Aluminum Foil Packaging Market Report Scope & Overview:

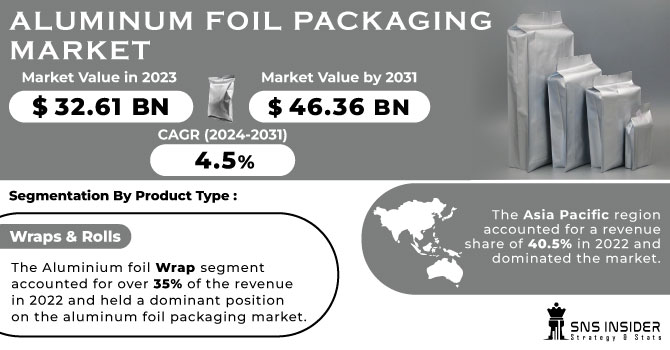

The Aluminum Foil Packaging Market size was USD 32.61 billion in 2023 and is expected to Reach USD 46.36 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

The main driver for the industry's growth could be the increasing application of aluminum foil in food and beverage packaging applications. In view of the growing urban population as well as changes in consumer lifestyle, processed foods are experiencing strong growth.

Get More Information on Aluminum Foil Packaging Market - Request Sample Report

Moreover, China's annual production of aluminium in 2022 grew by 4.5% from last year to a record 40.21 million tonnes helped by the addition of new and expanded capacities as well as easing capacity constraints on energy supply etc. According to the National Bureau of Statistics it is already at an all time high.

Sustainability of aluminium provides businesses with a competitive advantage and at the same time gives rise to product development advantages. Almost 75% of all aluminium produced in the world continues to be used, according to the Aluminum Association. Furthermore, aluminum waste is not added to water or soil with toxic constituents and can be economically recycled and sustainable when it is disposed of.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing adoption of the food industry in the world

The main driving factor for the market's growth is considered to be the growing adoption of aluminum foil in the food sector. The superior barrier properties, such as high moisture resistance and protection from light, are provided by aluminum foil. Aluminum is an excellent material for transporting food materials due to these elements. The convenience and portability of aluminum foil packaging is a benefit to consumers. Aluminium foils offer an added value for food packaging solutions, due to their heat conductivity.

RESTRAIN:

-

Aluminium foil has been associated with undesirable effects on the health

The production of aluminium foil involves the extraction of bauxite ore that has a significant environmental impact, including habitat destruction and soil erosion. In addition, there is a large amount of energy to be consumed in the production process that contributes to greenhouse gas emissions and climate change. The growth of industries that have a large impact on the environment may be affected by increased awareness and regulations designed to reduce carbon footprints and promote environmentally sound practices.

OPPORTUNITY

-

Environmental concerns have led to an increase in the demand for Sustainable Packaging Materials

The sustainability objectives of consumers and businesses are aligned with aluminium foil, which is a highly recycled material. The manufacturer can exploit this opportunity by promoting the recycling and reuse characteristics of aluminum foil packaging. In addition, the sustainability profile of aluminium foil packaging can also be improved by exploring alternatives with a less impact on the environment, like bio based or compostable films.

CHALLENGES

-

Cost Fluctuations and availability of raw materials is a challenge

The production of aluminium foils is influenced by variations in raw material cost, including the price of alumina. Within the aluminium foil packaging sector, price fluctuations may have a bearing on production costs and total profitability.

IMPACT OF RUSSIAN UKRAINE WAR

The war had affected the supply of aluminium and, moreover, resulted in additional costs for these materials. The manufacturers of aluminium foil packaging have therefore had difficulty in producing and selling their products. Aluminium, which is a primary raw material used to produce aluminium foil packaging, was badly hit by the war. This lack has led to an increase in the price of aluminium and, consequently, a higher cost for aluminum foil packaging. The supply chain for aluminium foil packaging has also been adversely affected by the war. In order to obtain raw materials and components, a number of aluminium foil packaging producers are relying upon suppliers in Russia and Ukraine. These manufacturers were faced with difficulties in producing and marketing their products due to a disruption of the supply chain.

Disruptions in supply can also affect Russian aluminum production, since Rusal has been reduced from 68% of its alumina imports. In 2021, Ukraine had the highest share of these imports, amounting to 36%. However, the major The conflict has led to the closing down of Ukraine's alumina refinery. In 2021, Australia had been the second most significant source of alumina imports from Russia, accounting for 32%.

The duty on imported unprocessed aluminium from Russia has risen to between 10% and 25.0%, having been between 0 and 2.6%. 1 In addition, the major The concern that further import restrictions could also be imposed on Rusal aluminum products has arisen from the allegations of its association with the Kremlin. The U.S. imports the most aluminum in the world.

IMPACT OF ONGOING RECESSION

The decrease in consumer spending is one of the main reasons why growth is projected to slow down. Consumers are likely to reduce their discretionary spending, e.g. in the form of packaging goods, due to reduced amounts of cash at their disposal. This will lead to a decrease in demand for aluminum foil packaging. The increase in raw material costs is another factor likely to affect the aluminum foil packaging market. In recent months, as a result of many factors such as the war in Ukraine and supply chain disruption, aluminum prices have risen. The costs of aluminium foil packaging are expected to increase, which is likely to result in further pressure on demand.

KEY MARKET SEGMENTS

By Type

-

Backed Foil

-

Rolled Foil

-

Others

By Product Type

-

Wraps & Rolls

-

Containers

-

Bags & Pouches

-

Blisters

-

Others

The aluminium foil wrap segment accounted for over 35% of the revenue in 2022 and held a dominant position on the aluminum foil packaging market. It is used in snack pouches, liquid boxes, candy wrappers, confectionery wraps and pharmaceutical packaging as one of the layers. Foil wraps have become an important product segment due to these extensive applications in the end use industries.

By Packaging Type

-

Flexible

-

Semi-Rigid

-

Others

By Application

-

Food & Beverages

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

In 2022, the food and beverages sector was dominant, with a revenue share of 48 %. For the packaging of bakery products, dairy products, chocolates, coffee tea, dry foodstuffs, beverages and meat and shellfish it is generally used to include pouches, containers, capsules or lids. For the packaging of food and beverages, aluminium foils are also widely used for their flexibility, safety characteristics, wide availability and lower cost due to a variety of factors.

REGIONAL ANALYSIS

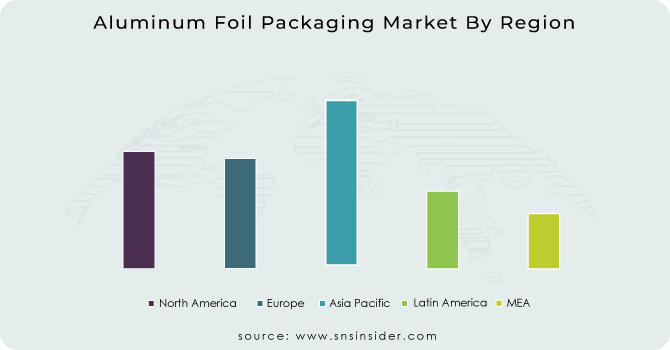

The Asia Pacific region accounted for a revenue share of 40.5% in 2022 and dominated the market. The market in Asia Pacific is growing, driven by an increasing middle class population and the growth of consumer markets for end use products such as food, beverages or pharmaceuticals. With high investments in the manufacturing sector, coupled with an extensive consumer base in these countries, India and China are likely to emerge as key markets for this product.

Due to their efficient single dose packaging and ease of use, pharmaceutical companies in the United States are gradually switching to flexible packaging products such as blisters. It is likely that this positive trend in the case of blister packs will provide significant growth opportunities for aluminum foil packaging.

Due to growing awareness amongst consumers of sustainable packaging solutions, the market in Europe is expected to experience significant growth. In addition, a positive impact on the industry may be achieved by strict government regulation in this area to limit use of plastic packaging.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Aluminum Foil Packaging market are Camvac, Constantia Flexibles, Amcor plc, Reynolds group holdings limited, Ardagh Group, Aleris Corporation, JW Aluminum, Eurofoil Luxembourg S.A, Express Flexi Pack, Ampco and other players.

Constantia Flexibles-Company Financial Analysis

RECENT DEVELOPMENT

-

In order to replace standard foils, Camvac has announced the introduction of Camfoil, a flexible, multi laminated, metallized laminate using the patented barrier coating technology of the company.

| Report Attributes | Details |

| Market Size in 2023 | US$ 32.61 Bn |

| Market Size by 2031 | US$ 46.36 Bn |

| CAGR | CAGR of 4.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Backed Foil, Rolled Foil, Others) • by Product Type (Wraps & Rolls, Containers, Bags & Pouches, Blisters, Others) • by Packaging Type (Flexible, Semi-Rigid, Others) • by Application (Food & Beverages, Pharmaceutical, Personal Care & Cosmetics, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Camvac, Constantia Flexibles, Amcor plc, Reynolds group holdings limited, Ardagh Group, Aleris Corporation, JW Aluminum, Eurofoil Luxembourg S.A, Express Flexi Pack, Ampco |

| Key Drivers | • Increasing adoption of the food industry in the world |

| Key Restraints | • Aluminium foil has been associated with undesirable effects on the health. |