Aircraft MRO Market Report Scope and Overview:

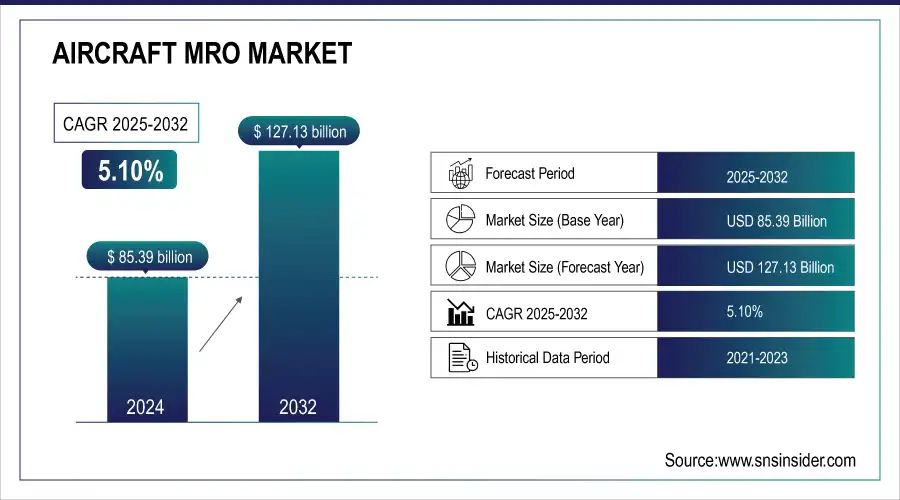

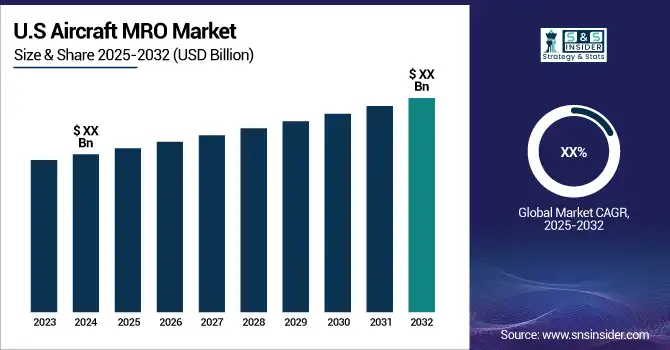

The Aircraft MRO Market Size was valued at USD 85.39 billion in 2024 and is expected to reach USD 127.13 billion by 2032 and grow at a CAGR of 5.10% over the forecast period 2025-2032.

To get more information on the Aircraft MRO Market - Request Free Sample Report

Aircraft MRO Market growth is driven by the increasing air travel demand, particularly in emerging economies, which drives a larger global fleet. More aircraft translates to more maintenance needs. For example, Boeing projects 41,000+ new aircraft deliveries over the next 20 years to meet demand. Airlines look to cut costs by outsourcing MRO activities to specialized providers. This allows them to focus on core operations and benefit from the expertise of MRO companies.

Aircraft MRO Market Highlights:

-

Lufthansa Technik and other major third-party MRO providers serve airlines such as Delta and Emirates, with aging aircraft fleets driving increased maintenance requirements to ensure compliance and airworthiness

-

Regulatory bodies including the FAA and EASA enforce strict maintenance schedules, creating consistent demand for inspections, repairs, and overhauls globally

-

New technologies like predictive maintenance and digital MRO tools streamline processes, enhance efficiency, and reduce aircraft downtime for airlines and lessors

-

Growing passenger traffic and rising air cargo trade expand operational aircraft fleets, increasing the need for regular inspections, engine overhauls, and structural maintenance activities

-

High costs of establishing and maintaining MRO facilities including infrastructure, tools, and skilled labor pose a challenge to market expansion and deter new entrants

-

Expanding aviation sectors in Asia and Africa present significant opportunities for MRO services, supported by increasing fleets, lower labor costs, and strategic collaborations such as Boeing’s partnership with Tata Advanced Systems Limited in India

For Example, Lufthansa Technik is a major third-party MRO provider offering diverse services to airlines like Delta and Emirates. With many aircraft exceeding their expected lifespans, there is increased maintenance demand to keep them airworthy and compliant. A significant portion of narrowbody aircraft globally are older models requiring frequent checks and overhauls. Regulations from agencies like the FAA and EASA mandate rigorous maintenance schedules. This consistently fuels the Aircraft MRO market. For Example, FAA Airworthiness Directives (ADs) outline mandatory inspections and repairs.

New technologies like predictive maintenance and the use of digital tools streamline MRO processes, increase efficiency, and reduce aircraft downtime. For Example, MRO software providers like Ramco Aviation offer solutions for optimized maintenance scheduling and parts management. Airlines and lessors seek aircraft conversions and upgrades, driving demand for MRO specialization in this area. Companies like Israel Aerospace Industries (IAI) specialize in passenger-to-freighter conversions for older aircraft models.

Aircraft MRO Market Drivers:

- Growing passenger demand and air cargo trade will lead to a rise in operational aircraft, boosting demand for MRO services.

The steady increase in global passenger traffic and the expansion of air cargo trade are significantly contributing to the growth of operational aircraft fleets worldwide. Airlines are expanding their routes, upgrading existing fleets, and introducing new aircraft to accommodate rising travel demand and meet the surge in freight transportation. This growth directly drives the demand for aircraft Maintenance, Repair, and Overhaul (MRO) services to ensure airworthiness, operational efficiency, and compliance with stringent aviation safety regulations. As aircraft utilization rates increase, the need for regular inspections, component replacements, engine overhauls, and structural maintenance activities is expected to rise substantially.

Aircraft MRO Market Restraints:

-

The high cost associated with the establishment and maintenance of MRO facilities

The establishment and maintenance of Aircraft MRO facilities involve substantial costs, posing a significant challenge for market players. Setting up an MRO facility requires heavy investments in advanced infrastructure, specialized tools, high-tech diagnostic equipment, and skilled workforce training to meet stringent aviation safety and regulatory standards. Additionally, the ongoing operational expenses, including equipment calibration, procurement of certified spare parts, compliance audits, and continuous technology upgrades, further increase the financial burden. Fluctuating raw material prices and high labor costs also contribute to rising expenses. These high initial and recurring costs often deter new entrants and limit expansion for existing providers.

Aircraft MRO Market Opportunities:

-

Growing aviation industries in Asia and Africa will create demand for MRO services in these regions.

As economies develop in these regions, airlines are buying more aircraft to meet rising passenger demand. Larger fleets mean more aircraft needing maintenance. Airports in countries like India, China, Ethiopia, and South Africa are becoming major passenger and cargo hubs. This concentration of aircraft increases MRO demand locally and regionally. Some airlines in these regions operate older aircraft that require more frequent and intensive maintenance, increasing MRO needs. Some locations in Asia and Africa offer lower labor and operating costs for MRO, making them attractive to airlines seeking affordable maintenance options. Boeing collaborates with local MRO providers and establishes joint ventures to expand its footprint in developing countries.

For example, Boeing has partnered with Tata Advanced Systems Limited (TASL) in India for MRO work on the Boeing 737 and other models.

Aircraft MRO Market Segment Analysis:

By Service Type

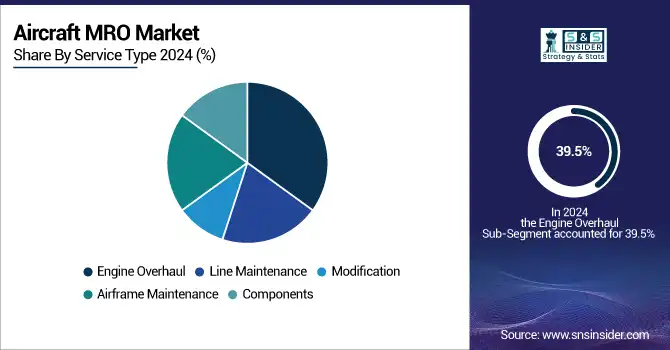

The engine overhaul dominated the Aircraft MRO Market with the highest revenue share of more than 39.5% in 2024. Aircraft engines are complex and expensive components. Overhauling them requires specialized expertise, facilities, and expensive parts. This translates to a significant portion of an aircraft's overall maintenance cost. Aviation regulations (FAA, EASA) mandate regular engine overhauls based on factors like flight hours and cycles (starts and landings). This guarantees a steady demand for engine MRO services. Modern aircraft engines are incredibly reliable but also increasingly complex. Specialized MRO providers are essential for servicing and overhauling them. Overhauling engines restores them to peak efficiency, improving fuel economy and reducing operational costs for airlines. Within engine overhauls, high-cost components like turbines and blades often require individual maintenance, further adding to the revenue pool for this segment.

In April 2024, Honeywell and ITP Aero, a global leader in aircraft propulsion, revealed their intentions to create a new authorized maintenance facility for Honeywell's F124-GA-200 aircraft engines.

In Feb 2024, General Atomics Aeronautical Systems (GA-ASI) solidified an expression of interest (EOI) with Hindustan Aeronautics (HAL) in India to offer support services for the turbo-propeller engines of the MQ-9B aircraft. In this joint endeavor to cater to the Indian market, HAL will be responsible for providing maintenance, repair, and overhaul (MRO) services for the engines at its Engine and Industrial & Marine Gas Turbine (IMGT) division located in Bengaluru, India.

By Organization Type

Independent MRO led the Aircraft MRO Market in 2024 and is expected to dominate the market during the forecast period. Independent MROs aren't tied to a specific aircraft manufacturer. This allows them to offer services for a wider range of aircraft models, opening a larger customer base. They can also tailor maintenance solutions to individual airline needs. Independent MROs often have lower overhead costs compared to OEM-affiliated providers. This can translate into more competitive pricing for airlines. Independent MROs have established networks across various regions, offering proximity to customers and potentially reducing aircraft downtime during maintenance. Many independent MROs develop expertise in specific engine types, components, or aircraft models. This helps them offer niche services in high demand. Independent MRO may form partnerships with OEMs or parts suppliers, securing access to technical data and parts while maintaining flexibility in service offerings.

For example, Lufthansa Technik has capitalized on the increased demand for aircraft maintenance, repair, and overhaul (MRO) services. Lufthansa Technik showcases its prominent position in engine maintenance by completing the first overhaul of a LEAP-1B engine, which powers the Boeing 737 MAX. As the first independent MRO provider globally, Lufthansa Technik has signed a service agreement for both the LEAP-1A (Airbus A320neo) and LEAP-1B engines, ensuring access to the fleets of tomorrow.

Aircraft MRO Market Regional Analysis:

Asia-Pacific Aircraft MRO Market Trends:

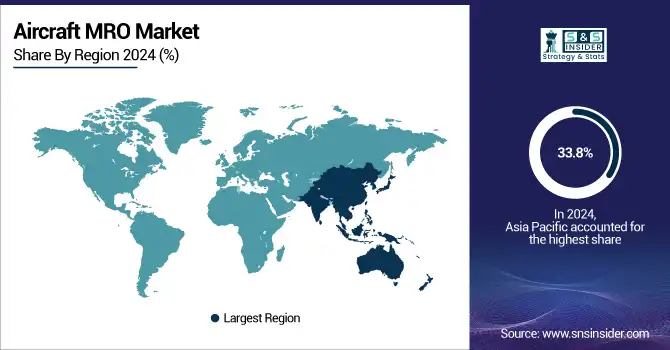

Asia Pacific led the Aircraft MRO Market with the highest revenue share of more than 33.8% in 2024. The Asia Pacific region has seen unprecedented growth in air travel demand, particularly in China, India, and Southeast Asia. This surge is driven by economic development, a burgeoning middle class, and increased tourism. More aircraft in operation naturally lead to a higher demand for maintenance, repair, and overhaul services. To meet the skyrocketing demand, airlines in the Asia Pacific are rapidly adding to their aircraft fleets. Newer aircraft require specialized MRO services, and the region is investing heavily in infrastructure and capabilities to support this expanding fleet.

Many Asia Pacific airlines are strategically outsourcing non-core functions like MRO to specialized providers. This allows airlines to focus on operations while reducing costs. The region boasts a relatively lower cost of skilled labor in comparison to North America and Europe, making it an attractive location for MRO service providers.

Need any customization research on the Aircraft MRO Market - Enquiry Now

North America Aircraft MRO Market Trends:

North America held a significant share of the Aircraft MRO Market in 2024, supported by a mature aviation industry and a high volume of both domestic and international flights. The region is characterized by strong regulatory frameworks, advanced technological adoption, and well-developed infrastructure. The United States remains the largest contributor due to the presence of major airlines, OEMs, and independent MRO providers. Airlines are increasingly embracing predictive maintenance, digitalization, and automation to enhance operational efficiency and reduce downtime. High labor costs and strict compliance standards drive innovation and the integration of advanced tools for maintenance and repair processes.

Europe Aircraft MRO Market Trends:

Europe continues to be a prominent hub for Aircraft MRO, driven by a dense network of international travel routes and the presence of leading aerospace companies. Countries such as Germany, France, and the United Kingdom are key markets due to their strong airline fleets and technical expertise. The European Union enforces stringent safety regulations, leading to consistent demand for regular inspections, overhauls, and upgrades. Moreover, the region is witnessing a growing emphasis on sustainable aviation, including green MRO practices and eco-friendly solutions for next-generation aircraft. Strategic collaborations and government support further enhance the market’s growth prospects.

Middle East & Africa Aircraft MRO Market Trends:

The Middle East & Africa region is experiencing rapid growth in Aircraft MRO services, primarily fueled by its strategic position as a global aviation hub. Countries such as the UAE, Saudi Arabia, and Qatar are investing extensively in aviation infrastructure, supported by national carriers and increasing passenger traffic. Tourism expansion, long-haul routes, and major airport development projects contribute to rising maintenance demand. Africa, though developing at a slower pace, is gradually improving its aviation capabilities with fleet modernization and regional connectivity initiatives. MRO outsourcing remains prevalent, while investments in local facilities are steadily increasing.

Latin America Aircraft MRO Market Trends:

Latin America is witnessing steady growth in the Aircraft MRO sector, driven by rising air travel demand in nations such as Brazil, Mexico, and Chile. Expanding tourism, a growing middle class, and the proliferation of low-cost carriers are key factors supporting market expansion. However, the region faces challenges such as political instability, currency fluctuations, and limited large-scale MRO infrastructure. To address these challenges, airlines increasingly outsource maintenance services to international providers while gradually investing in regional capabilities. Strategic partnerships and infrastructure modernization are expected to support long-term growth in the Latin American MRO landscape.

Aircraft MRO Market Key Players:

-

Safran SA

-

Airbus SE

-

General Electric Company

-

AAR Corp.

-

Lufthansa Technik

-

Delta Airlines, Inc.

-

MTU Aero Engines AG

-

KLM U.K. Engineering Limited

-

Boeing

-

Singapore Technologies Engineering Ltd.

-

Hong Kong Aircraft Engineering Company Limited

-

Raytheon Technologies Corporation

-

TAP Maintenance & Engineering

-

SR Technics

-

ST Aerospace Solutions (a division of ST Engineering)

-

Ameco Beijing (Aircraft Maintenance and Engineering Corporation)

-

Hainan Airlines Technic Co., Ltd.

-

Aviation Technical Services (ATS)

-

China Airlines Engineering and Maintenance Organization (CAL MRO)

-

SIA Engineering Company (SIAEC)

Aircraft MRO Market Competitive Landscape:

Safran Aircraft Engines Services Morocco (SAESM), established in 2005, is a leading aircraft engine maintenance, repair, and overhaul (MRO) provider located in Casablanca, Morocco. The company specializes in servicing CFM56 engines used in commercial aviation, offering advanced repair solutions, component maintenance, and technical support. SAESM plays a crucial role in Safran’s global MRO network, supporting airlines across Europe, Africa, and the Middle East. With state-of-the-art facilities and a highly skilled workforce, the company ensures high-quality, efficient, and cost-effective engine maintenance services. Its strategic location enhances regional connectivity and contributes to the growth of Morocco’s aviation industry.

-

In April 2024, Safran Aircraft Engines Services Morocco (SAESM), a partnership between Safran Aircraft Engines and Royal Air Maroc, officially opened the expansion of its Nouaceur facility. The plant is located near Mohammed V International Airport in Casablanca.

Pratt & Whitney, a division of RTX, established in 1925, is a global leader in designing, manufacturing, and servicing aircraft engines and auxiliary power units. Renowned for its innovative geared turbofan engines, the company provides advanced propulsion solutions for commercial, military, and business aviation, ensuring efficiency, reliability, and reduced environmental impact.

-

In Feb 2024, RTX's Pratt & Whitney division expanded its operations in South Asia by inaugurating the India Digital Capability Center (IDCC) in Bengaluru, the capital city of Karnataka.

Boeing, established in 1916, is a leading global aerospace company engaged in the design, manufacturing, and servicing of commercial airplanes, defense systems, and space technology. The company provides advanced aviation solutions, including aircraft, rotorcraft, satellites, and related services, supporting global connectivity, defense operations, and innovation in the aerospace and aviation industries.

-

In May 2022, Boeing announced a strategic partnership with AI Engineering Services Ltd. (AIESL) to enhance Maintenance, Repair, and Overhaul (MRO) services for crucial equipment on key Boeing defense platforms in India. This collaboration will focus on supporting the P-8I aircraft utilized by the Indian Navy and the 777 VIP aircraft operated by the Indian Air Force.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 85.39 Billion |

| Market Size by 2032 | USD 127.13 Billion |

| CAGR | CAGR of 5.10% From 2024 to 2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Engine Overhaul, Line Maintenance, Modification, Airframe Maintenance, and Components) • By Organization Type (Airline/Operator MRO, Independent MRO, and Original Equipment Manufacturer MRO) • By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet, and Others) • By Aircraft Generation (Old Generation, Mid Generation, and New Generation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Safran SA, Airbus SE, General Electric Company, AAR Corp., Lufthansa Technik, Delta Airlines, Inc., MTU Aero Engines AG, KLM U.K. Engineering Limited, Boeing, Singapore Technologies Engineering Ltd., Hong Kong Aircraft Engineering Company Limited, Raytheon Technologies Corporation, TAP Maintenance & Engineering, SR Technics, ST Aerospace Solutions (a division of ST Engineering), Ameco Beijing (Aircraft Maintenance and Engineering Corporation), Hainan Airlines Technic Co., Ltd., Aviation Technical Services (ATS), China Airlines Engineering and Maintenance Organization (CAL MRO), SIA Engineering Company (SIAEC). |