Application Development Software Market Report Scope & Overview:

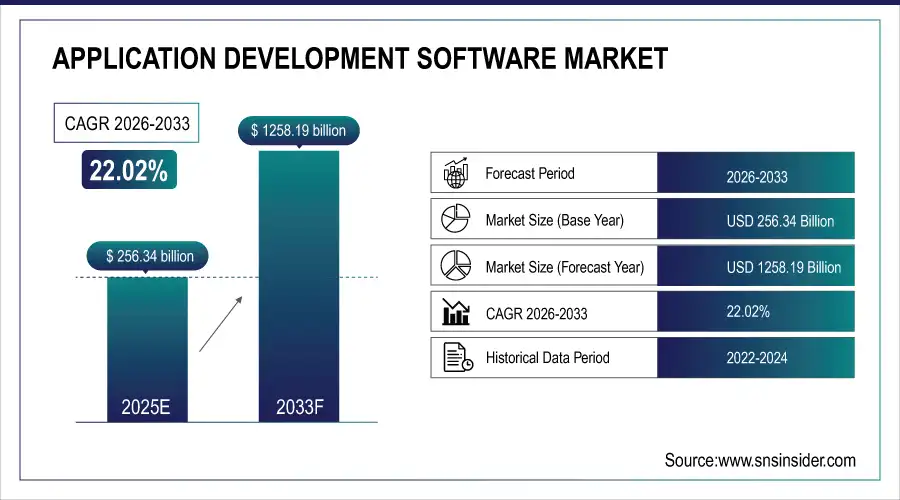

The Global Application Development Software Market size was valued at USD 256.34 Billion in 2025E. Looking ahead, the market is estimated to reach USD 1258.19 Billion by 2033, allowing for a CAGR of 22.02% between 2026-2033.

The Global Application Development Software Market is primarily driven by the increasing use of low code, no code platforms to scalable create applications associated with all sectors. Rising need for cloud-based offerings, digital transformation projects and efforts towards agile and DevOps are driving the uptake. The market is also driven by the increasing demand for mobile and web applications, scalability, and compatibility with various technologies, including AI, IoT, and analytics.

In 2024–2025, low-code and no-code platforms captured over 55% of the market, while cloud deployment contributed nearly 35%. Asia-Pacific held around 40% share, driven by digital transformation and rising demand for AI-powered, mobile-first applications.

Market Size and Forecast:

-

Market Size in 2025: USD 256.34 Billion

-

Market Size by 2033: USD 1258.19 Billion

-

CAGR: 22.02% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Application Development Software Market - Request Free Sample Report

Application Development Software Market Trends:

• The Asia Pacific was the leading region in the Application Development Software Market in 2025 due to fast-paced digital transformation, advanced IT service hubs in India and China and growing mobile-first ecosystems.

• The low-code development platforms segment was the largest with considerable adoption in the enterprises for faster app delivery and cut down on coding complexity.

• Cloud deployment dominated the cloud-delivery model preference, significantly adopted due to its scalability, cost efficiency, and the ability to integrate with existing businesses systems.

• Web and mobile applications continued to be the biggest applications markets in 2025, driven by demand for customer-facing platforms and digital services.

• Companies with more than 1,000 employees were the dominate organization type with the highest spend from scaling DevOps as well as agile development.

• SME: SMEs had explosive growth with increasing adoption of SaaS-based platforms to support faster time to market needs.

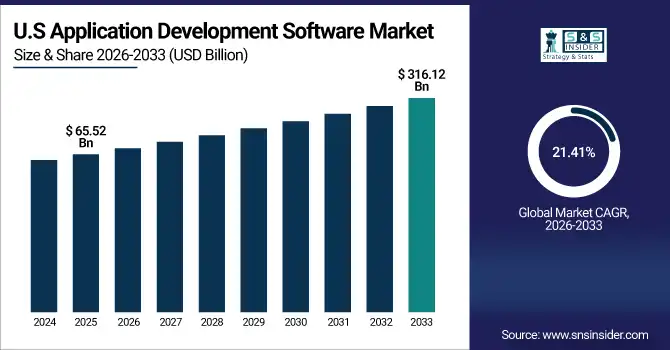

The U.S. Application Development Software Market was valued at USD 65.52 billion in 2025E and is projected to reach USD 316.12 billion by 2033, at a CAGR of 21.41%. Growth is driven by the rising adoption of low-code and no-code platforms, cloud-native tools, and agile/DevOps practices. Strong demand from BFSI, IT & telecom, healthcare, and retail further support expansion. Leading players such as Microsoft, Oracle, Salesforce, and IBM are advancing AI-powered and SaaS-based solutions, fueling innovation.

Application Development Software Market Growth Drivers:

-

Rising Adoption of Low-code and No-code Platforms, Accelerating Faster, Scalable, and Cost-effective Application Development Across Industries

The increasing trend of low-code and no-code platforms is a major factor contributing to the Application Development Software Market, as software tools help I&O leaders who lack coding skills to rapidly assemble applications. They can also lead to shorter development times, cost savings and faster prototyping for both corporates and SMEs, supporting them in driving digital transformation. Their aggregation with cloud, AI, and IoT platforms enhances their uptake among various types of industries.

-

In 2025, 70% of new business applications developed by organizations are projected to use low-code or no-code technologies, up from less than 25% in 2020.

Application Development Software Market Restraint:

-

High Implementation and Maintenance Costs, Expensive Licensing and Training Burdens Restrict Adoption Among SMEs and Startups

The high cost of implementation and maintenance has been a major challenge in the Application Development Software Market. Licensing, infrastructure, customization, and long-term services require substantial investment, which is impractically high cost for small and medium enterprises (SMEs) and startups. The cost factor impedes market penetration even though the demand for rapid and scalable application development tools is increasing.

Application Development Software Market Opportunity:

-

Surge in Low-code/No-code Platforms, Rising Citizen Development, and Growing Demand for Faster, Cost-effective Application Creation Drive New Market Opportunities

The rapid adoption wave of the low-code and no-code platforms offers the largest growth to the Application Development Software Market. These tools democratize application development enabling ‘citizen developers’ to create applications with less technical expertise. In addition to lowering costs, providing faster time-to-delivery, and enabling digital transformation, they are opening up the market for SMEs and driving innovation across an array of sectors.

-

A Mendix survey in March 2025 found 98% of enterprises use low-code platforms or tools in their development, and 84% say these platforms empower more stakeholders beyond IT to get involved.

Application Development Software Market Segmentation Analysis

-

By Type, Low-code Development Platforms was the largest segment with a market share of 52.6% in 2025 and are expected to grow at the highest CAGR of 21.30% CAGR from 2026 to 2033.

-

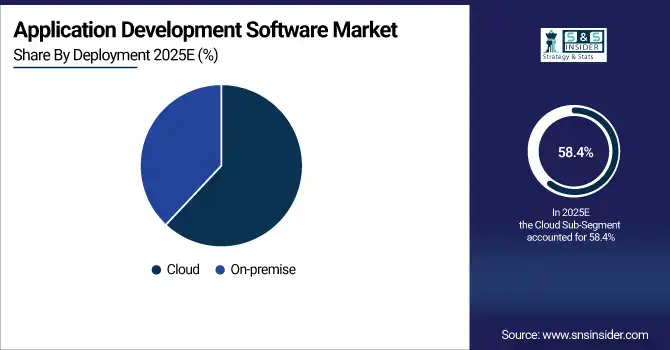

By Deployment, Cloud was the largest segment in 2025 accounting for 58.4% share whereas Hybrid deployment models may grow at a CAGR of 18.9%.

-

By Organization, Dominance of Large Enterprises The market was dominated by large enterprises with a share of 63.7% in 2025, while the SME segment is expected to exhibit high CAGR of 20.4%.

-

By Industry, IT & Telecom had the highest market share of 40.5% in 2025, and Healthcare & Life Sciences is expected to grow at the highest CAGR of 19.8%.

By Type, Low-code Development Platforms dominate market share, while No-code Development Platforms grow fastest

Low-code Development Platforms accounted for the largest share of the Application Development Software Market in 2025, as they offer faster development along with the flexibility for professional developers and enterprises for scaling. However No-code Development Platforms are expected to emerge as the fastest growing platform type due to increasing citizen development, enabling business users and growing need for cost-effective and faster application development across various industries.

By Deployment, Cloud-based solutions lead adoption, while Hybrid models expand fastest

Application Development Software Market was predominantly hosted on on-premise servers that are now being slowly replaced by cloud-based solutions, and this trend will only gain further impetus in future since organizations across the globe prefer solutions which consume less space and are available at lower costs. Hybrid deployment models, on the other hand, are gaining popularity quickly due to the necessity to balance flexibility, data security and compliance with integration of on-premise and cloud environments.

By Organization, Large Enterprises hold majority share, while SMEs rise fastest

The Big businesses dominated the Application Development Software Market due to huge investments on innovative platforms to run complex & large digital transformation projects. Conversely, SMEs are poised to grow the fastest supported by increased access to low-code/no-code tools, cloud adoption and demand for a cost-effective scalable application development platform.

By Industry, IT & Telecom drive demand, while Healthcare & Life Sciences grow fastest

Application Development Software Market to be dominated by IT & Telecom On the basis of vertical, the Application Development Software Market is segmented into BFSI, IT and Telecom, Media and Entertainment, Retail, Healthcare, Education and Others (Government, Energy and Utilities, Transportation and Logistics).IT & Telecom holds the largest market share in the Mobile and Web-based applications have significantly changed the way people and enterprises do their work and they rely on real-time access to analytics and business process to make faster and better decision.

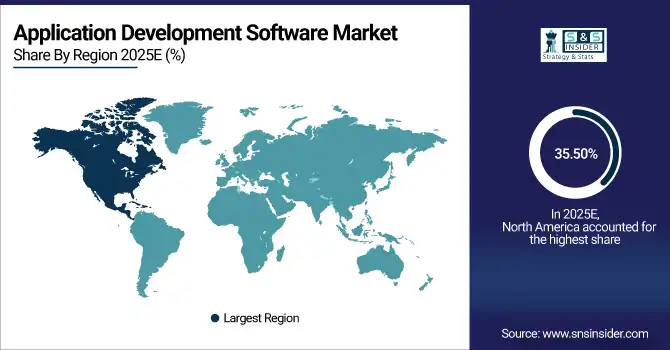

Application Development Software Market Regional Analysis

North America Application Development Software Market Insights:

The North America is the biggest area of Application Development Software, which is about 35.50%. The region is leading majorly on account of well-established IT infrastructure, early adoption of cloud platform and availability of major technology key players like Microsoft, Oracle, Salesforce, and IBM amongst others. Rising need for BFSI, healthcare, and government sector, along with increasing digital transformation, and DevOps adoption and heavy investment in AI and low-code/no-code platform contribute to North America’s dominance in the worldwide market.

Get Customized Report as per Your Business Requirement - Enquiry Now

US Application Development Software Market Insights:

The US is the leading market for the Application Development Software, which is encouraged by the presence of key technology giants such as Microsoft, Oracle, IBM, and Salesforce in this region. Market growth is propelled by strong R&D, high digital adoption and heavy investment in low-code/no-code. Demand driven by BFSI, healthcare, and government sectors in the country, and cloud adoption, regulatory compliance, and innovation in AI and DevOps practices make the US the largest Application Development Software innovation and commercialization hub."

Asia-Pacific Application Development Software Market Insights:

Asia-Pacific is the fastest growing region with 22.69% CAGR of Application Development Software, and the proportion of Application Development Software is and the proportion may be reach. The growth in the region’s market is fueled by widespread digital transformation which is underway in countries such as China, India, Japan, and South Korea as well as strong government initiatives on cloud adoption and IT modernization. Growth: More SMEs joining, demand for mobile-first solutions and cost efficiencies of development outsourcing drive continued growth. The region’s proximity to emerging tech hubs, growing AI and IoT embeddedness, and high levels of smartphone penetration will make the Asia Pacific a critical region for application development growth.

China Application Development Software Market Insights:

China emerges as the largest market for Application Development Software in the APEJ The dominance of China is fueled by the country’s massive digital ecosystem, Government’s strong backing for IT innovation, and the nation’s pole position in the race for cloud dominance. The burgeoning of e-commerce, fintech, mobile apps and more means there's a ton of demand for development platforms.

Europe Application Development Software Market Insights:

European Application Development Software Market As per the market study, European Application Development Software Market is projected to expand predominantly across Germany, the UK, France and other countries with the increasingly advanced IT infrastructure along with stringent data protection laws including GDPR propelling the need for secure software solutions. BFSI, healthcare and public service digitalization programs by the government are driving the region.

Germany Application Development Software Market Insights:

The EU Application Development Software Market has been particularly dominated by Germany thanks to its powerful base in advanced Manufacturing, strong engineering excellence and highly digital Economy. Automotive, industrial, and enterprise verticals drive adoption with demand for bespoke applications and automation. Government efforts to promote digital transformation, Industry 4.0, and sustainability perpetuate demand.

Middle East & Africa (MEA) and Latin America Application Development Software Market Insights:

The MEA Application Development Software is rising at a steady pace, mainly supported by government-led digital transformation initiatives and smart city programs in the UAE and Saudi Arabia. Increased spending across cloud infrastructure, fintech, and healthcare applications also are boosting growth. “Latin America is also growing with Brazil and Mexico leading the adoption fueled by the growing penetration of mobile, rise in digital commerce and the strong need for affordable low-code/no-code,” he added.

Competitive Landscape Application Development Software Market Insights:

Microsoft controls the application development software space with its Power Apps low-code platform and Azure cloud services. Integrated with Office 365 and Dynamics 365, it enables large enterprises and SME’s to quickly build, deploy and scale apps. Powerful developer tools such as Visual Studio and GitHub increasingly enhance that ecosystem, and Microsoft leads the world as a citizen developer platform.

-

In May 2025, Microsoft announced that up to 30% of its code is now being generated by AI for some internal projects, underscoring how AI is deeply integrated into its software development lifecycle.

Oracle's low-code platform Oracle APEX and the Java ecosystem form part of Oracle’s application development software market presence, as also does Oracle Cloud Infrastructure (OCI). Its products help businesses to transform legacy systems, embed analytics, and create secure, data-driven applications. With its strong database connectivity and enterprise-level security, Oracle makes it easy to go mission-critical across any sector, further solidifying its hold on enterprise-level app development.

-

In September 2024, Oracle released Java 23, which includes productivity enhancements like preview features for pattern matching, module import simplification, and generational mode ZGC, aiding developer efficiency.

IBM extends its application dev position on IBM Cloud Rak for Applications, Red Hat OpenShift, and AI-infused solutions including Watson. Its solutions are in both hybrid and multi-cloud, which help organizations to modernize applications, microservices, and DevOps. With deep investment in enterprise transformation, IBM delivers to regulated industries and is a preferred partner for large-scale application development.

-

In May 2025, IBM launched new hybrid AI capabilities enabling enterprises to build and deploy AI agents using watsonx data, support for regulated environments, and improved ROI for AI through hybrid cloud integration.

Application Development Software Market Key Players:

Some of the Application Development Software Market Companies are:

-

Microsoft

-

Oracle

-

IBM

-

Salesforce

-

SAP

-

Adobe

-

ServiceNow

-

Holloware

-

Unqork

-

SmartBear

-

Netguru

-

TCS (Tata Consultancy Services)

-

Intellectsoft

-

Deloitte Digital

-

Approbation

-

ScienceSoft

-

LeewayHertz

-

Citrix Systems

-

Mendix

-

OutSystems

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 256.34 Billion |

| Market Size by 2033 | USD 1258.19 Billion |

| CAGR | CAGR of 22.02 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type(Low-code Development Platforms and No-code Development Platforms) •Deployment (Cloud and On-premise) •Organization (Large Enterprises and Small & Mid-sized Enterprises (SMEs)) •Industry (BFSI, IT & Telecom, Healthcare & Life Sciences, Retail & Consumer Goods, Government & Public Sector, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft, Oracle, IBM, Salesforce, SAP, Adobe, ServiceNow, Holloware, Unqork, SmartBear, Netguru, TCS (Tata Consultancy Services), Intellectsoft, Deloitte Digital, Approbation, ScienceSoft, LeewayHertz, Citrix Systems, Mendix, OutSystems. |