Application Modernization Services Market Report Scope & Overview:

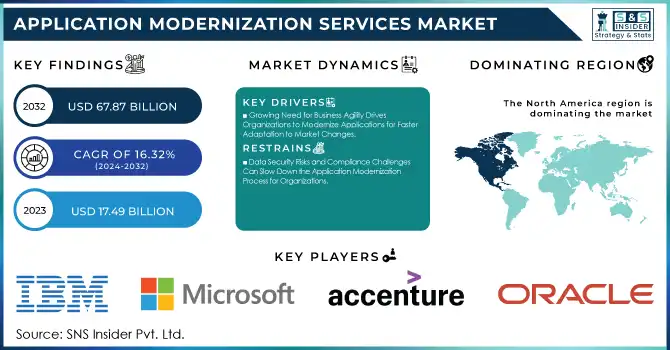

The Application Modernization Services Market was valued at USD 20.34 billion in 2024 and is expected to reach USD 67.18 billion by 2032, growing at a CAGR of 16.32% from 2025-2032.

The Application Modernization Services Market has been experiencing rapid expansion as businesses face mounting pressure to update and optimize their legacy systems. As companies increasingly depend on cloud computing and digital transformation, they acknowledge the necessity of updating their legacy applications to provide enhanced scalability, performance, and security. Microsoft Azure is the leading cloud platform for application modernization services, with AWS and Google Cloud trailing behind. This advancement toward modernization has led to a growing need for services that facilitate the shift from on-premise systems to more flexible, cloud-based environments. For example, in November 2024, Kyndryl and Microsoft launched new services to update mainframe applications for businesses leveraging Microsoft Cloud. As digital disruption keeps speeding up, companies are seeking effective solutions to satisfy the needs of a more competitive market.

With organizations in industries such as banking, retail, and manufacturing focusing on innovation, the need for application modernization services has increased significantly. Outdated applications frequently obstruct the integration of emerging technologies such as artificial intelligence, machine learning, and advanced data analytics, rendering modernization essential for maintaining competitiveness. In January 2025, Accenture purchased Percipient’s digital twin technology to improve its essential banking modernization services, underscoring the growing incorporation of advanced solutions. The necessity to optimize operations and enhance customer experiences is compelling companies to spend on services that update their outdated systems.

Get more information on Application Modernization Services Market - Request Free Sample Report

Application Modernization Services Market Size and Forecast:

-

Market Size in 2024: USD 20.34 Billion

-

Market Size by 2032: USD 68.18 Billion

-

CAGR: 16.32% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Application Modernization Services Market Highlights:

-

Adoption of microservices, automation, hybrid, and multi-cloud environments is driving transformation in application modernization.

-

AI, ML, and IoT integration into legacy systems fuels the demand for modernization services.

-

Organizations modernize applications to enhance business agility and rapidly respond to market changes.

-

Data security and compliance challenges (e.g., GDPR, HIPAA) can slow modernization efforts.

-

High initial costs for technology upgrades, consulting, and workforce training may deter businesses.

-

Opportunities exist for providers enabling secure, efficient, and technology-integrated modernization.

Looking toward the future, the Application modernization is set for transformation with the rise of microservices and automation tools. As an increasing number of organizations embrace hybrid and multi-cloud setups, the need for modernization services that aid these infrastructures will expand. In December 2024, MongoDB broadened its AI Applications Program by collaborating with Capgemini, IBM, and others to merge AI solutions with company data, emphasizing AI’s growing importance in modernization. Moreover, the incorporation of blockchain, edge computing, and IoT into traditional systems will stimulate market innovation even more. This change offers considerable prospects for service providers able to assist businesses in navigating the intricacies of modernization while facilitating enduring digital transformation.

Application Modernization Services Market Drivers:

-

Growing Need for Business Agility Drives Organizations to Modernize Applications for Faster Adaptation to Market Changes.

As organizations face growing pressures to respond quickly to market changes and customer demands, the need for efficient, flexible, and scalable systems has become critical. Legacy applications often hinder these objectives due to their rigidity, slow adaptation to new technologies, and high maintenance costs. To remain competitive, businesses are turning to modernized applications that offer enhanced agility, allowing them to rapidly adjust to evolving business environments. This shift empowers companies to streamline operations, introduce new features faster, and respond to market opportunities more effectively. As digital transformation accelerates, the ability to continuously evolve business applications ensures sustained growth, innovation, and improved customer satisfaction. The growing emphasis on business agility is, therefore, a significant motivator for organizations to invest in application modernization services.

-

Emerging Technologies Like AI, ML, and IoT Drive the Need for Modernizing Legacy Applications to Stay Competitive.

Technological innovations such as artificial intelligence, machine learning, and the Internet of Things are rapidly transforming industries by enabling smarter, more efficient systems. However, legacy applications are often not equipped to harness the potential of these emerging technologies fully. Organizations must modernize their applications to integrate AI and ML algorithms or support IoT devices to ensure compatibility and optimal performance. Modernization enables businesses to leverage real-time data analysis, predictive insights, and automated processes, which are essential for staying competitive. Moreover, as new technologies continue to evolve, businesses need flexible, scalable solutions that can quickly adapt to future advancements. The need to integrate and optimize these technologies is a key driver for the growth of application modernization services in today's rapidly evolving digital landscape.

Application Modernization Services Market Restraints:

-

Data Security Risks and Compliance Challenges Can Slow Down the Application Modernization Process for Organizations

Modernizing legacy applications often requires significant changes to how data is managed and secured, which introduces potential risks. As businesses move to integrate advanced technologies and new architectures, maintaining robust security standards becomes a complex challenge. With increased data flow and exposure, organizations face higher chances of data breaches, especially when legacy security protocols are not compatible with modernized systems. Additionally, compliance with industry regulations, such as GDPR or HIPAA, must be carefully managed during the transition. Any missteps in ensuring that new systems meet security requirements can lead to costly penalties or reputational damage. As a result, concerns over data security and maintaining regulatory compliance can slow the pace of application modernization, especially for organizations dealing with sensitive or highly regulated data. Addressing these security challenges is critical to the success of modernization initiatives.

-

High Initial Costs of Modernizing Legacy Applications Can Deter Businesses from Undertaking Modernization Projects

Modernizing legacy applications requires significant upfront investment, including costs related to technology upgrades, consulting services, and skilled workforce training. For many organizations, especially smaller businesses or those with limited budgets, the financial burden of these expenses can be a major obstacle. These high initial costs may cause some companies to delay or forgo modernization efforts, as they may perceive the immediate financial strain to outweigh the long-term benefits. Moreover, the uncertainty of achieving a quick return on investment can make decision-makers hesitant to commit. While modernization can lead to improved efficiency and lower maintenance costs over time, the initial expenditure remains a critical concern for many organizations. As a result, some businesses may continue to rely on outdated systems, despite the growing need for modernization.

Application Modernization Services Market Segment Analysis:

By Application Type

In 2024, the Legacy Applications segment dominated the Application Modernization Services Market with the highest revenue share of approximately 45%. This dominance is largely attributed to the extensive reliance on outdated systems across industries, which continue to incur high maintenance costs and hinder business agility. Many organizations are prioritizing the modernization of legacy applications to address inefficiencies, improve security, and align with newer technologies, thus driving a strong demand for application modernization services.

The Cloud-Native Applications segment is expected to grow at the fastest CAGR of around 18.00% from 2025 to 2032. This growth is fueled by the increasing adoption of cloud technologies, offering businesses the scalability, flexibility, and cost efficiency needed to stay competitive in an evolving digital landscape. As more organizations shift their operations to the cloud, the demand for cloud-native applications that are optimized for cloud environments is expected to surge, further propelling this segment's rapid expansion.

By Service Type

In 2024, the Application Re-Platforming segment dominated the Application Modernization Services Market, capturing the highest revenue share of approximately 28%. This leadership is primarily driven by businesses seeking a cost-effective solution to modernize their legacy systems without undergoing a complete overhaul. Re-platforming enables companies to transition applications to more flexible, scalable platforms, such as the cloud, enhancing performance while maintaining continuity. This approach strikes a balance between modernization and cost efficiency, making it highly attractive for organizations aiming to improve their IT infrastructure with minimal disruption.

The Cloud Application Migration segment is projected to grow at the fastest CAGR of about 18.22% from 2025 to 2032. This growth is fueled by the accelerating shift of businesses towards cloud environments to capitalize on enhanced scalability, security, and operational efficiency. As organizations seek to move their applications and workloads to the cloud to better align with digital transformation goals, cloud application migration services are expected to see robust demand, offering businesses a streamlined path to leverage cloud technologies for growth and innovation.

By Deployment

In 2024, the Public Cloud segment dominated the Application Modernization Services Market, holding the largest revenue share of approximately 49%. This dominance can be attributed to the widespread adoption of public cloud platforms by businesses seeking scalable, flexible, and cost-efficient solutions for application modernization. Public cloud services provide easy access to cutting-edge technologies, enhanced security, and faster deployment, making them the preferred choice for organizations looking to streamline their digital transformation and optimize their IT infrastructure.

The Hybrid Cloud segment is expected to grow at the fastest CAGR of about 18.70% from 2025 to 2032. This rapid growth is driven by the increasing demand for a blend of public and private cloud environments, allowing businesses to maintain control over sensitive data while taking advantage of the scalability and cost benefits of the public cloud. The hybrid approach offers greater flexibility, making it an ideal solution for organizations aiming to balance performance, security, and compliance needs in their modernization efforts.

Application Modernization Services Market Regional Analysis:

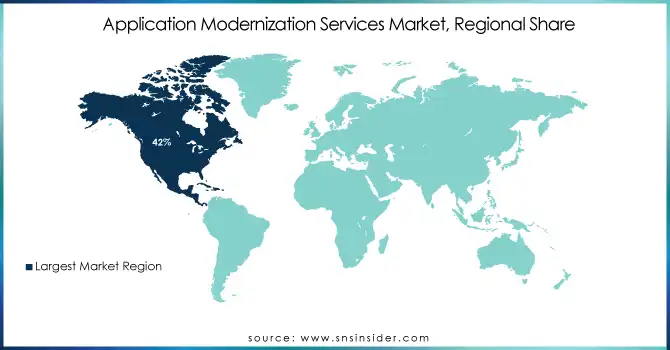

North America Application Modernization Services Market Trends:

In 2024, North America dominated the Application Modernization Services Market, accounting for the highest revenue share of approximately 42%. This market leadership is driven by the region's advanced technological infrastructure, high levels of digital transformation, and widespread adoption of cloud and AI technologies. Organizations in North America are increasingly modernizing legacy systems to enhance operational efficiency, improve security, and stay competitive in a rapidly evolving business landscape, positioning the region as a key driver of market growth.

Asia-Pacific Application Modernization Services Market Trends:

Asia Pacific is expected to experience the fastest CAGR of about 18.15% from 2025 to 2032. This rapid growth is fueled by the region's expanding digital economy, increasing investments in IT modernization, and a surge in cloud adoption. As businesses across Asia Pacific embrace digital transformation to streamline operations and drive innovation, the demand for application modernization services is set to rise, particularly in emerging markets where modernization is seen as a key strategy for achieving sustainable growth.

Europe Application Modernization Services Market Trends:

In 2024, Europe held a significant share of the Application Modernization Services Market, supported by strong regulatory frameworks, growing cloud adoption, and increasing emphasis on cybersecurity and compliance. Enterprises across industries are modernizing their IT systems to align with EU data protection standards and sustainability goals. The presence of advanced economies like Germany, the UK, and France, coupled with ongoing investments in AI, automation, and hybrid cloud, is driving steady growth in the region.

Latin America Application Modernization Services Market Trends:

Latin America is projected to witness steady growth in the Application Modernization Services Market during 2025–2032. Factors such as the growing adoption of digital banking, expansion of e-commerce, and rising government initiatives for digital transformation are fueling modernization efforts. Brazil and Mexico are at the forefront, with increasing demand for cloud migration and agile application development. However, budget constraints among SMEs may slow down adoption, though partnerships with global technology providers are expected to accelerate market growth.

Middle East & Africa Application Modernization Services Market Trends:

The Middle East & Africa region is anticipated to grow moderately in the Application Modernization Services Market, driven by smart city initiatives, rapid adoption of cloud infrastructure, and the rising importance of cybersecurity. Countries like the UAE and Saudi Arabia are leading digital transformation projects under national visions (such as Saudi Vision 2030), while South Africa is experiencing growing demand from financial services and telecom sectors. Although challenges such as limited skilled IT workforce exist, increasing investments from multinational tech providers are likely to support the region’s market expansion.

Need any customization research on Application Modernization Services Market - Enquiry Now

Application Modernization Services Market Key Players:

-

Oracle (Cloud Infrastructure, Java Application Development)

-

IBM (IBM Cloud, IBM Watson)

-

Microsoft (Azure, Power BI)

-

HCL Technologies (HCL CloudSmart, HCL Digital Transformation)

-

Accenture (Accenture Cloud Platform, Accenture myNav)

-

ATOS SE (Atos Digital Workplace, Atos Cloud Services)

-

Capgemini (Capgemini Cloud Services, Capgemini Smart Enterprise)

-

Cognizant (Cognizant Cloud, Cognizant Digital Engineering)

-

Tata Consultancy Services (TCS Cloud, TCS iON)

-

Aspire Systems (Aspire Digital Transformation, Aspire Cloud Solutions)

-

NTT Data Group Corporation (NTT Data Cloud, NTT Data Digital Transformation)

-

Infosys (Infosys Cloud, Infosys Cobalt)

-

Dell Technologies (Dell VxRail, Dell PowerEdge)

-

Innova Solutions (Innova Cloud Services, Innova Digital Transformation)

-

Epam Systems (EPAM Cloud, EPAM Digital Transformation)

-

DXC Technology (DXC Cloud, DXC Modernization Services)

-

MongoDB (MongoDB Atlas, MongoDB Enterprise)

-

LTIMindtree (LTM Cloud, LTM Digital Transformation)

-

Wipro (Wipro FullStride Cloud, Wipro Digital)

-

Rocket Software (Rocket Modernization, Rocket Cloud)

-

Fujitsu (Fujitsu Cloud, Fujitsu Digital Transformation)

-

Hexaware Technologies (Hexaware Cloud, Hexaware Digital Engineering)

-

Virtusa (Virtusa Cloud, Virtusa Digital Transformation)

-

Softura (Softura Cloud, Softura Digital Transformation)

-

CloudHedge (CloudHedge Modernization, CloudHedge Migration)

-

D3V Technology (D3V Cloud Solutions, D3V Digital Transformation)

-

Bayshore Intelligence (Bayshore Cloud, Bayshore Analytics)

-

Opinov8 (Opinov8 Cloud, Opinov8 Digital Transformation)

-

Icreon (Icreon Digital, Icreon Cloud)

-

Symphony Solutions (Symphony Cloud, Symphony Digital Transformation)

-

Cleveroad (Cleveroad Cloud, Cleveroad Digital Solutions)

-

Soft Suave (Soft Suave Cloud, Soft Suave Modernization)

-

Geomotiv (Geomotiv Cloud, Geomotiv Digital Transformation)

-

PalmDigitalz (PalmDigitalz Cloud, PalmDigitalz Digital Transformation)

-

AveriSource (AveriSource Cloud, AveriSource Digital Services)

Application Modernization Services Market Competitive Landscape:

Oracle Corporation Founded in 1977, Oracle Corporation is a global leader in enterprise software, cloud solutions, and database management systems. Headquartered in Austin, Texas, it offers a broad portfolio including ERP, HCM, and AI-driven analytics. With a strong presence across industries, Oracle empowers organizations to modernize IT infrastructure, enhance efficiency, and drive digital transformation worldwide.

Google Cloud Established in 2008 as part of Google LLC, Google Cloud provides advanced cloud computing, AI, data analytics, and application modernization services. Headquartered in Mountain View, California, it delivers scalable infrastructure, machine learning, and productivity tools through platforms like Google Cloud Platform and Workspace. Google Cloud supports enterprises globally in accelerating innovation, agility, and secure digital transformation.

-

In June 2024, Oracle and Google Cloud announced a groundbreaking multicloud partnership, combining Oracle Cloud Infrastructure with Google Cloud to simplify cloud migrations and deployments.

Cloud4C Founded in 2014, is a global cloud-managed services provider specializing in application modernization, migration, and automation. Headquartered in Singapore, it operates in over 26 countries with 25 Centers of Excellence. As a certified Oracle Partner, Cloud4C delivers Oracle Applications-as-a-Service, including ERP, Fusion, and database modernization, leveraging OCI. Its Self-Healing Operations Platform (SHOP) ensures automation, security, compliance, and single-SLA management from infrastructure to application login, supporting 4,000+ enterprises, including Fortune 500 companies.

-

In 2024, Cloud4C detailed Oracle Application Management Services on Oracle Cloud Infrastructure (OCI), focusing on its role in simplifying cloud management, enhancing performance, and supporting application modernization. The services aim to optimize Oracle applications with features like automated patching, monitoring, and 24/7 support.

IBM (International Business Machines Corporation) Founded in 1911 as the Computing-Tabulating-Recording Company, IBM is a global leader in technology and consulting based in Armonk, New York. Specializing in AI, hybrid cloud, quantum computing, software, infrastructure, and IT services, it helps enterprises modernize, secure, and scale their operations. IBM serves clients across industries worldwide, with strong emphasis on research, innovation, and sustainability.

-

In January 2024, IBM announced its acquisition of application modernization capabilities from Advanced, focusing on mainframe application and data modernization. This acquisition aims to enhance IBM Consulting’s services, supporting clients’ hybrid cloud strategies with AI-powered tools like Watsonx Code Assistant for Z to streamline mainframe transformation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 20.34 Billion |

| Market Size by 2032 | USD 68.18 Billion |

| CAGR | CAGR of 16.32% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Application Portfolio Assessment, Cloud Application Migration, Application Re-Platforming, Application Integration, UI/UX Modernization, Post-Modernization Services) • By Application Type (Legacy Applications, Cloud-Hosted Applications, Cloud-Native Applications) • By Industry Vertical (BFSI, Retail & E-commerce, Manufacturing, IT & Telecommunication, Energy and Utilities, Healthcare & Life Sciences, Other) • By Deployment (Public Cloud, Private Cloud, Hybrid Cloud) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle, IBM, Microsoft, HCL Technologies, Accenture, ATOS SE, Capgemini, Cognizant, Tata Consultancy Services, Aspire Systems, NTT Data Group Corporation, Infosys, Dell Technologies, Innova Solutions, Epam Systems, DXC Technology, MongoDB, LTIMindtree, Wipro, Rocket Software, Fujitsu, Hexaware Technologies, Virtusa, Softura, CloudHedge, D3V Technology, Bayshore Intelligence, Opinov8, Icreon, Symphony Solutions, Cleveroad, Soft Suave, TechAhead, Geomotiv, PalmDigitalz, AveriSource. |