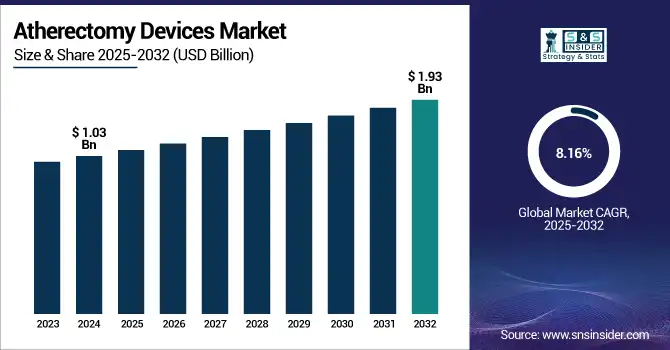

Atherectomy Devices Market Size Analysis:

The Atherectomy Devices Market size was valued at USD 1.03 billion in 2024 and is expected to reach USD 1.93 billion by 2032, growing at a CAGR of 8.16% over 2025-2032.

The global atherectomy devices market is experiencing an outstanding traction owing to the increasing cases of peripheral artery disease (PAD) and coronary artery disease (CAD), with the growing geriatric population. High demand is a reflection of increasing clinical awareness, developments of minimally invasive procedures, and a trend toward outpatient settings. Presence of increasing R&D investments is another key factor driving the atherectomy devices market, as evident from Philip with its continuous clinical trial studies like the THOR IDE study, which uses a single device approach to treat PAD.

To Get more information on Atherectomy Devices Market - Request Free Sample Report

In April 2024 Philips enrolled the first U.S. patient in its trial of a hybrid device that is both an imaging and an atherectomy device in one for a single PAD treatment.

Regulatory nods are making for a faster shaping U.S. atherectomy devices market, with the US FDA slamming Bard’s Jetstream devices with a Class I recall, after serious injuries and four deaths, pointing to more watches by the authorities. This is likely to enhance device safety and innovation in the future, however. Leading atherectomy devices companies such as Boston Scientific and Abbott (acquired Cardiovascular Systems Inc.) are making vigorous investments in product development and broadening indications. Moreover, increasing reimbursement coverage and growing investments by hospitals in endovascular equipment are also contributing to the atherectomy devices market growth. R&D expenditure is booming, particularly in the area of unified procedural devices and real-time imaging improvements. A 2024 Journal of Vascular Surgery study revealed that mechanical atherectomy systems lower TLR rates by more than 25% compared to balloon angioplasty alone, solidifying demand-side fortitude.

In May 2024, the FDA broadened a safety alert it had issued on BD/Bard’s Jetstream system, highlighting the need for solid clinical validation, and this will drive the atherectomy devices market assessment related to device utility and operator well-being.

Atherectomy Devices Market Dynamics:

Drivers:

-

Technological Innovations, Procedural Demand, and Favorable Clinical Outcomes Propel the Market Growth

The global atherectomy devices market is propelled by demand for minimally invasive cardiovascular procedures, on the back of the increasing prevalence of PAD and vascular complications among people with diabetes. According to the American Heart Association, more than 8.5 million people in the U.S. have PAD, leading to the call for alternative revascularization approaches. The transition to same-day patient discharge and the growth of outpatient vascular labs have led to significantly increased adoption of convenient and transportable atherectomy systems.

Medtronic and Boston Scientific have added rotation and orbital devices to their product portfolios with the new generation, less hazardous devices, the production whereof being supported by substantial R&D investments. In 2023, Boston Scientific R&D spending grew by 7.6% compared to the previous year.

In March 2024, the FDD approved a new photoablative atherectomy device platform with a breakthrough device designation, which will speed up its marketing approval. Additionally, greater reimbursement coverage for PAD treatment procedures in the outpatient setting and a 15% rise in the purchase of equipment for in-hospital cath labs in 2023 have underpinned demand. The atherectomy devices industry trends show a shift toward employing drug-coated, real-time imaging, and precise cutting tools that attract fund inflow and enhance patient outcomes. These advances are essential in developing a response to the changing requirements of the interventional cardiology and vascular surgery community.

Restraints:

-

Safety Concerns, Device-Related Failures, And Stringent Regulatory Oversight Impacting Adoption of the Market

The U.S. FDA announced in February 2024 that the HawkOne Directional Atherectomy System (Medtronic) was recalled (Class I) because the catheter tips were breaking with the potential to become emboli, impacting more than 95,000 devices distributed since 2018. Cases like these have caused distrust among clinicians and purchasing entities, leaving buyers reluctant to buy. Moreover, operator-dependent differences and complex learning curves have restricted the utilization of some device categories, especially in low-volume vascular centers. FDA's growing focus on real-world performance data has extended review deadlines. Moreover, a Journal of Interventional Cardiology (2024) study showed that more than 12% of atherectomy procedures ended in distal embolization following improper technique application, with the condition sweeping fears among clinicians.

Reimbursement discrepancies between varieties of devices and procedural techniques contribute to the complexity, especially in resource-limited healthcare systems. And litigation exposure and patient safety litigation have driven companies to re-evaluate how they make products and how they control the quality, which is all attaching itself as a cost of this business. These regulatory and procedural obstacles are emerging as major stumbling blocks in the atherectomy devices market assessment, necessitating stronger training programs, design improvements, and evidence-based clinical validation to rebuild the confidence of both physicians and institutions.

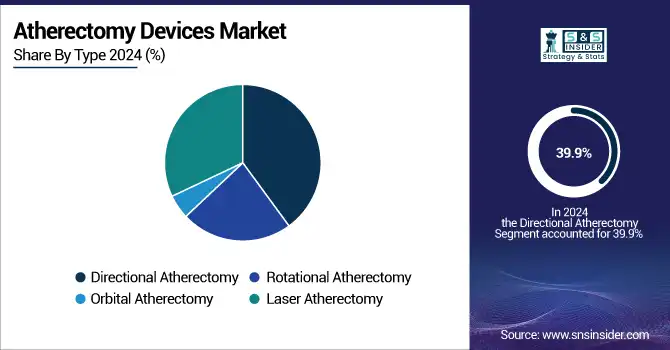

Atherectomy Devices Market Segmentation Analysis:

By Type

In 2024, the directional atherectomy was the leading segment in the global atherectomy devices market, and the atherectomy devices market share was 39.9%. This supremacy is largely due to the endovascular precision in the removal of plaque and the ubiquity of its use in the treatment of above- and below-the-knee peripheral arterial lesions. Directional atherectomy instruments remove atherosclerotic plaque at the site, with minimal vessel wall injury, for improved long-term patency. These devices are popular among operators for the management of eccentric hard plaque lesions because of their flexibility. Additionally, an offering of various catheter sizes and real-time image-guided features has enhanced procedural success, thereby driving worldwide adoption of the technology in hospitals and outpatient labs.

By type, the laser atherectomy is expected to be the fastest growing segment over the forecast period. The benefit of laser atherectomy is that it vaporizes plaque using high-frequency ultraviolet light, for which the risk of heat damage and embolism is diminished. It is most successful in stent restenosis and long occlusions. Accelerating clinical need for accurate and non-mechanical processes, along with technological developments in the field of fiber-optic catheters, is accelerating the growth of this segment. In addition, increasing clinical data demonstrating its effectiveness for complex arterial blockages, plus additional FDA clearances for next-generation laser catheters, are driving its adoption at high-volume vascular centers.

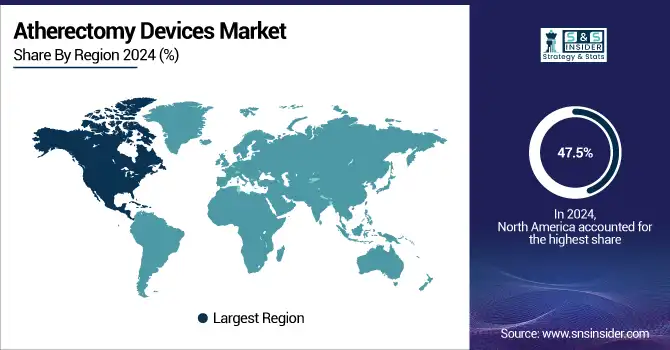

Regional Insights:

North America held the leading position in the global atherectomy devices market share of 47.5% in the year 2024, on account of the high prevalence of diseases, developed healthcare infrastructure, and favorable reimbursements. The U.S. atherectomy devices market size was valued at USD 370.50 million in 2024 and is expected to reach USD 644.30 million by 2032, growing at a CAGR of 7.22% over 2025-2032. The U.S. held the major share in the region owing to the high prevalence of vascular centers and the rise in utilization of minimally invasive treatments for PAD. More than 6.5 million Americans age 40 and older have PAD, which is driving the need for atherectomy procedures, the CDC reports. Substantial R&D expenditure and regular FDA device approval, and for instance, Boston Scientific, Abbott Systems, also support the regional growth. Canada is experiencing slow uptake through government-funded screening programs and interventional cardiology training expansion. Mexico demonstrates promising public-private partnerships targeting vascular disease in urban population management.

Asia Pacific is the fastest growing region of the atherectomy devices market due to the growing prevalence of cardiovascular disease, expansion of the healthcare infrastructure, and increase in procedures performed. Because the country has already aged the most, its vascular disease population becomes the largest accounting for the double-digit growth rate in the vascular disease patients, and the great improvement of the access rate of grade III hospitals, which led the vascular market to become the most active in the region with the patients quantity of more than 110 million. Japan is also progressing on the adoption of Laser and Orbital Atherectomy devices, propelled by regulatory changes and technology linkages with Western companies. India is a high-growth market because it has increasing numbers of ICs, urbanization, and growing government support for NCD programs. In addition, Singapore and South Korea have risen up as R&D hubs, as public funding has been poured into medtech innovation and good clinical trial infrastructure.

The second rapidly growing region is Europe, which has witnessed the increasing usage of atherectomy devices in the major markets, such as Germany, France, and the UK. Germany is a leading nation due to their strong network of interventional cardiology and substantial per capita healthcare expenditure. Increasing peripheral vascular interventions and government reimbursement policies in France and the UK will further aid the atherectomy devices market growth. Italy and Spain are experiencing growing public hospital device uptake driven by European Union cardiovascular initiatives. Poland and Turkey, due to increasing investments by the private sector in the field of endovascular care as well as early PAD detection programs, are continually growing.

Get Customized Report as per Your Business Requirement - Enquiry Now

Atherectomy Devices Market Key Players:

Leading atherectomy devices companies operating in the market include Medtronic, Boston Scientific Corporation, Abbott, BD, Cardiovascular Systems Inc., Avinger, Koninklijke Philips N.V., Cordis, Terumo Medical Corporation, and Stryker Corporation.

Recent Developments in the Atherectomy Devices Market:

In March 2025, BD was compelled to modify its instructions for use for its Rotarex atherectomy system to state that vascular tortuosity and calcification are conditions that may lead to helix fracture.

In January 2025, AngioDynamics launched the AMBITION BTK randomized clinical trial and registry to examine its Auryon laser atherectomy system for below-the-knee PAD—a pivotal move to broaden indications and further build clinical evidence.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.03 billion |

| Market Size by 2032 | USD 1.93 billion |

| CAGR | CAGR of 8.16% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Directional Atherectomy, Rotational Atherectomy, Orbital Atherectomy, and Laser Atherectomy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Medtronic, Boston Scientific Corporation, Abbott, BD, Cardiovascular Systems Inc., Avinger, Koninklijke Philips N.V., Cordis, Terumo Medical Corporation, and Stryker Corporation. |