Application Delivery Controller Market Report Scope & Overview:

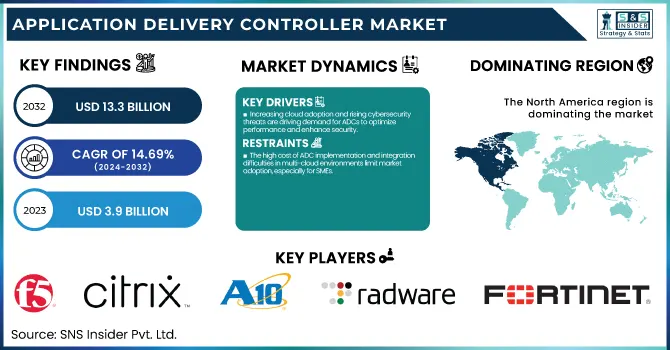

The Application Delivery Controller Market was valued at USD 3.9 Billion in 2023 and is expected to reach USD 13.3 Billion by 2032, growing at a CAGR of 14.69% from 2024-2032.

To Get more information on Application Delivery Controller Market - Request Free Sample Report

The adoption of Application Delivery Controllers (ADCs) is shifting toward cloud-based and virtual deployments, replacing traditional hardware solutions for better scalability and flexibility. The rising demand for cloud-native ADCs in hybrid and multi-cloud environments from 2020 to 2025 is driven by enterprises seeking cost-efficient and adaptive traffic management. AI and automation are playing a crucial role in optimizing ADC performance, enabling real-time traffic monitoring, anomaly detection, and intelligent load balancing for improved network efficiency. Additionally, the growing need for security and seamless application performance in high-traffic digital environments is accelerating the market expansion of ADC solutions, particularly in cybersecurity and load balancing applications.

Application Delivery Controller Market Dynamics

Drivers:

-

Increasing cloud adoption and rising cybersecurity threats are driving demand for ADCs to optimize performance and enhance security.

The rising technology substantiates with growing cloud, mobile apps adoption, with digital transformation driving the Application Delivery Controllers market. ADCs help businesses optimize traffic management, deliver high-performance application experiences, and improve cyber threat defenses. With the increasing occurrence of DDoS attacks and web application vulnerabilities, the demand for ADC is expected to increase even further, due to the deployment of ADCs with security features built in. Apart from this, organizations are now using ADCs for load balancing, SSL offload, content caching, etc., to keep applications highly available & scalable. The ADC market is expected to record substantial growth as enterprises continue to expand their digital footprint through hybrid and multi-cloud phenomena.

Restraints:

-

The high cost of ADC implementation and integration difficulties in multi-cloud environments limit market adoption, especially for SMEs.

While ADCs provide benefits, the high deployment cost and complexity in integrating existing network infrastructure make them challenging for businesses. Conventional hardware-based ADCs have a high upfront investment cost that presents an obstacle for SMEs to adopt testing. Licenses are still required, such that even with ADC solutions that are purely software or cloud-native, in practice, there is a dependency on network professionals who know how to stitch together solutions. For example, organizations utilizing multi-cloud or hybrid environments may struggle to provide interoperability across platforms with ADCs deployment. Such hurdles in integration may cause the adoption rates to slow down, which would restrict the overall market growth to a larger extent, particularly for organizations with limited budget and little in-house tech skills.

Opportunities:

-

AI and automation in ADCs enable intelligent traffic management, self-healing networks, and real-time performance optimization.

As the technology of artificial intelligence and automation improves, we can expect ADCs to evolve into intelligent traffic management with capabilities like anomaly detection and real-time optimization. AI-based ADCs can dynamically steer traffic, identify congestion points before they happen, and avoid downtimes for application delivery. In addition, automation features are alleviating the amount of work hitting the IT teams by adopting self-healing networks and adaptive load balancing. Such innovations are becoming popular with enterprises seeking to improve application security, latency, and cloud workload performance. With the increasing demand for next-gen digital experiences, ADC providers have a lucrative opportunity to build smart, self-learning ADCs in the age of AI and automation.

Challenges:

-

Strict data protection laws and security risks create challenges in ADC deployment, requiring compliance-friendly and secure solutions.

As organizations increasingly turn to ADCs for securing the transfer of highly sensitive information, questions abound regarding compliance with the stringent data privacy regulations such as GDPR, CCPA and HIPAA. Having ADC deployments comply with various regulation frameworks, especially if enterprises operate across the geographic regions, becomes a very tedious and resource-consuming process. Moreover, since ADCs handle application traffic and protection, they become a cybercriminal's favourite target to exploit. Vendors must provide very strong encryption, handling of data, compliance, etc. in their ADC solutions to gain customer trust. The problem is finding a way to deliver scale you can trust without increasing operational costs so astronomically that you cannot continue to afford to provide service.

Application Delivery Controller Market Segmentation Analysis

By Deployment

In 2023, hardware-based ADCs segment dominated the market and accounted for a significant revenue share. Compared with software-based ADCs, hardware-based ADCs are explicitly designed for performance. These devices incorporate specialized hardware components like Application-Specific Integrated Circuits to facilitate data processing and traffic maximization. This allows for rapid processing of packets in this specialized architecture, which means less latency and higher throughput. Therefore, hardware-based ADCs are ideal for organizations with high traffic loads, and for mission-critical applications that need guaranteed performance.

The virtual ADCs are expected to register the fastest CAGR during the forecast period. Cloud environments are being adopted at great speed, this has led to rapid adoption of Virtual Application Delivery Controllers by commercial organizations. Virtual ADCs are designed to work as part of cloud-based architectures and are instantly deployable to the cloud whenever and wherever needed without the limitations of physical hardware. With this functionality, businesses have the flexibility to dynamically scale their application delivery resources in line with variable workloads, so optimal performance can be guaranteed, automatically when needed.

By Enterprise Size

In 2023, the large enterprises segment dominated the market and accounted for a significant revenue share. Large enterprises typically have complexity in their IT landscape, spread across on-premises, cloud, and hybrid architectures. Management These trends lead to unprecedented complexity in application delivery, traffic management, and security, and require next-generation solutions that are infrastructure agnostic. ADCs are built to operate in these complex environments, providing a single point of control for application traffic, as well as transparency across platforms.

The SME segment is expected to register the fastest CAGR during the forecast period. With small and medium enterprises looking to increase operational efficiency and customer engagement, more and more are starting to undertake their digital transformation projects. Part of this transition often requires moving to cloud services, which can help make resources and applications accessible to SMEs more flexibly and cost-effectively. During this transformation, ADCs play a crucial role by providing reliable access to applications while streamlining performance between all points of your platform.

By End-Use

In 2023, BFSI segment dominated the market and accounted for significant revenue share. As the BFSI sector grows, the transaction volumes that financial institutions have to manage are also increasing. The increased activity results in the need for scalable solutions that are instantiated based on demand. This is where the ADC comes in, giving you the ability to adjust scale resources up or down on-demand.

The retail segment is expected to register the fastest CAGR during the forecast period. E-commerce has boomed, revolutionizing the retail market, and greatly increasing the volume of sales and customer interactions online. In response to this increasing need for faster and a more accessible shopping experience, retailers are now focusing on digital mediums to create their presence.

Regional Analysis

In 2023, North America dominated the market and accounted for significant revenue share. Cloud adoption and digital transformation are thus at the forefront of North American enterprises, specifically in the U.S. and Canada. With more and more businesses moving to a hybrid and multi-cloud setup, the demand for Application Delivery Controllers has drastically increased. ADC plays a critical role in the seamless application delivery, scalability, and securing of these infrastructures across the data center. ADCs are extremely important in cloud environments since they are responsible for controlling the optimal performance of cloud-based applications, perform load balancing of traffic, and help in reducing latency.

Asia Pacific is expected to register the fastest CAGR during the period. As small and medium enterprises in the Asia sector quickly adopt the digital AWS and cloud innovations, growing these businesses digitally also means the need for scalable, cost-effective Application Delivery Controllers is on the rise.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

F5, Inc. – BIG-IP ADC

-

Citrix Systems, Inc. – Citrix ADC

-

A10 Networks, Inc. – Thunder ADC

-

Radware Ltd. – Alteon ADC

-

Barracuda Networks, Inc. – Barracuda Load Balancer ADC

-

Fortinet, Inc. – FortiADC

-

Array Networks, Inc. – APV Series ADC

-

Kemp Technologies (Progress) – LoadMaster ADC

-

Broadcom Inc. – Brocade Virtual Traffic Manager

-

NGINX (F5 Networks) – NGINX Plus ADC

-

AWS (Amazon Web Services) – AWS Elastic Load Balancer

-

Microsoft Corporation – Azure Application Gateway

-

Cloudflare, Inc. – Cloudflare Load Balancer

-

Google Cloud – Google Cloud Load Balancing

-

Imperva, Inc. – Imperva Incapsula ADC

Recent Developments

In August 2023, Array Networks, Inc., a U.S.-based developer of application delivery controllers, partnered with Luna Technologies to introduce APV application delivery controller solutions targeting corporations, banks, and government organizations in Malawi.

In October 2023, Progress Software Corporation, a U.S.-based software company, launched LoadMaster 360, a unified cloud-centric application delivery platform designed to enhance performance, reliability, and security across diverse infrastructures.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 3.9 Billion |

|

Market Size by 2032 |

USD 13.3 Billion |

|

CAGR |

CAGR of 14.69% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Deployment (Hardware based ADCs, Virtual ADCs) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

F5, Inc., Citrix Systems, Inc., A10 Networks, Inc., Radware Ltd., Barracuda Networks, Inc., Fortinet, Inc., Array Networks, Inc., Kemp Technologies (Progress), Broadcom Inc., NGINX (F5 Networks), AWS (Amazon Web Services), Microsoft Corporation, Cloudflare, Inc., Google Cloud, Imperva, Inc. |