Contraceptives Market Size & Overview:

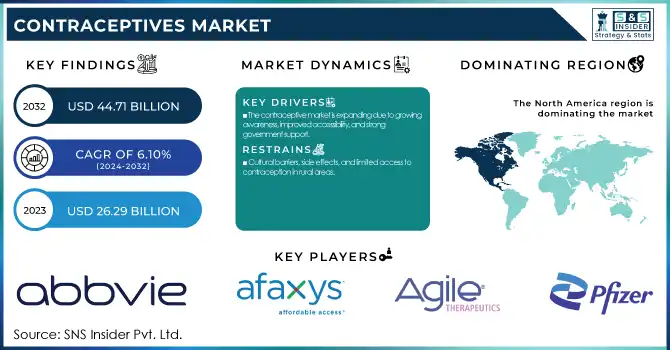

The Contraceptives Market size was valued at USD 26.29 billion in 2023 and is expected to reach USD 44.71 billion by 2032 with a growing CAGR of 6.10% over the forecast period of 2024-2032.

The report identifies changing patterns of preference and switching trends for contraceptive methods as well as how access to health care and health policy is shifting to affect the availability and choice of contraception. This study also focuses on the contribution of technological advancements and digital health solutions to improved product delivery and accessibility. Moreover, it addresses demographic and socioeconomic trends that impact market demand by highlighting age, income, and education levels influencing consumer preferences in choosing specific types of contraceptives.

Get more information on Contraceptives Market - Request Sample Report

Contraceptives Market Dynamics

Drivers

-

The contraceptive market is expanding due to growing awareness, improved accessibility, and strong government support.

Around 1.1 billion women across the globe need contraception, according to the United Nations Population Fund (UNFPA), and 257 million have no access to modern contraceptive methods. Market growth has been aided by an upsurge in long-acting reversible contraceptives (LARCs), such as intrauterine devices (IUDs) and implants. For example, in the U.S. LARCs represented over 10% of contraceptive use in 2023. Moreover, programs such as India’s National Family Planning Program and Europe’s subsidized contraception policies have reduced the cost and improved the availability of methods. The proliferation of telehealth services and online pharmacies, like Nurx and Planned Parenthood Direct, has facilitated access to contraceptives for consumers who do not want to see a healthcare provider, as well.

Restraints

-

Cultural barriers, side effects, and limited access to contraception in rural areas

Even with increasing awareness, cultural and religious barriers still limit contraceptive adoption and use in the Middle East, Africa, and parts of Asia. According to estimates from the Guttmacher Institute, the rate of pregnancies that arise unpredictably is as high as 43%. The stigma of contraceptives and the absence of availability leads to this. The hormonal contraceptives, such as birth control pills and implants, often have side effects, including weight gain, mood swings, and the risk of blood clots, which restrains their use. The major problem with birth control acceptance in rural areas is the lack of access to healthcare facilities. For example, in sub-Saharan Africa, only 24% of married women use modern contraceptives as opposed to over 70% in Western Europe.

Opportunities

-

Innovating contraceptive technology indicates big opportunities within the market.

With newly developed non-hormonal contraceptives, such as Phexxi (a vaginal pH regulator), freedom is given to opt for a hormone-free alternative. Also, ongoing research into male contraceptive pills and gels, such as Nestorone-Testosterone gel, is expected to change the face of the market. The rise of telemedicine and digital pharmacies bolstered accessibility further in areas where the option of an in-person healthcare visit is impossible. The telehealth contraception market in the U.S. grew by 35% in 2023, growing larger due to a rise in platforms such as Nurx, Hers, and Lemonaid Health. Also, some government-backed digital healthcare schemes, including France's free birth control for women aged under 26, are increasing further market growth.

Challenges

-

The contraceptive market is faced with many difficulties, especially due to both tough regulations and counterfeit products.

In several countries, new contraceptive drugs or devices take several years to gain approval, thus delaying market entry. For example, many countries require that a cooperative clinical trial test be conducted for the approval of new birth control methods. In the U.S. Counterfeit contraceptives represent an increasing concern in many developing areas, as much as up to 30% of contraceptive pills sold are purportedly counterfeit or substandard (as per the World Health Organization). These challenges need to be addressed by efforts that range from stricter regulations to global anti-counterfeiting measures, along with general awareness about genuine products for a safe and firm platform for growth in the market.

Contraceptives Market Segmentation Insights

By Product

In 2023, the contraceptive devices segment accounted for the highest revenue share at 68.2%, further highlighting its dominant position in the market. Growth in this segment is attributed to increasing demand for LARCs and a desire for non-daily methods. The Condom segment took up the largest market share of contraceptive devices, both male and female because it remains the most commonly used form of contraception due to its affordability, accessibility, and the dual benefit of protection against STIs besides preventing pregnancy. Widespread availability and low cost of condoms also contribute to the dominance of the market.

The Contraceptive Drugs segment, although the smallest contributor to the market compared to contraceptive devices, is also expected to have promising growth over the forecast period. Within the Contraceptive Drugs segment, the largest category in 2023 was Contraceptive Pills, since oral contraceptives are still the most popular means of contraception for many users, given the convenience and ease of use and access. One more reason women across the globe favor contraceptive pills lies in their reasonably priced and readily available nature, thus becoming many a woman's preferred choice of contraceptive. Increasing innovations in hormone-based pills coupled with the incorporation of new types that have low side effects and thereby are beneficial will continue increasing demand for them as a result, acting like an important driving factor in contraceptive drugs. Among the contraceptive drugs, injectables are likely to grow at the fastest pace. Injectable contraceptives are gaining popularity because of their convenience and effectiveness in regions where long-acting contraceptives are not readily available. These injectables, usually administered every 3 months, provide a reliable alternative to daily pills and offer greater discretion and ease of use for women. The company can see an upward trend in the adoption of injectable contraceptives in emerging countries driven by improved and accessible health programs along with better networks for distribution.

Contraceptives Market Regional Analysis

In 2023, North America dominated the contraceptives market owing to high awareness about contraceptives, availability of a wide range of products, and strong government support for reproductive health initiatives. The U.S. leads in this market, due to an increasing uptake of long-acting reversible contraceptives (LARC) like contraceptive implants and intrauterine devices (IUDs). Furthermore, the rise of over-the-counter availability of emergency contraception has spurred the market growth.

Europe followed closely, with nations such as Germany, the U.K., and France pushing refundable contraception plans and campaigns to raise awareness about reproductive health. Hormonal contraceptives (such as patches, vaginal rings, and IUDs) continue to see strong demand from females due to positive healthcare policies and extensive insurance coverage. High acceptance of modern contraceptive methods within the region continues to drive expansion within the contraceptive market.

Supported by growing awareness, increased urbanization, and family planning policies initiated with governmental assistance in countries like India and China, the Asia-Pacific region is anticipated to witness the fastest growth. However cultural barriers and limited access in rural areas persist as significant obstacles. Factors such as increasing affordable contraceptive options, improving healthcare infrastructure, and the growth of telehealth services are expected to facilitate the growth of the market in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Product Offering by Them Related to Contraceptives

-

AbbVie, Inc. – Viramune

-

Afaxys, Inc. – Plan B One-Step

-

Agile Therapeutics – Twirla

-

Bayer AG – Mirena, Kyleena, Yaz, NuvaRing

-

Church & Dwight Co., Inc. – Trojan Condoms

-

Cupid Limited – Cupid Condoms

-

Johnson & Johnson Services, Inc. – Ortho Evra Patch

-

Organon Group of Companies – Nexplanon, NuvaRing

-

Pfizer Inc. – Sayana Press, Depo-Provera

-

Veru, Inc. – FC2 Female Condom

-

Amneal Pharmaceuticals – Alesse, Nordette

-

Cooper Companies – ParaGard (Copper IUD)

-

Evofem Biosciences – Phexxi

-

HRA Pharma – Ella

-

Maxwellia Ltd – Eden

-

Mayer Laboratories, Inc. – Glyde Condoms

-

Mithra Pharmaceuticals – Donesta

-

Reckitt Benckiser Group PLC – Durex Condoms

-

TherapeuticsMD, Inc. – Annovera

Recent Developments

In Feb 2025, the Albanese government introduced a USD 573.3 million women's health package, which includes the addition of the first new contraceptive pills to the PBS list in over 30 years. This initiative aims to improve access to healthcare for women across the country.

In March 2024, Governor Hochul announced that pharmacists in New York are now authorized to provide hormonal contraception without the need for a prescription. This new policy aims to improve access to contraceptive options and enhance reproductive healthcare across the state.

| Report Attributes | Details |

| Market Size in 2023 | USD 26.29 billion |

| Market Size by 2032 | USD 44.71 billion |

| CAGR | CAGR of 6.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Contraceptive Drugs (Contraceptive Pills, Patch, Injectables), Contraceptive Devices (Condom {Male Condom, Female Condom}, Subdermal Implants, Intrauterine Devices (IUDs) {Copper IUDs, Hormonal IUDs}, Vaginal Ring, Diaphragm)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Inc., Afaxys, Inc., Agile Therapeutics, Bayer AG, Church & Dwight Co., Inc., Cupid Limited, Johnson & Johnson Services, Inc., Organon Group of Companies, Pfizer Inc., Veru, Inc., Amneal Pharmaceuticals, Cooper Companies, Evofem Biosciences, HRA Pharma, Maxwellia Ltd, Mayer Laboratories, Inc., Mithra Pharmaceuticals, Reckitt Benckiser Group PLC, TherapeuticsMD, Inc. |