Aircraft Micro Turbine Engines Market Report Scope & Overview:

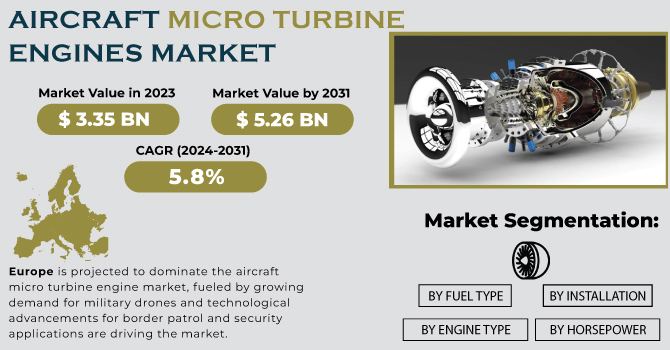

The Aircraft Micro Turbine Engines Market Size was valued at USD 3.35 Billion in 2023 and is expected to reach USD 5.26 Billion by 2031 and grow at a CAGR of 5.8% over the forecast period 2024-2031.

The International Air Transport Association (IATA) forecasts a surge in air travellers to 4 billion by 2024, necessitating more aircraft and potentially boosting the micro turbine market. Innovative hybrid aircraft designs are incorporating microturbines as power sources for small, unmanned drones. This technology offers efficient power generation and heat utilization simultaneously (cogeneration). Finally, the growing focus on reducing emissions makes microturbines attractive alternatives to traditional engines due to their lower emissions profile.

To get more information on Aircraft Micro Turbine Engines Market - Request Free Sample Report

Microturbines themselves are compelling due to their compact size and efficient design. They utilize micro combustion for cogeneration and can operate on various fuels with high efficiency. Imagine a refrigerator-sized engine – that's a microturbine, capable of generating 25 kW to 500 kW of power. Their simple design, with just one set of turbine and compressor blades, translates to fewer moving parts and easier maintenance, making them ideal for unmanned aerial vehicles (UAVs) and small aircraft.

However, the future of microturbines isn't without challenges. While the aviation industry aspires towards electrification, current battery technology lacks the energy density required for long-distance flights. This limitation keeps microturbines relevant in the near future. Nevertheless, research on next-generation battery chemistries like Sodium-ion or Lithium-metal is ongoing, aiming to surpass the energy density of jet fuel. These advancements could eventually challenge the dominance of microturbines.

MARKET DYNAMICS

KEY DRIVERS:

-

Hybrid aircraft development utilizing microturbines as power sources for small drones is driving growth in the aircraft micro turbine engine market

New hybrid aircraft designs are incorporating microturbines as power sources for small, unmanned aerial vehicles (UAVs or drones). Microturbines offer efficient power generation and the ability to utilize heat simultaneously (cogeneration), making them well-suited for hybrid applications.

-

The anticipated surge in air travellers fuels the demand for more aircraft and potentially boosts the micro turbine engine market.

RESTRAIN:

-

Limited Aftermarket for Newer Segments

Currently, the aftermarket for micro turbine engines is primarily focused on replacements for Auxiliary Power Units (APUs) in older aircraft. Newer segments like light aircraft, military drones, and urban air taxis (cargo drones and air taxis) are not yet widespread, limiting the aftermarket for these engines.

-

Microturbine engines themselves are expensive due to research and development (R&D) costs for specialized aircraft components

OPPORTUNITY:

-

The development of distributed power generation systems at airports and remote landing strips presents a new market opportunity for microturbine engines

These systems would provide on-site electricity generation, reducing reliance on traditional power grids that might be unavailable or unreliable in remote locations. The compact size, fuel flexibility, and efficiency of microturbines make them well-suited for this application, potentially powering facilities, ground equipment, and even contributing to electric or hybrid aircraft charging infrastructure

-

Integration with Electric Propulsion Systems

CHALLENGES:

-

High Manufacturing and Certification Costs

Microturbines involve specialized technology, leading to high research and development (R&D) expenses. Additionally, obtaining aviation authority certification for these engines adds a significant cost burden for manufacturers.

IMPACT OF RUSSIA UKRAINE WAR

On the downside, supply chain disruptions caused by the war could inflate transportation costs by 20-30% (McKinsey & Company), leading to production delays and price increases for microturbines due to difficulty acquiring materials. Additionally, sanctions on Russia, a former major supplier (10% of global aluminum exports in 2021 - Forbes), could limit access to crucial resources. Furthermore, the war's economic uncertainty might decrease demand for new civilian aircraft by 5-10% (Air Lease Corporation), potentially reducing the need for new microturbines in auxiliary power units.

The surge in military spending around 10-15% increase could boost demand for military drones powered by microturbines. Additionally, countries might prioritize domestic production of critical microturbine components with 20-25% increase to create a more geographically diverse supply chain.

IMPACT OF ECONOMIC SLOWDOWN

Airlines and private jet operators, tightening their budgets, might delay or cancel new aircraft orders by 15-20%, according to industry analysts. This translates to a direct drop in demand for new microturbines, especially those powering Auxiliary Power Units (APUs) in these grounded planes. Innovation might also stall as budget cuts lead to a 10-15% decrease in R&D spending for advanced microturbine technologies. With a focus on cost-cutting, airlines might delay scheduled maintenance or upgrades for existing microturbines by 5-10%, potentially impacting their performance and lifespan. Additionally, tight credit markets could make securing financing for new aircraft or microturbines difficult, with smaller aviation companies facing a potential 20% reduction in financing options.

Airlines prioritizing fuel efficiency might find microturbines, known for their efficiency, 10-15% more attractive compared to traditional engines in specific applications. Economic slowdowns could also lead to airlines extending the lifespan of existing aircraft, potentially boosting the aftermarket for replacement microturbines and parts by 15-20%.

KEY MARKET SEGMENTS

BY ENGINE TYPE

-

Turbojet

-

Turboprop

-

Turboshaft

BY FUEL TYPE

-

Jet Fuel

-

Multi Fuel

BY HORSEPOWER

-

Below 50 HP

-

50-100 HP

-

100-200 HP

-

Greater Than 200 HP

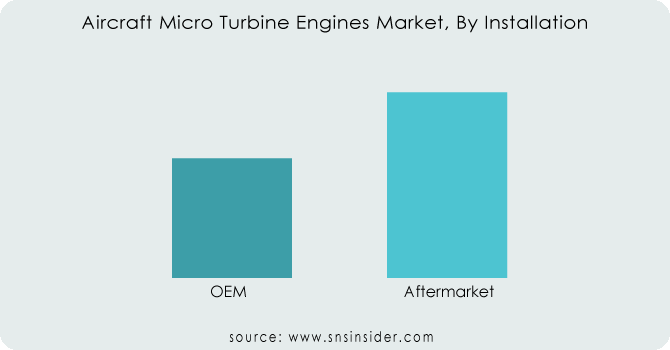

BY INSTALLATION

-

OEM

-

Aftermarket

In the aircraft micro turbine engine market, aftermarket parts, mainly for replacing Auxiliary Power Units (APUs) in older aircraft, are expected to lead in 2023 with the market share of 60%. This excludes newer segments like light aircraft, military drones, and urban air taxis (cargo drones and air taxis) since they're not yet widespread. Currently, only engine manufacturers supply replacement APUs. Though aftermarket parts for these newer segments are limited due to their recent development, advancements in micro turbine technology are expected to boost this market in the future.

Need any customization research on Aircraft Micro Turbine Engines Market - Enquiry Now

BY PLATFORM

-

General Aviation

-

Business Jets

-

Light Aircraft

-

-

Military Aviation

-

Military Drones

-

Military Aircraft

-

-

Commercial Aviation

-

Advanced Air Mobility

-

Cargo Drones

-

Air Taxis

-

BY END USE

-

Auxiliary Power

-

Propulsion

Auxiliary power units (APUs) are expected to be the dominant application for micro turbine engines in aircraft (2024-2031). Research suggests micro turbines (5-500 HP) could power APUs in light aircraft and business jets, reducing operating costs and emissions. Similar to aircraft gas turbines, micro turbines use compressors, combustors, turbines, and generators for on-board electricity. Compared to other technologies, micro turbines for aircraft propulsion offer advantages like fewer parts, lighter weight, and higher efficiency. They even utilize waste heat, achieving efficiencies over 80%.

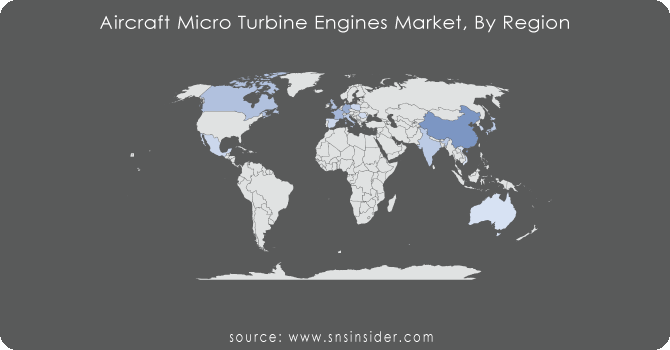

REGIONAL ANALYSIS

Europe is projected to dominate the aircraft micro turbine engine market, fueled by growing demand for military drones and technological advancements for border patrol and security applications are driving the market. The surge in private jet usage post-pandemic is creating a need for new engines, with major European cities experiencing significant increases in private flights.

Overall growth in air traffic and investment in the aviation sector are contributing to the market's expansion. Research suggests the commercial drone market in Europe will balloon from 10,000 units in 2019 to 395,000 by 2035, highlighting the significant role drones will play in this market growth.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Aircraft Micro Turbine Engines Market are General Electric Company, Sentient Blue Technologies, Turbotech SAS, Williams International, AeroDesignWorks GmbH, Elliott Company, Kratos Defense & Security Solutions, Inc., Micro Turbine Technology B.V., Honeywell International Inc., PBS Group. a.s, Raytheon Technologies Corporation, UAV Turbines Inc, Kratos Defense & Security Solutions Inc., and other players.

RECENT TRENDS

-

In June 2023, Czech engineering company PBS and Ukrainian engine designer Ivchenko Progress signed a memorandum of understanding to develop a compact turbojet for small UAVs and cruise missiles at Le Bourget.

-

In February 2020, UAV Turbines Inc. introduced the Micro Turbogenerator System 1.0 (MTS 1.0). This innovative system is designed to be portable and meet the needs of both ground power and auxiliary power applications. The MTS 1.0 offers flexibility, delivering on-demand electrical power in a range of outputs, from 3 kW to 40 kW.

Sentient Blue Technologies-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.35 Billion |

| Market Size by 2031 | US$ 5.26 Billion |

| CAGR | CAGR of 5.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Engine Type (Turbojet, Turboprop, Turboshaft) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | General Electric Company, Sentient Blue Technologies, Turbotech SAS, Williams International, AeroDesignWorks GmbH, Elliott Company, Kratos Defense & Security Solutions, Inc., Micro Turbine Technology B.V., Honeywell International Inc., PBS Group. a.s, Raytheon Technologies Corporation, UAV Turbines Inc, Kratos Defense & Security Solutions Inc |

| KEY DRIVERS |

• Hybrid aircraft development utilizing microturbines as power sources for small drones is driving growth in the aircraft micro turbine engine market |

| Restraints |

• Limited Aftermarket for Newer Segments |