AI Enhanced HPC Market Size & Trends:

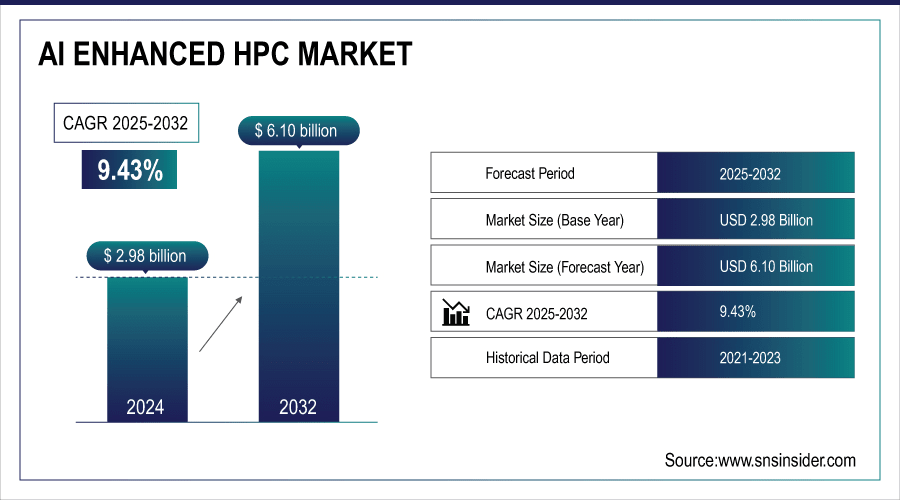

The AI Enhanced HPC Market size was valued at USD 2.98 Billion in 2024 and is projected to reach USD 6.10 Billion by 2032, growing at a CAGR of 9.43% during 2025-2032. Demand for high-performance data processing, increasing adoption of AI and machine learning in research and enterprise applications, and boom in cloud-based HPC services are also contributing to growth of the AI enhanced HPC market. This further enhanced by advances in GPUs, CPUs, and exascale computing accelerated by demand in healthcare, finance, manufacturing, and scientific research. A Citi report estimates that AI adoption could boost global banking profits by approximately USD 170 billion over five years, reflecting the tangible benefits of AI-enhanced HPC systems in financial applications.

To Get More Information On AI Enhanced HPC Market - Request Free Sample Report

Key AI Enhanced HPC Market Trends:

-

Increasing adoption of AI and machine learning in enterprises and research to accelerate data processing and analytics.

-

Rapid expansion of cloud-based HPC services enabling scalable, flexible, and real-time AI workloads.

-

Advancements in GPUs, CPUs, and interconnect technologies enhancing performance for simulations, analytics, and AI-driven computations.

-

Growth of Industry 4.0 applications, including smart manufacturing, predictive maintenance, and optimized supply chains.

-

Development of energy-efficient architectures, AI-optimized cloud HPC platforms, and zetta-scale systems for high-performance computing differentiation.

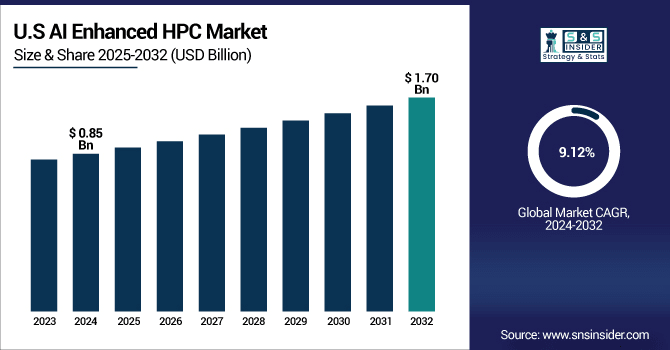

The U.S. AI Enhanced HPC market size was valued at USD 0.85 Billion in 2024 and is projected to reach USD 1.70 Billion by 2032, growing at a CAGR of 9.12% during 2025-2032. The U.S. The demand of AI-driven research, healthcare, and financial analytics, among others. Coupled with the accelerated investment from the U.S. governments in exascale supercomputing infrastructure is the key factors attributing the continuous growth for the U.S. AI Enhanced HPC market.

AI Enhanced HPC market trends are driven by the convergence of AI with exascale computing, accelerating breakthroughs in healthcare, finance, and scientific research. They are also shaped by rapid cloud adoption, energy-efficient architectures, and specialized AI accelerators.

AI Enhanced HPC market Growth Drivers:

-

AI-HPC Market Soars on High-Performance Computing, Cloud Adoption, Advanced GPUs/CPUs, and Exascale Innovation

Growing demand for high-performance data and machine learning processing, increasing adoption of AI and machine learning across enterprise and research settings, and rapid expansion of cloud-based HPC services are some ascribed factors for the growth of AI Enhanced HPC market. Improvements in GPUs, CPUs, and interconnect technologies drive even more performance gain, allowing to complete simulations and analytics quicker. At the same time, national exascale programs in parallel with the existing, strong, industry demand in healthcare, finance, manufacturing for real-time insights become enabler for tighter market momentum.

In the U.S., data centers already consume about 4% of national electricity and this could skyrocket to 12% by 2028 due to AI data processing, potentially driving electricity costs up nationwide.

AI Enhanced HPC market Restraints:

-

Key Restraints in AI-HPC Market Include Security, Skills Gap, Legacy Integration, Energy, Compliance, and Interoperability

Data privacy and security concerns, shortage of skilled professionals, and challenges in integration of AI with legacy HPC systems. Additionally, energy consumption, compliance with regulatory requirements, and interoperability between different platforms are also significant barriers to the deployment and scalable use of AI-based high-performance computing solutions.

AI Enhanced HPC market Opportunities:

-

AI-HPC Integration Expands Opportunities Across Healthcare, Finance, Manufacturing, and Zetta-Scale Energy-Efficient Computing Platforms

AI-HPC integration creates opportunities beyond healthcare applications, including genomics, drug discovery and medical imaging, and financial risk modeling and fraud detection. As Industry 4.0 soars, opportunities arise in smart manufacturing, predictive maintenance, and supply chain optimization. At the same time, energy-efficient architectures, AI-optimized cloud HPC platforms and zetta-scale systems create substantial opportunity for technology providers to differentiate their solutions and address long-term growth opportunity.

Researchers using ML in Parkinson’s disease drug screening accelerated initial screening 10-fold and reduced costs by 1,000-fold.

AI Enhanced HPC Market Segment Highlights:

-

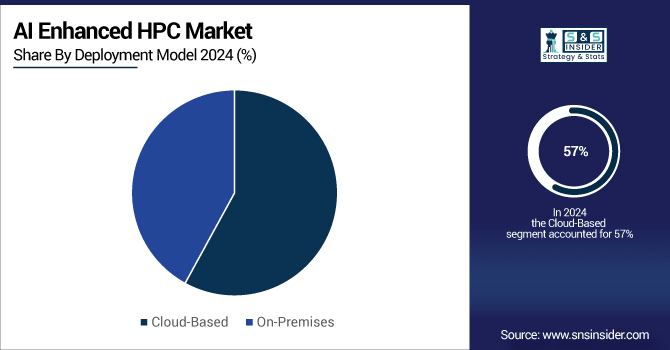

By Deployment Model, Cloud-Based dominated ~57% in 2024 and is fastest growing (CAGR 9.61%).

-

By Component, Hardware led with ~ 51% share in 2024 and Software is fastest segment (CAGR 9.96%).

-

By End-User, Healthcare & Life Sciences led ~27% in 2024; Industrial & Manufacturing fastest growing (CAGR 9.81%).

-

By Computing Type, Parallel Computing held ~46% in 2024; and Exascale Computing is fastest growing (CAGR 10.12%).

By Deployment Model, Cloud-Based AI-HPC Dominates Market with Rapid Growth Driven by Scalability, Flexibility, and Real-Time Processing

Cloud-based topped its share in 2024 and is projected to grow at the highest CAGR during 2025–2032, owing to advantages of scalability, flexibility, and cost efficiency over on-premise models. Cloud-based HPC for AI is becoming increasingly popular due to the need for enterprises to deliver acceleration of AI workloads, accelerating research, and supporting real-time data processing, while strong vendor support and AI-optimized cloud platform integration also drives industry adoption.

By Component, Hardware Leads AI-HPC Market in 2024 While Software Poised for Rapid Growth and Innovation Expansion

The AI Enhanced HPC market in 2024 was primarily hardware driven fueled by significant demand for GPUs, CPUs, and high-end interconnect systems to support faster simulations, faster real-time analytics, and large-scale processing. Software is projected to grow the fastest during 2025-2032, driven by rising adoption of various AI frameworks, middleware, and workload-optimized applications. As the demand for scalability, automation and AI-driven analytics expands, software becomes a foundational element for next-generation HPC innovation.

By End-User Industry, Healthcare Leads AI-HPC Market While Industrial and Manufacturing Set for Rapid Growth Through Industry 4.0 Integration

In 2024, Healthcare & Life Sciences segment led the market driven by growing genomics, drug discovery, and AI-enabled medical imaging processes that impose enormous computational requirements. Industrial & Manufacturing segment is expected to have fastest CAGR over 2025–2032, driven by combined power of Human Performance Computing (HPC) and Industry 4.0 with applications in smart factories, predictive maintenance, supply chain optimization to improve efficiency, automation and productivity.

By Computing Type, Parallel and Exascale Computing Drive AI-HPC Innovation with Unmatched Performance and Scalable Solutions globally

Parallel Computing Outpace in 2024 by its legacy adoption as the default strategy for large-scale AI workloads and HPC workloads, platting faster processing and scalability. The fastest burgeoning CAGR with regard to Exascale Computing will be existing over 2025–2032, which is mainly attributed due to national exascale initiatives, enhancing the technology of CPUs, GPUs and interconnects and providing unprecedented performance to tackle complex simulations and AI-driven research.

AI Enhanced HPC Market Report Analysis:

North America AI Enhanced HPC Market Insights

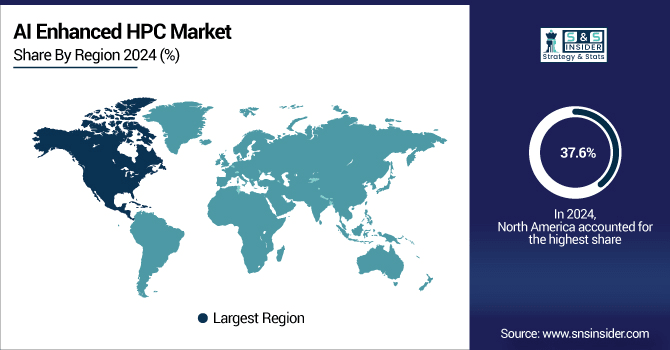

In 2024, North America led the AI enhanced HPC market with 37.6% share due to high investments in AI research, advanced infrastructures for supercomputing, the increasing adoption of supercomputers in the healthcare, finance, and manufacturing sectors, and government-supported exascale initiatives.

North America was led by the U.S., which is scaling up and maintaining its lead in domains ranging from supercomputing and cloud to AI innovation, as well as making large scale investments in AI-HPC research and enterprise applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific AI Enhanced HPC Market Insights

Asia Pacific region shows a potential growth of the highest CAGR of 10.07% during 2025 –2032 due to the rising digital transformation, increasing AI adoption rate, exascale government projects, and the demand for cloud-based HPC in healthcare, manufacturing, and research sectors. Complementing this momentum are robust investments in AI infrastructure and regional innovation hubs.

Strong government support for exascale supercomputing projects, coupled with fast-paced AI applications adoption in major industries, from healthcare to finance to smart manufacturing, propelled China to the forefront of Asia Pacific.

Europe AI Enhanced HPC Market Insights

The AI enhanced HPC market in Europe continued to grow steadily through 2024, driven by deep and persistent investments in science, health and economic digitization. EuroHPC JU, among others are some EU backed initiatives to promote such collaborations in HPC and innovation in the region. The continuous rise of AI-accelerated supercomputing in academia and enterprises further cement Europe as an essential global center.

Rigorous industrial manufacturing, extensive government support for HPC infrastructure, and a leadership position in AI driven research and development in automotive, healthcare and engineering sectors ensure that Germany dominates Europe.

Latin America (LATAM) and Middle East & Africa (MEA) AI Enhanced HPC Market Insights

Latin America (LATAM) and Middle East & Africa (MEA) are emerging markets for AI Enhanced HPC, driven by growing digital transformation, increasing cloud adoption, and rising demand for AI in healthcare, finance, and energy sectors. Limited infrastructure challenges remain, yet expanding government initiatives and private investments are fueling gradual adoption across these regions.

Competitive Landscape for AI Enhanced HPC market:

NVIDIA is a global leader in AI-enhanced high-performance computing (HPC), offering a comprehensive ecosystem that integrates GPUs, CPUs, networking, and software to accelerate scientific research, simulations, and AI workloads. Its full-stack architecture, including the Blackwell GPU and Grace CPU, powers some of the world's most advanced supercomputers, such as FugakuNEXT in Japan and JUPITER in Europe.

-

In June 2025, NVIDIA powers JUPITER, Europe’s fastest supercomputer, built on the Grace Hopper platform. JUPITER is on track to become Europe’s first exascale system, delivering over 90 exaflops of AI performance while maintaining high energy efficiency.

Intel Corporation is a global leader in AI-enhanced high-performance computing (HPC), offering a comprehensive portfolio that includes Intel® Xeon® CPUs, Intel® Gaudi® AI accelerators, and Intel® Data Center GPUs. These technologies are optimized for scalability, flexibility, and performance, supporting a wide range of applications from scientific research to enterprise AI workloads.

-

In September 2024, Intel introduced the Xeon 6 processors with Performance-cores (P-cores) and the Gaudi 3 AI accelerators.

Advanced Micro Devices (AMD) is a leading provider of AI-enhanced high-performance computing (HPC) solutions, offering a comprehensive portfolio that includes EPYC™ processors, Instinct™ accelerators, and the ROCm™ open software platform. These technologies are designed to deliver exceptional performance, scalability, and efficiency, empowering AI applications across various industries.

-

In October 10, 2024, AMD introduced the 5th Gen AMD EPYC processors and Instinct MI325X accelerators, designed to deliver superior performance for AI and HPC workloads.

AI Enhanced HPC Market Key Players:

-

Intel Corporation

-

AMD (Advanced Micro Devices)

-

IBM Corporation

-

Hewlett Packard Enterprise (HPE)

-

Amazon Web Services (AWS)

-

Google Cloud

-

Microsoft Corporation

-

Alibaba Cloud

-

Lenovo

-

Fujitsu

-

Penguin Computing

-

YOTTA

-

Cray (HPE)

-

Oracle

-

Rescale

-

Supermicro

-

Ampere Computing

-

Wiwynn

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.98 Billion |

| Market Size by 2032 | USD 6.10 Billion |

| CAGR | CAGR of 9.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, and Services) • By Deployment Model (Cloud-Based, and On-Premises) • By End-User Industry (Healthcare & Life Sciences, Financial Services, Industrial & Manufacturing, and Research & Academia) • By Computing Type (Parallel Computing, Distributed Computing, and Exascale Computing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | NVIDIA, Intel, AMD, IBM, HPE, Dell, AWS, Google Cloud, Microsoft, Alibaba Cloud, Lenovo, Fujitsu, Penguin Computing, YOTTA, Cray (HPE), Oracle, Rescale, Supermicro, Ampere Computing, and Wiwynn. |