Airless Packaging Market Report Scope & Overview:

The Airless Packaging Market size was USD 6.11 billion in 2023 and is expected to Reach USD 10.67 billion by 2032 and grow at a CAGR of 6.4 % over the forecast period of 2024-2032.

Get More Information on Airless Packaging Market - Request Sample Report

Market growth is expected over the forecast period as a result of increasing demand for premium cosmetic products worldwide. In recent years there has been a substantial increase in global demand for high quality cosmetic products, e.g. natural skincare creams, foundations and serums. Another key factor that contributes to the growing demand for premium cosmetic products is rising demand of natural skin care products, an increasing number of women working and product introduction throughout the world.

Their widespread acceptance in applications industries is hindered by a number of factors, including high costs associated with airless bottles and jars as well as their sustainability issues. In April 2021, a 50 ml airless plastic bottle will cost about USD 1.50 to 2.5, whereas a 25 ml non-airless bottle costs around USD 0.25 to 0.45 prices vary by volume of procurement.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing demand for Hygiene Solution in the Packaging Industry

In particular with regard to the Covid 19 pandemic, hygiene and cleanliness are becoming increasingly important for consumers. Due to the pandemic, demand for products which are packaged in an environment of hygiene and cleanliness is increasing. Strict rules on the safety and hygiene of products are applied to a large number of industries such as pharmaceuticals and cosmetics.

By providing a hygienic packaging solution, airless packaging can help manufacturers to comply with these regulatory requirements. Exposure to air and bacteria may compromise the efficacy of products that are likely to be contaminated, for example skin care or cosmetic products. In order to retain the efficiency of these products it may be possible to use airless packaging in order to protect against outside contaminants.

RESTRAIN:

-

Compatibility with more than one product may not be possible with airless packaging

Material compatible with a wide range of product formulations is usually used in the manufacture of airlessly packaged products. However, some products may contain ingredients that are not compatible with the packaging material and can result in degradation, lysis or other issues which might have an impact on product quality and safety. The use of airless packaging is intended for products that have different characteristics. However, given the pressure that is necessary to dispense them, specific products such as thick or very viscous formulations may not work well in airless packaging.

OPPORTUNITY:

-

Increased demand in the area of alternatives to plastic packaging

The demand for packaging solutions which are produced from alternative raw materials such as paper or recycled metal has increased in view of increasing environmental concerns caused by plastic. With the introduction of packaging solutions as an alternative to plastic packaging, a number of competent and reliable market players responded to changing demands from the cosmetic industry for sustainability and environmental protection.

CHALLENGES:

-

Technological Complexity and Cost

In order to deliver the product without exposure to air, airless packaging involves complex mechanisms. Compared to traditional packaging, the complexity of these mechanisms and related production costs are likely to make airless packaging more expensive.

IMPACT OF RUSSIAN UKRAINE WAR:

The war has led to shortages of basic materials such as glass, plastic and metal. For the manufacture of airless packaging, these materials are essential. Due to the disruptions, there was a shortfall of raw materials and higher prices. By 4 March, the price of aluminum that had fallen to as low as $2,885 per tonne just before the war began in early February was up to $3,825.2 per tonne. The world's largest producers of aluminium are both China and Russia, with Russia accounting for six per cent of total production.

The cost of energy has also increased as a result of the war. As the process is very energy intensive, this has made it difficult to produce Airless Packaging. The cost of the production of airless packaging has increased as a result of higher energy costs.

The volatility of energy commodity prices started rising in December 2021, when reports about the possible invasion of Ukraine by Russia reached a fever pitch. Prices of oil, coal and gas have increased by approximately 40%, 130% and 1800% respectively over the two weeks following the invasion.

IMPACT OF ONGOING RECESSION:

The decrease in demand for consumer products is one of the major factors which are anticipated to have a negative effect on the market for insulated packaging during the recession. In particular in the pharmaceutical and personal care sectors, airless packaging has been widely used but a recession could lead to reduced demand for these products.

The increased competition for other packaging materials is another factor which is expected to have an impact on the airless packaging market. Airless packaging costs more than other forms of packaging, such as plastic and aluminium, which may be why businesses are more inclined to make use of cheaper packaging materials in times of recession.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Metal

-

Glass

In 2023, plastic accounted for 65.5% of worldwide sales, and is projected to retain its dominance over the forecast period. In the production of airless containers, cups and tubes it is widely used different types of plastic resins such as PE, PET, ABS, PMMA or SAN.

By Packaging Type

-

Bags & Pouches

-

Bottles & Jars

-

Tubes

In 2023, bottles & jars accounted for more than 85 % of global volume and are expected to maintain their leading position until forecast period. The shape of bottles and containers makes it possible to incorporate airless pumps in them, which is also a common type of packaging due to the ease with which products can be evacuated or used from bottle & jar.

By Packaging Type

-

Pumps

-

Twist & Clicks

-

Dropper

By Application

-

Pharmaceutical

-

Personal & Homecare

-

Pet care

-

Others

The segment of Personal & Home Care led the market in 2023, with a total revenue share of 80.3%. In the personal care sector, packaging of semisolids such as lotions, creams, ointments, gels and pastes are used in airless containers & jars, pouches or tubes. This product maintains the integrity of its formulations and prolongs their shelf life by preventing oxidation.

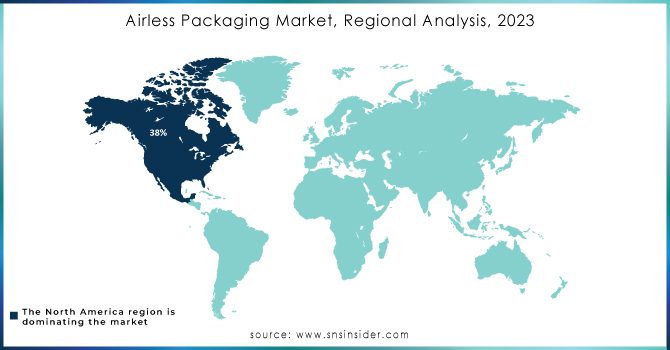

REGIONAL ANALYSIS:

The biggest market shares are held in North America of around 38%; this region is projected to continue its dominance over the forecast period. Sustainable alternatives for airless packaging have been developed in response to increasing concerns regarding the environment, which include marine litter and a range of general impacts on packaging in North America. Furthermore, the development of airless packaging markets in North America is underlined by the presence of potential consumers who are buying luxury cosmetic and personal care products.

Europe remains the most attractive market for airless packaging, and is expected to remain in this position during the analysis period. Europe held the market share of around 28%. In order to supplement the growth of airless packaging in Europe, increasing demand for luxury packages specially formulated for personal care and beauty products is a significant factor.

The Asia Pacific region, with countries such as China, Japan, India and South Korea leading the way, is a fastest growing market for airless packaging. In China, the use of sustainable packaging solutions is gaining increasing awareness and consumers have become more aware of their environmental impact in order to seek eco-friendly alternatives. Airless packaging is an environmentally responsible solution because it reduces waste and can be easily recycled.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Airless Packaging market are APC Packaging, HCP Packaging, Silgan Holdings, Quadpack, Aptar Group Inc, Albea SA, Fusion PKG, Lumson SPA and other players.

RECENT DEVELOPMENT

-

The NUORI Skincare brand in Denmark has been supplied with Regula Airless Packaging by a global cosmetic packaging manufacturer Quadpack and its new line of "The One" products.

-

Lumson introduces APP Light, a lightweight airless solution for PCR PE

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.11 Bn |

| Market Size by 2032 | US$ 10.67 Bn |

| CAGR | CAGR of 6.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Metal, Glass) • by Packaging Type (Bags & Pouches, Bottles & Jars, Tubes) • by Dispensing Systems (Pumps, Twist & Clicks, Dropper) • by Application (Pharmaceutical, Personal & Homecare, Pet care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | APC Packaging, HCP Packaging, Silgan Holdings, Quadpack, Aptar Group Inc, Albea SA, Fusion PKG, Lumson SPA |

| Key Drivers | • Increasing demand for Hygiene Solution in the Packaging Industry |

| Key Restraints | • Compatibility with more than one product may not be possible with airless packaging |