Artificial Intelligence in Manufacturing Market Report Scope & Overview:

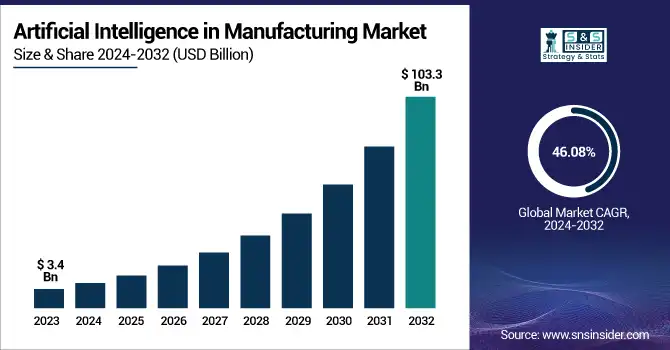

The Artificial Intelligence in Manufacturing Market was valued at USD 3.4 billion in 2023 and is expected to reach USD 103.3 billion by 2032, growing at a CAGR of 46.08% from 2024-2032.

To Get more information on Artificial Intelligence in Manufacturing Market - Request Free Sample Report

The statistical insights for the Artificial Intelligence in Manufacturing Market highlight key dynamics shaping the industry. In 2023, AI adoption in manufacturing varied by region, with North America and the Asia-Pacific leading due to strong industrial digitalization initiatives and supportive government policies. The deployment of predictive maintenance solutions was especially prominent in the automotive and electronics sectors, driven by the need to reduce downtime and improve asset efficiency. Country-wise investment in AI-driven automation technologies showed that the U.S., China, and Germany were leading in funding for robotics, machine learning, and smart production tools. The impact of AI on production efficiency was evident across various application areas, particularly in quality control, supply chain optimization, and real-time process monitoring. Beyond these insights, the report also explores emerging trends such as the integration of generative AI in product design, increased use of AI-powered edge computing for real-time decision-making on factory floors, and growing strategic partnerships between AI vendors and manufacturing OEMs to deliver scalable, sector-specific solutions—indicating a transformative shift toward more intelligent and responsive manufacturing systems.

The U.S. Artificial Intelligence in Manufacturing market is experiencing rapid growth, driven by the increasing adoption of automation technologies and the need for enhanced operational efficiency. In 2023, the market was valued at approximately USD 0.8 billion and is projected to reach USD 23.9 billion by 2032, reflecting a compound annual growth rate of 45.73% during this period. This expansion is further supported by government initiatives, such as the CHIPS and Science Act, which aim to bolster domestic semiconductor manufacturing and research.

Artificial Intelligence in Manufacturing Market Dynamics

Driver

-

AI is being adopted to boost efficiency, cut costs, and enable smarter, faster manufacturing decisions.

Recent AI companies are helping manufacturers automate better, reduce downtime, and make data-driven decisions in real time. Production processes are increasingly being complemented to be more effective and cost-effective with powerful smart sensors, machine learning algorithms, and predictive analytics. In the United States and other developed parts of the world, AI is being deployed to optimize supply chains, track equipment health, and enhance quality control. As competition increases, organizations are adopting AI tools to gain a technological lead, allowing businesses to become agile and responsive. The availability of IoT devices and cloud platforms is enabling these systems to become scalable and cost-effective, fuelling this demand.

Restraint

-

High setup costs and challenges in merging AI with legacy systems slow down adoption.

Despite its benefits, the adoption of AI in manufacturing faces hurdles due to high upfront investment and integration complexity. Deploying AI requires expensive infrastructure, skilled personnel, and time-consuming system upgrades. Many small and mid-sized enterprises struggle to afford these costs, creating a gap in adoption. Moreover, integrating AI with legacy equipment and outdated IT systems poses technical challenges, often leading to downtime and productivity loss during transitions. This financial and operational burden limits the pace of AI deployment, especially in price-sensitive markets, thereby restraining the overall growth of the industry.

Opportunity

-

Edge AI and IIoT are enabling real-time, scalable, and cost-effective smart manufacturing.

The emergence of Edge AI and Industrial IoT is opening new opportunities in the manufacturing sector. Edge AI allows real-time data processing directly at the machine level, reducing latency and dependency on cloud infrastructure. This is particularly valuable in scenarios where milliseconds matter, such as robotic assembly lines or quality inspection systems. IIoT devices gather data across the entire production floor, enabling holistic performance monitoring and proactive maintenance. The convergence of these technologies empowers manufacturers to achieve hyper-automation and greater production agility. As these innovations mature, they offer cost-effective, scalable, and decentralized AI solutions for all manufacturing scales.

Challenge

-

AI systems in manufacturing face risks of cyberattacks and data breaches, raising security concerns.

As manufacturing becomes increasingly digitized and AI-driven, data privacy and cybersecurity emerge as critical challenges. AI systems rely on large volumes of sensitive data, including proprietary designs, production metrics, and supply chain details. This data, when stored or transmitted across cloud and IoT platforms, becomes vulnerable to cyberattacks, data breaches, and industrial espionage. A successful breach can halt operations, lead to significant financial losses, and damage a company’s reputation. Additionally, manufacturers must comply with evolving data protection regulations, which can be complex and region-specific. Ensuring robust cybersecurity frameworks and secure data-handling practices is essential to gaining trust and fully leveraging AI in the manufacturing landscape.

Artificial Intelligence in Manufacturing Market Segmentation Analysis

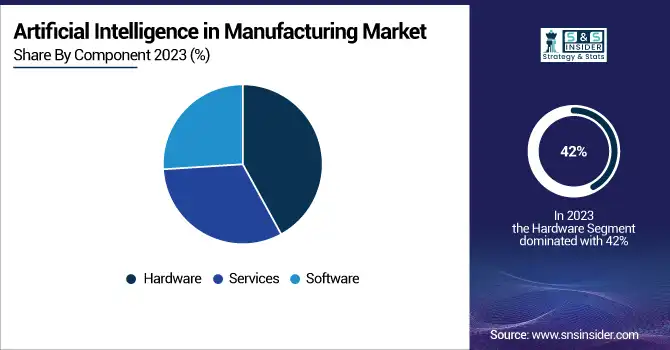

By Component

The hardware segment dominated the market and held the largest share, accounting for 42% of the revenue in 2023. Developments in these fields were key in AI in manufacturing. This led to the development of new hardware alternatives specifically designed to cater to the computing needs presented by AI algorithms, allowing for faster and more efficient processing of large and complex datasets. Companies were putting resources toward the development of tailor-made hardware that specifically catered for tasks associated with machine learning — making systems more efficient and, therefore, enabling them to deploy more advanced instances of AI applications in a manufacturing environment.

The software segment is anticipated to grow at the fastest CAGR during the forecast period. Due to their unparalleled flexibility and adaptability, software solutions from various sectors can be applied broadly across a wide range of production processes. Due to its essential elasticity, software used to be considered the best candidate for an industry with diverse needs.

By Technology

The machine learning segment dominated the market and accounted for 34% of revenue share in 2023, as it has a proven effectiveness that increases operational efficiency and minimizes downtime. The analytical intelligence of machine Learning algorithms over historical equipment data facilitates predicting machinery breakdowns in advance. This predictive insight helps manufacturers to plan maintenance activities proactively. Such a transition from reactive to proactive maintenance gives manufacturers control over how they utilize their resources, reducing unscheduled downtimes and boosting overall performance reliability.

The computer vision segment is expected to grow at the highest CAGR during the forecast period. It combines AI and computer vision approaches to ease the tasks. In the industrial premises, computer vision in robots improves their effective understanding of the surroundings and assists safer navigation around humans. AI-equipped computer vision systems facilitate the identification of product results to further enhance factory workflows in smart manufacturing environments.

By Application

In 2023, the production planning segment held the largest market revenue share in the market. Driven by AI and machine learning, demand prediction was entering a new era with more sophisticated predictive analytics, which was changing production planning systems. These systems use machine learning algorithms to analyze historical data, market trends, and various other factors to predict demand accurately. By utilizing this information, manufacturers reduce inventory levels, improve production schedules, and more effectively allocate resources, resulting in lower costs and increased operational efficiency.

The predictive maintenance & machinery inspection segment is anticipated to grow at the fastest CAGR during the forecast period. Predictive maintenance systems powered by AI also focus increasingly on remote monitoring and diagnostics. Using AI algorithms, manufacturers could remotely monitor the status of equipment, detect anomalies, and diagnose potential issues in real time.

By End Use

The medical device segment dominated the market in 2023 and accounted for a significant revenue share in 2023. AI also has great potential in medical device manufacturing, as its technology can ensure quality control, yield optimization, predictive maintenance, and other functions. Engineering is elevated with the use of machine learning and computing as we learn from those mistakes and improve on them. AI can be used by medical device manufacturers in many different environments.

The automobile segment is expected to register the fastest CAGR during the forecast period, owing to the advanced connectivity elements paired with AI technology. Moreover, the incorporation of such technology has empowered Vehicle-to-Vehicle and Vehicle-to-Infrastructure communication, birthing advanced AI assistants capable of delivering real-time traffic information and predictive navigation suggestions, ultimately augmenting the driver’s overall experience and safety on the road.

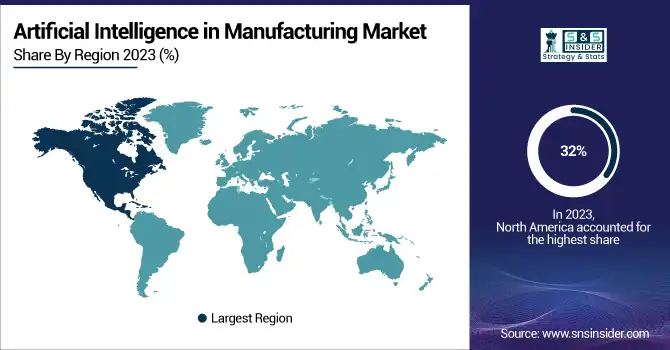

Regional Landscape

In 2023, North America dominated the market and accounted for 32% of revenue share driven by the presence of leading companies manufacturing high-performance hardware components, which are the key to running advanced AI models. As the U.S. government looks for ways to invigorate the manufacturing sector while also strengthening its own national supply chains toward national security and encouraging investment in research and development, it published its National Strategy for Advanced Manufacturing, a strategic plan establishing the principal ways in which it intends to accomplish that.

The Asia Pacific is expected to register the fastest CAGR during the forecast period. The Asia Pacific took significant steps towards promoting smart manufacturing based on the Industry 4.0 concept. This region, including countries like China, Japan, and India, worked on using AI-based technologies to digitize and improve production processes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

IBM Corporation – Watson IoT for Manufacturing

-

Siemens AG – Industrial Edge

-

Microsoft Corporation – Azure AI

-

Alphabet Inc. (Google Cloud) – Vertex AI

-

Amazon Web Services (AWS) – AWS IoT SiteWise

-

General Electric Company (GE Digital) – Predix Platform

-

SAP SE – SAP Digital Manufacturing Cloud

-

Oracle Corporation – Oracle AI for Manufacturing

-

Rockwell Automation, Inc. – FactoryTalk Analytics

-

NVIDIA Corporation – NVIDIA Metropolis for Factories

-

Intel Corporation – Intel Edge AI Software

-

Schneider Electric SE – EcoStruxure Machine Advisor

-

PTC Inc. – ThingWorx Industrial IoT Platform

-

Fanuc Corporation – FIELD system (Fanuc Intelligent Edge Link and Drive)

-

ABB Ltd. – ABB Ability™ Genix Industrial Analytics and AI Suite

Recent Developments

-

January 2024: Figure AI announced a partnership with BMW to deploy humanoid robots in automotive manufacturing facilities, aiming to enhance automation and efficiency on the production line.

-

February 2024: Siemens and Microsoft collaborated to assist manufacturers in adopting AI technologies, focusing on creating AI co-pilots that work alongside human operators to boost productivity and safety.

-

March 2024: Applied Intuition partnered with Porsche to jointly develop advanced automotive software, enhancing the integration of AI in vehicle systems.

-

April 2024: Applied Intuition and Audi began collaborating to develop automated driving systems aimed at improving vehicle autonomy and safety through AI technologies.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 3.4 Billion |

|

Market Size by 2032 |

US$ 103.3 Billion |

|

CAGR |

CAGR of 46.08 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

IBM Corporation, Siemens AG, Microsoft Corporation, Alphabet Inc. (Google Cloud), Amazon Web Services (AWS), General Electric Company (GE Digital), SAP SE, Oracle Corporation, Rockwell Automation, Inc., NVIDIA Corporation, Intel Corporation, Schneider Electric SE, PTC Inc., Fanuc Corporation, ABB Ltd. |