Apoptosis Assay Market Report Scope & Overview:

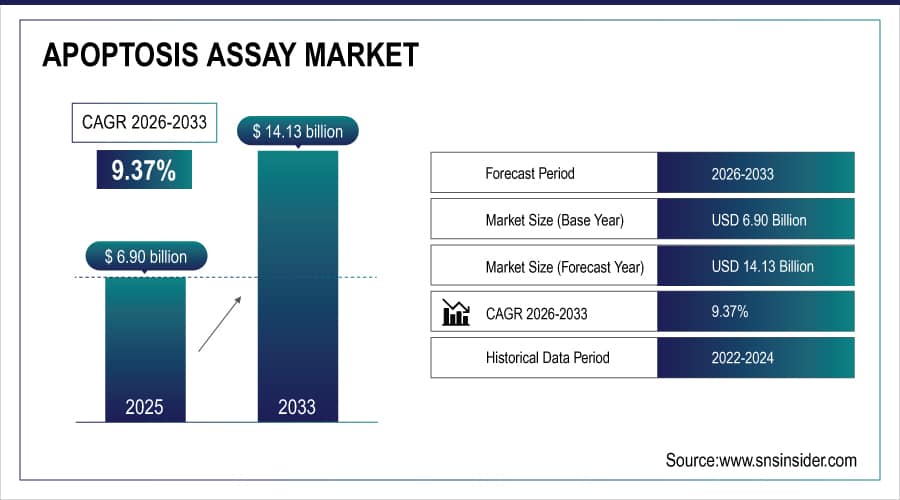

The Apoptosis Assay Market size is estimated at USD 6.90 billion in 2025 and is expected to reach USD 14.13 billion by 2033, growing at a CAGR of 9.37% over 2026-2033.

The global apoptosis assay market trend is rising due to chronic illnesses, such as cancer, neurological diseases, and autoimmune disorders are becoming more common and need accurate detection of programmed cell death for both diagnostic and therapeutic purposes. The use of apoptosis tests in pharmaceutical and biotech businesses is being driven by the increasing demand for targeted medicines and customized medicine. Drug discovery research is being boosted by technological advancements in detection techniques including flow cytometry, fluorescence microscopy, and high-throughput screening, which are increasing accuracy and efficiency.

For instance, in September 2024, Bio-Rad Laboratories launched annexin V conjugated to eight new StarBright Dyes, enabling early apoptotic cell detection via flow cytometry and offering researchers more fluorophore options for multicolor analysis.

Apoptosis Assay Market Size and Forecast:

-

Market Size in 2025E: USD 6.90 billion

-

Market Size by 2033: USD 14.13 billion

-

CAGR: 9.37% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Apoptosis Assay Market - Request Free Sample Report

Apoptosis Assay Market Trends:

-

Rising cancer, neurodegenerative, and autoimmune disease cases driving demand for reliable apoptosis detection.

-

Development of patient-specific therapies using apoptotic pathway analysis, genetic profiling, and biomarkers.

-

High-throughput screening, advanced imaging, and multiplexed assays enhancing sensitivity and reducing analysis time.

-

Automation, AI, and machine learning applied to data analysis, image processing, and real-time apoptotic monitoring.

-

Increasing demand for ready-to-use kits, optimized reagents, and user-friendly instruments for lab standardization.

-

Partnerships among pharma, biotech, and research institutions to advance assays and improve clinical trials.

-

FDA, EMA, and local authorities promoting standardized assay guidelines, quality control, safety, and public awareness.

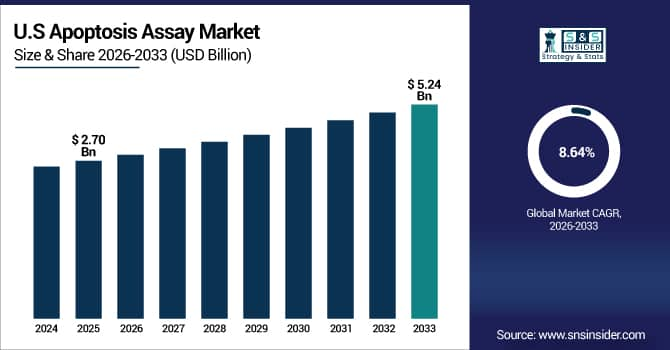

The U.S. Apoptosis Assay Market is estimated at USD 2.70 billion in 2025 and is expected to reach USD 5.24 billion by 2033, growing at a CAGR of 8.64% from 2026-2033.

Owing to its top biotech and pharmaceutical firms, sophisticated healthcare system, and substantial R&D expenditure, the U.S. has the biggest market share. High rates of cancer and chronic illness, significant government and commercial financing, and early adoption of technologies like flow cytometry and sophisticated imaging are the main drivers of growth. The U.S. is the largest regional market in the world due to strong regulatory support and significant market players.

Apoptosis Assay Market Growth Drivers:

-

Rising Cancer Prevalence is Driving the Apoptosis Assay Market Growth

The need to comprehend cancer cell death and create tailored treatments that cause malignant cells to undergo apoptosis is a major factor propelling the market for apoptosis assays. Pharmaceutical and biotech firms are investing in apoptosis research due to the rising incidence of cancer worldwide, which is increasing demand for sophisticated assay technology. Both the market base and overall market share are growing as a result of these solutions.

For instance, in February 2025, the World Health Organization’s International Agency for Research on Cancer reported about 20 million new cancer cases in 2024, emphasizing the rising need for apoptosis-based therapeutics and diagnostics.

Apoptosis Assay Market Restraints:

-

High Instrument Costs and Technical Complexity are Hampering the Apoptosis Assay Market Growth

The expansion of the apoptosis assay market is constrained by high instrument prices and technical complexity since equipment such as flow cytometers and sophisticated imaging systems require substantial investment and specialist knowledge. This limits market penetration and lowers adoption of modern apoptosis detection technologies in areas with limited cost and technical skills by limiting smaller labs and academic institutions with limited funding.

Apoptosis Assay Market Opportunities:

-

Expansion into Emerging Markets Drive Future Growth Opportunities for the Apoptosis Assay Market

Rapid expansion of healthcare infrastructure, increased R&D expenditures, and growing awareness of advanced diagnostics in Asia Pacific, Latin America, and the Middle East present opportunities for the apoptosis assay market in emerging regions. These areas exhibit robust biotech and pharmaceutical growth, bolstered by government life sciences programs. Businesses can access these high-growth areas and flourish internationally through strategic alliances, local distribution, and affordable assays.

For example, in November 2024, Bayer AG received EMA approval for a new research-grade apoptosis detection reagent, highlighting ongoing innovation and regulatory support for apoptosis research in drug development and toxicology.

Apoptosis Assay Market Segment Analysis:

-

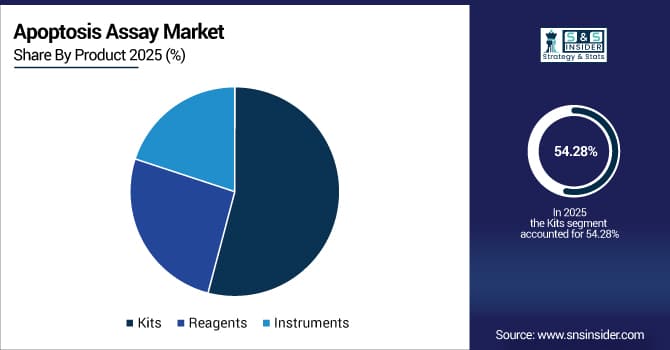

By product, kits held the largest share of around 54.28% in 2025E, and the reagents segment is expected to register the highest growth with a CAGR of 9.68%.

-

By technique, the flow cytometry segment dominated the market with approximately 42.15% share in 2025E, while fluorescence microscopy is expected to register the highest growth with a CAGR of 9.85%.

-

By assay type, caspase assay accounted for the leading share of nearly 36.92% in 2025E, and the mitochondrial assay is expected to register the highest growth with a CAGR of 9.92%.

-

By end user, pharmaceutical & biotechnology companies led the market with about 47.83% share in 2025E, while the academic & research institutes segment is forecasted to grow the fastest at a CAGR of 9.89%.

By Product, Kits Lead the Market, While Reagents Register Fastest Growth

The kits segment held the largest revenue share of 54.28% in 2025, due to the convenience, standardization, and all-in-one nature of pre-packaged assay kits with reagents and protocols for apoptosis detection. Trends include rising demand for ready-to-use kits in pharmaceutical research and drug discovery.

The reagents segment is expected to record the highest CAGR of 9.68% during 2026–2033, driven by recurring demand for individual reagents, antibodies, and probes used in multiple assays. Growth is supported by the adoption of customized protocols and the flexibility of procuring individual reagents for specialized research.

By Technique, Flow Cytometry Segment Dominates the Market, While Fluorescence Microscopy Shows Rapid Growth

The flow cytometry segment held the largest revenue share of 42.15% in 2025, due to high-throughput capabilities, multi-parameter analysis, and rapid processing of large sample volumes with single-cell resolution. Its dominance is driven by adoption in pharmaceutical research, clinical diagnostics, and advanced cytometry platforms with enhanced sensitivity and automated analysis.

The fluorescence microscopy segment is expected to grow at the highest CAGR of 9.85% during 2026–2033, fueled by advances in super-resolution imaging, confocal microscopy, and live-cell imaging. Key factors include improved visualization of apoptotic morphology, real-time monitoring of cellular processes, and rising applications in neuroscience and developmental biology.

By Assay Type, Caspase Assay Leads, and Mitochondrial Assay Registers Fastest Growth

The caspase assay held the largest share of the apoptosis assay market at 36.92%, due to its specificity in detecting caspase activation, a hallmark of apoptotic pathway initiation and execution. Its growth is driven by widespread use in drug screening, mechanistic studies, and availability of diverse caspase-specific substrates and inhibitors. It is expected to maintain strong growth as caspase assays offer insights into apoptotic signaling, therapeutic target validation, and toxicology.

The mitochondrial assay segment is projected to register the highest CAGR of 9.92% during 2026–2033, driven by recognition of mitochondrial dysfunction as an early apoptosis indicator and its role in intrinsic pathways. Key factors include applications in cardiovascular research, neurodegenerative disease studies, and drug-induced toxicity screening, where mitochondrial membrane potential changes are sensitive biomarkers.

By End User, Pharmaceutical & Biotechnology Companies Lead the Market, While Academic & Research Institutes Segment Grows the Fastest

The pharmaceutical & biotechnology companies held the largest revenue share of around 47.83% in the apoptosis assay market in 2025, driven by extensive drug discovery, large-scale screening, and high R&D investment. Key drivers include the focus on targeted cancer therapies, immunotherapy development, and toxicology and safety assessments in preclinical and clinical stages.

The academic & research institutes segment is projected to register the highest CAGR of 9.89% during 2026-2033, supported by rising government and private research funding, expanding life sciences infrastructure, and emphasis on mechanistic studies of cell death pathways. Factors include growing collaborative research, adoption of advanced imaging and flow cytometry, and expansion of translational programs linking basic science to clinical applications.

Apoptosis Assay Market Regional Highlights:

Asia Pacific Apoptosis Assay Market Insights:

Asia Pacific is the fastest-growing segment in the apoptosis assay market with a CAGR of 10.24%, driven by expanding pharmaceutical and biotechnology sectors, rising healthcare expenditure, and growing awareness of personalized medicine in China, India, Japan, and South Korea. Growth is being accelerated by factors, such as rising cancer incidence, growing research infrastructure, and government support for life sciences. Access to cutting-edge test technologies is improved by the growth of university institutions and contract research organizations that study apoptosis. Innovation in drug research is encouraged by multinational partnerships and government support. Growth in the region is further fueled by lower operating costs compared to Western markets, and the increasing use of flow cytometry and imaging-based detection technologies.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Apoptosis Assay Market Insights:

North America held the largest revenue share of 41.23% in 2025 in the apoptosis assay market, driven by the strong presence of top pharmaceutical and biotech companies, advanced research infrastructure, and high life sciences investment. High rates of cancer and chronic illness, substantial funding from private foundations and government organizations, such as the NIH, and early adoption of technologies including high-throughput screening and AI-assisted analysis are important contributing causes. Additionally, market dominance and substantial global apoptosis assay revenues are supported by a favorable regulatory environment, prominent firms, such as Thermo Fisher Scientific and Bio-Rad Laboratories, and a strong industry–academia relationship.

Europe Apoptosis Assay Market Insights:

The apoptosis assay market in Europe is the second-largest region after North America due to established pharmaceutical and biotech industries, strong research infrastructure, and focus on precision medicine. Rising cancer research investment, supportive EMA regulations, and advanced diagnostic technologies support market growth. Leading research institutions, growing use of automated and high-throughput assay platforms, and government-backed programs in Germany, the UK, and France drive European market expansion.

Latin America (LATAM) and Middle East & Africa (MEA) Apoptosis Assay Market Insights:

Apoptosis assay market expansion is supported in Latin America and the Middle East & Africa by the increasing incidence of chronic diseases, increased healthcare awareness, and improved access to cutting-edge diagnostic technologies. Early adoption of novel assays is encouraged by growing research partnerships with global organizations and investments in biotechnology infrastructure. Although from a lesser foundation than developed markets, increasing pharmaceutical production and concentrating on medication development further stimulate market growth.

Apoptosis Assay Market Competitive Landscape:

Thermo Fisher Scientific Inc. (est. 1956) is a global leader in scientific research and lab equipment, providing innovative solutions for life sciences, drug discovery, and diagnostics. It uses strong R&D and strategic acquisitions to deliver advanced apoptosis detection technologies.

-

In March 2025, launched high-sensitivity caspase detection reagents for improved drug screening, featuring better signal-to-noise ratios for accurate results.

Becton, Dickinson and Company (BD) (est. 1897) is a leading medical technology firm improving drug discovery, diagnostics, and lab research. It invests in flow cytometry and multiparameter analysis to advance apoptosis detection with efficient, accurate assay platforms.

-

In January 2025, launched an advanced flow cytometry panel for simultaneous detection of multiple apoptotic markers, enhancing research in oncology and immunology.

Merck KGaA (est. 1668) operates globally in life sciences, healthcare, and performance materials. Its life sciences division provides high-quality reagents, antibodies, and apoptosis assay kits, backed by strong R&D and market presence.

-

In August 2025, introduced a new apoptosis detection kit to improve cell-death measurement accuracy, strengthening its assay portfolio and adoption in oncology, toxicology, and drug screening.

Apoptosis Assay Market Key Players:

-

Thermo Fisher Scientific Inc.

-

Becton, Dickinson and Company (BD)

-

Merck KGaA

-

Bio-Rad Laboratories Inc.

-

Promega Corporation

-

Abcam plc

-

Agilent Technologies Inc.

-

PerkinElmer Inc.

-

Sartorius AG

-

Bio-Techne Corporation

-

Takara Bio Inc.

-

GeneCopoeia Inc.

-

Biotium Inc.

-

Danaher Corporation

-

F. Hoffmann-La Roche Ltd

-

Qiagen N.V.

-

Cell Signaling Technology Inc.

-

Enzo Life Sciences Inc.

-

BioVision Inc.

-

BioTek Instruments Inc.

-

Abnova Corporation

-

Creative Bioarray

-

Geno Technology Inc.

| Report Attributes | Details |

|---|---|

|

Market Size in 2025 |

USD 6.90 Billion |

|

Market Size by 2033 |

USD 14.13 Billion |

|

CAGR |

CAGR of 9.37% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Kits, Reagents, Instruments) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Thermo Fisher Scientific Inc., Becton Dickinson and Company (BD), Merck KGaA, Bio-Rad Laboratories Inc., Promega Corporation, Abcam plc, Agilent Technologies Inc., PerkinElmer Inc., Sartorius AG, Bio-Techne Corporation, Takara Bio Inc., GeneCopoeia Inc., Biotium Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd, Qiagen N.V., Cell Signaling Technology Inc., Enzo Life Sciences Inc., BioVision Inc., BioTek Instruments Inc., Abnova Corporation, Creative Bioarray, Geno Technology Inc. |