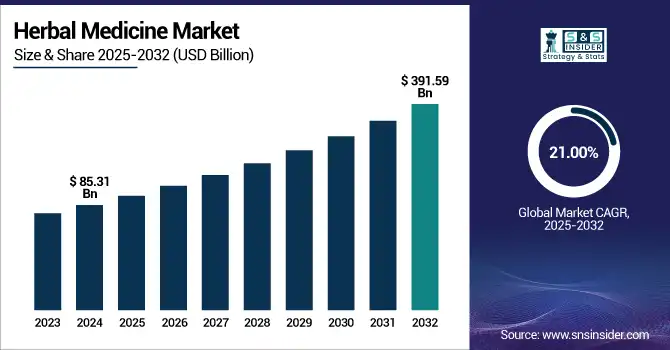

Herbal Medicine Market Size Analysis:

The Herbal Medicine Market size was valued at USD 85.31 billion in 2024 and is expected to reach USD 391.59 billion by 2032, growing at a CAGR of 21.00% over the forecast period of 2025-2032.

The growing need for plant-based drugs, ancient herbal remedies, and botanical supplements is fueling exponential herbal medicine market growth. The value of the market is significantly increased by increasing customer preference for traditional herbal medicines and organic herbal drugs for the treatment of long-term diseases.

To Get more information on Herbal Medicine Market - Request Free Sample Report

For instance, the WHO indicates that 80% of the world's population use herbal medicinal products for the bulk of their healthcare, thus pointing to high demand globally.

Moreover, the U.S. herbal medicine market is being influenced by a growing awareness of integrative care and a strategic shift in healthcare approaches. Furthermore, efforts at regulatory standardization, such as the FDA’s CAM guidelines and the EMA’s herbal monograph, are helping to boost consumer confidence and streamline product approvals.

Major players in the herbal medicine market analysis, such as Himalaya, Blackmores, and Nature's Bounty, are heavily investing in the Ayurvedic medicine market and Chinese herbal medication portfolios, thereby accelerating the herbal medicine market revenue. WHO's traditional medicine global center plans to standardize and market evidence-based herbal medicinal products globally, further assisting the industry.

Established in India in 2024, the WHO Global Traditional Medicine Center operates globally in the scientific authentication of herbal medicinal products, thus promoting global integration and policy reforms.

Global Herbal Medicine Market Dynamics:

Drivers:

-

Expanding Consumer Acceptance and Regulatory Support Fuel Growth

Growing consciousness of health, demand for vegetable remedies, and knowledge of the negative effects of synthetic medications drive the herbal medicine market share forward. For conditions including anxiety, inflammation, and gastrointestinal problems, patients are turning more and more to conventional herbal remedies. Individuals used some type of herbal supplements, therefore highlighting consumer dependency. Recently supported with active R&D support, positive regulatory guidelines such as WHO's traditional medicine strategy 2014–2023 and the simplified registration process for traditional-use herbal medicinal products are leading the way in including herbal medicinal products into official healthcare systems.

Furthermore, companies like Gaia Herbs and Nature's Way are signaling increased investment in the herbal extract sector by expanding their product lines and enhancing clinical substantiation initiatives. R&D spending in the alternative medicine market is also rising, given a 28% five-year global phytopharmaceutical study growth rate. Improved extraction and formulation technologies driving product efficacy and shelf life are fueling demand herbal medicine market. Especially in metropolitan regions, widening e-commerce channels improve access to over-the-counter herbal medications, organic herbal items, and global supply chains.

Restraints:

-

Lack of Standardization and Scientific Validation Impede Growth

Despite phenomenal growth, the market continues to be plagued by serious issues due to poor standardization, inconsistent product quality, and inadequate clinical verification. Variability in doses, safety, and efficacy of herbal remedies arises from the lack of uniform global regulatory standards. A majority of herbal supplements are marketed with insufficient data and no oversight, therefore, their safety cannot be assured.

For instance, the US FDA excludes most herbal extracts from rigorous pre-market testing because they are regarded as ingredients of dietary supplements rather than drugs. The worth of herbal medicine is influenced by professional skepticism and patient distrust of physicians.

Additionally, factors undermining market trustworthiness include pharmaceutical adulteration with synthetics and fragmented supply chains. A 2022 research study by JAMA Internal Medicine indicates that about 20% of over-the-counter herbal supplements available in the U.S. contain undeclared drugs. Furthermore, the lack of funding for Chinese herbal medicine and Ayurvedic medicine limits innovation and long-term clinical research. Moreover, intellectual property laws and biodiversity regulations restrict the commercial manufacturing of most traditional herbal therapies. Collectively, these barriers limit the potential expansion of the market and impede its acceptance at a general level in the context of evidence-based treatment.

Herbal Medicine Market Segmentation Analysis:

By Intervention

Ayurveda led the herbal medicine market in 2024 with a significant 29.9% share. Strong historical roots, increasing global awareness, and official integration into public health systems in countries such as India contribute to its leadership. With the use of plant-based drugs, Ayurvedic treatments have gained popularity for managing chronic diseases such as stress, arthritis, and metabolic disorders. International companies are investing in Ayurvedic product development, verifying recipes through modern R&D, and putting products with improved bioavailability on the market.

Apitherapy is the most rapidly expanding category. Its popularity is due to the increasing application of bee products, such as honey, propolis, and royal jelly, in dermatology, immunological support, and wound healing. Its popularity is increasing as consumers look for natural, powerful, multifaceted remedies. Apitherapy has the potential to significantly increase the herbal medicine market since scientific research demonstrating the anti-inflammatory and antibacterial properties of bee products facilitates their expansion.

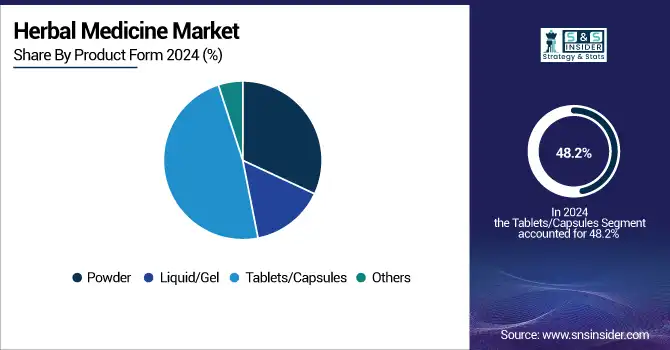

By Product Form

The tablets/capsules segment dominated the market with the largest revenue share of 48.2% in 2024. Their dominance stems from consumer preference for ease of use, precise dosage, portability, and longer shelf life compared to traditional forms, such as decoctions. Developed and emerging markets appreciate these forms, particularly among young people and professionals. Standardized herbal medicinal products in this way are increasingly being manufactured by pharma and nutraceutical companies to meet increasing consumer and regulatory quality demands.

The powder segment is the fastest-growing, spurred by its rising inclusion into functional foods, health drinks, and smoothies. Customers looking for more natural and customized health remedies choose powdered variants of ashwagandha, moringa, and turmeric. Minimal processing, bioavailability, and cost of the format further help to explain its appeal in the wellness and fitness sectors. Its flexibility in several consumption forms increases its attractiveness and drives expansion in the larger herbal medicine market analysis.

By Source

Roots dominated the herbal medicine market by source in 2024, accounting for 42.03% of total revenue. Widely applied across the Chinese herbal medicine, Ayurvedic medicine market, and traditional herbal medicines, the medicinal strength of such roots as turmeric, ginseng, licorice, and ashwagandha contributes to maintaining their dominance. Well-established concentrated bioactive compounds in roots are those with historical herbal medicine market value and create consumer confidence and tolerance. Additionally, growing clinical evidence favoring phytochemicals derived from roots encourages further herbal extract industry growth based on formulations.

The Leaves category is the most rapidly growing, driven by increasing demand for neem, green tea, and moringa for use in skin care, detox, and metabolic products. Rich in antioxidants, leaves take many forms, such as organic herbal products, tablets, and teas. Their easier production and cultivation compared to roots enable them to scale more easily, thus supporting growth in mainstream as well as specialty botanical supplement channels.

By Distribution Channel

Direct sales comprised the largest market share of 69.9% in 2024, led specifically in rural and semi-urban regions by strong consumer belief in practitioner-recommended herbal therapeutic products. Chief distribution points remain herbal clinics, health shops, and Ayurvedic centers; consumers appreciate personal consultation and product tailoring. Through this channel, it is also feasible to advise consumers on product usage, building long-term loyalty. Companies such as Dabur and Himalaya have maintained robust direct channels to take advantage of this trust-based business.

E-sales became the most rapidly expanding distribution channel. Increasing digitization and e-commerce growth, fueled by access to global brands, greater product variety, and doorstep delivery, consumers now prefer the convenience of accessing over-the-counter herbal drugs online. The rise of health-oriented websites like iHerb and Amazon Wellness is transforming the way consumers purchase botanical supplements and alternative medicine market products, thus accelerating growth in this digital channel.

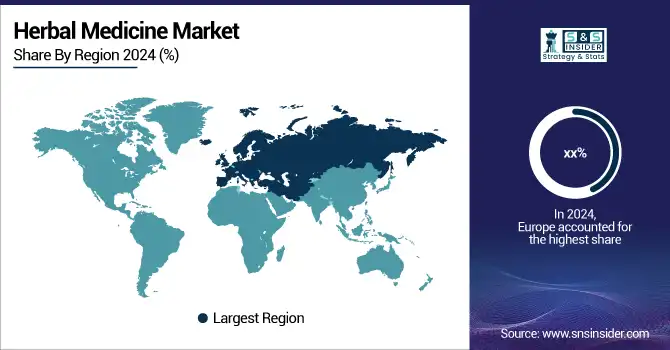

Regional Insights:

Europe dominated the global herbal medicine market in 2024 due to strong legal systems, excellent utilization of botanical supplements, and increasing public awareness of alternative medicine. The European Medicines Agency (EMA) has made scientific guidelines for herbal medicinal products, thus enhancing product quality and consumer trust. Spurred by a long cultural history of herbal product use and a well-organized pharmaceutical distribution network, Germany dominates the region.

For instance, phytopharmaceuticals are quite widespread in both prescription and over-the-counter segments; more than 70% of Germans use herbal medicine.

France and the UK also show high consumption, as natural cosmetics and organic herbal products are being purchased increasingly. Conventional herbal medication is being utilized within mainstream treatment in Italy and Poland increasingly, thus backing regional supremacy. Persistent dominance in the region is highly credited to leading European herbal medicine firms and sustained R&D investment.

The Asia Pacific region is the fastest-growing in the herbal medicine market, driven by the intensive cross-cultural mixing of Japanese Kampo medicine, Chinese traditional therapy, and Ayurvedic therapy. The growth in demand for plant-based pharmaceuticals in preventative medicine, government support, and R&D expenditures all play a role in fueling development.

The two largest markets are India and China; India is notable due to its well-established Ayurveda infrastructure that is bolstered by state-sponsored AYUSH programs and over 8,000 approved manufacturing sites. China is also essential as more than 60% of its population uses traditional Chinese medicine routinely. Adding herbal medical products to hospitals' and national health insurance schemes enhances availability. Additional market growth drivers have been increasing exports and international recognition of these systems.

North America is experiencing steady growth in the market, aided by increasing health awareness, the over-the-counter herbal products market, and the increasing trend towards organic herbal products, with high consumer spending on dietary and botanical supplements estimated at more than USD 12 billion in annual sales. The U.S. dominates this field. The U.S. herbal medicine market was valued at USD 12.22 billion in 2024 and is expected to reach USD 63.91 billion by 2032, growing at a CAGR of 22.99% over the forecast period of 2025-2032.

In addition to the National Center for Complementary and Integrative Health (NCCIH), FDA regulatory efforts have increased consumer recognition and prompted further clinical research on herbal medical products. Credibility has been spurred, in part, by the increasing popularity of naturopathic treatment and incorporation into wellness programs at institutions such as the Mayo Clinic. Canada's diversity of population and friendly regulatory environment under Health Canada's Natural Health Products Directorate are likewise propelling development in this nation.

The LAMEA region is experiencing steady growth in the herbal medicine market due to increasing urbanization, renewed interest in ethnobotanical methods, and expansion of retail outlets for herbal remedies. Brazil is quite influential in Latin America due to its high biodiversity and government-backed integration of traditional treatments into public healthcare. Argentina comes next with an increased need for alternative medicine market offerings in wellness tourism and community healthcare initiatives. With a growing home herbal market and widespread use of native therapies, South Africa is the largest market in the Middle East and the African region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Herbal Medicine Market Key Players:

Major herbal medicine companies in the market include Sheng Chang Pharmaceutical, Nordic Nutraceuticals (now under Oy Verman Ab), AYUSH Ayurvedic Pte Ltd., Herbal Hills, Herb Pharm, LKK Health Products Group, International Chinese Body Care Houses, KindCare Medical Center, Pascoe Natural Medicine, Bionorica SE, Ming Chen Clinic, The Center for Natural and Integrative Medicine, and Sinomedica.

Recent Developments and Trends:

-

A 2025 study published in Frontiers in Pharmacology reveals that the past decade has witnessed a 5–to 10-fold growth in clinical trials involving botanical supplements, a reflection of firm R&D growth and expansion of the market.

-

In August 2024, Herbal medicine manufacturer Pascoe Naturmedizin partnered with SNP to transition its ERP system to SAP S/4HANA. This move aims to enhance operational efficiency, streamline digital processes, and support future scalability within the growing market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 85.31 Billion |

| Market Size by 2032 | USD 391.59 Billion |

| CAGR | CAGR of 21.00% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Intervention (Ayurveda, Apitherapy, Bach Flower Therapy, Naturopathic Medicine, Traditional Chinese Medicine, Traditional Korean Medicine, Traditional Japanese Medicine, Traditional Mongolian Medicine, Traditional Tibetan Medicine, and Zang Fu Theory) • By Product Form (Powder, Liquid/Gel, Tablets/Capsules, and Others) • By Source (Barks, Leaves, Roots, and Others) • By Distribution Channel (Direct Sales, E-sales) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sheng Chang Pharmaceutical, Nordic Nutraceuticals (now under Oy Verman Ab), AYUSH Ayurvedic Pte Ltd., Herbal Hills, Herb Pharm, LKK Health Products Group, International Chinese Body Care Houses, KindCare Medical Center, Pascoe Natural Medicine, and Bionorica SE. |