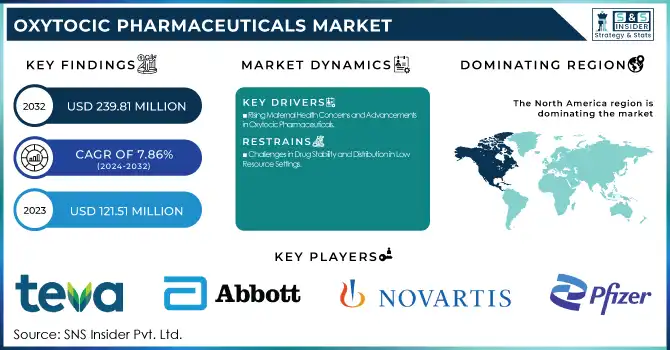

Oxytocic Pharmaceuticals Market Size & Overview:

The Oxytocic Pharmaceuticals Market Size was valued at USD 121.51 Million in 2023 and is expected to reach USD 239.81 Million by 2032 and grow at a CAGR of 7.86% over the forecast period 2024-2032.

This report highlights the increasing incidence and prevalence of labor induction and postpartum hemorrhage (PPH), which are fueling the demand for oxytocic drugs across various regions. The study examines prescription trends, emphasizing regional drug usage variations and evolving healthcare protocols' impact. Additionally, it explores regulatory and compliance trends, assessing how policy changes influence drug approvals and market accessibility. Innovations in oxytocic pharmaceuticals, including advancements in drug formulations and delivery methods, are reshaping treatment approaches. The report also analyzes healthcare spending on oxytocic drugs across government, commercial, private, and out-of-pocket segments, reflecting market expansion's economic factors.

Get more information on Oxytocic Pharmaceuticals Market - Request Sample Report

Oxytocic Pharmaceuticals Market Dynamics

Drivers

-

Rising Maternal Health Concerns and Advancements in Oxytocic Pharmaceuticals

The primary driving force behind the oxytocic pharmaceuticals market is increasing global awareness of maternal health issues, especially in preventing and managing postpartum hemorrhage (PPH), a leading cause of maternal mortality. International organizations and governments have worked towards improving maternal health outcomes through efforts to implement oxytocic drugs for labor management and to reduce PPH incidents. Advances in the formulation of these drugs, through the development of heat-stable oxytocin analogs among others, facilitate greater access with better efficacy from these drugs at low-resource-based health facilities. Increased focus and development of medical infrastructure for care related to the health of the female population similarly increase the level of demand for oxytocic pharmaceuticals.

Restraints

-

Challenges in Drug Stability and Distribution in Low-Resource Settings

Despite the advantages, the oxytocic pharmaceuticals market is significantly hindered by the stability and distribution of oxytocin in low-resource settings. Oxytocin is a drug that needs to be stored in a cold chain for its effectiveness. This is a challenge in regions where refrigeration facilities are not reliable. It has been noted that oxytocin potency degrades due to exposure to high temperatures during transportation and storage, which reduces its effectiveness in clinical use. The other factor is the prevalence of substandard or counterfeit oxytocin products in some markets, which undermines treatment outcomes and poses safety risks, thereby hindering market growth.

Opportunities

-

Innovations in Drug Formulations and Delivery Mechanisms

Opportunities lie within the market due to the innovation of new oxytocin receptor agonists and better delivery systems. The exploration of oxytocin analogs with better stability profiles aims at overcoming the deficiencies related to temperature-sensitive formulations and thus allows a wider spread within difficult environments. Alternative delivery routes, including inhaled or oral formulations, can also improve compliance among patients and extend the usability of oxytocic drugs. These innovations could potentially address current limitations and meet the unmet needs in maternal healthcare.

Challenges

-

Regulatory Hurdles and Ensuring Drug Quality

Regulatory and quality control approvals are the major challenges for the oxytocic pharmaceuticals market. The various complexities in regulatory compliance across different countries require a good amount of investment in compliance and quality assurance processes. Maintaining consistency in the manufacture of high-quality oxytocic drugs is necessary since variation in drug potency affects the clinical outcome. Besides, combating counterfeit medication distribution would require coordination by manufacturers, regulatory bodies, and healthcare providers for the safety of patients and maintaining the integrity of the market.

Oxytocic Pharmaceuticals Market Segmentation Insights

By Indication

In 2023, the PPH segment accounted for 48.7% of the global oxytocic pharmaceuticals market share. The high prevalence of PPH, a leading cause of maternal mortality, is the primary driver of this dominance. PPH requires prompt administration of oxytocic drugs, such as synthetic oxytocin, to induce uterine contractions and prevent excessive bleeding after childbirth. As awareness regarding maternal health spreads across the world, governments and organizations are keen on reducing PPH-related deaths, thus boosting the demand for effective treatments. Hospitals, which manage most PPH cases, have been among the primary dispensers of oxytocic drugs to reduce the rate of maternal mortality. Increased institutional births in developed and developing regions also create a demand for oxytocic pharmaceuticals. The Labor Induction segment is the fastest-growing within the oxytocic pharmaceuticals market. With more pregnancies being induced for medical reasons, such as gestational hypertension and overdue births, the demand for oxytocic drugs for labor induction is rapidly increasing and reflects changes in modern obstetric care practices.

By Route of administration

In 2023, the Intravenous (IV) Injection route of administration dominated with a market share of 67.7% of oxytocic pharmaceuticals. The route of IV injection is preferred due to its rapid onset and exact control over the dosage of drugs, which is critical in the management of acute situations such as labor arrest and postpartum hemorrhage. Oxytocic drugs include synthetic oxytocin, delivered via IV; with this kind of delivery method, healthcare workers can manage uterine contractions in real time and ensure maximum success in any form of delivery or labor process. High-risk pregnancy and emergencies mostly require this mode of application. The general increase in institutional births and delivery globally also continues to increase demand for this application. The IM route is the fastest-growing injection route because of its ease of administration in emergencies and resource-limited settings. It is gaining popularity in rural areas, where IV equipment may not be as readily available.

By Source of Origin

In 2023, synthetic oxytocin derivative was the market leader with a share of 69.5%. Synthetic oxytocin derivatives like Pitocin have become the gold standard in obstetrics as they are potent, stable, and easy to manufacture. They are widely used for labor induction, postpartum hemorrhage management, and controlling labor arrest. Their action mimics the body's natural oxytocin response, making it possible to manage uterine contractions precisely. In addition, synthetic formulations show better stability with a longer shelf life compared to natural oxytocin. In healthcare settings, this makes synthetic formulations a more convenient source of oxytocin. Their cost-effectiveness has also favored synthetic oxytocin over other forms in the developed and developing world. Synthetic oxytocin derivatives have also gained high growth due to advancements in research and development and the continuous quest for safety enhancement and effectiveness of the drugs. Newer derivatives may have an edge on stability as well as the patient's outcome, thus fuelling demand.

By End User

The Hospitals segment accounted for the largest share of the oxytocic pharmaceuticals market in 2023, with a market share of 78.3%. Hospitals are the primary settings for the administration of oxytocic drugs, especially in emergency obstetric care such as labor induction, arrest, and PPH. These facilities are equipped with advanced monitoring systems and skilled healthcare professionals, ensuring the safe and efficient administration of oxytocic pharmaceuticals. This demand is closely related to the increasing rate of institutional deliveries across the world, coupled with increasing awareness about maternal health. Also, the institutions are better equipped to handle complex and high-risk pregnancies that call for the cautious use of drugs and thus minimize the complications associated with oxytocic drugs. The Maternity Clinics segment is growing fast, as increasing numbers of women are opting for specialized care away from hospitals. These clinics specialize in maternity care, including the management of labor, and have increasingly resorted to oxytocic drugs in routine and emergency procedures. Such a trend can be observed even more strongly in regions with proper healthcare infrastructures.

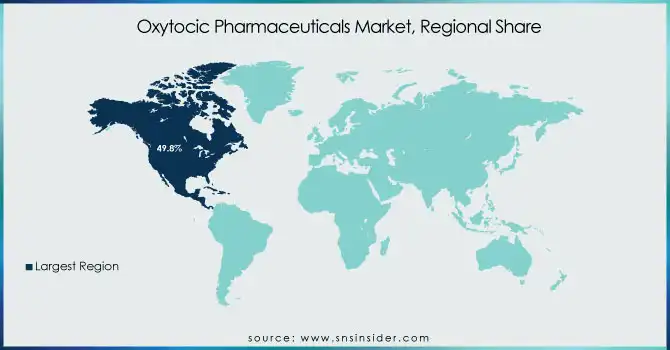

Oxytocic Pharmaceuticals Market Regional Analysis

In 2023, North America held a 49.8% market share, mainly due to high healthcare standards and the wide application of oxytocic drugs in hospitals and clinics. The demand for oxytocic pharmaceuticals in this region is mainly attributed to the increasing prevalence of labor induction, controlled cesarean deliveries, and the management of postpartum hemorrhage. The region has also well-established pharmaceutical companies focused on the development and distribution of synthetic oxytocin, making it widely available. Government regulations and healthcare initiatives in North America are also directed toward improving maternal health, reducing mortality rates, and ensuring the safe administration of these drugs, which further fuels the growth of the market.

The Asia Pacific region is emerging as the fastest-growing market for oxytocic pharmaceuticals. Rapid urbanization, increasing healthcare investments, and rising awareness of maternal health are driving growth in countries like India, China, and Southeast Asia. With expanding healthcare infrastructure and a growing focus on improving maternal mortality rates, the demand for oxytocic drugs is escalating.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Products in the Oxytocic Pharmaceuticals Market

-

App Pharmaceuticals LLC – Pitocin

-

Teva Parenteral Medicines Inc. – Oxytocin Injection USP

-

Abbott Laboratories – Depo-Oxytocin

-

JHP Pharmaceuticals LLC

-

Novartis Pharmaceuticals Corporation – Syntocinon

-

LBS Labs

-

Baxter Healthcare Corporation

-

Pfizer Inc – Pitocin

-

Fresenius Kabi

-

Bio Futura

-

Ferring Pharmaceuticals

-

Bio Futura SpA

-

Dr. Reddy’s Laboratories

-

Granules Pharmaceuticals, Inc.

-

Fresenius Kabi AG

Recent Developments

In Nov 2024, Insud Pharma received a USD 2.7 million grant from the Bill & Melinda Gates Foundation to advance a Phase II clinical trial for a novel sublingual oxytocin treatment. This new therapy aims to prevent postpartum hemorrhage (PPH), a major cause of maternal mortality globally, marking a significant development in the oxytocic pharmaceuticals market.

| Report Attributes | Details |

| Market Size in 2023 | USD 121.51 Million |

| Market Size by 2032 | USD 239.81 Million |

| CAGR | CAGR of 7.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Indication [Abortion Induced Incomplete, Inevitable Abortion, Postpartum Haemorrhage, Labor Induction, Labor Arrest] • By Route Of Administration [Intravenous Infusion/Injection, Intramuscular Injection] • By Source of Origin [Natural Oxytocin, Synthetic Oxytocin Derivative] • By End User [Hospitals, Maternity clinics] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | App Pharmaceuticals LLC, Teva Parenteral Medicines Inc., Abbott Laboratories, JHP Pharmaceuticals LLC, Novartis Pharmaceuticals Corporation, LBS Labs, Baxter Healthcare Corporation, Pfizer Inc, Ferring Pharmaceuticals, Bio Futura SpA, Dr. Reddy’s Laboratories, Granules Pharmaceuticals, Inc., Fresenius Kabi AG |