Allergy Diagnostics Market Report Scope & Overview:

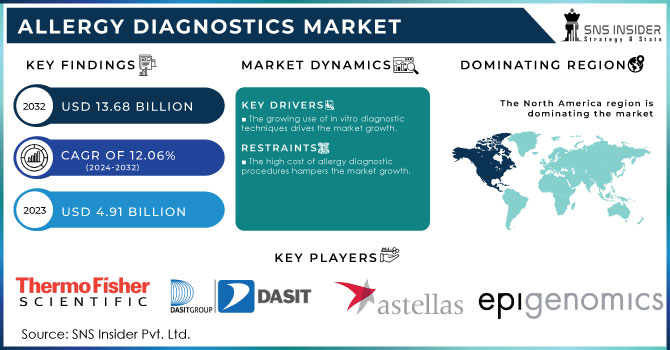

The Allergy Diagnostics Market Size was valued at USD 4.91 billion in 2023 and is expected to reach USD 13.68 billion by 2032 at a CAGR of 12.06% during the forecast period of 2024-2032. The rise in the allergic population and increasing incidence of allergies is one of the key factors contributing to allergy diagnostics market growth. It is due to the high-risk factors for the development of chronic respiratory diseases including an increase in exposure to outdoor and indoor air pollutants and occupational exposure. The number of those suffering from allergies is much greater in the urban population compared to the rural population due to increased exposure to environmental pollutants from industrial processes and urbanization.

Get More Information on Allergy Diagnostics Market - Request Sample Report

For example, as per the statistics, published by the World Health Organisation in January 2023, around 1 in 4 children and 1 in 3 adults has a seasonal allergy in the U.S. So, there are about 27.69 million and 66 million people have seasonal allergies among the total population of 331 million. Additionally, nearly 6% of children and adults in the U.S. have a food allergy being highest among black, Asian, and Hispanic persons. Similarly, as per the statistics given by the Asthma and Allergy Foundation of America in 2021, about 81 million people are suffering from seasonal allergic rhinitis in the U.S. among which around 26% of adults and 19% of children are affected.

Moreover, government initiatives and healthcare policies have also significantly contributed to the market's expansion. For instance, in the U.S., the Centers for Disease Control and Prevention and other public health agencies have been actively promoting the importance of allergy testing as part of public health strategies to manage allergic diseases. In Europe, government-funded healthcare systems have integrated allergy diagnostics into routine healthcare, ensuring broader access to these essential tests. These factors combined are driving the growth of the allergy diagnostics market.

In Australia, the government has recognized the rising prevalence of allergies, leading to the establishment of the National Allergy Strategy in collaboration with the Australasian Society of Clinical Immunology and Allergy (ASCIA). This initiative focuses on improving access to allergy diagnostics and management, reflecting the growing demand for these services in the healthcare system.

Allergy Diagnostics Market Dynamics

Drivers

-

The growing use of in vitro diagnostic techniques drives the market growth.

The rising uses of in vitro diagnostics are mainly prompted by the increasing prevalence of chronic diseases, the rising demand to diagnose diseases early and correctly, and the evolution of personalized medicine. On the one hand, a significant number of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, among others, have become substantially more prevalent in the world. Therefore, healthcare systems have come to prioritize the early detection of these diseases, a process highly facilitated by the application of the in vitro diagnostic. On the other hand, the introduction of such technologies as next-generation sequencing and diagnostic tools based on artificial intelligence applications, among others, has substantially increased the accuracy and efficiency of the in vitro diagnostic.

Moreover, the popularity of the application of in vitro diagnostics in the era of precision medicine can be largely confirmed by the Food and Drug Administration’s approval of several next-generation sequencing in vitro diagnostics in recent years. Moreover, similar initiatives of other governmental bodies in the United States and the European Union provide further support of the in vitro diagnostic’s rising popularity in modern healthcare systems.

Restraint

-

The high cost of allergy diagnostic procedures hampers the market growth.

The high costs related to allergy diagnostics are factor that hampered the broad use of the discussed tests. For the most part, allergy testing is associated with the use of efficient diagnostic equipment, such as immunoassay analyzers and skin testing devices, and consumables, including allergen extracts and reagents. The specified components are crucial for a highly accurate and dependable diagnosis. However, each of the items that have been listed above is connected to a hefty price. From the part of healthcare providers, it involves the initial cost of implementation of the technology, as well as the expenses related to maintenance and recurring consumables purchase.

Opportunities

-

The allergy diagnostics market presents numerous opportunities driven by technological advancements and increasing demand for at-home diagnostic solutions.

One of the greatest possibilities is the creation of home test kits that are consumer-friendly, enabling people to carry out allergy tests easily in the comfort of their own homes. Everlywell and Immuven are at the forefront of making inexpensive, simple-to-use kits available for testing common allergens like food intolerance, pollen, and cat dander. These kits have transformed the market by bringing allergy testing within reach of a larger population, particularly in areas where laboratory testing might not be available. Furthermore, the advent of artificial intelligence (AI) and machine learning in diagnostics is another area where the allergy diagnostics market can capitalize. AI-based platforms can improve test accuracy and deliver faster results, thus making diagnosis more efficient. In addition, the increasing popularity of personalized medicine, where the treatment is personalized to a person's allergy profile, is boosting demand for more accurate and sophisticated diagnostic techniques. As demand for personalized treatment increases, the market for allergy diagnostics will grow, offering plenty of room for growth and innovation.

Challenges

-

Despite the significant growth of the allergy diagnostics market, challenges related to the accuracy of diagnostic tests and regulatory hurdles remain prominent.

One of the major challenges is test accuracy variability. Conventional diagnostic tests, like skin prick tests and blood tests, at times may produce false positives or negatives, resulting in misdiagnosis and inappropriate therapy. For example, false positives in skin prick tests may lead to unnecessary avoidance of some allergens, whereas false negatives might delay the diagnosis of severe allergies. Additionally, with new technologies, verifying that they are compliant with regulations and getting necessary approvals from the regulatory authorities such as the FDA or EMA can be time-consuming and convoluted. Such regulatory risk can hinder new product adoption and postpone market access. Furthermore, there are also challenges related to the standardization of allergy testing processes, especially across global markets with varying healthcare practices. Providing consistent standards and procedures in various regions to enhance test reliability is paramount. With new diagnostic technology on the horizon, addressing these issues will be key to sustained growth and efficiency in the allergy diagnostics market.

Allergy Diagnostics Market Segmentation

By Type

In the allergy diagnostics market, consumables held the largest market share. This segment includes items such as reagents, test kits, and other disposable materials required for allergy testing. The high demand for consumables-type products is driven by their recurring nature; they are essential for every test conducted, making them a continuous revenue stream for manufacturers. Additionally, the increasing prevalence of allergies worldwide has led to a rise in the number of tests performed, further boosting the demand for consumables. The frequent use and replenishment of these products in both large and small healthcare settings, coupled with the ongoing development of new and more effective diagnostic tests, solidify the consumables segment as the market leader.

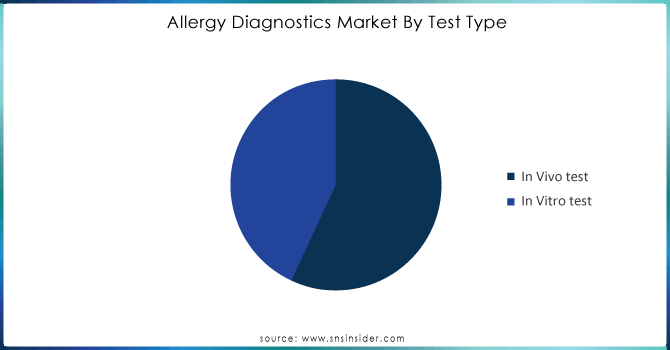

By Test Type

The in vitro test segment held the largest market share of 54.23% in 2023. This test is used to determine allergen-specific immunoglobulin E. It has been found that Serum IgE has a high positive predictive value and improved specificity for identifying aeroallergen sensitization. It is believed that factors, such as, food allergy are growing as a major public health issue worldwide where the incidence of food allergy and sensitization is increasing both in developed nations & developing nations across the globe is expected to have a significant impact on allergy diagnostics market penetration during the forecast period. For example, according to Food Allergy Research and Education’s 2022 statistics, it is estimated that around 2.8 million Americans may have an egg allergy in 2020 while 2.5 million might have a wheat allergy.

Need any customization research on Allergy Diagnostics Market - Enquiry Now

By Allergen

The inhaled allergens segment dominated the market with the highest share around 48.68% in 2023. The growth is driven by the increasing incidence of respiratory allergies induced by industrialization and escalating air pollution. The Allergy and Asthma Foundation of America estimated that the prevalence of seasonal allergic rhinitis in the U.S. would reach approximately 81 million in 2021, with about 26% of 67 million adults and 19% of 14 million minors accounted for the estimate. The number is expected to increase over the forecast period. Hence, the growing prevalence of allergic rhinitis is anticipated to offer future growth opportunities for the market.

By End-User

Hospital-based Laboratories & Clinics held the largest market share around 32.65% in 2023. This is because of the comprehensive nature of the service these facilities offer, where allergy diagnostics are a crucial component of broader healthcare services. Hospitals and clinics have access to various diagnostic tools and technologies, allowing them to conduct detailed and accurate allergy tests. Additionally, these facilities are often the first point of contact for patients experiencing allergic reactions, making them essential in both the initial diagnosis and ongoing management of allergies.

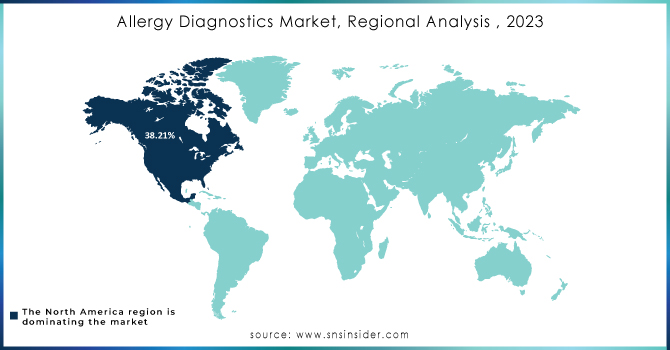

Allergy Diagnostics Market Regional Analysis

North America held the highest market share in the allergy diagnostics market about 38.21% in 2023. This can be referred to the increasing incidences of allergy and favorable government initiatives in the region. It is known that North America is a developed region with high healthcare expenditure. The research shows that U.S.-based firms have made substantial investments in the development of these kinds of drugs as they have an increased understanding of the large target population. In addition, the key players focused on entering the market with its innovations and products is expected to escalate and enhance the competitive rivalry in the North American market.

Asia Pacific market is expected to grow at a lucrative rate due to a number of factors. These factors include increasing healthcare reforms and developing healthcare infrastructure. Other factors that have facilitated the growth of the market are increasing population, rising prevalence of allergies, and a growing number of local companies entering the market. With Japan, China, and India being major markets in Asia Pacific, its growth is projected to lower the market in the region. Players in these countries have taken varied strategies to increase their market dominance.

Key Players

-

Thermo Fisher Scientific, Inc. - ImmunoCAP, Phadia 250, Phadia 500

-

DASIT Group SPA - Allergen Specific IgE Tests

-

AESKU.GROUP GmbH - AESKU.DIA System, AESKU.RAPID Tests

-

Astellas Pharma Inc. - Allergic Rhinitis Treatment (e.g., Astelin, Astepro)

-

Epigenomics AG - Epi proLung

-

Sun Pharmaceutical Industries Ltd - Ozel (oral antihistamine for allergy treatment)

-

Teva Pharmaceutical Industries Ltd. - Qnasl, ProAir HFA

-

Pfizer, Inc. - Xolair

-

AbbVie, Inc. - Rinvoq

-

Lincoln Diagnostics, Inc. - Linco Interdermal Test System, Linco Allergen Extracts

Recent Development:

-

In 2023, Thermo Fisher launched an advanced allergy test that provides faster and more accurate results. This development aims to enhance the diagnostic capabilities of healthcare providers, addressing the growing demand for precision medicine in allergy diagnostics.

-

In 2022, Siemens Healthineers launched a new automated allergy testing platform, which help to reduce the time required for testing multiple allergens simultaneously.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.91 Billion |

| Market Size by 2032 | USD 13.68 Billion |

| CAGR | CAGR of12.06 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Consumables, Instruments, Services) • By Test Type (In Vivo Test, In Vitro Test) • By Allergen, (Inhaled Allergens, Food Allergens, Drug Allergens, and Other Allergens) • By End-User (Hospital-based Laboratories & Clinics, Diagnostic Laboratories, Academic Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., DASIT Group SPA, AESKU.GROUP GmbH, Astellas Pharma Inc., Epigenomics AG, Sun Pharmaceutical Industries Ltd, Teva Pharmaceutical Industries Ltd., Pfizer, Inc., AbbVie, Inc., Lincoln Diagnostics, Inc. |