Allergic Conjunctivitis Market Size & Trends:

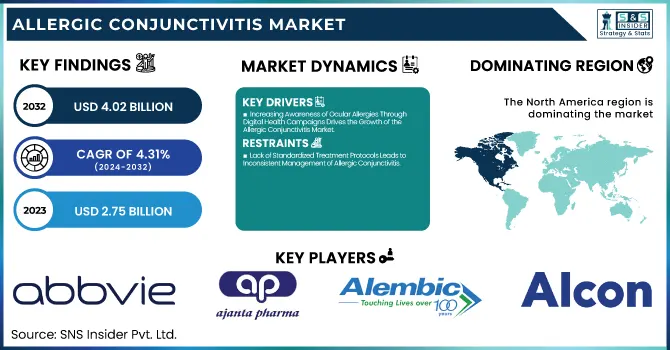

The Allergic Conjunctivitis Market Size was valued at USD 2.75 Billion in 2023 and is expected to reach USD 4.02 Billion by 2032, growing at a CAGR of 4.31% over the forecast period of 2024-2032.

To Get more information on Allergic Conjunctivitis Market - Request Free Sample Report

The Allergic Conjunctivitis Market is evolving as rising environmental allergens fuel demand for effective treatments. Pricing trends and cost variations by region influence patient accessibility, with significant disparities between developed and emerging markets. The frequency of hospital visits and emergency cases per year underscores the need for advanced therapies, as severe cases strain healthcare systems. Regulatory approval timelines by region shape market entry for new treatments, impacting availability. The economic burden of allergic conjunctivitis treatment remains high, with direct medical costs and productivity losses affecting patients and healthcare providers alike. A breakdown of treatment preferences by patients highlights a growing shift toward antihistamines, corticosteroids, and novel therapies. Our report explores these key factors, offering critical insights into market trends and future growth.

The US Allergic Conjunctivitis Market Size was valued at USD 0.76 Billion in 2023 and is expected to reach USD 1.04 Billion by 2032, growing at a CAGR of 3.53% over the forecast period of 2024-2032.

The U.S. Allergic Conjunctivitis Market is witnessing steady growth, driven by increasing pollen allergies, rising pollution levels, and growing awareness of ocular health. Organizations like the American Academy of Allergy, Asthma & Immunology (AAAAI) report a surge in seasonal allergies, contributing to higher demand for antihistamines and corticosteroids. The Centers for Disease Control and Prevention (CDC) highlights the economic burden of allergic conditions, emphasizing healthcare costs and productivity losses. Additionally, U.S. pharmaceutical giants like Alcon and Bausch & Lomb are advancing innovative eye drop formulations, further expanding market accessibility. Our report delves into these trends, analyzing key drivers and future growth opportunities in the U.S. market.

Allergic Conjunctivitis Market Dynamics:

Drivers

-

Increasing Awareness of Ocular Allergies Through Digital Health Campaigns Drives the Growth of the Allergic Conjunctivitis Market

The rising awareness of ocular allergies, largely driven by digital health campaigns, is significantly contributing to the expansion of the allergic conjunctivitis market. Social media platforms, healthcare websites, and mobile applications provide easy access to information about allergic conjunctivitis symptoms, triggers, and treatment options. Organizations such as the American Academy of Ophthalmology (AAO) and Allergy & Asthma Network actively promote educational initiatives to raise public awareness. These campaigns emphasize the importance of early diagnosis, preventive measures, and the effectiveness of antihistamines, corticosteroids, and immunotherapy. Moreover, pharmaceutical companies are increasingly investing in online patient engagement strategies, offering virtual consultations, symptom-tracking applications, and telehealth services. For example, companies like Alcon and Bausch & Lomb use digital outreach programs to educate consumers about their latest eye care solutions, enhancing product adoption. The convenience of online pharmacy platforms has also expanded patient access to medications, further fueling market growth. As more individuals become aware of allergic conjunctivitis and its treatment options, healthcare professionals witness an increase in patient visits, leading to higher prescription rates. Additionally, insurance providers in the United States have begun including digital health tools for allergy management in their coverage, encouraging greater treatment compliance. The integration of digital education in healthcare is expected to continue driving demand for effective allergic conjunctivitis treatments, ultimately supporting market expansion.

Restraints

-

Lack of Standardized Treatment Protocols Leads to Inconsistent Management of Allergic Conjunctivitis

The absence of globally standardized treatment guidelines for allergic conjunctivitis results in inconsistent medical approaches, impacting patient outcomes. While the American Academy of Ophthalmology (AAO) and the American College of Allergy, Asthma & Immunology (ACAAI) provide general treatment recommendations, variations in prescribing habits among healthcare providers create confusion. Some physicians rely heavily on antihistamines, while others prefer corticosteroids, leading to different symptom management strategies. Additionally, patients with mild symptoms often self-medicate using over-the-counter drugs, potentially delaying necessary medical intervention. A lack of clear protocols also affects clinical trial design, slowing the development of innovative drugs. In regions with high allergic conjunctivitis prevalence, such as the United States and Europe, healthcare professionals are pushing for evidence-based guidelines tailored to different patient demographics. Establishing standardized diagnostic and treatment protocols would improve treatment consistency, enhance physician confidence in prescribing novel therapies, and ultimately optimize patient care.

Opportunities

-

Expansion of Telemedicine Services for Allergic Conjunctivitis Patients Improves Accessibility to Eye Care Specialists

The growing adoption of telemedicine is transforming the allergic conjunctivitis market by improving access to specialized care. With the rise of virtual consultations, patients suffering from allergic conjunctivitis can receive expert guidance without the need for in-person visits, reducing the burden on hospitals and clinics. Reports from the American Telemedicine Association (ATA) highlight a surge in ophthalmology-related telehealth services, driven by improved video consultation platforms and AI-powered diagnostic tools. Digital health startups are also introducing mobile applications that allow patients to track their symptoms and receive personalized treatment recommendations. This is particularly beneficial for individuals in rural areas or those with mobility constraints who struggle to access allergists or ophthalmologists. Additionally, telemedicine enables faster diagnosis and prescription fulfillment, streamlining the treatment process. Pharmaceutical companies are collaborating with telehealth providers to integrate virtual prescription services, increasing the reach of allergic conjunctivitis medications. As more healthcare systems embrace digital solutions, telemedicine will continue to expand, driving market growth and improving patient outcomes.

Challenge

-

Disruptions in Pharmaceutical Supply Chains Affect the Availability of Key Allergic Conjunctivitis Medications

Supply chain disruptions pose a significant challenge to the allergic conjunctivitis market, affecting the availability of essential medications. Factors such as geopolitical tensions, trade restrictions, and raw material shortages impact the production and distribution of antihistamines, corticosteroids, and immunomodulators. The U.S. Food and Drug Administration (FDA) has reported periodic shortages of key ophthalmic drugs due to supply chain bottlenecks. Pharmaceutical companies sourcing active ingredients from Asia have faced shipment delays, leading to stock shortages in pharmacies and hospitals. Additionally, the COVID-19 pandemic exposed vulnerabilities in global pharmaceutical logistics, prompting manufacturers to reconsider supply chain strategies. To address this challenge, companies are investing in local production facilities, diversifying supplier networks, and adopting predictive analytics to anticipate demand fluctuations. However, rebuilding resilient supply chains requires time and substantial investment, making it an ongoing concern for drug manufacturers and healthcare providers.

Allergic Conjunctivitis Market Segmentation Analysis:

By Type

Seasonal Allergic Conjunctivitis (SAC) dominated the allergic conjunctivitis market in 2023, holding a 42.5% share, primarily due to its high prevalence and increasing environmental allergen exposure. According to the American College of Allergy, Asthma & Immunology (ACAAI), over 50 million Americans suffer from seasonal allergies, with SAC being the most common type of allergic conjunctivitis triggered by pollen, grass, and airborne allergens. Climate change is exacerbating pollen seasons, as noted in a National Aeronautics and Space Administration (NASA) report, which stated that rising global temperatures have prolonged pollen seasons in North America. Additionally, a Centers for Disease Control and Prevention (CDC) study revealed that emergency visits for allergy-related eye conditions peak during spring and fall, aligning with pollen surges. Pharmaceutical companies have responded with innovative treatments like over-the-counter antihistamines and prescription eye drops, further boosting the SAC segment’s dominance.

By Drug Class

Antihistamines and mast cell stabilizers dominated the allergic conjunctivitis market in 2023, accounting for 45.6% of total sales, owing to their rapid action and widespread availability. These drugs are the first-line treatment for allergic conjunctivitis, recommended by organizations like the American Academy of Ophthalmology (AAO) due to their effectiveness in reducing itching, redness, and swelling. The U.S. Food and Drug Administration (FDA) has approved multiple combination therapies, such as olopatadine and ketotifen, which provide both immediate and long-term relief. Increased awareness campaigns, such as the National Eye Institute (NEI) initiative on eye health, have further educated the public on these medications. Moreover, the Pharmaceutical Research and Manufacturers of America (PhRMA) has reported increased R&D investment in advanced antihistamine formulations, including extended-release versions, which are expected to sustain the segment's leadership position in the coming years.

By Route of Administration

Topical (eye drops) administration segment dominated the allergic conjunctivitis market in 2023, capturing a 72.3% market share due to its direct and effective relief. Unlike oral medications, eye drops provide localized treatment, minimizing systemic side effects while ensuring quicker action. The AAO and the American Optometric Association (AOA) strongly recommend topical treatments for mild to moderate cases, contributing to their widespread adoption. Several pharmaceutical companies, including Alcon, Bausch + Lomb, and Novartis, have expanded their portfolio of prescription and over-the-counter eye drops, increasing market penetration. Additionally, the FDA’s approval of novel formulations, such as preservative-free antihistamines, has driven further demand. Reports from the CDC highlight an increase in over-the-counter allergy medication sales, with eye drops being the fastest-growing category, reinforcing their dominance in the market.

By Distribution Channel

Hospital pharmacies dominated the allergic conjunctivitis market in 2023, holding a 50.2% market share, primarily due to the preference for prescription-based treatments for moderate to severe cases. Hospitals serve as primary treatment centers for patients with chronic allergic conjunctivitis or complications such as keratoconjunctivitis, driving demand for hospital-dispensed medications. The American Hospital Association (AHA) has reported a steady increase in hospital visits related to allergic reactions, particularly in urban areas. Additionally, hospital-affiliated pharmacies offer specialized medications such as immunomodulators and corticosteroids, which are not readily available at retail pharmacies. The rise in healthcare infrastructure investments, particularly in North America and Europe, has strengthened this segment. The expansion of 340B Drug Pricing Program in the U.S. has also contributed to the affordability of hospital-dispensed medications, ensuring continued dominance of hospital pharmacies in the allergic conjunctivitis market.

Allergic Conjunctivitis Market Regional Insights:

North America dominated the allergic conjunctivitis market in 2023, commanding a 38.5% market share, driven by high prevalence rates, well-established healthcare infrastructure, and strong pharmaceutical industry presence. According to the CDC, allergic conjunctivitis affects over 20% of the U.S. population annually, with rising cases attributed to increased air pollution and prolonged pollen seasons. The National Institutes of Health (NIH) has been funding extensive research into innovative treatments, such as biologics and gene therapies, to address severe allergic cases. The FDA’s approval of multiple over-the-counter and prescription antihistamines has also accelerated market growth. The United States was the dominating country, supported by a robust pharmaceutical landscape led by Pfizer, Johnson & Johnson, and AbbVie, which have continuously introduced advanced formulations. Canada emerged as the fastest-growing market within North America, with government-backed allergy awareness programs and increasing adoption of prescription eye drops. Mexico also contributed to market expansion, with rising healthcare investments and improving allergy diagnosis rates. Collectively, these factors have reinforced North America’s leadership in the allergic conjunctivitis market.

On the other hand, Asia Pacific emerged as the fastest-growing region in the allergic conjunctivitis market with a significant growth rate during the forecast period of 2024 to 2032. The dominance is driven by rising urbanization, increased air pollution, and growing awareness of eye health. Countries such as China, India, and Japan are experiencing a surge in allergic conjunctivitis cases due to worsening environmental conditions. A study by the Asia Pacific Association of Allergy, Asthma & Clinical Immunology (APAAACI) highlighted that nearly 30% of urban populations in China and India suffer from allergic eye conditions, with rapid industrialization exacerbating air quality issues. Government initiatives, such as China’s National Health Commission (NHC) programs for allergy awareness and India’s push for improved healthcare accessibility under the Ayushman Bharat Scheme, are expanding treatment options. Japan leads in prescription-based treatments, with companies like Santen Pharmaceutical launching innovative ophthalmic solutions. Southeast Asian countries, including Indonesia and Thailand, are also seeing increased adoption of antihistamines and corticosteroids, supported by rising disposable incomes and improved healthcare infrastructure. The region’s strong growth trajectory is further fueled by pharmaceutical investments in emerging markets, making Asia Pacific the fastest-expanding region in the allergic conjunctivitis market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Allergic Conjunctivitis Market:

-

AbbVie Inc. (Allergan) (Lastacaft, Acuvail, Pred Forte)

-

Ajanta Pharma Limited (Olopatadine, Ketotifen, Fluorometholone Eye Drops)

-

Akron Operating Company LLC (Ketotifen, Naphazoline-Pheniramine, Artificial Tears)

-

Alembic Pharmaceuticals Ltd. (Olopatadine, Ketotifen, Fluorometholone Eye Drops)

-

Alcon (Patanol, Pataday, Zaditor)

-

Bausch & Lomb Incorporated (Bausch Health Companies Inc.) (Alaway, Bepreve, Lotemax)

-

Cipla Ltd. (Olopatadine, Ketorolac, Fluorometholone Eye Drops)

-

Grevis Pharmaceutical Private Limited (Olopatadine, Ketotifen, Artificial Tears)

-

Indoco Remedies Ltd. (Olopatadine, Fluorometholone, Moxifloxacin Eye Drops)

-

Jabs Biotech Pvt. Ltd. (Olopatadine, Ketotifen, Artificial Tears)

-

JAWA Pharmaceuticals Pvt. Ltd. (Olopatadine, Ketotifen, Fluorometholone Eye Drops)

-

Johnson & Johnson (Acuvue RevitaLens, Blink Tears, Visine-A)

-

Novartis AG (Pataday, Cibacen, Alrex)

-

Ocular Therapeutix Inc. (Dextenza, OTX-DP, ReSure Sealant)

-

Pfizer Inc. (Zyrtec Itchy Eye Drops, Xalatan, Prednisolone Acetate Eye Drops)

-

Santen Pharmaceutical Co., Ltd. (Verkazia, Cationorm, Epinastine Eye Drops)

-

Spectra Vision Care Pvt. Ltd. (Olopatadine, Ketotifen, Sodium Hyaluronate Eye Drops)

-

Sun Pharmaceutical Industries Ltd. (Flarex, Loteprednol, Olopatadine Eye Drops)

-

Teva Pharmaceutical Industries Ltd. (Ketotifen, Epinastine, Fluorometholone Eye Drops)

-

Eton Pharmaceutical (Zerviate, EM-100, Betimol)

Recent Developments in the Allergic Conjunctivitis Market:

-

June 2023: Aldeyra Therapeutics announced positive Phase 3 INVIGORATE-2 trial results for reproxalap ophthalmic solution in allergic conjunctivitis. The drug met primary and secondary endpoints, showing rapid relief of ocular itching, redness, and tearing.

-

December 2023: Lupin received FDA approval for Loteprednol Etabonate Ophthalmic Suspension, a generic version of Alrex, for seasonal allergic conjunctivitis relief. The drug will be produced at its Pithampur facility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.75 Billion |

| Market Size by 2032 | USD 4.02 Billion |

| CAGR | CAGR of 4.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Seasonal Allergic Conjunctivitis (SAC), Perennial Allergic Conjunctivitis (PAC), Vernal Keratoconjunctivitis (VKC), Atopic Keratoconjunctivitis (AKC), Others) •By Drug Class (Corticosteroids, Antihistamines and Mast Cell Stabilizers, Nonsteroidal Anti-inflammatory Drugs (NSAIDs), Immunomodulators, Others) •By Route of Administration (Oral, Topical (Eye Drops), Injectable) •By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Drug Stores & Retail Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allergan (AbbVie Inc.), Alcon, Novartis AG, Bausch & Lomb Incorporated (Bausch Health Companies Inc.), Pfizer Inc., Santen Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Alembic Pharmaceuticals Ltd., Cipla Ltd. and other key players |