Immunoassay Analyzers Market Size:

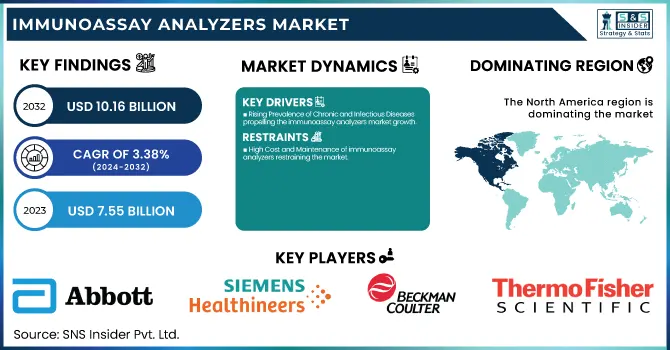

The Immunoassay Analyzers Market was valued at USD 7.55 billion in 2023 and is expected to reach USD 10.16 billion by 2032, growing at a CAGR of 3.38% from 2024-2032.

To Get more information on Immunoassay Analyzers Market - Request Free Sample Report

The Immunoassay Analyzers Market report provides exclusive insights by presenting testing volume and utilization rates in major regions, reflecting the increasing demand for immunoassay-based diagnostics. It presents a comprehensive analysis of disease burden and prevalence, with a focus on infectious diseases, cancer, and autoimmune disorders. The report also discusses adoption trends of automated immunoassay analyzers, with a focus on the transition towards high-throughput and point-of-care (POC) solutions. In addition, it analyzes healthcare expenditures, dividing spending by government, commercial, private, and out-of-pocket investments. The report charts regulatory approvals and new product launches, highlighting recent FDA and CE-marked innovations leading to market innovation and competition.

Immunoassay Analyzers Market Dynamics

Drivers

-

Rising Prevalence of Chronic and Infectious Diseases propelling the immunoassay analyzers market growth

The growing number of chronic conditions like cancer, cardiovascular diseases, and infectious diseases such as HIV, hepatitis, and COVID-19 is propelling the need for immunoassay analyzers. As per the WHO, more than 74% of mortality in the world is comprised of non-communicable diseases, which highlights the importance of sophisticated diagnostic technology. Immunoassay analyzers are vital in the detection of disease at an early stage, monitoring, and making treatment choices. Recent innovations in high-throughput and automated immunoassay systems, i.e., Roche's Cobas e series and Abbott's Alinity I, have enhanced diagnostic efficiency. Additionally, increased use of point-of-care testing (POCT) devices across hospitals and diagnostic laboratories also underpins market growth, providing timely and precise results for patient management.

-

Technological Advancements in Immunoassay Platforms driving the growth of the immunoassay analyzers market

Ongoing innovations in immunoassay technologies, viz., chemiluminescence immunoassays (CLIA), fluorescence immunoassays (FIA), and multiplex immunoassays, are refining assay sensitivity, specificity, and throughput. Next-generation immunoassay analyzers combine automation, artificial intelligence, and analytics, facilitating in real-time the detection of diseases and optimization of workflows. The DxI 9000, for example, from Beckman Coulter and Atellica IM by Siemens Healthineers, uses smart algorithms for added accuracy. The increasing adoption is also driven by microfluidics-based and nanotechnology-enabled immunoassays for rapid, low-cost diagnostic applications. Widening immunoassay utilization in therapeutic drug monitoring, cancer diagnostics, and autoimmune disease diagnostics is further stimulating market adoption. These advances are enhancing laboratory productivity and widening access to high-quality diagnostics globally.

Restraint

-

High Cost and Maintenance of immunoassay analyzers restraining the market

The high cost of immunoassay analyzers and their maintenance is still a major hurdle for market expansion, especially in low- and middle-income economies. High-end systems like chemiluminescence and multiplex immunoassay analyzers demand high capital investment and, hence, are not affordable to small diagnostic labs and health centers. Moreover, the recurring expenditure on consumables, reagents, and calibration materials adds to the overall expense. The requirement for trained personnel to run and maintain these sophisticated systems contributes to operational costs. In the developing world, constrained healthcare budgets and poor reimbursement strategies limit the universal uptake of these technologies. Consequently, the majority of laboratories still depend on conventional diagnostic techniques, which slow the spread of automated immunoassay solutions in resource-constrained environments.

Opportunities

-

The growing demand for rapid, accurate, and decentralized diagnostic solutions has fueled the expansion of point-of-care testing (POCT) in the immunoassay analyzers market.

The increasing need for fast, precise, and decentralized diagnostic tests has driven the growth of point-of-care testing (POCT) in the immunoassay analyzers market. POCT immunoassays provide rapid turnaround times, enabling real-time clinical decision-making, especially in emergency care, infectious disease screening, and chronic disease management. Technological innovation, such as miniaturization and automation, has enhanced the portability and effectiveness of immunoassay analyzers to make them applicable for ambulatory care, pharmacies, and home healthcare. The growing number of infectious diseases and the demand for early detection of diseases further accelerate the uptake of POCT. Favorable regulatory frameworks and the convergence of digital health technologies also improve access, offering high growth opportunities for manufacturers in this new segment.

Challenges

-

One of the major challenges in the immunoassay analyzers market is the variability in test sensitivity and specificity across different platforms and manufacturers.

Variability in test sensitivity and specificity among platforms and manufacturers is one of the key challenges in the market for immunoassay analyzers. Immunoassays are based on antigen-antibody binding, which is susceptible to variability due to factors like sample quality, reagent stability, and cross-reactivity with non-target molecules. Such variability can cause false-positive or false-negative results, which have a bearing on clinical decision-making and patient outcomes. The absence of standardization in immunoassay test kits across different laboratories makes the comparability of results more challenging. Also, the evolving nature of infectious diseases and new biomarkers necessitates ongoing adjustments of immunoassay methodology, and the manufacturers find it challenging to sustain accuracy across a wide range of applications. These deficiencies can only be overcome through ongoing research, rigorous quality control, and greater regulatory control.

Immunoassay Analyzers Market Segmentation Analysis

By Product

The Consumables and Accessories segment dominated the immunoassay analyzers market with a 37.12% market share in 2023 because of the reoccurring demand for consumables such as reagents, assay kits, and others used in healthcare institutions and diagnostic labs. Immunoassay analyzers need regular replenishment of consumables to maintain continuous and precise testing for different diseases like cancer, infectious diseases, and autoimmune diseases. The rise in the number of diagnostic tests, along with the augmented demand for high-throughput and high-sensitivity assays, also contributed to driving demand further. Also, evolution in assay technologies, like multiplex immunoassays, as well as the prevalence of automated immunoassay platforms worldwide, added to the segment's massive revenue share in 2023.

The Enzyme-Linked Immunoassay (ELISA) segment is anticipated to witness the fastest growth during the forecast period as a result of its sensitivity, affordability, and extensive applications in disease diagnosis, drug discovery, and food safety analysis. The growing incidence of infectious diseases and chronic illnesses, such as cancer and autoimmune diseases, has stimulated the need for ELISA-based diagnostic tests. Furthermore, ongoing improvements in assay design, automation, and multiplexing capabilities are increasing the efficiency and throughput of ELISA platforms. The increasing use of point-of-care testing and the convergence of ELISA with digital healthcare solutions for remote diagnostics are also fueling the growth of the segment, especially in emerging markets with growing healthcare infrastructure.

By Application

The Infectious Disease Testing segment dominated the immunoassay analyzers market with a 31.21% market share in 2023, owing to the significant worldwide prevalence of infectious diseases such as COVID-19, HIV, hepatitis, tuberculosis, and respiratory infections. The constant requirement for early detection and surveillance of such diseases fueled an upsurge in immunoassay-based diagnostic tests within hospitals, diagnostic labs, and point-of-care settings. Further, government programs and funding for infectious disease surveillance, as well as mass vaccination and screening programs, drove the demand for immunoassay analyzers. The growing use of high-throughput and automated immunoassay systems that improve accuracy and efficiency in infectious disease diagnosis further entrenched this segment's market leadership.

By End Use

The hospital segment dominated the immunoassay analyzers market with a 48.23% market share in 2023 as a result of the heavy inflow of patients for disease diagnosis, treatment, and monitoring. Hospitals are the first point of contact for people for the management of acute and chronic diseases and, therefore, are the biggest consumers of immunoassay analyzers to identify diseases like infectious diseases, cancer biomarkers, and cardiovascular diseases. The presence of sophisticated laboratory facilities, expert professionals, and government-supported healthcare schemes also increased hospitals' hold. Furthermore, the increased occurrence of hospital-acquired infections (HAIs) and the escalating demand for high-throughput, rapid diagnostic devices in ICUs and emergency units further augmented the use of immunoassay analyzers in hospitals.

Regional Insights

North America dominated the immunoassay analyzers market with a 43.25% market share in 2023 because of its well-developed healthcare system, superior adoption of cutting-edge diagnostic technologies, and prevalent presence of prominent market players like Abbott, Roche Diagnostics, and Siemens Healthineers. The region enjoys impressive investments in R&D, allowing ongoing innovation in immunoassay methods to identify and monitor diseases. Also, the increasing incidence of chronic diseases like cancer, cardiovascular diseases, and infectious diseases has propelled the market for immunoassay-based diagnostics. Positive reimbursement policies, rigorous regulatory environments guaranteeing quality diagnostic standards, and growing government surveillance initiatives further support the market's robust position in North America.

Asia Pacific is the fastest-growing region in the immunoassay analyzers market with a 5.37% CAGR, fueled by the fast-paced development of healthcare infrastructure, growing knowledge of early detection of diseases, and an enhanced burden of infectious and chronic ailments. China, India, and Japan are observing huge investments in diagnostic centers, as well as an expanding network of healthcare centers and laboratories using immunoassay technologies. The growth of medical insurance coverage and government programs sponsoring disease screening programs also contribute to increased market growth. The availability of local manufacturers providing affordable diagnostic solutions and increasing demand for point-of-care testing in rural and underserved communities also fuel the market's rapid growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Immunoassay Analyzers Market

-

Abbott Laboratories (ARCHITECT i2000SR, Alinity i)

-

Roche Diagnostics (cobas e 411 analyzer, Elecsys 2010)

-

Siemens Healthineers (ADVIA Centaur XP, Atellica IM Analyzer)

-

Beckman Coulter (Access 2 Immunoassay System, UniCel DxI 800)

-

bioMérieux (VIDAS 3, miniVIDAS)

-

Ortho Clinical Diagnostics (VITROS 3600, VITROS ECiQ)

-

DiaSorin (LIAISON XL, LIAISON XS)

-

Tosoh Bioscience (AIA-900, AIA-360)

-

Mindray Medical International (CL-2000i, CL-6000i)

-

Randox Laboratories (Evidence Investigator, Evidence MultiStat)

-

PerkinElmer (GSP Instrument, Victor2 D)

-

Thermo Fisher Scientific (B·R·A·H·M·S KRYPTOR compact PLUS, Phadia 250)

-

Quidel Corporation (Sofia 2 Fluorescent Immunoassay Analyzer, Triage MeterPro)

-

Luminex Corporation (MAGPIX System, xMAP INTELLIFLEX)

-

Bio-Rad Laboratories (BioPlex 2200, Evolis System)

-

Meril Life Sciences (Mispa-i2, Mispa-i3)

-

Agilent Technologies (AriaMx Real-Time PCR System, Bravo Automated Liquid Handling Platform)

-

Becton, Dickinson, and Company (BD Veritor Plus System, BD MAX System)

-

Hologic, Inc. (Panther Fusion System, Tigris DTS System)

-

Sysmex Corporation (HISCL-5000, HISCL-800

Suppliers (These suppliers provide essential components such as reagents, assay kits, consumables, and precision instruments necessary for the development and performance of immunoassay analyzers.)

-

Thermo Fisher Scientific

-

Merck KGaA

-

Danaher Corporation

-

Agilent Technologies

-

PerkinElmer Inc.

-

Bio-Rad Laboratories, Inc.

-

Siemens Healthineers

-

Beckman Coulter, Inc. (a subsidiary of Danaher Corporation)

-

Roche Diagnostics

-

Abbott Laboratories

Recent Development

-

In June 2024, Axis-Shield plc reported the release of an anti-CCP assay for Abbott's AxSYM platform to increase diagnostic power for rheumatoid arthritis.

-

In November 2024, Roche was granted CE Mark approval for its VENTANA FOLR1 (FOLR1-2.1) RxDx Assay, the first IHC-based companion diagnostic to detect ovarian cancer patients suitable for treatment with ELAHERE.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.55 Billion |

| Market Size by 2032 | US$ 10.16 Billion |

| CAGR | CAGR of 3.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Chemiluminescence Immunoassay (CLIA), Fluorescence Immunoassay (FIA), Radioimmunoassay, Enzyme-Linked Immunoassay, Consumables and Accessories) • By Application (Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease Testing, Autoimmune Disease, Others) • By End Use (Hospitals, Diagnostic Laboratories, Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Beckman Coulter, bioMérieux, Ortho Clinical Diagnostics, DiaSorin, Tosoh Bioscience, Mindray Medical International, Randox Laboratories, PerkinElmer, Thermo Fisher Scientific, Quidel Corporation, Luminex Corporation, Bio-Rad Laboratories, Meril Life Sciences, Agilent Technologies, Becton, Dickinson and Company, Hologic, Inc., Sysmex Corporation, and other players. |