All-Terrain Vehicle (ATV) Engines Market Report Scope & Overview:

Get more information on All-Terrain Vehicle (ATV) Engines Market - Request Sample Report

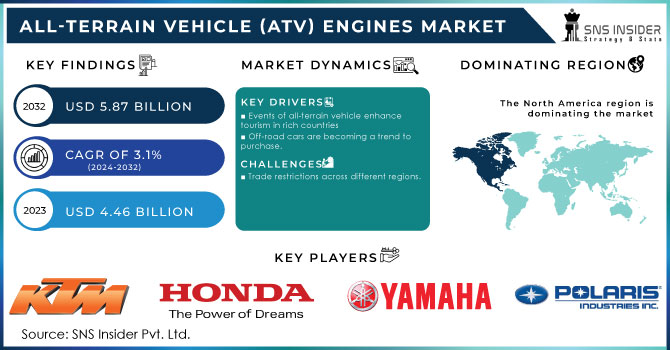

All-Terrain Vehicle (ATV) Engines Market Size was valued at USD 4.46 billion in 2023 and is expected to reach USD 5.87 billion by 2032 and grow at a CAGR of 3.1% over the forecast period 2024-2032.

A few factors drive the ATV engine market a growing outdoor recreational culture of off-road enthusiasts, which has risen by 35% in the past decade, is further complemented by a rise of 20% in adventure parks and trails that would provide the perfect terrains for usage of ATVs. Further, an efficient and versatile vehicle demand in the agricultural sector increases it by 15%. The military and defense sectors use ATVs majorly for logistic and surveillance purposes simultaneously. Growth in demand for high-performance engines forms one of the major trends; it occupied about 60% of the market share in the 400-800cc segment. The market caters to recreational users, professional users, thereby driving the overall market growth.

Changes are bringing about growth in the ATV engines market at present. With a budding interest in outdoor sports, the demand for ATVs has gone up, hence pumping up demand for engines. That is also the reason why more attention started to be paid to the efficiency of the engines. Manufacturers are now more focused on fuel-injected ones; hence, there has been a remarkable market share increase of 25% over the past five years. Moreover, there is a growing trend of electric and hybrid powertrains, that has reached around 8% of the market demand, with the average consumer becoming highly environment conscious. Further, with the increased usage of sophisticated technologies like ECUs, there is a huge growth of around 30% in their usage in the recent past, that has enhanced the engine performance along with emission control.

MARKET DYNAMICS:

KEY DRIVERS:

-

Events of all-terrain vehicle enhance tourism in rich countries.

-

Demand for all-terrain vehicles has increased in many diverse industries, such as agriculture, military, and recreation.

-

Off-road cars are becoming a trend to purchase.

-

In the case of all-terrain vehicles, disposable income is the primary motivator.

It is one of the strong forces that the industry is pushing forward, but the main reason enthusiasts are investing in such off-road beasts is due to the freedom provided by excess money resources. For ATV enthusiasts, motivated by the idea of riding across varied landscapes, their disposable income is not only the factor but a strong desire to unbridled adventure. It's an engine full-bore the people have money to spend on things they maybe don't really need. The advertising puts at the forefront the adventurous, bold nature of the riders—people who just like to get out and ride around while exploring and challenging.

CHALLENGES:

-

Trade restrictions across different regions.

-

All-terrain vehicles come at a price.

The cost of these engines for ATVs extends far beyond the monetary, for it is the price one has to pay for the conquest of varied terrains and the unlocking of untamed potentials lying beyond conventionally recognized boundaries. That would be the marriage of the finest in technology, relentless innovation in engineering, and the never-tiring pursuit by thrill-seekers ready to pay a premium for the unparalleled experience an ATV promises to deliver.

Market, By Product Type:

The global market has been further segmented under product type into sport ATVs, and utility ATVs. Utility ATVs are expected to dominate all-terrain vehicles in the recent future. They have huge applications in various industries like military, agricultural, construction, and forestry. Utility ATVs are multi-dimensional vehicles. Hence, manufacturers of all-terrain vehicles stand to profit considerably from the sales of these vehicles.

Market, By Engine Type:

Based on the segment of engine type, the global market has been categorized into below 400cc, 400-800cc, and above 800cc. Among these, the 400-800cc category holds the most considerable market share. Vehicles with engine capacities between 400 and 800 cc are normally used for goods and equipment carrying or transporting purposes since huge storage capacities are usually built into their design.

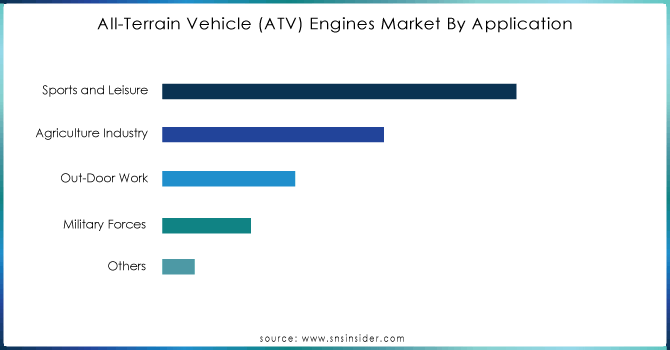

Market, By Application:

Get Customized Report as per your Business Requirement - Request For Customized Report

Based on the segment of application, the global market has been divided into Sports and Leisure, Agriculture Industry, Out-door Work, Military Forces, and Others. Boosting demand for utility all-terrain vehicles in agriculture and military and defense applications across a host of countries is likely to drive the market during the forecast period.

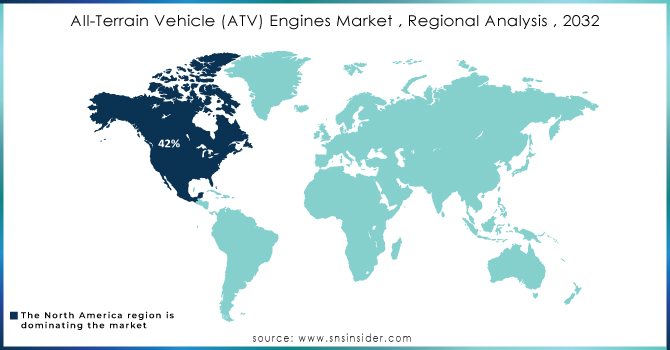

REGIONAL ANALYSIS:

North America is projected to dominate the all-terrain vehicle engines market and will be holding the market share of 42% by 2032. In countries like the United States and Canada, sprawling and diverse landscapes range in their terrain from mountainous to forested—on a gigantic scale. The European region is estimated to turn out to be the second-largest market for all-terrain vehicles globally. In this global market region, a considerable percentage of autos are sold. The Asia-pacific region in the all-terrain vehicle market has just started booming. Other aspects that determine the growth of the market include the increasing production and sales of ATVs and rapid technological development. Models underway for all-terrain vehicles are the new models adaptable for a wide range of environments and terrains.

KEY PLAYERS:

Polaris Industries Inc. (US), KTM AG (Austria), Honda Motor Company, Ltd. (Japan), Yamaha Motor Company Limited (Japan), Arctic Cat (US), Bombardier Recreational Products (Canada), Kawasaki Suzuki Motor Corporation (Japan), Arctic Cat (US), Bombardier Recreational Products (Canada), Heavy Industries Ltd. (Japan), CFMOTO Powersports Inc. (US), and BMW (Germany) are some of the affluent competitors with significant market share in the All-Terrain Vehicle (ATV) Engines Market.

RECENT DEVELOPMENTS:

-

Polaris Inc.: In May 2023, Polaris announced advancements in their engine technology, emphasizing improved power delivery and efficiency for utility applications.

-

Yamaha Motor Corporation: Yamaha's August 2022 launch of their 2023 off-road ATV models showcased a focus on rider ergonomics and engine performance for a more thrilling experience.

-

Suzuki Motor Corporation: September 2021 saw the introduction of Suzuki's KingQuad ATV line, potentially catering to a wider range of riders with diverse needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.46 Billion |

| Market Size by 2032 | US$ 5.87 Billion |

| CAGR | CAGR of 3.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Sport ATV, Utility ATV) • by Engine Type (Below 400cc, 400-800cc, above 800cc) • by Application (Sports and Leisure, Agriculture Industry, Out-door Work, Military Forces, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Polaris Industries Inc. (US), KTM AG (Austria), Honda Motor Company, Ltd. (Japan), Yamaha Motor Company Limited (Japan), Arctic Cat (US), Bombardier Recreational Products (Canada), Kawasaki Suzuki Motor Corporation (Japan), Arctic Cat (US), Bombardier Recreational Products (Canada), Heavy Industries Ltd. (Japan), CFMOTO Powersports Inc. (US), and BMW (Germany) |

| Key Drivers | •Tourism is increased as a result of all-terrain vehicle events in wealthy countries. •Demand has increased across multiple industries, including agriculture, the military, and recreational pursuits. |

| RESTRAINTS | •Demand for ATVs is limited by their high price, which has a significant impact on the market. •Market players face tight government limitations on ATV riding due to its negative impact on soil structure. |