Cancer Biologics Market Report Scope & Overview:

Get More Information on Cancer Biologics Market - Request Sample Report

The Cancer Biologics Market Size was valued at USD 102.2 Billion in 2023 and is expected to reach USD 195.5 Bn by 2032, with a growing CAGR of 7.5% Over the Forecast Period of 2024-2032.

The global cancer biologics market is witnessing high growth due to the increasing prevalence of different types of cancers around the world and the rising number of government initiatives for improving healthcare services by using more effective treatment. In 2023, according to the latest statistics of the World Health Organization (WHO), there were around over 19.3 million new cancer cases and also more than 10 million deaths caused by cancers. Governments globally are stepping up efforts to address this growing health crisis. The U.S. National Cancer Institute (NCI) has estimated that government funding for cancer research reached $7.6 billion in 2023, a gain of 8% over the previous year.

Monoclonal antibodies, vaccines, and gene therapies that constitute biological treatments are more effective with fewer side effects when compared to traditional chemotherapy making them revolutionary in oncology. The governments in both Europe and the Asia-Pacific regions have launched substantial campaigns to streamline clinical trials as well as regulatory approvals for biologics. For example, the European Medicines Agency (EMA) expedited approvals of a number of cancer biologics in 2023, and China's National Medical Products Administration (NMPA) saw a record number of biologics approved in 2023 as part of its expanded healthcare reforms. The supportive regulations and increasing awareness about personalized medicine are anticipated to keep the demand for cancer biologics. As governments continue to focus on healthcare infrastructure and increase their spending on advanced therapies, the market is poised for significant expansion in the coming years.

Cancer Biologics Market Dynamics

Drivers

-

Increasing global cancer rates, driven by aging populations and lifestyle factors, are boosting the demand for cancer biologics.

-

Continuous innovations in biotechnology and targeted therapies, such as monoclonal antibodies and CAR-T cell therapies, are expanding treatment options.

-

Growing support from governments and non-governmental organizations (NGOs) for cancer research, drug development, and awareness programs is fuelling market growth.

-

Fast-track approvals and orphan drug designations for novel biologics by regulatory bodies like the FDA and EMA are accelerating product launches.

-

Increasing focus on personalized and precision medicine is encouraging the development of biologics tailored to individual cancer profiles.

The global cancer biologics market is driven by the rising global prevalence of cancer, especially because the world population is aging and many environmental factors are making it easier for people to get diagnosed with some form of this disease. Cancer, which the World Health Organization (WHO) still lists as one of its leading causes for death since most cancer types are detected late stage. With the growing burden of cancer, demand for novel biological cancer treatments is on the rise due to their precision and ability to target cancer cells with minimal damage to surrounding healthy tissue.

Global governments are already addressing the crisis through escalated financial funding and support for cancer research and biological drug development. The U.S. National Cancer Institute (NCI), part of the National Institutes of Health (NIH) is anticipated to budget $6.9 billion for cancer research in fiscal year 2023. This funding aims to foster innovation in therapies, including biologics such as monoclonal antibodies and CAR-T cell therapies. They are also increasing speed regulations for government approval. In 2023, the U.S. FDA granted priority review status to several cancer biologics, expediting their approval and market entry. At the same time, orphan drug designations for biologics against rare cancers are being granted by the European Medicines Agency (EMEA), which means these drugs will be considered to receive individual treatment. Such initiatives account for a major share in the innovation and application of biologics, giving promising signs to global cancer therapy.

Restraints

-

The expensive nature of cancer biologics, including production and treatment costs, limits their accessibility to a wider patient base.

-

The production of biologics is complex and requires advanced facilities, which can lead to manufacturing delays and supply chain issues.

-

The rigorous and time-consuming regulatory approval process for biologics can slow down market entry and increase development costs.

-

The expiration of key biologic patents opens up the market to biosimilars, leading to increased competition and potential revenue decline for branded biologics.

The high cost associated with treating patients using cancer biologics is one of the critical challenges faced by players operating in this market. Monoclonal antibodies, CAR-T cell therapies, and immunotherapies are among the different types of cancer biologics that are notoriously difficult to develop and manufacture. Being produced through a complex biological process, their manufacturing necessitates strict infrastructure requirements: highly qualified workers and aggressive quality standards. This leads to high production costs, which are passed on to patients, making these treatments expensive. For many patients, the cost can be prohibitive, especially in low- and middle-income regions where healthcare coverage is limited. In even well-developed countries this increases cost and reduces access. More importantly, the complete cost of these advanced therapies might not be covered by insurance companies which could further make it difficult for patients who really need those treatments. This places financial pressure on the marketplace and limits equal access to innovative cancer treatments.

Cancer Biologics Market Segment analysis

By Application

The blood cancer segment dominated the market share in 2023 and accounted for 25% of the market share due to the increasing number of cases associated with blood cancers, such as leukemia and lymphoma in addition to myelomas. In 2023, an estimated 1.3 million people in the United States are expected to be living with or in remission from blood cancer including leukemia and lymphoma depending on estimates of disease prevalence made available by The Leukemia & Lymphoma Society (LLS). The US government is driving this with significant investment earmarked for blood cancer research by the National Cancer Institute alone allocating over $500 million for blood cancer research in 2023. Owing to the significant advantages in treatment outcomes that these novel agents provide, inherently there is more demand which has propelled a rapid market growth as well. Breast cancer accounts significant share of the cancer biologics market, because of the high proportion of breast cancer cases. Around the world, 2.3 million new cases of breast cancer have been diagnosed (WHO). In that context, governmental actions to increase coverage and improve early diagnosis and treatment are very important. Examples of this would be how in the US, organizations such as The National Institutes of Health (NIH) and others have upped funding for breast cancer screening programs, along with labeling very expensive biological treatments a top priority. This trend will likely be supported by the use of newer biologics namely, monoclonal antibodies (mAbs), immune checkpoint inhibitors, and antibody-drug conjugates that have been specifically developed for breast cancer indication.

The lung cancer segment is witnessing the highest compound annual growth rate (CAGR), due to the rising incidence of this cancer globally and the increasing adoption of biologics in its treatment. According to the World Health Organization (WHO), Lung Cancer is the main cause of death related to cancers with over 2.2 million new cases diagnosed annually. Government health agencies are actively promoting the use of biologics to improve treatment outcomes, especially for advanced-stage lung cancer patients. Lung cancer biologics, including immune checkpoint inhibitors and targeted therapies, have shown significant potential in improving survival rates, which is driving the rapid growth of this segment.

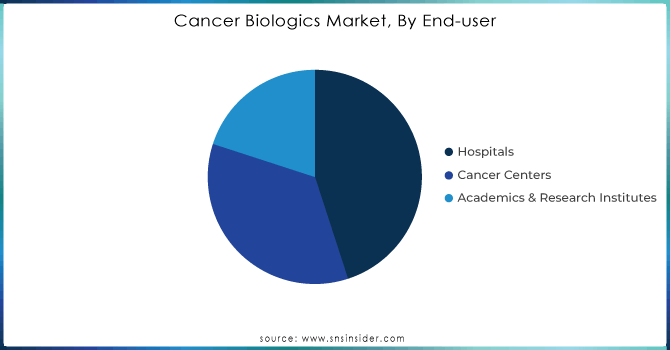

By End-User

Hospitals held the largest market share more than 45% of the cancer biologics market. This dominance is attributed to the extensive infrastructure available in hospitals for administering complex biological therapies, which often require specialized facilities and expertise. The capacity of hospitals to deliver state-of-the-art cancer treatments has been enhanced by government policy and funding. On the one hand, the U.S. government’s investment in cancer hospitals has been significant, with an estimated $4 billion in funding allocated through the National Cancer Institute’s Cancer Centers Program in 2023. This funding ensures that hospitals remain at the forefront of cancer treatment, providing the latest biological therapies to patients. Hospitals also benefit from government grants aimed at expanding oncology departments and purchasing advanced biologic therapies. The growing acceptance of biologics in cancer care protocols could keep the segment at the top position, underpinned by sustained government funding and healthcare infrastructure investments that favor hospitals.

The cancer centers segment is expected to grow at the highest CAGR during 2024-2032, driven by a growing preference towards a focus on specialized health concerns and growth in a number of standalone cancer treatment centers across the globe. Demand is surging at cancer centers dedicated to providing the latest biologic therapies as part of an integrated approach to caring for increasingly sophisticated patients. By 2023, there were more than 70 designated cancer centers in the United States categorized as the National Cancer Institute (NCI) and has helped some new facilities to gain government funding for boosting their biologics treatment abilities.

Need any customization research on Cancer Biologics Market - Enquiry Now

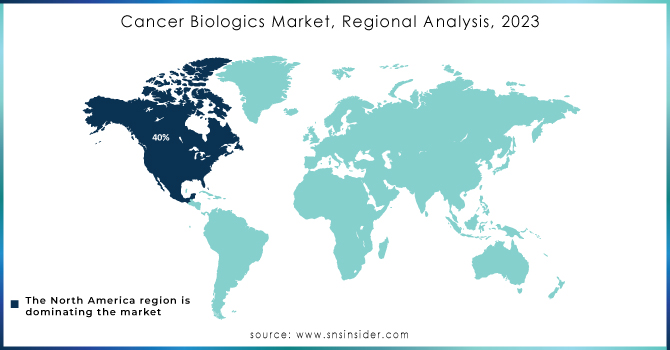

Cancer Biologics Market Regional Overview

North America dominated the cancer biologics market in 2023 and accounted for more than 40% of the market share in 2023. The dominance of the region is attributable to the high prevalence of cancer, well-established healthcare infrastructure, and heavy government funding for research in oncology. In particular, the United States has experienced major governmental spending in biologics with the National Cancer Moonshot initiative setting ambitious goals to reduce cancer deaths through early detection and innovative therapies, including biologics. Furthermore, the U.S. Food and Drug Administration (FDA) has created shorter regulatory pathways for biological drugs which lead to additional market growth throughout the forecast period. We also know that cancer biologics and their spending have increased in Canada, with the government offering supplementary payments to fund its programs on a large scale. Together, favorable government policies along with a high degree of innovation and increasing incidence of cancer cases are keeping North America in the dominating domain across the global market for the sale of biologics.

Key Players

The major players in the market are Gilead Sciences, Inc., F. Hoffmann-La Roche Ltd., Amgen, Inc., GSK plc., Eli Lilly and Company, Bristol-Myers Squibb Company, Pfizer, Inc., Abbott, AstraZeneca, Johnson & Johnson Services, Inc., and others in final Report.

Recent News

-

July 2023 - U.S. Food and Drug Administration (FDA): The FDA fast-tracked the approval of a new monoclonal antibody treatment for blood cancer, developed under the Orphan Drug Designation program. This biologic therapy has shown a 25% improvement in remission rates in clinical trials and is expected to be available for patient use by early 2024.

-

May 2023 – European Medicines Agency (EMA) approved two new products used to treat lung and colorectal cancers. The European Commission report said the therapies could increase survival rates by 15-20% for people with advanced-stage cancers.

-

January 2024: European Commission approves for Roche’s Tecentriq SC, marking the EU's first PD-L1 cancer immunotherapy available by subcutaneous injection in Europe across multiple cancer types

-

March 2024: Novartis Presents New Data Demonstrating Sustained and Improved Motor Milestones in Older, Heavier Children with Spinal Muscular Atrophy (SMA) Treated Early With Zolgensma

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 102.2 Billion |

| Market Size by 2032 | USD 195.5 Billion |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Monoclonal Antibodies (mAb), Recombinants Proteins, Cancer Growth Inhibitors, Vaccines, CAR-T Cells, Angiogenesis Inhibitors, Interleukins (IL), Others) • By Application (Blood Cancer, Lung Cancer, Breast Cancer, Colorectal Cancer, Prostate Cancer, Gastric Cancer, Ovarian Cancer, Others) • By End-user (Hospitals, Cancer Centers, Academics & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canon Medical Systems Corporation, Siemens Healthcare GmbH, Ziehm Imaging GmbH, Medtronic plc, GE HealthCare, IMRIS, Brainlab AG, Koninklijke Philips N.V., NeuroLogica Corp, Shimadzu Corporation (Medical Systems). |

| Key Drivers | • Increasing global cancer rates, driven by aging populations and lifestyle factors, are boosting the demand for cancer biologics. • Continuous innovations in biotechnology and targeted therapies, such as monoclonal antibodies and CAR-T cell therapies, are expanding treatment options. |

| RESTRAINTS | • The expensive nature of cancer biologics, including production and treatment costs, limits their accessibility to a wider patient base. • The production of biologics is complex and requires advanced facilities, which can lead to manufacturing delays and supply chain issues. |