High End Lighting Market Size & Trends:

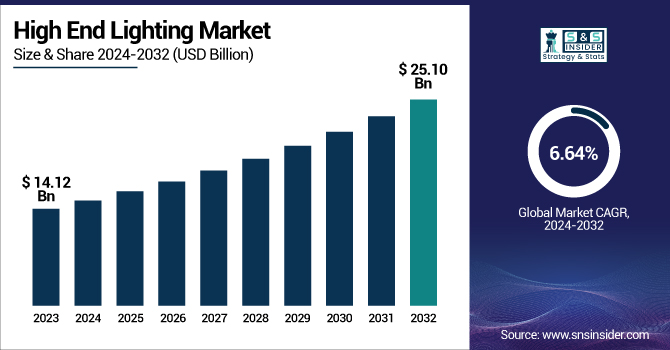

The High End Lighting Market Size was valued at USD 14.12 Billion in 2023 and is expected to reach USD 25.10 Billion by 2032 and grow at a CAGR of 6.64% over the forecast period 2024-2032.

To Get more information on High End Lighting Market - Request Free Sample Report

The luxury lighting market is now capable of customizing the intensity of light an individual prefers, promoting lighting based on the mood desired, and for specific use. Smart lighting is eagle-eyed concerning the earthing hyphenate, it is regularly undergoing in sumptuous homes, accommodation, and so forth, conversion spaces concerning energy efficiency, and so forth, and atmosphere rule. Common lighting control technologies include wireless dimming systems, motion sensors, and voice-based automation. Product development innovation: looks, energy efficiency, sustainability, integration into smart home ecosystems, and the existence of a new facade to make the user experience harmonious with the architecture of modern lighting. The U.S. high-end lighting market continued to make strides in 2024, with smart lighting use approaching one-third of Americans when smart home technologies are included. For instance, San Francisco replaced 18,500 streetlights with LEDs, as other government initiatives saved energy, while technologies such as Bluetooth and Zigbee made for more efficient lighting.

The U.S. High End Lighting Market was 2.48 billion in 2023 and is likely to grow at a CAGR of 6.04%. Growing requirement for eco-friendly solutions, advancements in smart lighting technologies, and the adoption of sustainable lighting systems are driving the U.S. high-end lighting market. The market also sees expansion due to initiatives by governments, increased consumer interest in smart homes, along with advent technologies in the wireless market like Bluetooth and Zigbee.

High-End Lighting Market Dynamics

Key Drivers:

-

Driving Forces Behind the Growth of U.S. High-End Lighting Market Emphasizing Energy Efficiency and Innovation

The increasing demand for energy-efficient and sustainable lighting solutions, such as LED technologies, is the major factor contributing to the growth of the high-end lighting market. The growing awareness about environmental damage, as well as energy prices, is accelerating the transition of consumers and companies from old lighting systems to smart and automated lighting systems. Moreover, the growing applications of IoT and lighting control networks in commercial and residential buildings are additionally driving the demand for contemporary lighting designs. Furthermore, rising urbanization and luxury real estate developments are also resulting in the adoption of luxury lighting products by interior designers and architects who are strongly focused on aesthetics as well as functionality.

Restrain:

-

Challenges in Integrating Advanced Lighting Technologies into Existing Infrastructure and Overcoming Compatibility Issues

The complex integration of new advanced lighting technologies within existing infrastructure is one of the primary restraints in the high-end lighting market, particularly in existing older buildings. Adoption of smart or modern lighting systems usually needs specialized installation and technical experience to do it right, causing delays. Also, the fast rate of innovation could result in product life cycle interruptions, which makes buyers and developers reluctant to invest in the most up-to-date technology. Lack of seamless operation with lighting and smart home platform incompatibility can also impact user experience and satisfaction.

Opportunity:

-

Opportunities in Smart Homes and Technological Innovations Driving Growth in the High-End Lighting Market

There are a lot of opportunities in the smart home ecosystem growth and the adoption of connected lighting systems. The residential sector is experiencing a boom in modern, minimalist, and simple lighting that comes with voice assistants and mobile app controls. Besides, infrastructure development and the rise in disposable incomes in emerging economies present a great opportunity. The human-centric trend that provides wellness and mood lighting can be leveraged by designers and manufacturers. Technological innovations in materials, including organic LEDs (OLEDs), and evolving sustainable manufacturing practices, are anticipated to create new growth opportunities across the high-end lighting spectrum.

Challenges:

-

Challenges in Awareness Technical Knowledge Design Consistency and Supply Chain Disruptions Affecting High-End Lighting Growth

The major challenge is the awareness and technical knowledge of end-users and some commercial decision-makers in regards to the advantages and features of new intelligent lighting systems. Users may want to stick with traditional lighting in industrial and less advanced markets due to comfort. Additionally, design consistency is another hurdle in the technologically sophisticated high-end lighting domain, incorporating smart sensors, automation, and sustainability. This is a continuous design challenge: achieving aesthetic appeal with ideal functionality without compromising the quality of lighting. In addition, supply chain disruptions, in particular certain key components such as semiconductors and advanced sensors deployed in smart lighting, can hinder production and availability, impeding growth momentum and timelines for large-scale projects.

High End Lighting Market Segmentation Outlook

By Type

Fluorescent lights held the largest share of the high-end lighting market with a 40.5% share in 2023, as they are predominantly used in commercial and institutional settings. This, balanced with moderate energy efficiency, made them a common choice among many sectors due to their low upfront cost and long life cycle. Except that the market is experiencing a paradigm shift away from basic lighting solutions.

From 2024 to 2032, LED lights are expected to grow at the fastest CAGR, due to the energy efficiency, longevity, and smart technology compatibility advantages associated with LED lights. LEDs provide greater control over brightness, variety in color, and lower maintenance requirements, making them ideal for modern, environmentally conscious residential and commercial spaces. With the increasing implementation of sustainability and smart infrastructure around the world, LED lighting is anticipated to grow beyond traditional lighting technologies to gain market share progressively from fluorescent lighting to become the dominant high-end lighting solution.

By Application

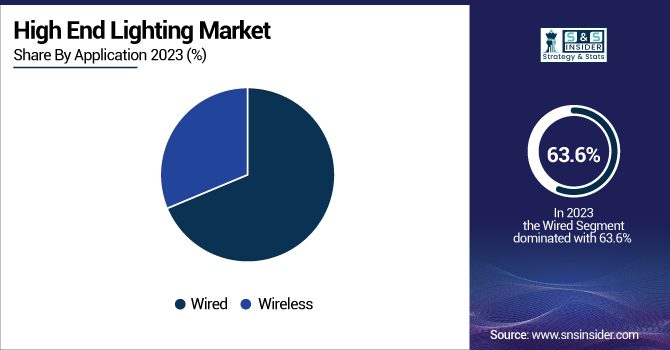

In 2023, wired lighting systems completely dominated the high-end lighting market with a 63.6% share. For years, a wired system has been the solution of choice on both the residential and commercial levels for its reliability, consistent performance, and integration with current electrical infrastructures. They are usually used in large installations for which stability and continuous power are paramount.

The wireless lighting systems segment is anticipated to be the fastest-growing segment in the level 4 light-controlled products market with a high CAGR from 2024 to 2032 due to its increasing demand for flexibility, minimal installation, and device connectivity with smart home technologies. Wireless solutions, due to technologies such as Wi-Fi, Bluetooth, and Zigbee, provide remote control, automation, and even energy optimization features, making them suitable for modern homes and commercial settings that change with their environment.

By Interior Design

Modern lighting accounted for the highest market share of 46.3% in high-end lighting in 2023, and is expected to dominate the market with the highest CAGR during the forecast period, 2024–2032. Its growth is driven by the rising preferences for minimalistic, sleek, and aesthetic lighting designs that match modern architectural designs. Today, intelligent, energy-efficient, and capable lighting solutions are the perfect solution for the residential, commercial, and hospitality sectors. Increasing consumer preference for aesthetically pleasing yet technologically versatile lighting systems. Also, the extensive penetration of smart home and IoT devices is fast-tracking the uptake of modern lighting. The smart home is conducive to automation, customizing based on various moods, and voice-controlled systems, which increases convenience and makes the smart home attractive to consumers. With every modern design choice, even urban landscape becoming a norm, the segment is all set to sustain its position in the luxury lighting market.

By End Use

In 2023, the commercial segment held the highest high-end lighting market share of 41.4% and was driven by increasing uptake in office buildings, hotels, retail, and other luxurious commercial spaces. Premium Lighting Solutions Businesses are spending on better lighting that not only improves ambience but also helps boost energy efficiency as well as the quality of customer experience. High-end lighting in commercial spaces is also another reason why it continues to reign supreme, as it allows branding and design consistency.

Residential segment is projected be grow at the fastest CAGR during the forecast period 2024 to 2032. The growth can be attributed to the increasing adoption of smart homes, evolving interiors as per personalization, and increasing expenditure on home aesthetics and comfort. Consumer product preferences for modern, energy-efficient, connected lighting and convenience, automation, and mood setting have permanently driven us to embrace this technology and functionality in our space. With changing preferences in urbanization and increasing knowledge of smart lighting advantages, the residential segment is set to be one of the largest growth segments for high-end lighting.

High End Lighting Market Regional Analysis

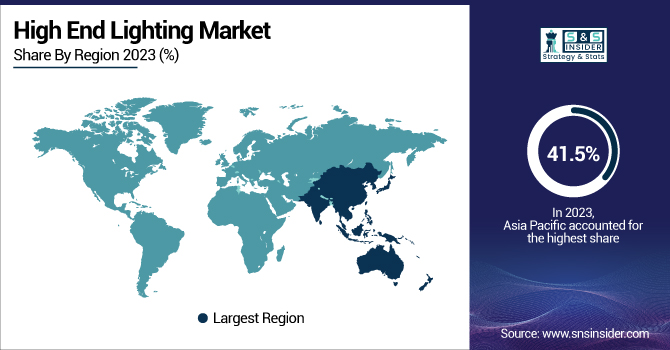

Asia Pacific dominated the high-end lighting market with a 41.5% market share in 2023 and is expected to grow at the fastest CAGR from 2024 to 2032. This growth is largely driven by rapid urbanization, smart city initiatives, and expanding infrastructure projects across major economies such as China, India, Japan, and South Korea. In China, for instance, the surge in luxury real estate and upscale commercial developments in cities like Shanghai and Shenzhen has significantly increased the demand for high-end lighting solutions. Similarly, India’s booming smart home market and premium housing sector in urban centers like Mumbai and Bengaluru are fueling the adoption of modern, energy-efficient lighting systems. Japan and South Korea are also leading in smart building integration, where advanced lighting control systems are a key component. Additionally, government policies promoting energy conservation and the shift toward green buildings across the region are further boosting the market. Asia Pacific’s strong manufacturing base also contributes to faster innovation and supply chain efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the High End Lighting Market Report are:

-

Philips Lighting (Hue Smart Bulbs)

-

Osram (LEDvance)

-

Cree Lighting (Cree LED Bulbs)

-

General Electric (GE Lighting)

-

Acuity Brands (Lithonia Lighting)

-

Zumtobel Group (TTC Technology)

-

Signify (Philips Hue)

-

Lutron Electronics (Caseta Wireless Smart Lighting)

-

Legrand (Adorne Collection)

-

Schneider Electric (Wiser Smart Lighting)

-

Brilliant Lighting (Smart Home Hub)

-

Vibia (Alba Collection)

-

Foscarini (Luminator Pendant Light)

-

Louis Poulsen (PH5 Pendant Lamp)

-

Tom Dixon (Etch Web Pendant Light)

Recent Development

-

In March 2025, Signify and Dixon Technologies proposed a 50:50 joint venture to enhance lighting product manufacturing in India, focusing on energy-efficient solutions and the "Make in India" initiative.

-

In April 2025, Tom Dixon showcased his new Spring/Summer 2025 collection at The Manzoni in Milan, featuring three new lighting families and updated versions of the MELT collection. The event, part of Milan Design Week, emphasized vibrant colors, compact designs, and enhanced luminosity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.12 Billion |

| Market Size by 2032 | USD 25.10 Billion |

| CAGR | CAGR of 6.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (LED, HID, Fluorescent Light, Others) • By Application (Wired, Wireless) • By Interior Design (Modern, Traditional, Transitional) • By End Use (Commercial, Industrial, Residential, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips Lighting, Osram, Cree Lighting, General Electric, Acuity Brands, Zumtobel Group, Signify, Lutron Electronics, Legrand, Schneider Electric, Brilliant Lighting, Vibia, Foscarini, Louis Poulsen, Tom Dixon. |