Anxiety Disorder Treatment Market Report Scope & Overview:

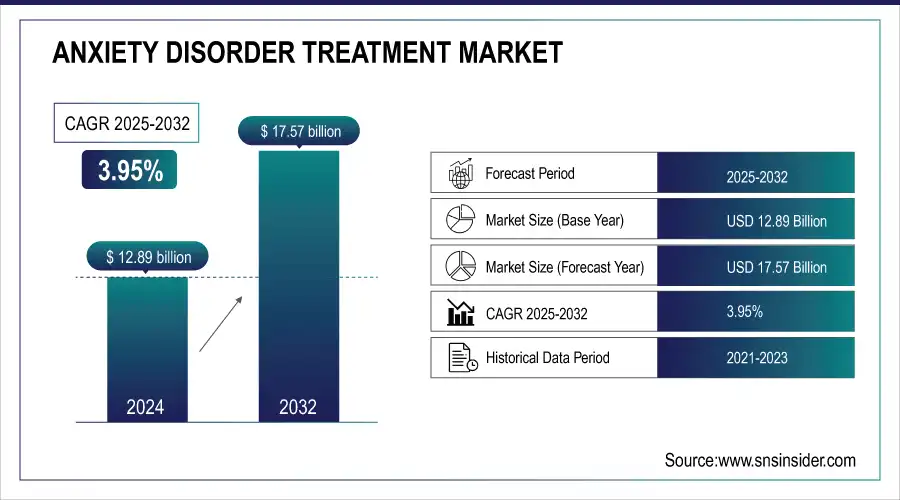

The Anxiety Disorder Treatment Market Size was estimated at USD 12.89 billion in 2024 and is projected to reach at USD 17.57 billion by 2032 with a growing CAGR of 3.95% Over the Forecast Period of 2025-2032.

The anxiety disorder market is expected to witness significant growth during the forecast period. The rising prevalence of personality disorders and stress build-up especially in adults, rising awareness programmes worldwide through campaigns & media and increased female adult population. Anxiety is becoming a major concern and with each passing time, it is becoming a serious issue for almost all set of population.

Get More Information on Anxiety Disorder Treatment Market - Request Sample Report

A growing consumer awareness of the minimal side effects of antidepressants and their increasing popularity are driving up demand for these medications. But in the upcoming years, it is anticipated that the market for treating anxiety disorders will grow more slowly due to the patent expiration of the majority of medications, the rising number of drug withdrawals, and the widespread introduction of generic alternatives.

Moreover, the high success rates of treatments and the availability of advantageous reimbursement policies for pharmaceuticals in developed nations are expected to fuel growth throughout the projection period. However, due to the high expense of using these tools and therapies, such as anesthesia and hospital stays, patients' preferences for medications have changed.

Market Size and Forecast:

-

Market Size in 2024: US$ 12.89 Billion

-

Market Size by 2032: US$ 17.57 Billion

-

CAGR: 3.95% (2025–2032)

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Anxiety Disorder Treatment Market Trends

-

Rising Prevalence of Anxiety Disorders – Around 301 million people globally are living with anxiety, making it one of the most common mental health conditions.

-

High Dependence on SSRIs & SNRIs – Selective serotonin reuptake inhibitors account for 30%+ of prescriptions, remaining the first-line drug therapy.

-

Adoption of Digital Therapeutics – Over 30% of patients now engage with mobile mental health apps and virtual therapy platforms.

-

Outpatient & Remote Treatment Growth – Outpatient facilities handle nearly 70% of anxiety treatments, with home-based and telehealth usage rising.

-

Combination Therapy Preference – Increasing use of integrated care models that blend medication with cognitive-behavioral therapy, showing 20–30% higher efficacy rates compared to single therapy.

-

Rising Awareness & Reduced Stigma – Surveys indicate a 40% increase in people seeking professional help for anxiety compared to a decade ago.

-

AI & Personalized Care – Growing use of AI-based tools for early detection, symptom monitoring, and tailored treatment plans.

Anxiety Disorder Treatment Market Drivers:

-

Growing Need for Oral Medicines

The demand for oral medicines in anxiety disorder treatment is witnessing steady growth, driven by patient preference, convenience, and proven clinical efficacy. Oral formulations such as SSRIs (Selective Serotonin Reuptake Inhibitors), SNRIs (Serotonin-Norepinephrine Reuptake Inhibitors), benzodiazepines, and tricyclic antidepressants remain the most widely prescribed therapies, accounting for the majority of treatment regimens. Their non-invasive administration, ease of self-use, and lower cost compared to injectable or device-based therapies make them the preferred choice for both patients and healthcare providers. Clinical data shows that nearly 70% of anxiety disorder patients are managed primarily with oral medications, highlighting their central role. Additionally, pharmaceutical innovation, such as extended-release capsules and combination formulations, is improving compliance and outcomes. With the rising prevalence of anxiety disorders globally and growing acceptance of pharmacological interventions, the reliance on oral medicines is expected to remain strong, ensuring sustained demand during the forecast period.

-

Release of Novel Anxiety Treatments

Anxiety is becoming more commonplace worldwide, which has encouraged researchers to create innovative treatments to enhance mental health. For example, the US FDA approved Janssen Care Path’s ketamine, a nasal spray formulation of ketamine known as SPRAVATO, to treat mood-related conditions like depression, anxiety, and post-traumatic stress disorder (PTSD). This accelerates market expansion.

Anxiety Disorder Treatment Market Restraint:

-

Patients often assist themselves during treatment, which can lead to complications.

A significant restraint in the anxiety disorder treatment market is the tendency of patients to self-manage their condition, often without proper medical supervision. Many individuals attempt to adjust dosages, combine multiple medications, or rely on over-the-counter supplements and herbal remedies. This self-directed approach can result in drug interactions, reduced treatment efficacy, and worsening of symptoms, sometimes leading to severe complications such as dependence or withdrawal effects. Studies indicate that up to 25–30% of patients with anxiety disorders engage in some form of self-medication. Additionally, the lack of professional guidance can hinder proper monitoring of side effects, delay clinical interventions, and negatively impact long-term outcomes. This behavior not only limits the effectiveness of approved therapies but also increases the healthcare burden due to emergency interventions and hospitalizations. Consequently, patient-led treatment practices pose a significant challenge for pharmaceutical companies and healthcare providers aiming to optimize therapeutic outcomes.

Anxiety Disorder Treatment Market Opportunities:

-

The prevalence of mental illness is rising.

The increasing prevalence of mental health disorders, particularly anxiety, presents a significant growth opportunity for the anxiety disorder treatment market. Globally, an estimated 300 million people are affected by anxiety disorders, and this number continues to rise due to factors such as urbanization, stressful lifestyles, and the long-term effects of the COVID-19 pandemic. This growing patient base drives demand for both pharmacological and non-pharmacological treatment options, including oral medications, cognitive-behavioral therapy, and digital therapeutics. Pharmaceutical companies and healthcare providers can leverage this trend by developing personalized treatment solutions, combination therapies, and patient-centric digital platforms to enhance adherence and outcomes. Additionally, increasing awareness campaigns and reduced stigma encourage more patients to seek professional care, further expanding market reach. The surge in mental illness prevalence also incentivizes innovation in new drug formulations, rapid-onset therapies, and AI-driven monitoring tools, creating avenues for companies to differentiate their offerings and capture larger market share. Overall, the rising incidence of anxiety and other mental disorders represents a robust opportunity for market expansion and long-term growth.

-

Growing Need for Retail Drugstores

Opportunities for market expansion are created by the rise in the number of retail pharmacies in developed nations and the rise in the number of medications for anxiety disorders that are supplied through these establishments. Furthermore, because retail pharmacies are more easily accessible, patients prefer to buy their medications from them.

Anxiety Disorder Treatment Market Segment Analysis:

By Drug Class

The market is segmented into SSRIs, SNRIs, TCAs, pregabalin, buspirone, benzodiazepines, moclobemide, and others. SSRIs and SNRIs dominate the market, collectively accounting for around 60% of global prescriptions, as they effectively target both depression and anxiety disorders with a relatively favorable safety profile. TCAs and benzodiazepines follow, though their use is limited due to side effects and dependency concerns. Medications like buspirone are prescribed for generalized anxiety disorder, while moclobemide sees regional adoption for specific anxiety types. Other niche drugs contribute a small share, reflecting localized or specialized treatment approaches.

By End-User

End users include hospitals, mental healthcare centers, asylums, and others. Hospitals lead the market, accounting for approximately 55% of treatment revenue, driven by their access to a broad patient base and availability of psychiatrists and treatment facilities. Mental healthcare centers contribute around 30%, providing outpatient services, therapy programs, and ongoing management for chronic anxiety patients. Asylums and specialized psychiatric institutions account for a smaller share, focusing on severe cases requiring intensive monitoring. The remaining share comes from clinics, telehealth providers, and community-based care, reflecting the growing trend of decentralized and patient-centric treatment models.

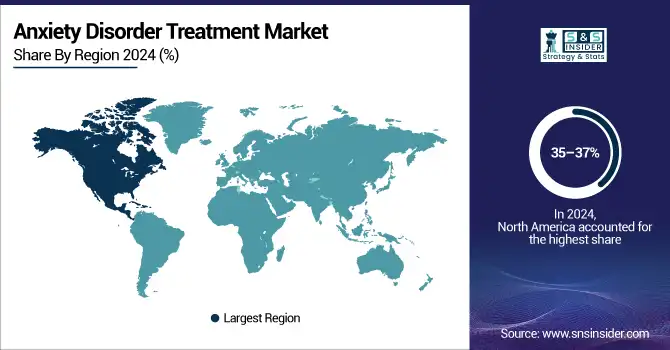

Anxiety Disorder Treatment Market Regional Analysis:

North America Anxiety Disorder Treatment Market Insights

North America dominates the global anxiety disorder treatment market, accounting for approximately 35–37% of total market share. The region benefits from advanced healthcare infrastructure, widespread insurance coverage, and high awareness of mental health conditions. Hospitals and mental healthcare centers are the primary treatment providers. SSRIs and SNRIs dominate prescriptions, supported by growing adoption of digital therapeutics and telemedicine platforms. The region is expected to grow at a CAGR of around 3.8% during 2025–2032, driven by increasing prevalence, technological integration, and a strong pipeline of new medications.

Need any customization research on Anxiety Disorder Treatment Market - Enquiry Now

Europe Anxiety Disorder Treatment Market Insights

Europe holds around 28–30% of the market share. Growth is fueled by government-led mental health initiatives, rising awareness, and increasing demand for outpatient and community-based care. Key contributors include Germany, the UK, and France. SSRIs remain the most prescribed class, while SNRIs and pregabalin are also widely used. The region is projected to grow at a CAGR of about 3.5% over the forecast period, supported by favorable reimbursement policies and increasing adoption of digital mental health solutions.

Asia Pacific Anxiety Disorder Treatment Market Insights

Asia Pacific accounts for roughly 20–22% of the global market and is the fastest-growing region, with a CAGR of 4.2% during 2025–2032. Rising awareness, urbanization, and improving healthcare access in countries like China, India, Japan, and Australia are driving demand. There is increasing adoption of SSRIs, SNRIs, and combination therapies, along with growing digital health initiatives for anxiety management. Traditional practices still influence treatment preferences in some areas, but pharmaceutical adoption is steadily rising.

Latin America Anxiety Disorder Treatment Market Insights

Latin America represents about 8–9% of the market share, with moderate growth expected at a CAGR of 2.8%. Brazil and Mexico are the largest contributors. Demand is supported by increasing mental health awareness, expanding outpatient facilities, and government programs targeting anxiety disorders. SSRIs dominate treatment, though benzodiazepines and TCAs are still used, particularly in rural areas where access to newer drugs may be limited.

Middle East & Africa (MEA) Anxiety Disorder Treatment Market Insights

MEA holds approximately 5–6% of the global market, growing at a CAGR of 2.5–3%. Growth is constrained by limited mental health infrastructure and lower awareness, but increasing urbanization and government initiatives to improve psychiatric care are driving adoption. Hospitals remain the primary treatment centers, with mental healthcare centers slowly gaining traction. SSRIs and SNRIs are preferred in urban regions, while benzodiazepines are more commonly used in some rural areas.

Anxiety Disorder Treatment Market Key Players:

Some of the players of Anxiety Disorder treatment Market are

-

Pfizer, Inc.

-

Eli Lilly and Company

-

GlaxoSmithKline (GSK)

-

Johnson & Johnson

-

Merck & Co. Inc.

-

AstraZeneca

-

Lundbeck A/S

-

AbbVie

-

Takeda Pharmaceutical Co.

-

Otsuka Pharmaceutical Co.

-

Bausch Health

-

Teva Pharmaceutical Industries

-

Sun Pharma Industries Ltd.

-

Novartis

-

Boehringer Ingelheim

-

Alkermes plc

-

Sage Therapeutics Inc.

-

Biogen

-

MindMed Inc.

-

Compass Pathways plc

Anxiety Disorder Treatment Market Competitive Landscape:

Johnson & Johnson (J&J) is a global healthcare leader, headquartered in New Brunswick, New Jersey, specializing in pharmaceuticals, medical devices, and consumer health products. Founded in 1886, the company pioneered sterile surgical dressings and has grown into a multinational with over 60 manufacturing facilities and approximately 138,000 employees worldwide. Its pharmaceutical division, Janssen, develops treatments for a range of conditions, including mental health, exemplified by the FDA approval of SPRAVATO® (esketamine) for treatment-resistant depression in 2025. Under CEO Joaquin Duato, J&J focuses on innovation, strategic acquisitions, and improving patient outcomes, maintaining a market-leading position in global healthcare.

-

January 2025 – Johnson & Johnson received FDA approval for SPRAVATO® (esketamine) as the first monotherapy for adults with treatment-resistant depression in the U.S., showing rapid efficacy compared to placebo.

Eli Lilly and Company, founded in 1876 by Colonel Eli Lilly, is a leading global pharmaceutical firm headquartered in Indianapolis, Indiana. With approximately 47,000 employees, Lilly operates in over 125 countries, focusing on the discovery, development, and manufacturing of human pharmaceuticals. The company's portfolio includes treatments for diabetes, oncology, immunology, and neuroscience, with notable products like Humalog, Trulicity, and Zepbound. In 2024, Lilly achieved a market capitalization of $842 billion, making it the most valuable pharmaceutical company globally. Under the leadership of CEO David A. Ricks, Lilly continues to prioritize innovation, investing significantly in research and development to address unmet medical needs. The company is also expanding its manufacturing capabilities, including a $27 billion investment in four new U.S. facilities to enhance production capacity and meet global demand.

-

December 2024 – The FDA approved Eli Lilly’s Zepbound (tirzepatide) for adults with obesity suffering from moderate to severe obstructive sleep apnea, representing a notable advancement in available treatment options in the U.S.

AbbVie Inc. is a global biopharmaceutical company headquartered in North Chicago, Illinois. Established in 2013 as a spin-off from Abbott Laboratories, AbbVie focuses on developing and marketing innovative medicines across various therapeutic areas, including immunology, oncology, neuroscience, and virology. The company's portfolio features leading products such as Humira (adalimumab), Skyrizi (risankizumab), Rinvoq (upadacitinib), and Botox (botulinum toxin), which collectively contribute significantly to its revenue. AbbVie is also actively expanding its pipeline through strategic acquisitions, including the purchase of Cerevel Therapeutics for $8.7 billion in 2024 to enhance its neuroscience offerings. With a global presence in over 170 countries, AbbVie is committed to addressing complex health challenges and improving patient outcomes through scientific innovation and collaboration.

-

October 2024 – AbbVie and Gedeon Richter announced a renewed collaboration to explore new targets for neuropsychiatric conditions, leveraging nearly two decades of partnership and advancing joint R&D efforts across the U.S. and Europe.

| Report Attributes | Details |

| Market Size in 2024 | USD 12.89 Billion |

| Market Size by 2032 | USD 17.57 Billion |

| CAGR | CAGR of 3.95% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Antidepressant, Anxiolytics, Antipsychotics, Others) • By Disorder Type (Generalized Anxiety Disorder, Major Depressive Disorder, Obsessive-Compulsive Disorder, Panic Disorder, Post-Traumatic Stress Disorder, Social Anxiety Disorder) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Pfizer Inc., Eli Lilly and Company, GlaxoSmithKline (GSK), Johnson & Johnson, Merck & Co., AstraZeneca, Lundbeck A/S, AbbVie, Takeda Pharmaceutical Co., Otsuka Pharmaceutical Co., Bausch Health, Teva Pharmaceutical Industries, Sun Pharma Industries Ltd., Novartis, Boehringer Ingelheim, Alkermes plc, Sage Therapeutics Inc., Biogen, MindMed Inc., Compass Pathways plc |