Tactical Data Link Market Report Scope & Overview:

To get more information on Tactical Data Link Market - Request Free Sample Report

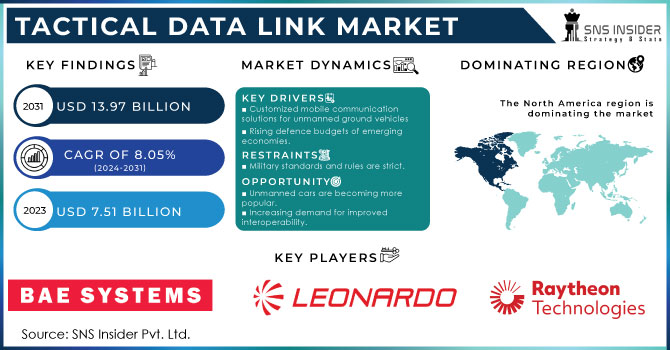

The Tactical Data Link Market Size was valued at USD 7.51 billion in 2023, expected to reach USD 13.97 billion by 2031 and grow at a CAGR of 8.05% over the forecast period 2024-2031.

The increase in demand for tactical data links (TDLs) is because of the rise of complex, network-enabled warfare. Modern conflicts often involve a mix of air, land, and sea forces, each requiring a common operational picture to effectively engage the enemy. TDLs reduces the gap by seamlessly transmitting critical data like target identification, friendly troop locations, and sensor readings across diverse platforms. This force coordinated strikes, reduces fratricide risks, and enhances overall mission effectiveness. A recent study done by SNS Insider, revealed a global increase in military spending of 2.6% a significant portion of which is being directed towards network-centric warfare capabilities.

Another factor supporting the growth of the TDL market is the growing adoption of unmanned aerial vehicles (UAVs) and manned-unmanned teaming (MUM). UAVs play an increasingly crucial role in modern warfare, providing intelligence, surveillance, and reconnaissance (ISR) data.

MARKET DYNAMICS

KEY DRIVERS

-

Customized mobile communication solutions for unmanned ground vehicles

-

Rising defence budgets of emerging economies.

These customized solutions go beyond traditional radio frequencies, often incorporating features like Satellite communication on the Move (SOTM) for extended range and mesh networking capabilities for enhanced battlefield coordination between UGVs and other tactical units. This ensures a constant flow of critical data, such as high-definition video feeds, sensor readings, and mission updates, empowering commanders with superior situational awareness and improved decision-making capabilities

RESTRAINTS

-

Military standards and rules are strict.

OPPORTUNITIES

-

Unmanned cars are becoming more popular.

-

Increasing demand for improved interoperability.

The need for seamless communication between soldiers and military units, especially during joint operations, is driving a push in demand for improved interoperability within the tactical data link market. Incompatibility between different systems can lead to crucial delays and hinder battlefield awareness. This is reflected in a growing focus on standardized protocols like Link 16, which facilitates data exchange across various platforms like land vehicles, fighter jets, and warships.

CHALLENGES

-

High gap of skilled labours.

-

System specifications and design restrictions

IMPACT OF RUSSIA-UKRAINE WAR:

Witnessing the battlefield advantages of real-time information sharing, many countries are re-evaluating their military modernization plans. This has led to a projected rise in TDL spending by upward of 20% for some nations directly involved or concerned by the conflict. This increased demand is expected to strain supply chains and potentially inflate the cost of TDL hardware and software by around 5-10% in the short term. However, this is likely to be offset by long-term production ramp-up and potential innovation driven by the renewed focus on military communication technologies. The war's impact transcends immediate purchases; it serves as a stark reminder of the importance of battlefield connectivity, potentially accelerating the development and adoption of next-generation TDL solutions.

IMPACT OF ECONOMIC SLOWDOWN:

An economic slowdown can significantly impact the Tactical Data Link (TDL) market by negatively impacting government defense budgets. This can lead to a decrease in demand for new TDL systems by as much as 15% compared to pre-slowdown projections. Constrained budgets also force governments to prioritize essential projects, potentially delaying upgrades or expansions of existing TDL infrastructure. This can further hamper market growth. Manufacturers may respond by offering more cost-effective solutions, potentially bringing down overall system costs by 10%. However, this could also lead to reduced profit margins and pressure on research and development for next-generation TDL technologies. The slowdown's ultimate effect will depend on the severity and duration of the economic downturn, but it's clear that both demand and spending in the TDL market will likely face headwinds in such a scenario.

MARKET SEGMENTATION ANALYSIS:

By Solution:

The tactical data link market is divided into two primary solutions: hardware and software. Hardware, encompassing the physical components like radios and antennas, held a dominant market share of around 60% in 2023. This is due to ongoing modernization efforts that require the integration of new tactical data link systems. However, the software segment is poised for significant growth at a CAGR exceeding hardware's. This surge is supported by the increasing adoption of sophisticated processing software for data communication, encryption, and network management.

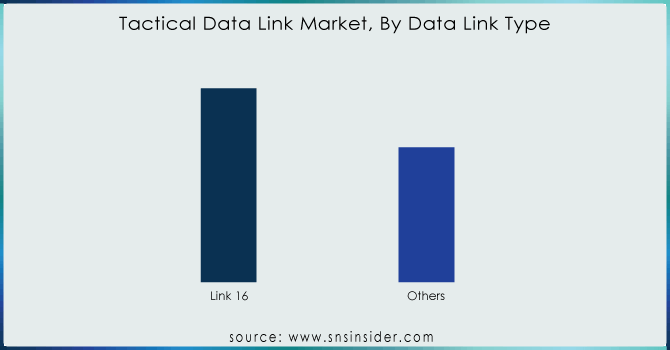

By Data Link Type:

Link 16, a mature and widely adopted standard, is expected to hold a dominant share, likely exceeding 60% due to its proven ability to seamlessly connect air, land, and sea forces. This facilitates real-time information exchange for superior situational awareness and coordinated operations. The "others" segment encompasses emerging technologies like Link 22 and proprietary solutions. While these may hold a smaller share currently, they offer potential for niche applications and future growth as interoperability needs evolve.

KEY MARKET SEGMENTATION

By Solution

-

Hardware

-

Software

By Data Link Type

-

Link 16

-

Others

Need any customization research on Tactical Data Link Market - Enquiry Now

By Platform

-

Air

-

Ground

-

Sea

By Application

-

Command and Control

-

ISR

-

Electronic Warfare

-

Radio Communication

-

Situational Awareness

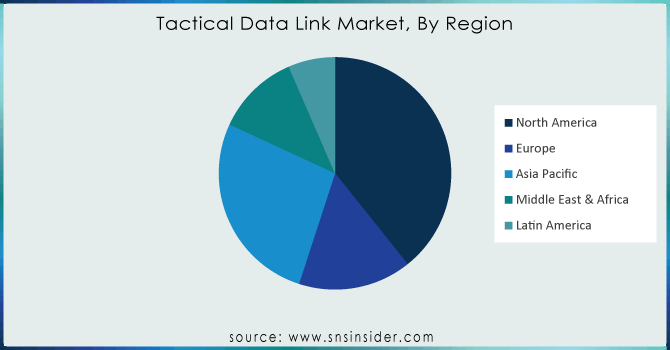

REGIONAL ANALYSIS

North America holds the maximum share in the Tactical Data Link (TDL) market, capturing a dominant share of roughly around 55%. This leadership stems from a several of key factors. The United States, a North American powerhouse, allocates a high portion of its budget to defense, with a significant portion earmarked for modernizing military communication technologies. This translates into substantial investments in TDL systems, fuelling market expansion.

The presence of leading TDL manufacturers like Lockheed Martin and Raytheon within the region forces domestic research and development, keeping North America at the forefront of TDL innovation. Finally, the emphasis on joint interoperability among North American defense forces necessitates strong and standardized TDL solutions, further promoting market growth. This dominance is likely to persist due to continuous military modernization programs and the ever-growing need for secure, real-time battlefield communication.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Players are Raytheon Technologies Corporation, Saab AB, BAE Systems., Leonardo S.p.A., Tactical Communications, L3Harris Technologies Inc., Collins Aerospace, General Dynamics Corporation, Viasat Inc., Northrop Grumman Corporation, and other players.

RECENT DEVELOPMENTS:

-

In October 2022, L3Harris Technologies, a leading defense contractor, forced its market position by acquiring the military communications division of Viasat. This acquisition strengthens L3Harris' capabilities in delivering secure and advanced data link solutions.

-

In December 2022 Hanwha Systems, a South Korean defense firm, land a significant contract with its government to develop combined maritime tactical data link systems for various vessels and land platforms.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.51 Billion |

| Market Size by 2031 | US$ 13.97 Billion |

| CAGR | CAGR of 5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Raytheon Technologies Corporation, Saab AB, BAE Systems., Leonardo S.p.A., Tactical Communications, L3Harris Technologies Inc., Collins Aerospace, General Dynamics Corporation, Viasat Inc., Northrop Grumman Corporation, and other players. |

| DRIVERS | • Customized mobile communication solutions for unmanned ground vehicles • Rising defence budgets of emerging economies. |

| RESTRAINTS | • Military standards and rules are strict. |