Leukemia Therapeutics Market Report Scope & Overview:

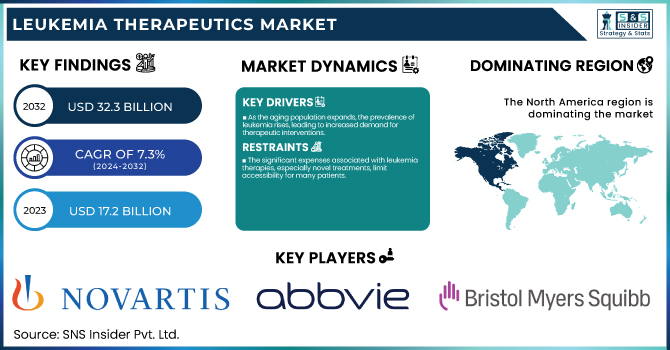

The Leukemia Therapeutics Market Size was valued at USD 17.2 Billion in 2023 and is expected to reach USD 32.3 Billion by 2032, growing at a CAGR of 7.3% over the forecast period 2024-2032.

To Get More Information on Leukemia Therapeutics Market - Request Sample Report

The growth of the global Leukemia Therapeutics Market is largely attributed by the increase in leukemia incidences worldwide. GLOBOCAN 2020 stated that approximately 475,000 new cases of leukemia were diagnosed worldwide in 2020, however, rates are estimated to rise to 692,000 new cases by 2040. An urgent demand for effective therapeutics is thus raised due to this shocking increase in leukemia cases. According to the American Cancer Society, 59,610 new cases of leukemia and 23,710 deaths were estimated in 2023 in the US alone, underscoring the urgent need to develop new potential treatments. Growing awareness and better diagnostic capabilities are also contributing to the market growth, as it is making diagnosis easy and aiding in initiative treatment at the early stage. Investments in research and development by both pharmaceutical houses and academic institutions are driving creativity in both targeted therapies and immunotherapy, bringing recent excitement to patients with all types of leukemia. The market is also benefiting from initiatives and funding by the government for cancer research. For example, the NCI in the U.S. has invested nearly $200 million in leukemia research in fiscal year 2021.

Additionally, the FDA's accelerated approval pathways for breakthrough therapies are facilitating faster market entry for promising leukemia treatments. Increasingly, genetic profiling and biomarker analysis are allowing for personalized medicine approaches to treatment strategies. At the same time, increasing penetration of healthcare infrastructure and access to advanced therapies in some emerging economies are boosting the growth opportunities in the market. The COVID-19 pandemic has also indirectly impacted the market by highlighting the importance of robust healthcare systems and accelerating digital health solutions, which may benefit leukemia patients in terms of remote monitoring and care delivery.

Market dynamics

Drivers

-

The global increase in leukemia cases, attributed to factors like genetic predisposition and environmental exposures, is boosting the demand for effective treatments.

-

Innovations such as targeted therapies, immunotherapies, and gene therapies have enhanced treatment efficacy and patient outcomes, propelling market growth.

-

As the aging population expands, the prevalence of leukemia rises, leading to increased demand for therapeutic interventions.

Leukemia is the most common childhood cancer and the increase in cases heavily drives the development of treatment. According to figures, 2025 is projected to see about 6,100 new cases of acute lymphocytic leukemia (ALL) in the United States, along with roughly 1,400 kills from the disease. Similarly, chronic lymphocytic leukemia (CLL) is expected to account for about 23,690 new cases in the same year, leading to approximately 4,460 deaths. Leukemia is the sixth most common cancer in India having a 4.83% prevalence of total cancer cases in India during 1990–2019. Males exhibit a higher incidence rate (6.27%) compared to females (4.03%). This upward trend in leukemia cases underscores the critical need for effective therapeutic strategies.

The rise in the number of leukemia cases has made a huge impact on the improvement of treatment practices. For example, the effectiveness of targeted treatments and immunotherapies has transformed patient results. Additionally, early detection through standard tests like complete blood counts (CBCs) and metabolic profiles is crucial and can lead to effective treatments, enhancing patient survival regardless of a late diagnosis.

Restraints

-

The significant expenses associated with leukemia therapies, especially novel treatments, limit accessibility for many patients.

-

Complex and lengthy approval processes for new drugs can delay the availability of innovative treatments in the market.

-

Concerns about adverse effects and the development of resistance to conventional treatments pose challenges to effective leukemia management

The high cost of leukemia therapeutics continues to be a significant obstacle to achieving widespread accessibility to this form of treatment. Drugs like CAR-T cell therapy, targeted drugs and other immunotherapies are expensive for patients because they have long and complex manufacturing processes paired with lengthy clinical guidelines as well as significant research and development costs. Additionally, prolonged treatment durations, hospital stays, and supportive care further add to financial burdens.

Inadequate insurance coverage and costly out-of-pocket expenses for many patients, especially in low-and middle-income settings, render these treatments inaccessible to patients who need them. In developed countries, insurance limits and reimbursement policies frequently induce financial burden. This affordability challenge also applies to healthcare systems that face restrictions on their budgets to allow access to new treatments. For this purpose, financial support, generics, or relevant changes to policies are being addressed by pharmaceutical companies and governments worldwide. However, cost remains a significant challenge, restricting treatment accessibility and adoption on a global scale.

Segment Analysis

By type of leukemia

In 2023, the Chronic Lymphocytic Leukemia (CLL) segment held the dominant share of the market. This is probably because CLL is more common than other forms of leukemia. Chronic lymphocytic leukemia (CLL) is the most prevalent adult leukemia in Western countries, accounting for around 25-30% of leukemia cases in total. Chronic lymphocytic leukemia (CLL) is responsible for nearly a third of leukemia cases in America, according to American Cancer Society. The CLL segment is expected to grow at a high rate thanks to the availability of a variety of treatment types, including targeted therapy such as BTK inhibitors and BCL-2 inhibitors, which have proven to be effective in the treatment of CLL. These novel therapies have not only improved the prognosis of patients but also substantially increased the market valuation for CLL therapies.

In addition, as CLL is a chronic disease, the long-term treatment requirement continues to underpin the demand for therapeutics. Also, one major factor is the aging population of the world, as chronic lymphocytic leukemia predominantly presents itself in the elderly (more than half of CLL patients are diagnosed at over 70 years of age). In addition, government initiatives for CLL treatment are also one of the factors for the CLL segment to dominate the global chronic lymphocytic leukemia market. As an example, the National Cancer Institute has conducted and funded many clinical trials and research related to CLL over the years, with a direct impact on CLL treatment protocols and drug development. The relatively better prognosis of CLL compared to acute leukemias has resulted in a larger patient pool requiring ongoing treatment, further driving market growth in this segment.

By treatment type

In 2023, the chemotherapy segment dominated the market and held the largest market share 48%. This dominance can be attributed to several factors, including the long-standing role of chemotherapy as a cornerstone in leukemia treatment. For the treatment of acute leukemias where the time for intervention is short, chemotherapy still plays an important part in many treatment regimens. Chemotherapy continues to be the most common first-line therapy for many types of leukemia and is the most important therapy for acute myeloid leukemia (AML) and acute lymphoblastic leukemia (ALL), the National Cancer Institute notes. One reason why chemotherapy is used so often is because it works for nearly all types and stages of leukemia. According to government data from cancer registries, many leukemia patients are treated with chemotherapy. For instance, the SEER database shows that over 60% of AML patients undergo chemotherapy as part of their initial treatment. However, the number of available chemotherapy drugs has expanded rapidly in recent decades, both old cytotoxic agents and new targeted therapies expanded treatment options and outcomes.

Moreover, the research and clinical trials are still in progress to broaden the scope of the chemotherapy protocols in an effective and low side effects manner. Due to the low cost per treatment of multiple chemotherapy regimens, especially for generic drugs, they are affordable to more healthcare settings and as such, command a significant market share. Moreover, since numerous countries have set up certain parts of reimbursement policies for chemotherapy, patients have much wider access to such treatments.

By Distribution Channels

In 2023, the hospital pharmacy segment held the largest market share. Several elements regarding leukemia treatment and healthcare delivery systems contribute to this dominance. Leukemia treatment, particularly for acute cases that need prompt and aggressive therapy, primarily occurs in hospital settings. Preliminary CDC data has previously indicated that a large portion of leukemia patients receive their first treatment and ongoing care in hospitals. Most leukemia therapies, such as chemotherapy regimens and stem cell transplants, require treatment in controlled hospital settings, which propels demand for hospital pharmacy services. Hospital pharmacies can manage specialized medications requiring more care in preparation and management, such as cytotoxic drugs and targeted therapies. As more chemotherapy treatments are being administered on an outpatient basis, the importance of the hospital pharmacy in the management and dispensing of these medications has only grown. Dedicated oncology pharmacy services must also be integrated to ensure the safe and effective management of leukemia therapeutics, driven partly by government regulations, accreditation standards, and delineation of pharmacy services. With the implementation of electronic health records and computerized physician order entry systems in the hospital, efficient and safe medication use has been made possible, allowing the hospital pharmacy to remain a mainstay of leukemia therapeutic drug management.

Regional analysis

In 2023, North America held the largest share of the global Leukemia Therapeutics Market with a 38% market share. Several factors, such as an advanced healthcare infrastructure, high healthcare expenditure, and a robust research and development ecosystem, contribute to this dominance. Leukemia research and treatment innovations have also been spearheaded in the United States, which has long been a dominant force in the field. The National Cancer Institute reports that leukemia research receives substantial financial resources, and ongoing clinical trials are testing many new therapies. Additionally, the continued strength of the market is due to the region's dominant position in the research and development of advanced treatment types including CAR-T cell therapeutic compounds and targeted molecular inhibitors.

However, the Asia-Pacific region is expected to grow with the highest CAGR in the forecast period. The major factors contributing to this rapid growth are improving healthcare infrastructure, increasing healthcare expenditure, and a large patient population. Countries including China and India are witnessing government initiatives for improving cancer care and increasing the reach of advanced treatments, thereby aiding the market growth. The Healthy China 2030 plan in China has emission targets for cancer diagnostics and treatment that should contribute to the growth of the leukemia therapeutics market. Market growth in the Asia-Pacific region is also driven by an increased domestic focus on developing pharmaceutical capabilities and several collaborations with pharmaceutical companies across the globe.

Do You Need any Customization Research on Leukemia Therapeutics Market - Enquire Now

Key Players

Service Providers / Manufacturers

-

Novartis International AG (Switzerland): [Kymriah, Gleevec]

-

AbbVie Inc. (USA): [Venclexta, Imbruvica]

-

Bristol-Myers Squibb Company (USA): [Sprycel, Revlimid]

-

F. Hoffmann-La Roche Ltd (Switzerland): [Gazyva, Venclexta]

-

Sanofi S.A. (France): [Clolar, Mozobil]

-

Pfizer Inc. (USA): [Bosulif, Besponsa]

-

Amgen Inc. (USA): [Blincyto, Neulasta]

-

Gilead Sciences, Inc. (USA): [Zydelig, Yescarta]

-

Takeda Pharmaceutical Company Limited (Japan): [Adcetris, Ninlaro]

-

Celgene Corporation (USA): [Revlimid, Idhifa]

Recent developments

-

Quizartinib was granted accelerated approval by the U.S. Food and Drug Administration (FDA) in August 2023 for patients with newly diagnosed FLT3-ITD-positive acute myeloid leukemia (AML) in combination with standard cytarabine and anthracycline induction and cytarabine consolidation. This approval offers a new targeted treatment option for a subset of AML patients.

-

In March 2024, Novartis announced positive Phase III results of the CAR-T cell therapy Kymriah in pediatric and young adult patients with relapsed or refractory B-cell acute lymphoblastic leukemia (ALL). This trial showed a meaningful improvement in OS and EFS making it a potential new treatment option in this patient population.

-

In November 2024 Bristol Myers Squibb secured FDA approval for a new formulation of dasatinib, the tyrosine kinase inhibitor indicated for patients with chronic myeloid leukemia (CML). However, the new formulation provides improved bioavailability and a more convenient dosing schedule, which may improve patient adherence and outcomes in the management of CML.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.2 Bn |

| Market Size by 2032 | US$ 32.3 Bn |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Leukemia (Chronic Lymphocytic Leukemia, Acute Lymphocytic Leukemia, Chronic Myeloid Leukemia, Acute Myeloid Leukemia, Others) • By Route of Administration (Oral, Injectable) • By Treatment Type (Chemotherapy, Immunotherapy, Targeted Therapy, others) • By Distribution channel (Hospital Pharmacies, Retail Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Novartis International AG, AbbVie Inc., Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd, Sanofi S.A., Pfizer Inc., Amgen Inc., Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Celgene Corporation |

| Key Drivers | • The global increase in leukemia cases, attributed to factors like genetic predisposition and environmental exposures, is boosting the demand for effective treatments. • Innovations such as targeted therapies, immunotherapies, and gene therapies have enhanced treatment efficacy and patient outcomes, propelling market growth. • As the aging population expands, the prevalence of leukemia rises, leading to increased demand for therapeutic interventions. |

| Market Restraints | • The significant expenses associated with leukemia therapies, especially novel treatments, limit accessibility for many patients. • Complex and lengthy approval processes for new drugs can delay the availability of innovative treatments in the market. • Concerns about adverse effects and the development of resistance to conventional treatments pose challenges to effective leukemia management |