Antiperspirants and Deodorants Market Report Scope & Overview:

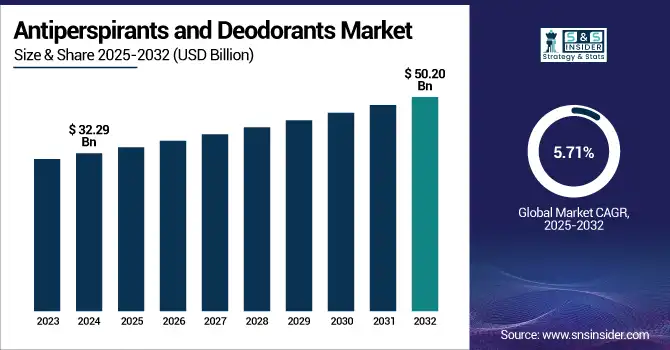

The Antiperspirants and Deodorants Market size was valued at USD 32.29 billion in 2024 and is expected to reach USD 50.20 billion by 2032, growing at a CAGR of 5.71% over the forecast period of 2025-2032.

To Get more information on Antiperspirants and Deodorants Market - Request Free Sample Report

The antiperspirants and deodorants market has been growing steadily due to increased consumer awareness about personal hygiene, rising urban populations, and shifting preferences for natural and sustainable products. Trend in product innovation due to high demand in younger demographics, gender-neutral and fragrance-free formulation, and growing demand. The market value is also driven by e-commerce growth and premium product sales.

The U.S. Antiperspirants and Deodorants Market size was valued at USD 12.46 billion in 2024 and is expected to reach USD 18.62 billion by 2032, growing at a CAGR of 5.20% over the forecast period of 2025-2032. The North American antiperspirants and deodorants market is dominated by the US, attributed to high consumer demand for personal hygiene products, accompanied by an increase in demand for natural and sustainable formulations. Adding to the dominance is the presence of global key brands operating in the country, as well as the constant stream of new product development.

Antiperspirants and Deodorants Market Dynamics:

Drivers

-

Increasing Focus on the Awareness of Personal Care is Driving the Market Growth

Partly driven by heightened health concerns and partly by societal factors, consumers nowadays are more mindful of hygiene and cleanliness. As a result, there is an increasing focus on the use of products, such as antiperspirants and deodorants, designed to prevent or mask perspiration odor. Recognizing them not just as products for freshness but also critical for personal and professional socialization, Personal grooming, as driven by ongoing public health campaigns, media influence, and trends among peers, has made the routine a daily habit, thus perpetually driving up demand in this market.

-

Rising Product Innovations are Propelling the Market Growth

Continuous product innovations in conjunction with the changing consumer preferences are benefiting a major portion of the antiperspirants and deodorants market. Consumers want safer, gentler formulations, aluminum-free, paraben-free, and organic, in response to the health concerns associated with these traditional ingredients. Meanwhile, hypoallergenic and fragrance-free products also meet the needs of consumers with sensitive skin. Other innovations are sustainable packaging, delivery formats (sprays, roll-ons, sticks), and multifunctional products with skincare benefits. These innovations continue to keep the market active and attract a wider variety of customers.

Restraint

-

The Market Growth is Restrained Due to High Competition and Market Saturation

The market for antiperspirants and deodorants remains a competitive one, as many global and regional brands vie for consumer attention. However attractive the growth potential of such a market may be, a strong saturation exists, relatively harsh on new entrants seeking a sizeable market share. It appears that consumers are developing a loyalty to the family name brands. Additionally, the wide variety of product options from fragrance to light formula results in competitive pressure leading to price wars, resulting in low profit margins for companies. Brands have to spend mighty bucks on marketing and innovation to keep their seats among the top in such a crowded landscape, which is a huge deterrent to growth and profits.

Antiperspirants and Deodorants Market Segmentation Analysis:

By Product

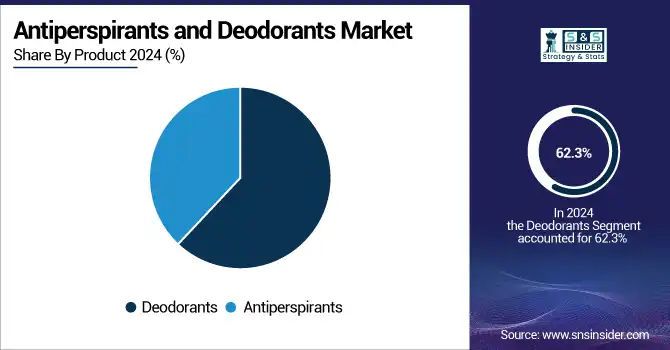

The Deodorants segment dominated the antiperspirants and deodorants market share with a 62.3% market share in 2024 due to consumer resonance and versatility. Deodorants are preferred for their primary function of masking body odor without affecting perspiration, making them more suited to everyday use, particularly in milder climates. The diversity of scent types, scent formulations, and types of products available (inline sprays, roll-ons) has encouraged consumer uptake as well. Furthermore, deodorants tend to be regarded as milder on the skin and so tend to win over consumers with delicate skin, or who just want a fragrance and which helps maintain their segment-leading position in this market.

The Antiperspirants segment is projected to observe the fastest growth over the forecast period, driven by rising awareness regarding hyperhidrosis along with the need for prolonged protection. Increasing concerns about personal hygiene and body odor in hot climates or active lifestyles promote the demand for sweat production inhibiting products. New consumers are being piqued by innovative antiperspirant forms, such as aluminum-free and natural. In addition rising number of male grooming trends and developing markets are keeping fueling the antiperspirants segment on a rapid growth path.

By Consumer Orientation

Women's segment dominated the market with a 48.12% market share in 2024 in the antiperspirants and deodorants market due to the higher levels of consumption that have historically existed, and the increased level of attention to personal grooming and fragrance preferences has been exerted by more women. For women's products, there is more variety in scents, formulations, and packaging because of the need for ingredients to account for the fact that most women have delicate, yet sensitive skin, using gentle products containing skin benefits. Marketing campaigns that highlight elegance, freshness, and long-lasting protection have great appeal to women. Furthermore, women constitute the frequent users of deodorants in their beauty and hygiene routines, retaining their market share in the industry.

The Men segment is estimated to witness the fastest growth during the forecast period due to the increasing global demand for male grooming. The rising awareness of personal hygiene and body odor among men, increasing disposable income, and evolving cultural attitudes are leading to higher rates of adoption of antiperspirants and deodorants among men. Brands, too, are focusing on gender-specific launches with sporty, woody, and musky fragrances to cater to the male tastes. This is followed by further bolstering the growth with the rapid urbanization alongside the men's segment held by the newer generation, more receptive to grooming products.

By Sales Channel

The modern trade segment dominated the global antiperspirants and deodorants market in 2024 with a 31.09% market share, as this segment provides wide reach and easy accessibility to consumers. The departmental nature of supermarkets, hypermarkets, and big box retail chains, with different brands, a variety of product options available under one roof, and the increased ease of comparing and choosing competitiveness and prices. These shops usually offer Pearls and also price cuts, whiz to more easily and less costly to obtain the item. Also, urban and suburban areas are rife with modern trade outlets, constantly receiving footfall from high-frequency shoppers, leading to regular sales of antiperspirants and deodorants.

The online retail segment is anticipated to register the fastest growth during the projected years, as consumers are moving their purchasing behavior to digital platforms. Tech-savvy consumers are drawn in by the convenience of home delivery, broader product choices, and tailored recommendations. Social media marketing, influencer marketing, and targeted advertising also drive sales up online. Further, due to the capability of online retail to support niche nature or a premium product which may not be available in physical stores, it is likely to contribute to young and varied representatives to bring rapid growth within the segment.

Regional Analysis:

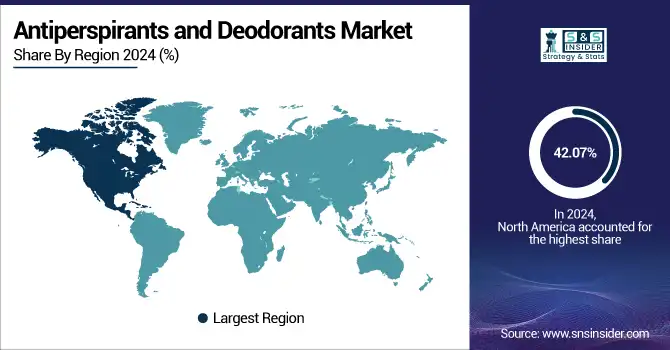

North America dominated the market with around 42.07% market share in 2024, owing to the matured consumer base, high awareness regarding hygiene & cleanliness, and a tied retail environment. This region is where prominent global players such as Procter & Gamble, Unilever, and Colgate-Palmolive are always investing in product innovation, marketing, and sustainable packaging. In the U.S. and Canada, segmentations have been driven by consumer preferences for premium, organic, and even gender segmented products, where gender-based market preferences and brand loyalties exist. Also, wide availability through modern trade and e-commerce channels ensures product presence and access.

The antiperspirants and deodorants market in the Asia Pacific region is anticipated to grow at the fastest rate with a 6.67% CAGR over the forecast period, facilitated by the rapid urbanization, improving disposable income, and an expanding middle-class population. In markets such as India, China, and Indonesia, grooming habits are changing, and daily grooming practices are increasingly being adopted by younger consumers as well as women. Rapid brand assortment increases by international and local brands, aggressive marketing efforts, and availability of mass-market price category products, are widening market penetration. In addition, the growth of digital retail and greater exposure of consumers to global hygiene trends are driving adoption and market growth through the region.

The antiperspirants and deodorants market is growing significantly in the European region due to the increased demand for natural, organic, and sustainable products. As health and environmental awareness rise, consumers are deeply concerned about their outside choice and increasingly turning to aluminum-free, paraben-free, and alcohol-free formulas.

The growth in eco-friendly product formats such as waterless deodorants and biodegradable packaging is appealing to more environment-conscious consumers, especially millennials and Gen Z, in the forecast years. As product visibility and availability increase due to more e-commerce engagement, social media and e-commerce channels continue to proliferate, and digital channels create favorable conditions for these products to thrive. This movement is spearheaded by nations such as Germany, France, and the UK, including many consumers in personal care categories with strong sustainability and wellness beliefs.

The antiperspirants and deodorants in Latin America are registering moderate growth, fueled by greater amounts of disposable incomes and an expanding commitment to infant care. The market comprises several international and local brands and is highly competitive, with prices and novelty being the most important competitive strategies.

The antiperspirants and deodorants market in the Middle East and Africa (MEA) is experiencing steady growth. The growth is driven by increasing urbanisation, rising disposable incomes, and increasing awareness about personal hygiene and grooming. The hot and humid climate prevalent in most parts of the region makes deodorant use even more crucial. Moreover, culture and religion play an important role in product preferences, where demand for alcohol-free and halal-certified gin (alcohol-free gin) is desired by some consumers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

Unilever, Procter & Gamble, L'Oréal, Beiersdorf, Colgate-Palmolive, Henkel, Reckitt Benckiser, Kao Corporation, Church & Dwight, Lavanila Laboratories, and other players.

Recent Developments in Antiperspirants and Deodorants Market

-

January 2025 – Unilever revealed the roll-out of its new deodorant innovation that will spearhead incremental growth in the deodorant business. Unilever launched Sure Whole Body Deodorant and Lynx Lower Body Spray, increasing the range to counter whole body odor protection. These new launches are currently in the marketplace and will be supported by a major above-the-line (ATL) campaign.

- March 2024 – Native launched its new Whole Body Deodorant line, including both traditional deodorant sticks and sprays. The line includes clinically proven 72-hour odor protection that is intended to deliver complete freshness from underarms to toes. The introduction represents Native's entry into more general personal care solutions with a focus on full-body odor control.

Antiperspirants and Deodorants Market Report Scope:

Report Attributes Details Market Size in 2024 USD 32.29 Billion Market Size by 2032 USD 50.20 Billion CAGR CAGR of 5.71% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Deodorants, Antiperspirants)

• By Consumer Orientation (Women, Men, Unisex)

• By Sales Channel (Modern Trade, Drug Stores, Convenience Stores, Beauty Stores, Online Retail, Other Sales Channels)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Unilever, Procter & Gamble, L'Oréal, Beiersdorf, Colgate-Palmolive, Henkel, Reckitt Benckiser, Kao Corporation, Church & Dwight, Lavanila Laboratories, and other players.