Cardiac Implants Market Size & Trends:

Get More Information on Cardiac Implant Market - Request Free Sample Report

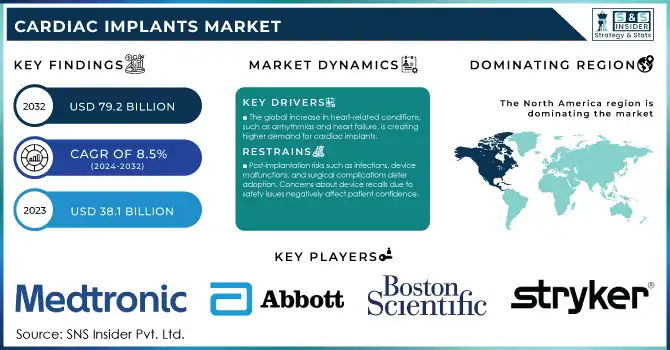

The Cardiac Implants Market Size was valued at USD 38.1 billion in 2023 and is expected to reach USD 79.2 Billion by 2032, growing at a CAGR of 8.5% over the forecast period 2024-2032.

The cardiac implants market is witnessing significant growth, largely due to the increasing prevalence of cardiovascular diseases (CVDs), the most common cause of death in the world. In 2023, cardiovascular diseases (CVDs) were responsible for 32% of all global deaths, or 17.9 million deaths according to the World Health Organization (WHO). Countries worldwide are taking countermeasures by expenditure on healthcare facilities development and planned activities to control CVDs. For instance, in 2023 the US HHS invested USD 10 billion in decreasing large population heart-related deaths via new medical technology offerings such as cardiac implants.

Parallel advancements in minimally invasive procedures and innovations in implantable devices have further enhanced patient outcomes and accessibility. For example, the development of leadless pacemakers and bioresorbable stents is reducing procedural risks and promoting widespread adoption. Public health campaigns in regions like Europe and Asia, supported by government subsidies for critical heart procedures, are also driving demand. This confluence of technological progress and policy support underscores the dynamic growth trajectory of the cardiac implants market.

Market Dynamics

Drivers

-

The development of innovative devices such as wireless and leadless pacemakers has improved treatment outcomes and patient convenience, driving market growth.

-

Increased adoption of advanced cardiac rhythm management devices is enhancing the ability to monitor and manage cardiac conditions effectively.

-

The global increase in heart-related conditions, such as arrhythmias and heart failure, is creating higher demand for cardiac implants.

The cardiac implant market has seen significant growth due to continuous technological innovations aimed at improving patient outcomes and device functionality. Leadless pacemakers, such as Micra TPS by Medtronic, have transformed pacing therapy by removing leads that can be of concern when it comes to infection. They are also substantially smaller up to one-tenth the size of traditional pacemakers allowing for minimally invasive and less complicated implant procedures. And just as bioabsorbable stents have changed the therapy of coronary interventions. Bioabsorbable stents, work differently from conventional stents, they tend to dissolve over time and thus help in decreasing long-term complications such as opening of artery narrowing again or restenosis. The FDA's approval of innovative devices like Boston Scientific's Synergy Bioabsorbable Polymer Drug-Eluting Stent reflects growing confidence in such technologies.

Furthermore, the usability of wearable and wireless monitoring technologies has improved post-operative care. Bluetooth-connected devices can send information to healthcare providers immediately, which makes it easier to manage chronic diseases. The study showed that detecting arrhythmias early, it proved to reduce the risk of readmission nearly by 15% from hospital to home with wireless cardiac monitoring devices. For example, a 2024 report highlighted over 300 ongoing trials globally focusing on implantable cardioverter defibrillators (ICDs) and leadless pacemakers. Collectively, these innovations are driving broader adoption and improving the quality of life for patients with cardiovascular conditions.

Restraints

-

The significant upfront and maintenance costs of devices like prosthetic heart valves and implantable cardioverter defibrillators limit their accessibility, especially in low and middle-income countries.

-

Post-implantation risks such as infections, device malfunctions, and surgical complications deter adoption. Concerns about device recalls due to safety issues negatively affect patient confidence.

The risk of complications and device malfunctions in cardiac implants is one major factor that is restricting the growth of the cardiac implants market. Complications after developing the implant (infections), blood clots, inflammation, etc. are common nuisances that end up with further medical procedures. The stakes are not only patient recovery, but they also dissuade some patients and providers from choosing to treat with implants. In addition to this, if the device malfunctions or the battery fails or the leads get dislodged, device recalls occur. These problems hinder confidence in cardiac implants and also create challenges to manufacturers to ensure the reliability of their products. These issues should be resolved with constant innovation, the most stringent manufacturing quality assurances, and improvements to the pre-and post-implantation care protocols themselves .

Segment Analysis

By application

The arrhythmias segment dominated the market in 2023 due to the increasing prevalence of conditions like atrial fibrillation. According to the Centers for Disease Control and Prevention (CDC), atrial fibrillation affects around 12.1 million Americans each year. Due to the growing prevalence of arrhythmias along with the increased utilization of pacemakers and implantable cardioverter-defibrillators (ICDs) across the globe. According to the CDC, the foremost cause of arrhythmias leads to more than 454,000 hospitalizations in the U.S. each year, which is further supported by government healthcare policies in countries such as Germany and Japan that offer large subsidies for treatments related to arrhythmias leading to significant growth of this market segment.

On the other hand, the myocardial infarction segment is expected to grow with a high CAGR owing to the higher prevalence of heart attacks along with the new development of implantable defibrillators and stent extracts which are primarily directed towards after-myocardial infarction conditions. Technological advancements including bioresorbable stents, and wearable cardiac monitors are driving the rapid CAGR of the myocardial infarction segment. As an example, the introduction of the "Healthy Heart Program" by the UK National Health Service (NHS) in February 2023 has helped create awareness and improve the uptake of preventive and corrective cardiac implants.

By end user

Hospitals accounted for the largest revenue share in 2023, at 45%. Hospitals have better infrastructure, trained professionals, and complex surgeries hence the preference. As an instance, U.S. Medicare program observed a 22% increase in reimbursement for hospital-associated cardiac implant source systems in 2023.

However cardiology centers are growing at a significant growth rate due to their cost-effectiveness and specialized services. In 2023, the European Society of Cardiology (ESC) reported that in Europe, 30% of cardiac implant procedures were performed at cardiology centers, an increase from 20% in 2020. Government initiatives like the "Cardiac Specialty Program" in India, launched in March 2023, aim to expand the network of dedicated cardiology centers to underserved regions.

By Product

The pacemakers segment dominated the cardiac implants market and held over 39.0% of revenue share in 2023. Pacemakers are in demand due to the increasing burden of bradycardia and heart block conditions. According to historical data from the National Institutes of Health (NIH), more than 1 million pacemakers will be implanted worldwide in 2022, with a projected 8% increase in 2023. Furthermore, the introduction of novel designs of pacemakers coupled with wireless monitoring has proven to improve patient outcomes and further increase the demand in the market.

Likewise, government support has been nothing short of crucial. For example, the implementation of several subsidies targeting the implantation of pacemakers in public hospitals are elements of China's "Healthy China 2030" program which has greatly lifted adoption rates across Asia-Pacific.

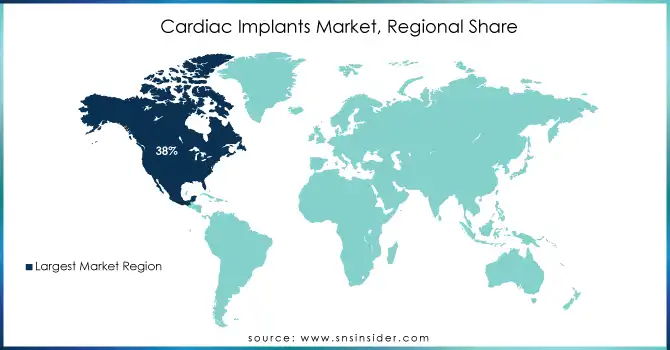

Regional Analysis

In 2023, North America the region held the largest revenue share of cardiac implants market share 38% in 2023. Factors such as the complicated healthcare system in this region, high USA healthcare expenditure, and supportive government programs such as Medicare and Medicaid are responsible for this. Through generous reimbursements, these programs have been instrumental in expanding access to cardiac implant procedures. As an example, in 2023, the U.S. government spent more than $120 billion to control cardiovascular diseases, which is part of this amount spent on innovative medical devices such as cardiac implants. There is also the continuous research and development of cardiac care expertise for both private and public markets.

Conversely, Asia-Pacific is the fastest-growing region by CAGR, which is attributed to growth in healthcare spending, growing awareness of heart health, and an increased penetration of advanced care Major economies like India and China are working on making cardiac treatments cheaper through government intervention. One good example in this regard is India, where over 50,000 cardiac procedures were performed with the help of the "Ayushman Bharat" scheme in 2023 alone; a national health policy that increased access to life-saving implants for underserved populations. Moreover, the launch of national campaigns such as "Healthy China 2030" has encouraged extensive health reforms across sectors, including government provision of subsidies and incentives to enhance prevention and treatment for the cardiac care market, which has hastened the market growth. Urbanization, a high geriatric population base, and a rise in cardiovascular diseases further boost the demand for cardiac implants in this region, thus being the most important growth driver for the market globally.

Need any customization research on Cardiac Implants Market - Enquiry Now

Recent Developments

-

In January 2024, the U.S. Food and Drug Administration (FDA) approved an additional leadless pacemaker from a new line, part of a public-private collaboration to mitigate complications associated with technologies.

-

In January 2023, Medtronic introduced the CardioMEMS HF System, a wireless implant designed to remotely monitor heart failure patients by transmitting data directly to their physicians.

Key Players

Service Providers / Manufacturers:

-

Medtronic plc (Micra Leadless Pacemaker, CardioMEMS HF System)

-

Boston Scientific Corporation (WATCHMAN Left Atrial Appendage Closure Device, EMBLEM S-ICD System)

-

Abbott Laboratories (CardioMEMS HF System, Xience Coronary Stent)

-

Biotronik SE & Co. KG (Orsiro Coronary Stent System, Rivacor CRT-D)

-

Stryker Corporation (Trevo ProVue Stent Retriever, Neuroform Atlas Stent System)

-

Zimmer Biomet Holdings, Inc. (Zimmer Universal Knee, ROSA Robotics)

-

LivaNova PLC (Perceval Valve, Solo Smart Valve)

-

Edwards Lifesciences Corporation (SAPIEN Transcatheter Heart Valve, Inspiris Resilia Valve)

-

Johnson & Johnson (Biosense Webster) (THERMOCOOL SmartTouch SF Catheter, CARTO 3 System)

-

GE Healthcare (Vivid E95 Ultrasound, CARESCAPE R860 Ventilator)

Key Users

-

Cleveland Clinic

-

Mayo Clinic

-

Johns Hopkins Hospital

-

Massachusetts General Hospital

-

Apollo Hospitals (India)

-

Fortis Healthcare (India)

-

Mount Sinai Hospital

-

Stanford Health Care

-

University of Texas MD Anderson Cancer Center

-

Karolinska University Hospital (Sweden)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 38.1 Billion |

| Market Size by 2032 | USD 79.2 Billion |

| CAGR | CAGR of 8.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Implantable Cardioverter-defibrillators (ICDs), Pacemakers, Coronary Stents, Implantable Heart Rhythm Monitors, Implantable Hemodynamic Monitors, Others) • By Material (Alloys, Biological, Metals, Polymers) • By Application (Arrhythmias, Acute Myocardial Infarction, Myocardial Ischemia, Others) • By End Users (Hospitals, Cardiology Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Biotronik SE & Co. KG, Stryker Corporation, Zimmer Biomet Holdings, Inc., LivaNova PLC, Edwards Lifesciences Corporation, Johnson & Johnson (Biosense Webster), GE Healthcare. |

| Key Drivers | • The development of innovative devices such as wireless and leadless pacemakers has improved treatment outcomes and patient convenience, driving market growth. • Increased adoption of advanced cardiac rhythm management devices is enhancing the ability to monitor and manage cardiac conditions effectively. |

| Restraints | • The significant upfront and maintenance costs of devices like prosthetic heart valves and implantable cardioverter defibrillators limit their accessibility, especially in low and middle-income countries. |