Aircraft Switches Market Report Scope & Overview:

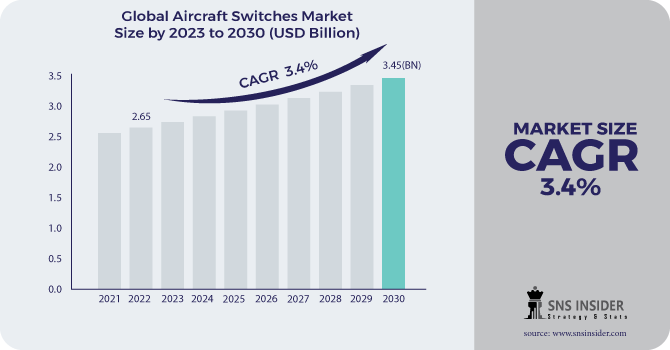

The Aircraft Switches Market Size was valued at USD 2.65 billion in 2022 and is expected to reach USD 3.45 billion by 2030, and grow at a CAGR of 3.4% over the forecast period 2023-2030. Flight switches are traps used in important tasks such as transmitting and receiving commands; therefore, flight modifications should be reliable and easy to access. They are used by the pilot and crew to monitor and control the performance of the aircraft. These changes can be activated automatically and automatically. Automatic switching is a type of sensor, which is used to measure temperature, pressure, and frequency. Flight switches are available in the aircraft cabinet, guard area, avionics, engine, and APU. Flight cockpit switches are used to control parts and systems such as fuel, engine, lights, radio communication equipment, navigation services, and more. In addition, they are used by the pilot for a number of tasks, such as starting the engine, selecting the wind speed, controlling the power supply, and so on. In addition, aircraft switches are also used in military aircraft for combat purposes such as ammunition control.

To get more information on Aircraft Switches Market - Request Free Sample Report

Sales of aircraft switches are expected to increase due to the increased development of prototyping tools that allow for the pre-validation of cockpit functionalities during flight tests to accommodate increasing air traffic. As a result, demand for aircraft switches is expected to increase significantly between 2022 and 2028. Similarly, rising demand for commercial aircraft safety and low operating costs, as well as the resulting increase in demand for aircraft switches, are expected to drive aircraft switches market share during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

-

Unmanned Aerial Vehicle and Space Application Switches

-

Increased Interest in In-Flight Entertainment and Connectivity

RESTRAINTS

-

Manual switches are being replaced by touch screen technology.

-

Touch Screens are becoming more popular in aircraft.

OPPORTUNITIES

-

Unmanned Aerial Vehicle and Space Application Switches.

CHALLENGES

-

Procedures for Complex Maintenance

THE IMPACT OF COVID-19

Because of the COVID-19 situation, R&D in the aircraft switch industries around the world has been hampered due to declared lock downs and government restrictions on public gatherings.

The pandemic has slowed the production rate of components such as selector, rocker, several sensors, and other power electronics parts.

As the world returns to normalcy, there will be a significant increase in demand for global aircraft switches.

Companies' testing of manufactured switches has been halted due to current restrictions, but it may resume once the restrictions are lifted.

The rotary wing has seen rapid growth in recent years. This expansion can be attributed to factors such as increased air travel, rising middle-class disposable income, and increased international trade and tourism around the world. Strong growth in this sector has resulted in an increase in aircraft orders to meet rising air passenger traffic. Manufacturers are currently focusing on aircraft switch components to develop more reliable, accurate, and efficient products. Software advancements have altered the human-machine interface of aircraft switches.

The switches in an aircraft differ from one another depending on the type of aircraft. Important functions are carried out via a panel of switches on the cockpit dashboard. Pilots are in charge of components and systems such as fuel, engine, APU, lights, radio communication aids, and navigation aids. Pilots perform tasks such as starting engines, controlling electrical power supplies to various systems, lighting and switching radio frequencies, selecting airspeed, controlling navigation computers, and many other critical functions required during various flight phases such as take-off, landing, and taxi. For combat purposes, military aircraft have ammunition control switches. Over the next few years, the increasing number of aircraft is expected to drive demand for aircraft switches in cabins.

The demand for commercial air crafts is increasing as air passenger traffic increases. Because of the increased demand for aircraft, aircraft manufacturers have been able to expand their product line. Furthermore, the increased production of new aircraft has increased demand for aircraft switches.

KEY MARKET SEGMENTATION

By Platform

-

Fixed Wing

-

Rotary Wing

By End-User

-

OEM

-

Aftermarket

By Application

-

Cockpit

-

Cabin

-

Engine & APU

-

Aircraft Systems

By Type

-

Manual

-

Automatic

.png)

Need any customization research on Aircraft Switches Market - Enquiry Now

REGIONAL ANALYSIS

The Asia Pacific region is expected to generate significant civil sector opportunities, while the United States and Europe are expected to gain traction in the aircraft switch market. The aerospace industry's primary market scope is civil and military sectors, owing to rising military budgets and disposable income in emerging economies. This factor is expected to generate a significant market share for aircraft switches in Asia Pacific, the Americas, and Europe. South East Asia's rapidly developing research and development expertise is expected to promise lucrative opportunities in the aircraft switches market by the end of the forecast period.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Barantec, Hydra-Electric Company, Safran, Meggitt PLC., Raytheon Technologies Corporation, Eaton., ITT INC., Honeywell International Inc, Curtiss-Wright Corporation, Transdigm Group Inc. and Other Players

Hydra-Electric Company-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 2.65 Billion |

| Market Size by 2030 | US$ 3.45 Billion |

| CAGR | CAGR of 3.4% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Fixed Wing and Rotary Wing) • By End-User (OEM, Aftermarket) • By Application (Cockpit, Cabin, Engine & APU, Aircraft Systems, Avionics) • By Type (Manual, Automatic) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Barantec, Hydra-Electric Company, Safran, Meggitt PLC., Raytheon Technologies Corporation, Eaton., ITT INC., Honeywell International Inc, Curtiss-Wright Corporation, Transdigm Group Inc. |

| DRIVERS | • Unmanned Aerial Vehicle and Space Application Switches • Increased Interest in In-Flight Entertainment and Connectivity |

| RESTRAINTS | • Manual switches are being replaced by touch screen technology. • Touch Screens are becoming more popular in aircraft.. |