Architectural Lighting Market Size & Trends:

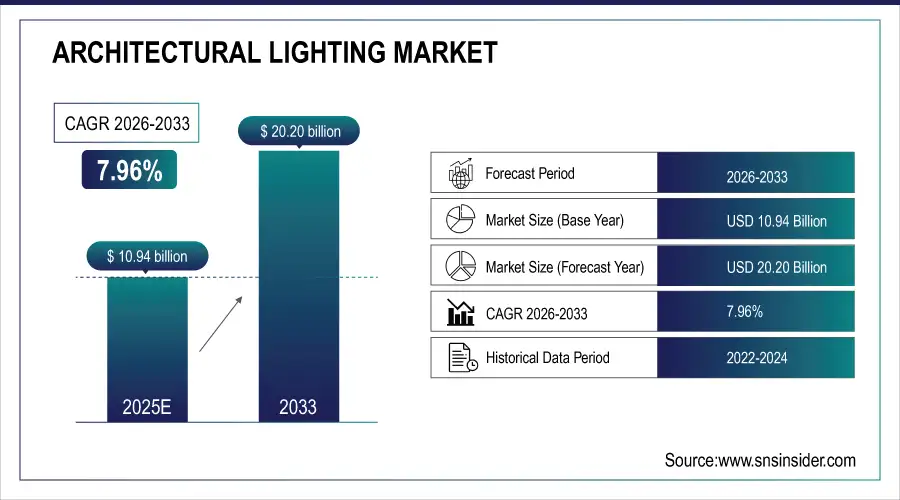

The Architectural Lighting Market Size is estimated at USD 10.94 Billion in 2025E and is expected to reach USD 20.20 Billion by 2033 and grow at a CAGR of 7.96% over 2026-2033.

The Architectural Lighting Market analysis report provides a gives a full coverage of lighting parts, sources, uses, and trends in how people use them in homes, businesses, and factories. Architectural lighting is all about improving the look, usefulness, safety, and energy efficiency of buildings by using integrated lighting systems. During the forecast period, the market is predicted to increase because more people are moving to cities, more smart buildings are being built, energy-efficiency rules are being stricter, and more people are asking for lighting designs that are beautiful and good for people.

Architectural lighting systems are deployed across over 14 million commercial and residential buildings globally by 2025, driven by infrastructure development, renovation projects, and rapid penetration of LED and smart lighting technologies.

Market Size and Growth Projection:

-

Market Size in 2025: USD 10.94 Billion

-

Market Size by 2033: USD 20.20 Billion

-

CAGR: 7.96% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Architectural Lighting Market - Request Free Sample Report

Architectural Lighting Market Trends:

-

Transition to LED-based architectural lighting is accelerating, with LEDs representing over 65% of new installations across indoor and outdoor applications.

-

Adoption of smart lighting integrated with IoT and building management systems is increasing, delivering 30–50% energy savings.

-

Rising focus on human-centric lighting is driving demand for tunable and color-changing solutions, growing at over 12% annually in commercial and healthcare spaces.

-

Growth of green buildings and sustainable architecture is boosting adoption of low-energy lighting, with over 70% of new commercial buildings using energy-efficient systems.

-

Investments in smart cities, urban infrastructure, and façade lighting are supporting strong growth in outdoor architectural lighting demand.

-

Emphasis on aesthetic and experiential lighting in retail and hospitality is reinforcing market expansion, with around 40% of premium retail spaces adopting customized lighting solutions.

U.S. Architectural Lighting Market Insights:

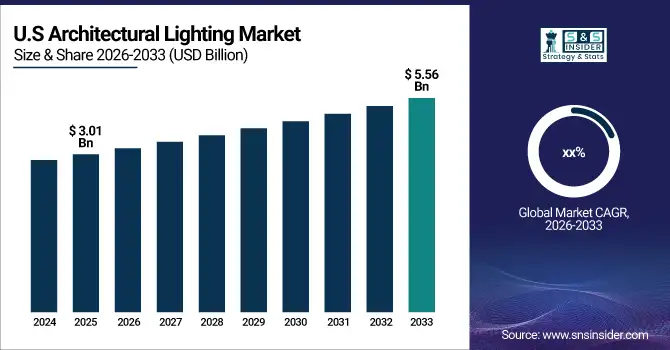

The U.S. Architectural Lighting Market size is projected to grow from USD 3.01 Billion in 2025E to reach USD 5.56 Billion by 2033. High levels of renovation work, strong rules about energy economy, the use of smart lighting technology, and a growing need for high-end lighting solutions in commercial buildings, retail spaces, and residential constructions are all driving growth.

Architectural Lighting Market Growth Drivers:

- Rising Urbanization and Infrastructure Development Accelerating Market Growth

The expansion of the Architectural Lighting Market is mostly due to more people moving to cities and building more infrastructure. More and more business complexes, residential buildings, public infrastructure, and mixed-use developments are being built, which is driving up the need for integrated lighting solutions that look good and work well. Architectural lighting helps with energy efficiency goals while also improving safety, visual comfort, and spatial perception. More and more, governments and commercial developers are using modern lighting schemes in their plans for cities. This keeps the industry strong.

Global urban construction spending surpassed USD 4.5 trillion in 2024, with architectural lighting accounting for a growing share of interior and exterior building systems.

Architectural Lighting Market Restraints:

- High Initial Costs and Design Complexity Limiting Adoption

High starting prices and complicated designs are big problems for the Architectural Lighting Market growth. High-end architectural lighting systems frequently need specialized designs, high-quality parts, and professional installation, which raises the expense of getting started. Adding smart controls and building automation systems makes things even more complicated. These things can make it hard for people to use it in homes and small businesses that are sensitive to costs, which slows down the process even though it will save money on energy in the long run.

Installation and design costs account for 25–35% of total architectural lighting project expenditure, impacting affordability in emerging markets.

Architectural Lighting Market Opportunities:

- Growing Adoption of Smart Buildings and Energy-Efficient Lighting Solutions

The Architectural Lighting Market has a lot of opportunities to grow as smart buildings become more popular. Smart lighting solutions let you manage the lights automatically, save energy, change the lighting sceneries, and work with HVAC and security systems. Building owners are putting more and more emphasis on sustainability, comfort for tenants, and operational efficiency. This is driving up the need for smart architectural lighting solutions. This development gives manufacturers a chance to incorporate more software-enabled products and services that provide value.

Smart lighting installations are expected to represent over 38% of new architectural lighting projects by 2026.

Architectural Lighting Market Segmentation Analysis:

-

By Component, Lamps held the largest market share of 34.12% in 2025, while Lenses/Shades are expected to grow at the fastest CAGR of 9.04% during 2026–2033.

-

By Source, Light-Emitting Diode (LED) dominated the market with a 58.46% share in 2025, while HID lighting is projected to decline, and LED continues to grow at a CAGR of 9.21% during the forecast period.

-

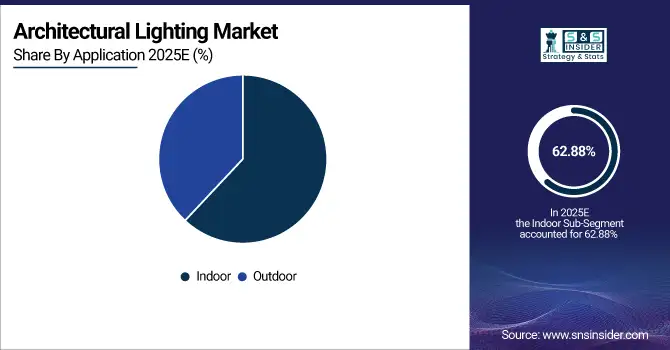

By Application, Indoor lighting accounted for 62.88% of the market in 2025, while Outdoor lighting is expected to grow at a faster CAGR of 8.74% through 2033.

-

By End-Use, Commercial segment dominated with a 44.96% share in 2025, while Residential is projected to expand at the fastest CAGR of 8.63% during 2026–2033.

By Application, Indoor Dominates While Outdoor Expands Rapidly

The Indoor segment dominated the market owing to the extensive use in offices, retail spaces, hospitality venues, healthcare facilities, and residential interiors. Indoor architectural lighting enhances productivity, ambiance, and occupant well-being. Over 11 million indoor spaces adopted architectural lighting solutions in 2025.

Outdoor architectural lighting is expected to be the fastest-growing segment, driven by façade lighting, landscape illumination, smart city projects, and public infrastructure development. Approximately 4.2 million outdoor projects deployed architectural lighting systems in 2025.

By Component, Lamps Dominate While Lenses/Shades Expand Rapidly

The Lamps segment dominated the market owing to the high replacement demand, widespread LED adoption, and continuous innovation in form factors and efficiency. Lamps are critical for achieving desired illumination levels, color rendering, and energy savings across architectural projects. Over 9.8 million buildings utilized architectural-grade lamps in 2025.

Lenses/Shades are the fastest-growing segment due to the high demand for glare control, aesthetic customization, and light distribution optimization. In 2025, over 3.6 million projects incorporated specialized lenses and shades to enhance visual comfort and architectural appeal.

By Source, LED Dominates While Conventional Sources Decline

LED lighting segment dominated the market as it offers superior energy efficiency, longer lifespan, design flexibility, and smart control compatibility. Over 70% of new architectural installations adopted LED solutions in 2025, replacing incandescent and fluorescent systems.

Incandescent and Fluorescent lights segment continue to decline due to regulatory restrictions and efficiency limitations. HID lighting maintains niche demand in high-output outdoor and industrial applications but faces gradual replacement by high-power LED systems.

By End-Use, Commercial Dominates While Residential Expands Rapidly

The Commercial segment dominated due to high spending on premium lighting designs in offices, retail chains, hotels, and entertainment venues. Commercial users prioritize branding, visual impact, and energy efficiency, driving demand for advanced architectural lighting systems.

Residential segment is the fastest-growing, supported by rising disposable incomes, home renovation trends, and adoption of smart home lighting solutions. In 2025, residential projects accounted for over 6.5 million architectural lighting installations globally.

Asia Pacific Architectural Lighting Market Insights:

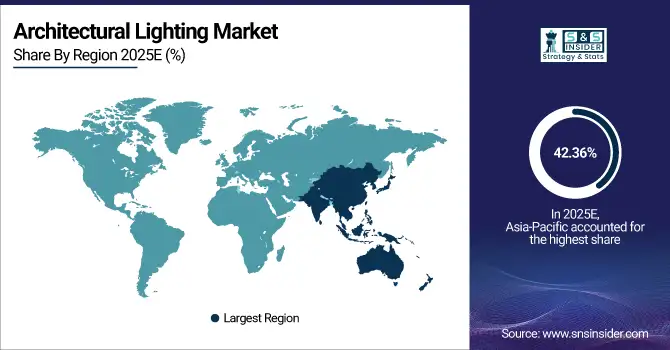

Asia Pacific dominated the Architectural Lighting Market, accounting for 42.36% of global market share in 2025. Rapid urbanization, big infrastructure projects, smart city programs, and robust residential and commercial building in both emerging and developed economies are all driving growth. Asia-Pacific is still the biggest regional market because more people are using LED-based solutions, the government is requiring energy efficiency, and commercial real estate is growing.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Architectural Lighting Market Insights:

China is the largest contributor in Asia Pacific, representing over 48% of regional demand. Huge expenditures in smart cities, commercial construction, and urban infrastructure are helping the market grow. The widespread use of LED and smart lighting systems, together with rigorous government rules that encourage energy-efficient and green buildings, is still driving adoption in commercial buildings, public infrastructure, and urban areas.

North America Architectural Lighting Market Insights:

North America is the fastest-growing region, projected to expand at a CAGR of 8.44% during the forecast period. Renovating old buildings, using smart buildings more widely, and strict rules about energy efficiency are all things that help growth. Strong growth in the region is supported by the growing demand for lighting solutions that are linked, human-centered, and adaptable in commercial and institutional buildings.

U.S. Architectural Lighting Market Insights:

The U.S. dominates the North American market, contributing approximately 71% of regional revenue. Modernizing commercial buildings, using smart offices, and a high demand for energy-efficient lighting retrofits are all things that help the business grow. IoT-enabled lighting controls and compliance with LEED and energy requirements are becoming more common, which is helping the market grow faster in the commercial, healthcare, and hospitality sectors.

Europe Architectural Lighting Market Insights:

Europe has a large part of the global architectural lighting market due to the rules about sustainability, green building certifications, and high standards for architecture. There is a strong demand for high-end and design-focused lighting solutions in businesses, cultural institutions, and public infrastructure. This constant expansion is supported by EU-wide rules on energy efficiency.

Germany Architectural Lighting Market Insights:

Germany is a leading contributor in Europe, accounting for nearly 26% of regional demand. Green building projects, updating infrastructure, and the widespread use of energy-efficient LED lighting are all helping the market grow. Architectural lighting is becoming more common in public spaces, transportation hubs, and commercial buildings. This is because the EU has severe rules about energy efficiency and sustainability that must be followed.

Latin America Architectural Lighting Market Insights:

Latin American market is growing steadily, due to more urban expansion, commercial construction, and upgrades to public infrastructure. The use of LED lighting systems is growing since they save money and energy. This is helping them reach more people in big cities.

Brazil Architectural Lighting Market Insights:

Brazil is the largest market in Latin America, holding approximately 37% of regional share. Urban redevelopment projects, the growth of commercial real estate, and the renovation of public infrastructure all help growth. As more and more people use LED architectural lighting for façades, streetscapes, and commercial buildings, demand stays strong in large cities.

Middle East & Africa Architectural Lighting Market Insights:

Large business ventures, tourism infrastructure projects, and smart city efforts are all helping the Middle East and Africa market grow gradually. High demand for high-end architectural and outdoor lighting, especially in public places and urban monuments, continues to drive growth in the region.

Saudi Arabia Architectural Lighting Market Insights:

Saudi Arabia leads the Middle East & Africa region, contributing nearly 32% of regional revenue. Vision 2030 megaprojects, the growth of commercial and hospitality infrastructure, and the increased demand for high-end façade and landscape lighting are all factors that are driving growth. More and more people are using LED and smart lighting solutions, which helps the market keep growing in big cities.

Architectural Lighting Market Competitive Landscape:

Philips Lighting (Signify), founded in 1891 and based in Eindhoven, the Netherlands, is a world leader in professional, consumer, and networked LED lighting products. The company makes smart, energy-efficient, and IoT-enabled lighting systems for homes, businesses, and factories. They put a lot of emphasis on sustainability and digital lighting platforms.

-

In June 2023, Signify expanded its Interact smart lighting portfolio with advanced cloud-based controls and data-driven lighting management solutions.

Osram, founded in 1919 and based in Munich, Germany, is a well-known lighting and photonics company that focuses on LED, automotive, industrial, and specialized lighting solutions. The company is a leader in architectural, smart, and human-centered lighting, due to cutting-edge optical and semiconductor technologies that are used in many different industries.

-

In August 2023, Osram enhanced its LED portfolio with high-efficiency architectural lighting components targeting commercial and smart building applications.

GE Lighting, started in the U.S. in 1911 and is now part of Savant Systems. It specializes on new LED and smart home lighting solutions. The company is noted for its lighting products that focus on the needs of consumers, such as connected bulbs, fixtures, and smart lighting controllers that work with home automation systems.

-

In April 2023, GE Lighting expanded its Cync smart lighting range with improved app-based controls and broader compatibility with major smart home platforms.

Acuity Brands, based in Atlanta, Georgia, and founded in 1892, is one of the top companies that offers lighting and building control systems. The company sells high-tech LED lights, controllers, and IoT-enabled solutions for businesses, factories, and institutions. It focuses on smart infrastructure and energy efficiency.

-

In September 2023, Acuity Brands strengthened its smart building capabilities by enhancing its nLight and Atrius platforms with advanced analytics and automation features.

Architectural Lighting Companies are:

-

Osram

-

GE Lighting

-

Acuity Brands

-

Legrand

-

Focal Point

-

Zumtobel Group

-

Ketra

-

Signify

-

Lutron

-

Selux

-

Holophane

-

Sylvania

-

Nimbus

-

Eaton

-

Meyer Lighting

-

Cannonball Lighting

-

Barn Light Electric

-

Edge Lighting

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 10.94 Billion |

| Market Size by 2033 | USD 20.20 Billion |

| CAGR | CAGR of 7.96% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Lamp Holders, Ballasts, Lamps, Lenses/Shades, Trims, Wiring, Reflectors, Others), • By Source (Incandescent Lights, Fluorescent Lights, Light-emitting diode (LED), High-Intensity Discharge (HID), Others) • By Application (Indoor, Outdoor) • By End Use (Commercial, Residential, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Philips Lighting, Osram, GE Lighting, Acuity Brands, Cree Lighting, Legrand, Focal Point, Zumtobel Group, Ketra, Signify, Lutron, Selux, Holophane, Sylvania, Nimbus, Eaton, Meyer Lighting, Cannonball Lighting, Barn Light Electric, and Edge Lighting. |