Military Wearable Medical Device Market Report Scope & Overview:

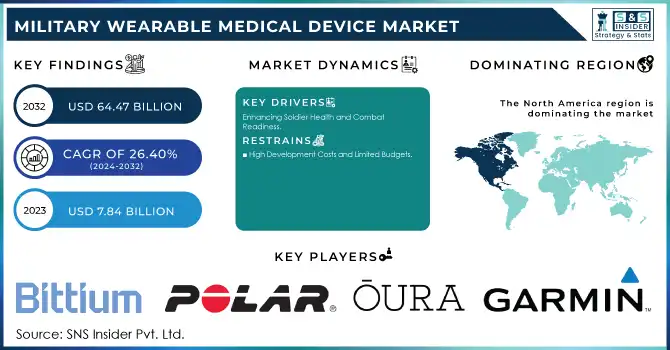

The Military Wearable Medical Device Market Size was valued at USD 7.84 billion in 2023 and is expected to reach USD 64.47 billion by 2032 and grow at a CAGR of 26.40% over the forecast period 2024-2032.

Get more information on Military Wearable Medical Device Market - Request Sample Report

The military wearable medical device market is experiencing remarkable growth, driven by cutting-edge technologies and an increasing emphasis on soldier health and operational efficiency. Wearable medical devices, such as advanced biosensors, smart textiles, and health monitoring systems, are revolutionizing military healthcare by enabling real-time tracking of vital signs, injury detection, and performance metrics. For instance, the U.S. Department of Defense has adopted wearable sensor technology capable of monitoring hydration levels, heart rates, and stress levels in soldiers, enhancing their performance during critical operations. A study by the National Defense Medical College highlights that wearable devices can reduce the time to deliver life-saving interventions in combat zones by up to 30%, significantly improving survival rates. Additionally, smart bandages equipped with biosensors are being tested to monitor wound healing and detect infections early. These bandages transmit data wirelessly to medical teams, allowing timely and precise medical responses. A collaboration between the Pentagon and leading tech firms has further enabled the development of devices that predict disease outbreaks by analyzing soldiers' physiological data in real-time.

In large-scale combat operations, where prolonged care is often required, wearable medical devices have proven indispensable. For example, the U.S. Army has integrated fitness wearables into training programs to measure endurance, predict injuries, and optimize performance. Devices like Hexoskin biometric shirts are being employed to monitor respiratory rates and cardiac activity during high-stress drills.

Despite these advancements, challenges such as data security, interoperability with legacy systems, and the ruggedness of devices in extreme conditions remain. Addressing these issues through robust encryption, standardized protocols, and durable designs is vital for broader adoption. As the military continues to prioritize technology integration, wearable medical devices stand out as transformative tools in ensuring soldier readiness, enhancing survival rates, and maintaining operational superiority. These innovations not only protect soldiers on the battlefield but also pave the way for a more data-driven approach to military healthcare.

Market Dynamics

Drivers

-

Enhancing Soldier Health and Combat Readiness

The increasing focus on soldier safety and combat readiness is a significant driver of the military wearable medical device market. As modern warfare grows more complex, ensuring the physical and mental well-being of soldiers is paramount. Wearable medical devices, such as biosensors, smart textiles, and real-time health monitoring systems, provide actionable insights into vital signs like heart rate, hydration levels, and respiratory status. These devices enable early detection of injuries or illnesses, allowing for swift medical intervention on the battlefield. For instance, wearable health monitors can alert commanders to signs of dehydration or exhaustion, preventing potential health crises during critical missions. Additionally, wearable technology supports prolonged care in austere environments where immediate medical assistance might be unavailable, ensuring soldiers remain operational for extended periods. This proactive approach to health management not only improves individual performance but also enhances overall unit efficiency, making these devices indispensable in modern combat scenarios.

-

Technological Advancements in Wearable Solutions

Technological innovations are transforming the landscape of wearable medical devices for military applications. Advances in miniaturization, AI, and IoT have enabled the creation of compact, lightweight devices capable of tracking multiple health parameters simultaneously. For example, IoT-enabled devices can transmit data to command centers in real time, ensuring remote monitoring and informed decision-making. AI algorithms analyze this data to detect anomalies or predict potential health issues, providing a significant edge in mission planning and execution. Furthermore, rugged designs ensure these devices withstand extreme conditions, including heat, humidity, and mechanical stress. Innovations like smart bandages with embedded sensors for wound monitoring and wireless communication exemplify the cutting-edge applications of these technologies. Such advancements not only improve soldier health management but also streamline logistical and medical support during operations, making technology integration a critical driver of market growth.

-

Increased Investments and Focus on Mental Health

Rising investments in wearable medical technology by governments and defense organizations are a crucial driver of market expansion. Programs like the U.S. Department of Defense’s initiatives to integrate wearable sensors highlight the growing reliance on technology to enhance soldier readiness. These investments have led to the development of devices that monitor not only physical health but also mental well-being. Stress-monitoring wearables, for example, measure cortisol levels and heart rate variability to provide insights into a soldier’s mental state during high-pressure situations. Such devices are particularly valuable as military operations increasingly prioritize mental resilience alongside physical fitness. Collaboration between defense agencies and tech innovators has further accelerated the pace of development, ensuring that these devices meet the unique demands of military environments. By addressing mental health alongside physical readiness, wearable medical devices are helping create a holistic approach to soldier care, driving their adoption across defense sectors globally.

Restraints

-

High Development Costs and Limited Budgets

The development of advanced military wearable medical devices involves significant investment in research, prototyping, and testing to meet stringent performance and durability standards. For many nations, especially those with limited defense budgets, the high costs of adopting these cutting-edge technologies pose a challenge, restricting large-scale implementation.

-

Data Security and Privacy Concerns

Wearable medical devices often rely on wireless data transmission to provide real-time monitoring and analytics. This raises significant concerns about data security and the potential for cyberattacks.

Key Segmentation

By Application

The heart monitor segment emerged as the largest contributor to the military wearable medical device market in 2023, accounting for approximately 38.0% of the market share. This dominance is driven by the critical need to monitor soldiers' cardiovascular health during high-stress training and combat scenarios. Soldiers often face physically demanding environments and psychological pressures, making them susceptible to cardiovascular issues such as arrhythmias and heart strain. Wearable heart monitors provide real-time insights into heart rate variability and other vital metrics, enabling early detection of potential issues and timely medical intervention. The widespread adoption of these devices reflects the military's commitment to safeguarding soldier health and reducing fatalities caused by cardiovascular complications in the field.

The performance monitor segment is the fastest-growing application in the military wearable medical device market. These devices are increasingly being adopted to enhance soldiers’ operational readiness and physical performance. Performance monitors track key metrics such as fatigue, endurance, hydration, and physical strain, providing military personnel and commanders with real-time feedback to optimize training and mission execution. The rising demand for technologies that can prevent injuries and maximize efficiency during physically intensive operations is a key factor driving growth in this segment. Additionally, the integration of advanced analytics and seamless connectivity with centralized systems makes performance monitors an essential tool for modern military healthcare.

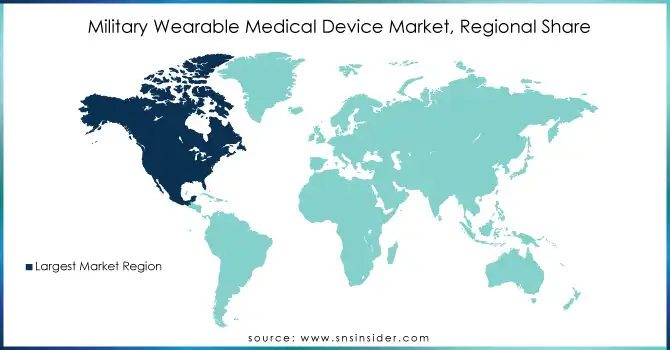

Regional Analysis

The North American region, particularly the United States, is the dominant player in the military wearable medical device market. This dominance is primarily due to significant investments in advanced defense technologies by the U.S. Department of Defense (DoD), which continually prioritizes soldier health, safety, and performance. The U.S. military is actively integrating wearable medical devices into its systems for real-time health monitoring and injury prevention, with programs that focus on enhancing physical and mental readiness. Furthermore, collaborations with leading tech companies in the wearable and healthcare sectors have accelerated the development and deployment of these devices, driving market growth in this region.

Europe followed closely, with countries like the United Kingdom, Germany, and France making substantial advancements in military health technologies. The European market is experiencing growth due to rising defense budgets, increasing military modernization efforts, and a heightened focus on soldier welfare. European nations are integrating wearables into their military operations to track vital signs, monitor physical performance, and improve mental health in combat situations.

In Asia-Pacific, particularly in China, India, and Japan, the market is expanding at a rapid pace, driven by increasing defense spending and technological advancements. These countries are adopting wearable technologies to enhance military capabilities and soldier safety. As the region focuses on modernizing its defense infrastructure, wearable medical devices are becoming integral to military health systems.

Need any customization research on Military Wearable Medical Device Market - Enquiry Now

Key Players

1. Bittium

-

Bittium Tough Mobile 2

-

Bittium BodyGuard 323

-

Polar H10 Heart Rate Sensor

3. Oura

-

Oura Ring

4. Garmin

-

Garmin Forerunner 945

-

Garmin Fenix 7

5. NeuroMetrix

-

Quell Wearable Pain Relief

6. GOQii

-

GOQii Smart Fitness Tracker

7. Apple Inc.

-

Apple Watch Series 8

-

Apple Watch Ultra

8. Samsung

-

Samsung Galaxy Watch 6

9. Fitbit

-

Fitbit Charge 5

-

Fitbit Sense

10. Zephyr Technology Corporation

-

Zephyr BioHarness 3

11. Camntech

-

SleepProfiler 4.0

-

Actiwatch Spectrum

Recent Developments

-

In June 2024, INVIZA Health was awarded a USD 2.3 million SEMI NBMC contract by the U.S. Air Force to enhance military and medical monitoring with its InvizaCare M1.0 platform. This innovative solution integrates machine learning, self-charging smart insoles, and secure cloud-based platforms for real-time health monitoring of airmen and military personnel.

-

In April 2023, The U.S. Department of Defense (DoD), through its Defense Innovation Unit (DIU), partnered with the private sector to develop wearable technology capable of rapidly detecting diseases, such as infections. This innovation proved highly effective during the COVID-19 pandemic, enhancing the ability to monitor and manage soldier health in real time.

-

In Nov 2023, Dallas-based Articulate Labs, in partnership with the Military Consortium, was awarded USD 1.3 million to conduct a clinical trial testing its innovative knee injury wearable technology. The funding will support efforts to accelerate the rehabilitation of service members, enabling faster recovery and a quicker return to duty.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.84 billion |

| Market Size by 2032 | USD 64.47 Billion |

| CAGR | CAGR of 26.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Heart Monitor (Sick Alert, Heart Rate Variability), Performance Monitor (Sleep-wake Cycle Alert, Core Body Temperature Monitoring)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bittium, Polar Electro, Oura, Garmin, NeuroMetrix, GOQii, Apple Inc., Samsung, Fitbit, Zephyr Technology Corporation, Camntech |

| Key Drivers | • Enhancing Soldier Health and Combat Readiness • Technological Advancements in Wearable Solutions • Increased Investments and Focus on Mental Health |

| Restraints | • High Development Costs and Limited Budgets • Data Security and Privacy Concerns |