Artificial Intelligence In Animal Health Market Size Analysis:

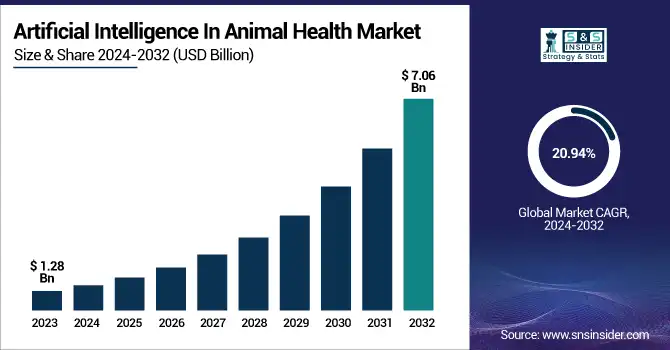

The Artificial Intelligence In Animal Health Market was valued at USD 1.28 billion in 2023 and is expected to reach USD 7.06 billion by 2032, growing at a CAGR of 20.94% over the forecast period 2024-2032. More veterinary practices are embracing the role of artificial intelligence as these technologies improve diagnostic specificity, sensitivity, and treatment protocols. Artificial intelligence-based diagnostics are emerging as the next frontier in early detection of diseases and enabling rapid treatments. Artificial intelligence or AI is used to speed up drug development by discovering new technologies for animal treatment and prescription. Healthcare spending in the animal health sector is growing, and so is the investment in AI-driven solutions, leading to more intelligent, data-driven decisions. This is accelerating the uptake of AI applications in companion and production animal health management.

To Get more information on Artificial Intelligence In Animal Health Market - Request Free Sample Report

AI In Animal Health Market Dynamics

Key Drivers:

-

Driving Animal Health Innovation with AI Enhancing Care Productivity and Sustainability in Farming Practices

The growing demand for these technologies, which increases animal care and productivity, is the primary driver of the animal health artificial intelligence (AI) market. These solutions utilize AI to periodically monitor and diagnose diseases, optimize feed schedules, track animal behavior, and maintain proper health management. In addition, the growing adoption of AI-based tools, such as predictive analytics and machine learning, allows the accurate detection of diseases instantly and reduces the requirement of manual labor, thus making it a more efficient process. Moreover, the increasing importance of animal welfare and the demand for sustainable farming practices are driving the need for AI adoption to track health parameters and lower medication expenses.

Restrain:

-

Overcoming Awareness Gaps and Interoperability Challenges to Accelerate AI Adoption in Animal Health

The crucial factor that is supporting the restraint in the growth of AI in the animal health market is the poor awareness and technical know-how, particularly in rural and underdeveloped regions. This has prevented a widespread deployment of AI technologies by farmers and veterinarians, while many farmers and veterinarians remain with little knowledge of AI technologies. The gap of complete understanding will hinder the initial mass adoption of AI because, without proper training, users will be reluctant to put their trust and money in technology they may not understand. Moreover, the interoperability of AI tools with existing veterinary practice systems and equipment could be cumbersome and require sustained time and resources for seamless implementation.

Opportunity:

-

Unlocking Opportunities in AI for Animal Health to Enhance Care and Boost Market Growth

AI is still developing and entering veterinary and farm management, and there are a lot of opportunities in this market. AI-driven tools to predict outbreaks, monitor herd health, manage veterinary records and more could all be implemented for more precise care. And, the rising need for high-quality disease-free meat and dairy products delivers a booming environment for AI to optimize breeding and nutrition. Emerging markets are likely to offer strong market growth as farmers and veterinarians strive to increase output and profit. Such innovations provide tremendous opportunities for animal health AI technology service providers.

Challenges:

-

Addressing Ethical and Regulatory Challenges for AI Integration in Animal Health and Veterinary Practices

The other hurdle is the ethics and regulation of AI in animal health. With AI increasingly having an eye on animal behavior and health, the same issues of data privacy and animal welfare come to the fore. Establishing clear and comprehensive regulatory frameworks is the first step towards the use of artificial intelligence in our veterinary healthcare delivery systems, ideally without compromising either the animal or the human, but strictly maintaining the animal, behavioral, human & data-ethical aspects within a good balance. In a few areas, expert bodies are settling on strategies to order AI in veterinary practices. Such ambiguity can impede the expansion of the market as organizations may hesitate to make investments in regions with bewildered laws or where there is opposition against new-age diagnostics in animals.

Segments Analysis

By Solutions

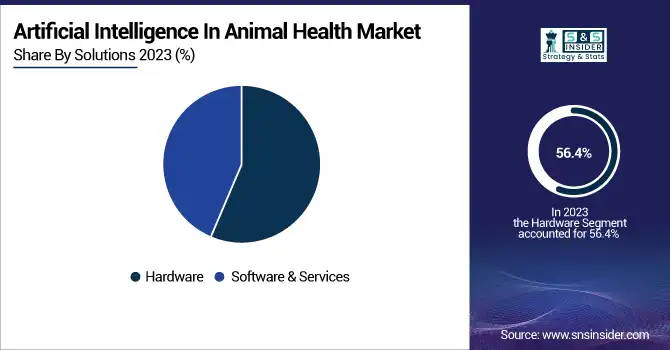

In 2023, the hardware segment held a larger share of the artificial intelligence in the animal health market, at 56.4%. The number one growth contributor in this space is the extensive deployment of AI-enabled devices: from sensors to wearables and diagnostic machinery, and can track animal behavior health and environmental-related sensors as they all cross-communicate. These devices are critical for obtaining real-time data for disease diagnosis and management.

It is expected that software and services will grow with the fastest CAGR from 2024 to 2032. Such growth can be attributed to ever-evolving AI algorithms, machine learning, and predictive analytics that are allowing for better and faster management of animal health. Additionally, the growing inclination towards cloud-based platforms and AI-enabled applications to process and leverage data for effective decision-making accelerates the growth of the software and services segment due to the increasing need for smarter and more integrated animal health solutions.

By Application

Artificial intelligence in the animal health market was dominated by the diagnostics segment in 2023. The growth of this segment is attributed to the growing use of AI-based diagnostic tools that help in early disease detection in animals. AI imaging systems and disease monitoring tools, to name a few, these devices improve precision, reduce human errors, and elevate the standard of veterinary care. Fast and accurate diagnostics of health problems in agricultural and companion animals is, of course, necessary for fast interventions and consequently can result in better outcomes.

The "other" segment, which includes AI applications in areas like behavior analysis, feed optimization, and genetic selection, is projected to grow at the highest CAGR from 2024 to 2032Innovations in AI are driving this growth, broadening the application of AI beyond the diagnostic niche and providing solutions that help the animal health industry improve animal welfare, increase productivity, and streamline breeding processes.

By Animal

In 2023, the companion animal segment accounted for the largest share. The growing emphasis on pet health and wellness drove this dominance, with artificial intelligence technologies being widely utilized for diagnostic, behavior, and health-monitoring applications. Tools powered by AI are utilizing companion animal care and health and wellness tracking, leaving a continuous record of vitals and habits, and facilitating early disease detection to add new dimensions of care for pets and more effectively assist veterinary professionals.

From 2024 to 2032, the highest CAGR is expected to be achieved by the production animal segment. It is driven by the demand for sustainable and effective livestock management. AI applications for disease monitoring, feeding, and reproduction management in production animals are likely to make tremendous gains in productivity, cost, and animal health at the population scale. This will be an ever-expanding segment due to the increasing global requirement for food.

Regional Analysis

North America held the largest share of the global artificial intelligence in animal health marketing in 2023 owing to technological advancement, huge investment in research and development, and the presence of major players in the region. In the USA and Canada, AI technologies in veterinary applications have found early pathways with many AI-centric startups and collaborations among tech firms and veterinary institutions. Some companies, such as PetPace in the USA, offer AI-based smart collars for pets that check vital signs and health metrics in real-time. AI is also extensively utilized in livestock health management such as disease detection and breeding enhancement across the region.

The region that is expected to have the highest CAGR during the forecast period from 2024 to 2032 is the Asia Pacific owing to the growing demand for animal health solutions from countries such as China and India, which are rapidly emerging markets. One contributing factor to this growth is the rapid urbanization of the region, a rising livestock population, as well as increased awareness of animal welfare. Zoetis, one of the foremost global animal health companies, worked with Chinese technology firms to develop artificial intelligence-based solutions for disease monitoring in livestock. Likewise, AI-based tools for pet care are on the rise across Japan, Such as Furbo for pet monitoring and safety.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Artificial Intelligence In Animal Health Market are:

-

Zoetis (Smartbow Ear Tag)

-

Merck Animal Health (Wisdom Panel)

-

Boehringer Ingelheim (IngenuityAI)

-

Elanco Animal Health (Assurance)

-

Vetoquinol (VetConnect Plus)

-

Cargill Animal Nutrition (Probiotics with AI Integration)

-

BASF (Digital Farming Solutions)

-

DeLaval (OptiDairy)

-

Agri-Tech East (AI-based Livestock Monitoring System)

-

Lely (Lely Horizon)

-

Pedigree (AI-based Genetic Analysis)

-

Vets First Choice (Veterinary Practice Management Software with AI)

-

Idexx Laboratories (IDEXX VetLab Station)

-

Biocontrol (Biological Pest Control with AI)

-

Hendrix Genetics (Smart Breeding Solutions)

Recent Trends

-

In September 2024, Zoetis launched the Vetscan OptiCell™, the first cartridge-based AI-powered hematology analyzer for veterinary use, offering lab-quality CBC analysis at the point of care.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.28 Billion |

| Market Size by 2032 | USD 7.06 Billion |

| CAGR | CAGR of 20.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solutions (Hardware, Software & Services) • By Application (Diagnostics, Identification, Tracking, and Monitoring, Others) • By Animal (Companion Animals, Production Animals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Vetoquinol, Cargill Animal Nutrition, BASF, DeLaval, Agri-Tech East, Lely, Pedigree, Vets First Choice, Idexx Laboratories, Biocontrol, Hendrix Genetics. |