantly in the coming years as demand for new aircraft rises globally, as does demand for electric aircraft for commercial aviation. The presence of several global and regional vendors distinguishes the global aircraft electrical systems market. The market is extremely competitive, with all players attempting to gain the greatest possible market share. The key factors influencing global market growth are frequent changes in government policies, intense competition, and government regulations. The vendors compete on price, product quality, and dependability.

KEY MARKET SEGMENTATION

By System

-

Conversion

-

Distribution

-

Energy Storage

By Component

-

Generators

-

Conversion devices

-

Distribution devices

By Platform

-

Commercial Aviation

-

Military Aviation

-

Business & General Aviation

By End User

-

Commercial

-

Defense

By Application

-

Power Generation

-

Utility Management

-

Configuration Management

-

Flight Controlling

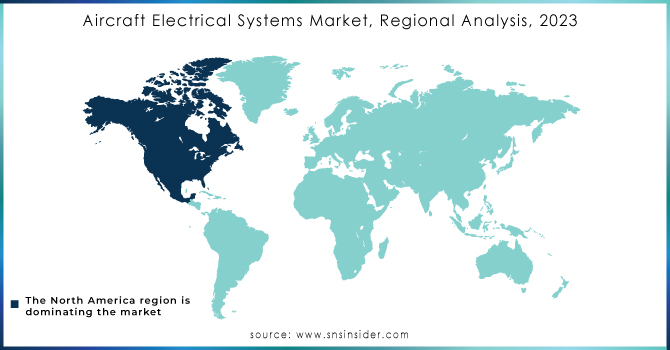

REGIONAL ANALYSIS

North America is supposed to be the biggest market for airplane electrical frameworks during the figure time frame. The developing interest for airplane for business applications and their rising utility in the protection area to do ship and observation exercises are extra factors affecting the development of the airplane electrical frameworks market in the North American district.

Tremendous interests in the innovative work of more electric airplane and expanding interest for eco-friendly and low-support airplane are factors driving the development of the airplane electrical frameworks market around here. Ongoing advances in innovation have empowered Boeing to consolidate a new no-drain frameworks engineering in the Boeing 787 Dream liner. The new engineering wipes out the customary pneumatic framework and drain complex, and converts the power wellspring of most capacities, previously fueled by drain air, to electric power, which incorporates cooling frameworks.

Need any customization research on Aircraft Electrical Systems Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Astronics, Boeing, Safran, UTC Aerospace, Fokker technologies, Thales, Lockheed Martin, Zodiac Aerospace, Esterline Control Systems, Eaton and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.76 Million |

| Market Size by 2032 | USD 43.69 Million |

| CAGR | CAGR of 7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Power Generation, Conversion, Distribution, Energy Storage) • By Component(Generators, Conversion devices, Distribution devices, Battery Management Systems) • By Platform (Commercial Aviation, Military Aviation, Business & General Aviation) • By End User (Commercial and Defense) • By Application (Power Generation, Utility Management, Configuration Management, and Flight Controlling) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Astronics, Boeing, Safran, UTC Aerospace, Fokker technologies, Thales, Lockheed Martin, Zodiac Aerospace, Esterline Control Systems, and Eaton. |

| DRIVERS | • improved aircraft performance by incorporating more electric technology. • The switch from hydraulic to electric power reduces the weight of the aircraft by eliminating the need for hydraulic reservoirs. |

| RESTRAINTS | • Existing aircraft delivery backlogs and electric failures in existing aircraft cast doubt on the reliability of new electric systems. • Leading Asian Economies Lack Aviation Infrastructure |