Mental Health Apps Market Size Analysis:

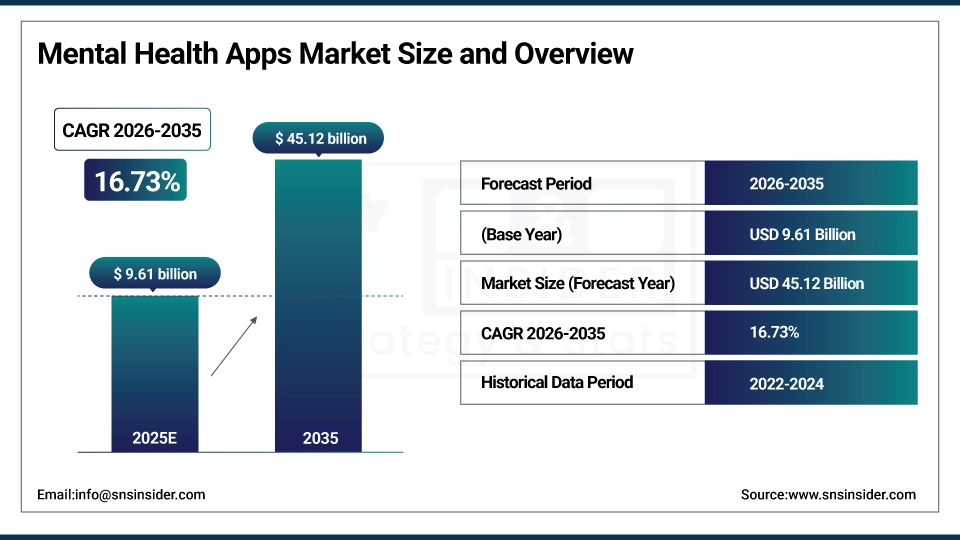

The Mental Health Apps Market size was valued at USD 9.61 billion in 2025 and is expected to reach USD 45.12 billion by 2035, growing at a CAGR of 16.73% over the forecast period of 2026-2035.

The global mental health apps market trend is a growing demand for digital mental wellness solutions such as depression and anxiety management platforms, meditation and stress management applications, and AI-powered behavioral health tools. Also driven by a growing adoption of telepsychiatry services and the growing focus on workplace mental wellness programs as employers and healthcare providers become more focused on improving employee mental health outcomes and are more willing to invest in app-based cognitive behavioral therapy and mindfulness tools, resulting in growth in the domestic and international market for iOS-based, Android-based, and cross-platform mental health application solutions.

For instance, in March 2024, growing awareness and the surge in post-pandemic mental health concerns drove a 26% increase in mental health app downloads across North America and Europe, boosting user engagement with digital therapy, guided meditation, and wellness management platforms.

Mental Health Apps Market Size and Forecast:

-

Market Size in 2025: USD 9.61 billion

-

Market Size by 2035: USD 45.12 billion

-

CAGR: 16.73% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get More Information on Mental Health Apps Market - Request Sample Report

Mental Health Apps Market Trends

-

Mental health app solutions are being adopted because users demand fast, on-demand access to therapy tools, guided meditation sessions, mood tracking features, and cognitive behavioral therapy (CBT) exercises.

-

Personalized mental wellness programs based on user behavior patterns, stress indicators, sleep quality data, and self-reported mood scores to improve outcomes and long-term app engagement.

-

The development of AI-powered chatbots, virtual therapist interfaces, and voice-based mindfulness coaching tools to improve the accessibility of mental health support and reduce dependency on in-person clinical visits.

-

Secure messaging with licensed therapists, video consultation features, and crisis intervention modules are all available to ensure continuous mental health care delivery and treatment plan adherence.

-

Increased demand for subscription-based wellness platforms, wearable device integration, and gamified mental health content to enhance user retention and daily active engagement across iOS and Android ecosystems.

-

Collaboration between mental health app developers, health insurance companies, and employer wellness program providers to integrate digital mental health tools into existing employee assistance and benefits platforms.

-

FDA, FTC, and global regulatory bodies promoting standards for clinical evidence requirements, data privacy protections, HIPAA compliance, and digital therapeutics approval pathways for mental health applications.

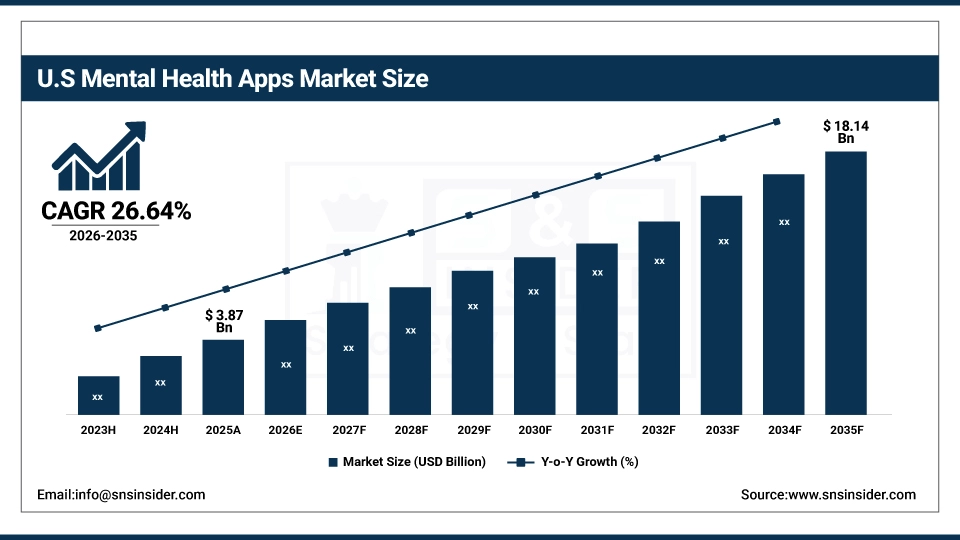

The U.S. Mental Health Apps Market was valued at USD 3.87 billion in 2025 and is expected to reach USD 18.14 billion by 2035, growing at a CAGR of 16.82% from 2026-2035. The United States represents the largest market for mental health apps, primarily driven by the high prevalence of anxiety and depressive disorders, growing insurance reimbursement for digital therapeutics, and a well-developed mobile health application ecosystem. Also, the U.S. is the largest regional market in the world, due to the regulatory progress around digital therapeutics and the swift adoption of subscription-based and employer-sponsored mental health app platforms.

Mental Health Apps Market Growth Drivers:

-

Rising Global Prevalence of Mental Health Disorders is Driving the Mental Health Apps Market Growth

Rising global prevalence of mental health disorders takes the center stage as a growth driver for the mental health apps market share, and is driven by the increasing incidence of depression, anxiety, post-traumatic stress disorder (PTSD), and burnout across working-age populations globally, particularly in the aftermath of the COVID-19 pandemic. The critical shortage of mental health professionals and the stigma associated with in-person therapy are compelling millions of users to seek accessible, anonymous, and affordable digital mental wellness solutions. These dynamics for widespread unmet mental health needs are expanding the base of the market, the penetration of self-guided and clinician-connected app platforms, and adding to the overall market share globally.

For instance, in May 2024, the World Health Organization reported that depression and anxiety disorders cost the global economy approximately USD 1 trillion per year in lost productivity, with digital mental health solutions identified as a cost-effective intervention, significantly accelerating app adoption and market investment.

Mental Health Apps Market Restraints:

-

Data Privacy Concerns and Lack of Clinical Validation are Hampering the Mental Health Apps Market Growth

Data privacy concerns and the lack of clinical validation of mental health apps also restrict the mental health apps market growth, as a large number of users who download mental health applications abandon them within the first month or raise concerns over how their sensitive psychological and behavioral data is being stored and used. This might lead to low long-term engagement, reputational risk for app developers, and reduced trust from healthcare providers and insurers needed to scale reimbursement pathways. As a result, user health outcomes suffer and market growth is stunted in regions where digital health literacy is limited and regulatory oversight of consumer mental wellness apps remains inconsistent.

Mental Health Apps Market Opportunities:

-

Employer-Sponsored Mental Wellness Programs and Digital Therapeutics Reimbursement Drive Future Growth Opportunities for the Mental Health Apps Market

The opportunity in employer-sponsored mental wellness programs and digital therapeutics reimbursement in the mental health apps market is in the form of enterprise wellness contracts, employee assistance program (EAP) integrations, and insurance-covered app subscriptions. These solutions provide for scalable mental health support delivery across large workforces, individualized stress management and burnout prevention programs, and real-time mood and wellness tracking for at-risk employee groups. Through enhanced workplace mental health outcomes, reduced absenteeism and presenteeism, and growing insurer willingness to cover prescription digital therapeutics (PDTs), these opportunities may expand the addressable user base, increase average revenue per user, and grow the market substantially.

For instance, in April 2024, the American Psychiatric Association reported that 67% of U.S. employers had increased investment in digital mental health and wellness app benefits for employees, highlighting the accelerating enterprise adoption and growing commercial opportunity for mental health app providers.

Mental Health Apps Market Segment Analysis

-

By platform, iOS held the largest share of around 52.34% in 2025E, and the Android segment is expected to register the highest growth with a CAGR of 17.28%.

-

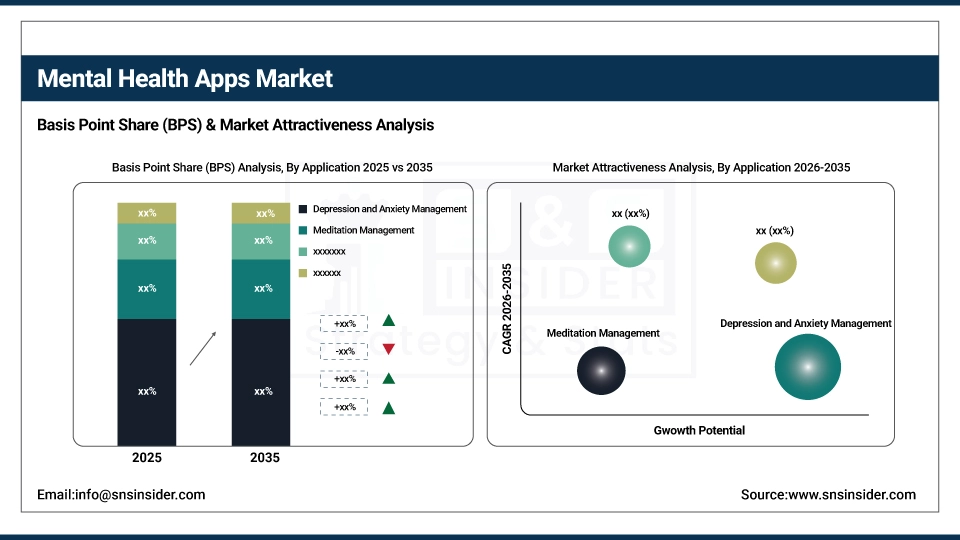

By application, depression and anxiety management held the largest share of around 38.46% in 2025E, and the wellness management segment is expected to register the highest growth with a CAGR of 17.91%.

By Application, Depression and Anxiety Management Leads the Market, While Wellness Management Registers Fastest Growth

The depression and anxiety management segment accounted for the highest revenue share of approximately 38.46% in 2025, owing to the high and rising global burden of depressive and anxiety disorders, the growing clinical legitimacy of app-based CBT and mood tracking tools, and the increasing willingness of users and health plans to invest in evidence-backed digital mental health solutions. Emerging trends include rising integration of AI-driven sentiment analysis and crisis detection features within depression management platforms, as well as growing partnerships between app developers and psychiatric care networks.

The wellness management segment is anticipated to achieve the highest CAGR of nearly 17.91% during the 2026–2035 period, driven by the increasing demand from health-conscious consumers seeking preventive mental wellness tools beyond clinical therapy, and by the rapid growth of corporate wellness contracts. Drivers include rising adoption of holistic wellness platforms combining sleep tracking, nutrition guidance, and mindfulness coaching, as well as the preference for proactive mental health maintenance among younger demographic groups.

By Platform, iOS Leads the Market, While Android Registers Fastest Growth

The iOS segment accounted for the highest revenue share of approximately 52.34% in 2025, owing to higher average consumer spending per app on the Apple App Store, stronger willingness to pay for premium mental health subscriptions among iPhone users, and the concentration of high-income demographics in North America and Europe who are early adopters of digital wellness solutions. Emerging trends, including growing integration of mental health apps with Apple Health and Apple Watch biometric data, and rising demand for clinician-grade features among iOS-based telehealth platforms.

The Android segment is anticipated to achieve the highest CAGR of nearly 17.28% during the 2026–2035 period, driven by the massive and growing Android user base across Asia Pacific, Latin America, and the Middle East & Africa, where smartphone penetration is expanding rapidly and free-to-download mental wellness apps are gaining significant traction. Drivers include rising adoption among lower- and middle-income populations, the availability of freemium app models suited to price-sensitive markets, and growing localization of mental health app content across regional languages and cultural contexts.

Mental Health Apps Market Regional Highlights:

North America Mental Health Apps Market Insights:

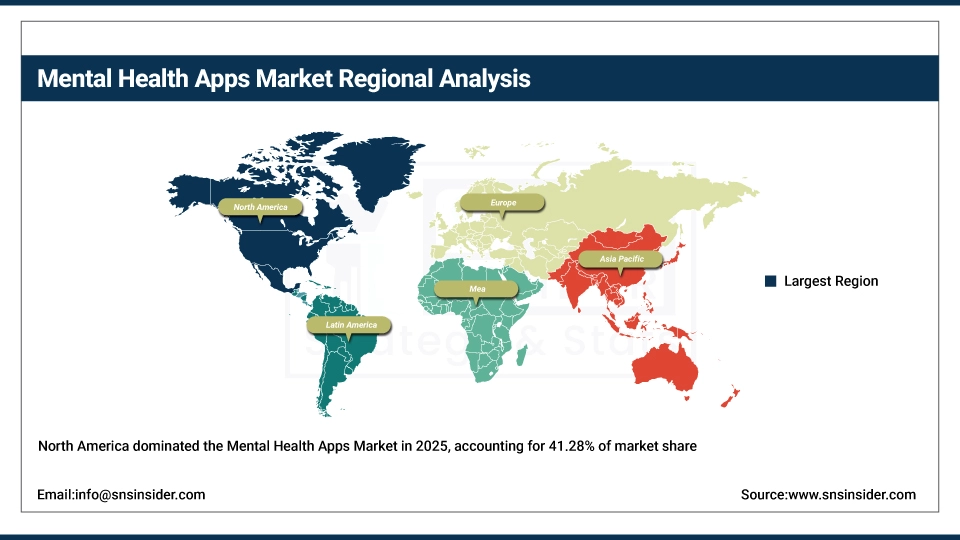

North America held the largest revenue share of over 41.28% in 2025 of the mental health apps market due to an established digital health ecosystem, high levels of mental health disorder awareness, and increased willingness among consumers and employers to invest in on-demand mental wellness solutions. At the same time, various government awareness initiatives, the Mental Health Parity and Addiction Equity Act compliance requirements, and enormous employer investment in workplace mental wellness benefits are anchoring mental health app platforms and services in the market, and ensuring multibillion dollar revenues across the region.

Do You Need any Customization Research on Mental Health AppsMarket - Enquire Now

Asia Pacific Mental Health Apps Market Insights:

In 2025, Asia Pacific is the fastest-growing segment in the mental health apps market with a CAGR of 18.62%, as the awareness about mental health disorders, government-backed digital health initiatives, and the dismantling of mental health stigma in countries such as Australia, Japan, India, and South Korea is growing. Factors including rapid smartphone adoption, expanding 4G and 5G connectivity, rising youth population dealing with academic and occupational stress, and growing uptake of meditation and wellness apps are stimulating the market growth. National mental health action plans and government-funded digital health programs have been instrumental in improving access to mental wellness tools, especially in underserved urban and rural communities. Public-private partnerships and regional app localization efforts also help in advancing mental health awareness and digital therapy adoption. Increase in demand in the Asia Pacific region owing to rising mental health awareness expenditure against historical spending levels and growing affordability of freemium and subscription-based mental wellness app models.

Europe Mental Health Apps Market Insights:

The mental health apps market in Europe is the second-dominating region after North America on account of an increase in the adoption of digital therapeutics, robust data privacy regulations including GDPR, and increasing national investment in mental health services and digital well-being programs across healthcare systems in the UK, Germany, France, and the Netherlands. Rising implementation of national digital mental health strategies, favorable government reimbursement frameworks for prescription digital therapeutics, and growing user awareness of meditation, stress management, and anxiety apps are also contributing to the sustained growth of the market in leading European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Mental Health Apps Market Insights:

In Latin America, and Middle East & Africa, the growing mental health awareness campaigns and increase in internet connectivity with mobile device penetration support the mental health apps market growth. The rising popularity of affordable freemium app models and multilingual mental wellness content, along with reduced social stigma around mental health in urban populations, will aid accessibility of digital therapy tools and user engagement. The increasing youth population and improving smartphone access in these regions are continuing to encourage market growth.

Mental Health Apps Market Competitive Landscape:

Headspace Health (est. 2010) is a leading digital mental health company that focuses on mindfulness, meditation, and clinician-supported mental wellness solutions for both consumers and enterprise clients. It uses its meditation content library and EAP partnership network to deliver evidence-based mental health tools with seamless employer benefits integration.

-

In February 2025, it expanded its enterprise mental health platform with AI-powered personalized stress management and burnout prevention programs, targeting large employer clients and health plan partners across North America and Europe to improve workforce mental wellness outcomes.

Calm (est. 2012) is a globally recognized consumer mental wellness platform focused on guided meditation, sleep improvement, anxiety reduction, and daily mindfulness content. It invests in celebrity-narrated sleep stories, therapist-designed anxiety and stress management programs, and enterprise wellness partnerships with the hopes of becoming the world's leading mental fitness platform for both individual and corporate users.

-

In July 2024, launched an enhanced corporate wellness suite featuring personalized meditation and stress management programs integrated with HR and benefits platforms across major U.S. and European enterprise clients, expanding its B2B revenue base and workforce mental wellness reach.

BetterHelp (Teladoc Health) (est. 2013) is a leading online therapy and telepsychiatry platform that connects users with licensed therapists, counselors, and psychiatrists through a fully app-based and web-based care delivery model. The company's mental health product portfolio focuses on accessible, affordable, and stigma-free therapy matching, and features a strong commitment to clinical quality and continuous platform innovation to complement its dominant market presence in direct-to-consumer online mental health services.

-

In October 2024, introduced AI-driven therapist matching and personalized depression and anxiety management care pathways within its mobile app, strengthening clinical engagement capabilities and expanding adoption among younger adults and college-age users seeking accessible mental health support.

Mental Health Apps Market Key Players:

-

Headspace Health

-

Calm

-

BetterHelp

-

Talkspace

-

Woebot Health

-

Noom Inc.

-

Sanvello Health

-

Happify Health

-

Spring Health

-

Lyra Health

-

Modern Health

-

Ginger

-

Insight Timer

-

MindDoc

-

Daylio

-

eMoods

-

SuperBetter LLC

-

Mindfulness Apps Ltd.

-

Ten Percent Happier

-

Cerebral Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 9.61 billion |

| Market Size by 2035 | USD 45.12 billion |

| CAGR | CAGR of 16.73% from 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform Type (Android, iOS, Others) • By Application Type (Depression and Anxiety Management, Meditation Management, Stress Management, Wellness Management, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Headspace Health, Talkspace Inc., BetterHelp (Teladoc Health), Sanvello Health Inc., Wysa Ltd., Happify Health, MoodMission, Youper Inc., K Health Inc., CVS Health (Aetna Inc.), Lyra Health Inc., Spring Health, Big Health (Sleepio), Unmind Ltd., MindDoc Health GmbH, MyStrength, Shine, Simple Habit, InnerHour, SilverCloud Health |