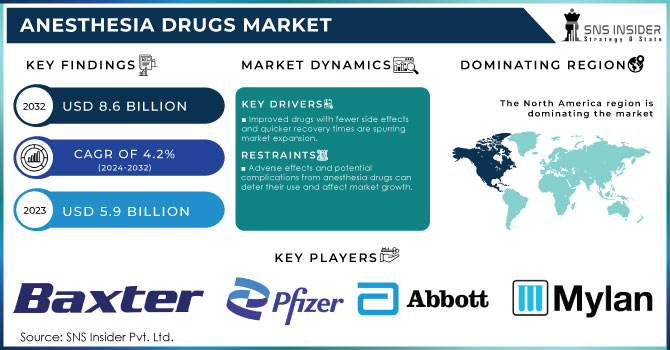

Anesthesia Drugs Market Size Analysis:

The Anesthesia Drugs Market size was valued at USD 5.9 billion in 2023 and is expected to reach USD 8.6 billion by 2032 with a growing CAGR of 4.2% over the forecast period of 2024-2032.

Get More Information on Anesthesia Drugs Market - Request Sample Report

The global anesthesia drugs market is poised for significant growth, driven by an increasing number of surgeries, a rising geriatric population, and advancements in anesthesia techniques. Anesthesia drugs are used to prevent pain during surgery by inducing a temporary loss of sensation or consciousness. The growing prevalence of chronic diseases, such as cancer, cardiovascular disorders, and respiratory ailments, is also fueling demand for surgical interventions, consequently boosting the anesthesia drugs market. For instance, according to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, causing 17.9 million deaths annually. This high prevalence drives the need for surgical interventions like heart bypasses and valve repairs. Additionally, improvements in healthcare infrastructure in developing countries and the rise of outpatient surgeries are contributing to the market's expansion.

Key drugs in the market include general anesthetics, which induce unconsciousness, and local anesthetics, which block pain in specific body parts. General anesthetics, particularly propofol, sevoflurane, and desflurane, dominate the market due to their widespread use in major surgeries. Local anesthetics such as lidocaine and bupivacaine are also growing in demand due to their role in minor surgeries and pain management. The emergence of newer drugs with fewer side effects and rapid recovery times is another growth driver.

Global Anesthesia Drugs Market Dynamics

Drivers

-

Improved drugs with fewer side effects and quicker recovery times are spurring market expansion.

-

Developing countries are enhancing their healthcare systems, fueling demand for anesthesia drugs.

-

The global rise in the elderly population, who require more surgical interventions, boosts the market growth.

The global rise in the elderly population is a key driver for the growth of the anesthesia drugs market, as older adults are more likely to require surgical interventions due to age-related health conditions. According to the United Nations, the number of people aged 65 and older is projected to reach 1.5 billion by 2050, nearly double the 727 million in 2020. This demographic shift increases the prevalence of chronic diseases like cardiovascular disorders, osteoarthritis, and cancer, all of which often necessitate surgical procedures.

With surgeries becoming more frequent among the elderly, the demand for anesthesia drugs is on the rise. Studies indicate that around 30% of all surgical procedures are performed on patients aged 65 and older, and this number is expected to increase. Additionally, the elderly are more prone to complications during surgery, requiring careful selection of anesthesia drugs with fewer side effects and faster recovery times. As a result, the anesthesia drugs market is experiencing growth to meet these specialized needs.

Developing countries are investing in healthcare infrastructure, leading to increased demand for anesthesia drugs as access to medical procedures expands. Governments in countries like India, China, and Brazil are prioritizing healthcare improvements, including the construction of new hospitals and surgical facilities. driven by infrastructure upgrades and government initiatives like Ayushman Bharat, which aims to provide millions with affordable healthcare. These advancements enable more surgical procedures, boosting the demand for anesthesia drugs.

As healthcare systems improve, the number of surgeries performed in developing nations is rising, further increasing the need for anesthesia drugs. For instance, the World Bank reports that low- and middle-income countries are now performing an estimated 30% more surgeries than a decade ago, driven by the growing availability of healthcare services. Additionally, medical tourism is flourishing in developing regions, particularly in Asia-Pacific, where countries like Thailand and India are becoming major destinations for affordable surgeries. Expanding healthcare access and increasing surgical capacity are key drivers behind the projected growth of the anesthesia drugs market in these regions.

Restraints

-

Adverse effects and potential complications from anesthesia drugs can deter their use and affect market growth.

-

Rigorous regulatory approvals and compliance can slow down the introduction of new anesthesia drugs.

-

The potential for misuse and abuse of anesthesia drugs may lead to stricter regulations and reduced market growth.

The potential for misuse and abuse of anesthesia drugs is a significant concern that can lead to stricter regulations, impacting the growth of the market. Anesthesia drugs, particularly opioids and certain sedatives, have a high potential for abuse and addiction. According to the National Institute on Drug Abuse (NIDA), opioid misuse is a major public health issue, with an estimated 10.1 million people misusing prescription opioids in 2019. This misuse can result in severe consequences, including addiction and overdose, prompting regulatory agencies to impose tighter controls.

For instance, the U.S. Drug Enforcement Administration (DEA) has implemented stringent guidelines and monitoring programs to control the distribution and use of these drugs. These measures can slow down the approval and availability of new anesthesia drugs, as manufacturers must navigate complex regulatory requirements. In addition, increased scrutiny and regulatory burdens can raise costs for drug development and reduce market entry for new players.

Rigorous regulatory approvals and compliance requirements can significantly delay the introduction of new anesthesia drugs, impacting the market. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce stringent standards to ensure the safety and efficacy of new drugs. The approval process involves extensive clinical trials, which can take several years to complete. For instance, according to a study published in JAMA Network Open, the average time from drug discovery to market approval can exceed 10 years. The complexity and duration of this process not only increase development costs but also delay market entry. The cost of bringing a new drug to market can exceed USD 2.6 billion, as reported by the Tufts Center for the Study of Drug Development. This high cost, coupled with prolonged approval times, can deter pharmaceutical companies from investing in the development of new anesthesia drugs. Additionally, adherence to evolving regulations and guidelines adds to the burden.

Anesthesia Drugs Market Segmentation Analysis

By Drug

In 2023, the propofol segment dominated the market and represented over 25.7% of revenue share, and it is also expected to grow at the fastest CAGR of 4.6% during the forecast period. Propofol is widely recognized for its fast onset and short recovery period, improving both patient comfort and procedural efficiency. Its versatility makes it a preferred option for both induction and maintenance of anesthesia in a variety of surgical and diagnostic procedures. Propofol's widespread use in outpatient and same-day discharge procedures highlights its popularity in the growing trend of minimally invasive and outpatient surgeries.

The global anesthesia drugs market is expected to grow at a CAGR of 4.7% during the forecast period, with sevoflurane contributing significantly to this growth. It is a widely used inhalational anesthetic, and is a significant segment in the anesthesia drugs market due to its rapid onset and recovery, making it ideal for both general and outpatient surgeries. The segment is forecasted to grow, driven by increasing surgical procedures, advancements in anesthetic techniques, and rising demand for safer, efficient anesthetics.

| Drug Class | Common Drugs | Primary Use | Advantages | Disadvantages |

|---|---|---|---|---|

| Barbiturates | Thiopental, Methohexital | Induction of general anesthesia | Rapid onset, effective for quick procedures | Respiratory depression, hangover effect |

| Benzodiazepines | Midazolam, Diazepam | Sedation, premedication | Anxiolytic, amnestic properties | Slower recovery, potential for dependence |

| Propofol | Propofol | Induction & maintenance of anesthesia | Quick onset/offset, antiemetic properties | Hypotension, pain on injection |

| Ketamine | Ketamine | Dissociative anesthesia, pain relief | Maintains airway reflexes, cardiovascular stability | Hallucinations, increased intracranial pressure |

| Inhalational Agents | Sevoflurane, Isoflurane | Maintenance of general anesthesia | Easily controllable, rapid recovery | Post-op nausea, risk of malignant hyperthermia |

| Opioids | Fentanyl, Morphine | Analgesia during surgery | Potent pain relief, adjunct to other anesthetics | Respiratory depression, risk of dependence |

| Local Anesthetics | Lidocaine, Bupivacaine | Regional & local anesthesia | Targeted numbing, minimal systemic effects | Risk of toxicity at high doses, allergic reactions |

By Route of Administration

In 2023, the intravenous (IV) segment led the market, accounting for the largest revenue share of 64.7%. It is also expected to register the fastest growth with a projected CAGR of 4.6% during the forecast period. This growth is driven by advancements in IV anesthesia delivery, its effectiveness, and convenience. IV anesthesia is favored for its rapid onset and precise control over drug administration, essential for managing complex surgeries and enhancing patient safety.

Innovations in infusion systems, like target-controlled infusion (TCI) devices, have enhanced the precision of drug delivery and patient monitoring. These systems allow for exact control over anesthesia levels, improving procedural outcomes and patient comfort. For example, the use of smart infusion pumps integrated with advanced monitoring technology has optimized the administration process, minimizing dosing errors and boosting patient safety.

By End-Use

In 2023, the hospitals segment captured a leading 68.8% revenue share of the market, largely due to their role in handling complex, high-volume surgeries, which significantly drives the demand for general anesthesia. Hospitals perform the majority of surgical procedures in the U.S., including both elective and emergency surgeries, according to the American Hospital Association (AHA). This consistent surgical activity sustains a continuous need for a variety of anesthetic agents. Furthermore, as of May 2024, the Urgent Care Association reported that approximately 14,714 urgent care centers across the U.S. provide diagnostic and treatment services to over 100 million patients annually.

Ambulatory Surgery Centers (ASCs) are expected to experience the fastest growth, with a projected CAGR of over 4.4% during the forecast period. The rising preference for outpatient surgeries, where patients can have procedures and return home the same day, is a key factor driving ASC growth. According to the Ambulatory Surgery Center Association (ASCA), ASCs provide a cost-effective and convenient alternative to hospital surgeries, appealing to both patients and insurance providers. Additionally, the Centers for Medicare & Medicaid Services (CMS) have expanded the range of procedures eligible for ASCs, further increasing their appeal and utilization.

By Application

In 2023, the knee and hip replacement segment led the market with a significant revenue share, driven by the rising prevalence of osteoarthritis, advancements in surgical techniques, and demographic shifts. Osteoarthritis, particularly in the knee and hip, is a major factor fueling demand for replacement surgeries. The CDC reports that around 32.5 million U.S. adults suffer from osteoarthritis, with the knee and hip joints being commonly affected, leading to a high volume of replacement procedures and increased demand for general anesthesia.

The cancer segment is projected to grow at the fastest CAGR during the forecast period, driven by rising cancer rates, advancements in treatment, and a focus on improving patient outcomes. According to the WHO, 1 in 5 people globally will develop cancer, affecting 1 in 12 women and 1 in 9 men. In 2022, 20 million new cancer cases were reported, with 9.7 million deaths and 53.5 million people surviving five years post-diagnosis. As the global population ages and exposure to risk factors increases, these figures are expected to rise, boosting the demand for cancer-related surgeries and anesthesia.

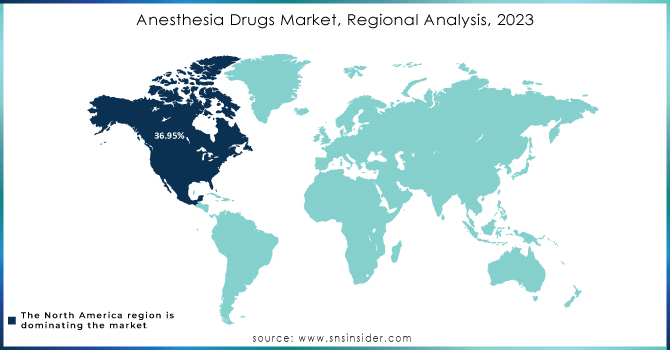

Regional Insights

In 2023, the North American anesthesia drugs market led with a 36.95% revenue share, driven by key factors such as the high prevalence of chronic diseases, technological advancements, and robust healthcare infrastructure. The increasing occurrence of chronic conditions like cardiovascular disease and cancer, which frequently necessitate surgical procedures, has amplified the demand for general anesthesia. In 2023, a total of 34.9 million procedures were performed worldwide, marking a 3.4% increase from 2022. In the U.S., over 6.1 million procedures were conducted, maintaining the country’s top position in the global ranking.

The anesthesia drugs market in the Asia-Pacific region is growing rapidly, driven by rising healthcare expenditures, an expanding population with increasing surgical needs, and advancements in medical technology. The region's large, diverse population and the growing incidence of chronic conditions are boosting the demand for surgical interventions and anesthesia. Additionally, governments in China and India are making significant investments in healthcare infrastructure and medical technology, further accelerating market growth.

Need any customization research on Anesthesia Drugs Market - Enquiry Now

Anesthesia Drugs Market Key Players

The major key players are

-

Baxter International – (Propofol, Fentanyl)

-

Pfizer – (Remifentanil, Rocuronium bromide)

-

Abbott Laboratories – (Desflurane, Sevoflurane)

-

AstraZeneca – (Atracurium besylate, Cisatracurium besylate)

-

Fresenius Kabi – (Midazolam, Ketamine)

-

Hospira – (Morphine sulfate, Succinylcholine chloride)

-

Teva Pharmaceuticals – (Etomidate, Vecuronium bromide)

-

Mylan – (Lidocaine hydrochloride, Bupivacaine hydrochloride)

-

Merck & Co. – (Ropivacaine hydrochloride, Levobupivacaine hydrochloride)

-

GlaxoSmithKline – (Pancuronium bromide, Doxacurium chloride)

-

Sanofi – (Atracurium besylate, Cisatracurium besylate)

-

Novartis – (Alfentanil hydrochloride, Mivacurium chloride)

-

Takeda Pharmaceuticals – (Dexmedetomidine hydrochloride, Ondansetron hydrochloride)

-

AbbVie – (Dexmedetomidine hydrochloride, Ondansetron hydrochloride)

-

Aspen Pharmacare Holdings – (Propofol, Fentanyl)

-

Hikma Pharmaceuticals – (Midazolam, Ketamine)

-

Avet Pharmaceuticals – (Lidocaine hydrochloride, Bupivacaine hydrochloride)

-

Piramal Enterprises – (Ropivacaine hydrochloride, Levobupivacaine hydrochloride)

-

Par Pharmaceutical – (Alfentanil hydrochloride, Mivacurium chloride)

Recent Developments in the Anesthesia Drugs Market

In August 2024, Amneal Pharmaceuticals, Inc. received FDA approval for its Propofol Injectable Emulsion USP, available in three single-dose vial concentrations. This drug is commonly used in hospitals for inducing and maintaining anesthesia and sedation.

In April 2024, Baxter expanded its U.S. pharmaceutical portfolio by launching Ropivacaine Hydrochloride Injection, USP, in a ready-to-use, single-dose infusion bag, providing a convenient option for anesthesia management.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.9 billion |

| Market Size by 2032 | US$ 8.6 billion |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug (Sevoflurane, Propofol, Dexmedetomidine, Remifentanil, Desflurane, Midazolam, Others) • By Route Of Administration (Intravenous, Inhaled) • By Application (Heart Surgeries, , Cancer, General Surgery, Knee And Hip Replacements, Others) • By End-Use (, Hospitals, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baxter International, Pfize, Abbott Laboratories, AstraZeneca, Fresenius Kabi, Hospira, Teva Pharmaceuticals, Mylan, Merck & Co., GlaxoSmithKline, Sanofi & Other Players |

| Key Drivers | • Improved drugs with fewer side effects and quicker recovery times are spurring market expansion. • Developing countries are enhancing their healthcare systems, fueling demand for anesthesia drugs. |

| Market Restraints | • Adverse effects and potential complications from anesthesia drugs can deter their use and affect market growth. • Rigorous regulatory approvals and compliance can slow down the introduction of new anesthesia drugs. |