Air Cargo Security Screening MarketReport Scope & Overview:

To get more information on Air Cargo Security Screening Market - Request Free Sample Report

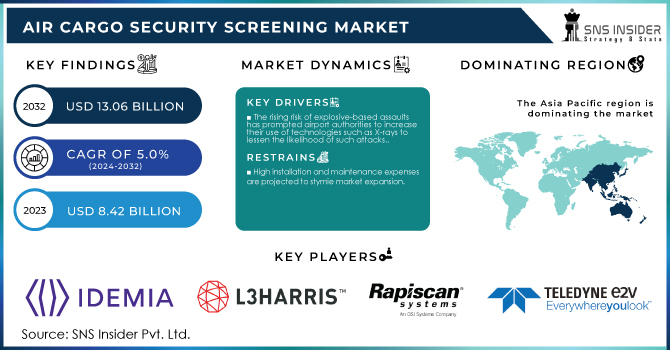

The Air Cargo Security Screening Market Size was valued at USD 8.42 Billion in 2023 and is projected to grow to USD 13.06 Billion by 2032, with a compound annual growth rate (CAGR) of 5.0% over the forecast period of 2024-2032.

Air cargo screening systems are devices installed at airport checkpoints to detect explosives and contraband hidden in cargo. These systems assist security agencies in securing airport infrastructure against safety violations while also maintaining the seamless operation of the worldwide supply chain, which increases the country's economic prospects through aviation services. The rise in e-commerce due to internet shopping has increased air freight volume in recent years. This is projected to drive demand for improved screening systems at airports capable of handling goods of varied sizes and types.

In addition, as air cargo grows, some airports across the world are building dedicated air cargo terminals, which is projected to drive demand for air cargo screening systems in the future years. The aviation cargo industry is a significant target for terrorist operations, and recent efforts to export explosive materials have aroused fears and resulted in increased tightening of screening requirements. The growing threat of terrorist-related activities has compelled airport authorities around the world to invest in bomb detection technology.

MARKET DYNAMICS

KEY DRIVERS

-

The rising risk of explosive-based assaults has prompted airport authorities to increase their use of technologies such as X-rays to lessen the likelihood of such attacks.

RESTRAINTS

-

High installation and maintenance expenses are projected to stymie market expansion.

OPPORTUNITY

-

Technological developments in security screening systems might be viewed as a market investment potential.

-

Due to a growth in the prevalence of security risks and the smuggling of prohibited commodities around the world, airport security procedures have become more stringent.

CHALLENGES

-

Integration of new technologies enabling screening equipment to maintain safety and boost airport operational efficiencies is also likely to fuel market expansion.

IMPACT OF COVID-19

National and international transportation have been hampered as a result of the lockdown applied in many nations, which has greatly damaged the supply chain of airport cargo screening systems around the world, consequently expanding the supply-demand imbalance. As a result, insufficient raw material supply is likely to slow the manufacturing rate of these systems, thereby impacting market growth. Furthermore, as a result of the COVID-19 pandemic, manufacturing processes for airport cargo screening equipment have dramatically decreased. This is mostly due to the production shutdown and disrupted supply chain, which has impacted the market's global operations and revenue.

The pandemic has taken its toll on Europe, with Italy, France, and the United Kingdom bearing the worst of the damage. A substantial number of COVID-19-related fatalities occurred in the region. This caused economic disruption in the region, with various industries experiencing a drop in demand and an inability to supply as a result of the lockdown measures. However, as governments around the world begin to relax laws for resuming company operations, the situation is projected to improve.

Several countries and airport authorities are working together to establish distinct, dedicated air cargo terminals for increased security, which will open up attractive potential for players in the air cargo security screening systems market in the near future. Furthermore, strategic supply chain alliances and IATA cooperation may help organisations develop sustainably.

The primary purpose of aviation cargo security screening systems is to identify bombs and narcotics. Airport authorities all over the world have put modern security technologies in place to detect explosives in cargo and trace narcotics in large and small pallets of cargo. In recent years, airport authorities have increased their use of technologies such as X-rays to lessen the likelihood of such assaults due to the rising risk of such attacks.

The high installation and maintenance costs of security solutions may stymie the adoption of airport cargo screening systems. Furthermore, rising worries among airport regulatory bodies, such as supplier privacy issues, may stymie the implementation of screening systems.

Stringent airport security laws are likely to give attractive growth prospects in the airport passenger screening systems market due to an increase in the prevalence of security threats and the smuggling of prohibited commodities around the world. Furthermore, the integration of modern technology enabling screening equipment to maintain safety and boost airport operating efficiencies is likely to fuel market expansion.

The increased use of air cargo facilities for the transportation of commodities in shorter time spans is leading to an increase in the use of such technology for cargo screening at airports. As a result, worldwide adoption of bomb-detecting technology and screening devices has expanded significantly in recent years. In Europe, for example, European legislators have mandated 100 percent cargo screening on all passenger flights departing from Europe.

KEY MARKET SEGMENTATION

By Size

-

Screening Systems for Small Parcels

-

Screening Systems for Break & Pallet Cargo

-

Screening Systems for Oversized Cargo

By Type

-

Metal Detectors

-

Magneto Static Detectors

-

Explosive Trace Detectors

-

Advanced Imaging Technologies

By Airport Type

-

International Airport

-

Domestic Airport

REGIONAL ANALYSIS

The market has been divided into five regions: North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America. Asia-Pacific leads the globe in both passenger and cargo volume, which has resulted in increased investment in aviation security. Economic expansion and increased demand for global trade to and from this region have accelerated global air cargo traffic and resulted in an upgrade in the security infrastructure linked with it. Asia is home to many of the world's largest and most efficient cargo operators. Boeing predicts that aviation cargo traffic in the region will increase by 5.5 percent per year over the next 20 years.

Along with increased air cargo traffic and the development of new airports, Asia-Pacific is investing in the use of cutting-edge technologies, such as cargo-screening systems based on neutron and X-ray radiography.

Air cargo traffic in North America is at an all-time high. This, together with stringent air cargo security rules in the United States such as the Aviation and Transportation Security Act, National Intelligence Reform Act, and Homeland Security Appropriations Act, is primarily driving the region's demand for air cargo security screening systems.

Europe is a robust and mature market, with annual revenue tonne-kilometers (RTKs) expected to grow by 3.5 percent over the next 20 years. Because of the region's high trade volumes, air cargo screening systems are widely used, which is projected to drive the expansion of the regional air cargo security screening market. Air cargo traffic RTKs are expected to expand at CAGRs of 5.9 percent and 6.1 percent in the Middle East and Africa, respectively, during the next 20 years. Significant infrastructure development expenditures are being made in the Middle East, with the goal of building new airports and terminals in the region's important cargo centres.

Need any customization research on Air Cargo Security Screening Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The key players are LLC, IDEMIA, L3Harris Technologies Inc., Rapiscan Systems, Smiths Detection Inc., Teledyne e2v, 3DX-RAY, Astrophysics Inc., Autoclear, Leidos, Nuctech Company Limited & Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 8.42 Billion |

| Market Size by 2030 | US$ 13.06 Billion |

| CAGR |

CAGR of 5.0% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Size (Screening Systems for Small Parcels, Screening Systems for Break & Pallet Cargo, and Screening Systems for Oversized Cargo) • By Type (Metal Detectors, Magneto Static Detectors, Explosive Trace Detectors, Advanced Imaging Technologies, and Full Body Scanners) • By Airport Type (International Airport, and Domestic Airport) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | LLC, IDEMIA, L3Harris Technologies Inc., Rapiscan Systems, Smiths Detection Inc., Teledyne e2v, 3DX-RAY, Astrophysics Inc., Autoclear, Leidos, Nuctech Company Limited. |

| DRIVERS | • The rising risk of explosive-based assaults has prompted airport authorities to increase their use of technologies such as X-rays to lessen the likelihood of such attacks. |

| RESTRAINTS | • High installation and maintenance expenses are projected to stymie market expansion. |