Asia Pacific Global Capability Centers Market Report Scope & Overview:

Get More Information on Asia Pacific Global Capability Centers (GCCs) Market - Request Sample Report

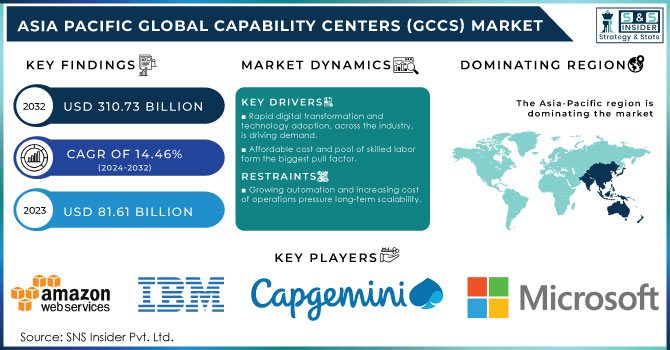

The Asia Pacific Global Capability Centers (GCCs) Market Size was valued at USD 81.61 Billion in 2023 and is expected to reach USD 310.73 Billion by 2032 and grow at a CAGR of 14.46% over the forecast period 2024-2032.

Global Capability Centres have become an important driver in the scaling up of operations and efficiency for multinational corporations with access to global talent. For instance, India boasts of more than 1,700 GCCs, 50% share of the world market, and a total of more than 1.9 million under its employment. Engineering, Research, and Development (ER&D) comprises 42% of GCC employment and stands as a robust talent pool for India, pushing its growth.

Government policies of countries in Asia Pacific also promote the development of GCCs. In India, such centers are attracted toward the regimes of Digital India and Make in India. Thailand 4.0 focuses on transforming the country toward becoming an innovation-driven economy, and Malaysia focuses on becoming a leading digital hub in Southeast Asia through its Malaysia’s Digital Economy Blueprint. Singapore stays competitive with the Smart Nation vision, promoting technological adoption in finance and IT sectors.

Emerging technologies like Blockchain, AI, and 5G also hold promise in the future, as GCCs are expected to play a crucial role in inducting these solutions into business processes. For instance, HCLTech launched its “Metafinity” platform in 2023, which supports businesses entering the metaverse. This aligns with India’s shift towards more advanced digital capabilities. Already in demand are high-end ER&D and data analytics services, and this is bound to facilitate market growth in the near future.

Asia Pacific Global Capability Centers Market Dynamics

KEY DRIVERS:

-

Rapid digital transformation and technology adoption, across the industry, is driving demand.

Digital transformation has become the top imperative for companies, particularly those in industries like IT, finance, and healthcare, that need to integrate data in real time and conduct global operations. The intensifying demands for digital services such as cloud computing, AI, and cybersecurity have led to an increase in GCCs through companies in the Asia Pacific region interested in leveraging growing technological capabilities within the region. For example, the Philippines and Vietnam have experienced sharp growth in demand for IT Outsourcing and Business Process Management Services due to huge pools of technology-skilled laborers. Companies are increasingly opting for these locations to scale up their global operations and enhance business continuity through advanced technological infrastructure.

-

Affordable cost and pool of skilled labor form the biggest pull factor.

Asia Pacific countries, particularly India, the Philippines, and Malaysia, offer competitive advantages, with a very skilled and affordable labor force compared to Western markets. At about 1.5 million engineering graduates annually, India has become a global magnet for tech talent and a prime destination for foreign companies that are willing to set up shared services centers. The demand and supply gap in India's tech talent is the lowest, at 21.1%, among the top tech countries, including the US, China and the UK and GCCs are taking notice. Of more than 1,700 GCCs in the country, nearly 78% have set up here to add on or create a better talent pool. This trend repeats in other regional hubs wherein experts in IT and engineering sectors continue to drive growth in GCCs. Companies are using these sources to maintain operational efficiencies and keep pace with global competition.

RESTRAIN:

-

Growing automation and increasing cost of operations pressure long-term scalability.

Indeed, while adoption of automation will improve operational efficiencies, it will still prove to be a challenge for the GCC market. As Artificial Intelligence and Machine Learning are growing more sophisticated, companies are automating systems with little or no human interaction. Rising operational costs, especially in previously viewed 'low cost' locations, such as India and the Philippines, may force companies to seek alternative sites or optimize operations to balance their costs.

The adoption of AI, cloud computing, and automation is making it more efficient while reducing operational costs. A survey suggests that 40% of the enterprises worldwide report their intention to reduce staff levels through automation. Similarly, 24% of these respondents intend to move their GCCs to less expensive regions. As companies have to balance the advantages of automation against the maintenance costs of global operations through GCCs, this restriction will pose an obstruction to any growth in the future.

Asia Pacific GCC Market Segmentation Overview

BY INDUSTRY VERTICAL

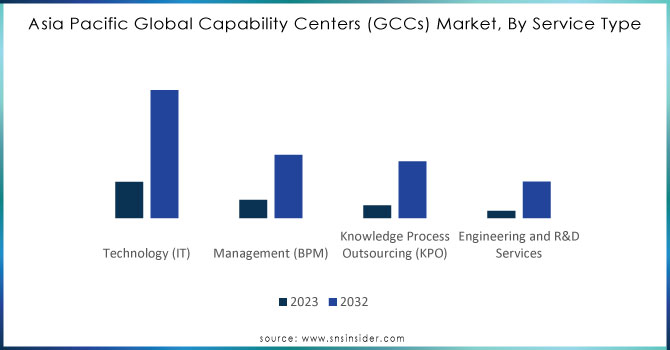

In 2023, IT sector dominated the market with 48.59% of the overall share; this can be attributed to the high demand for global IT outsourcing, software development, and digital transformation services. GCCs are now essential for the management of global IT infrastructures, software development, and cybersecurity solutions, especially in countries like India and Singapore.

According to a report, freshers can expect to see a 40% growth in hiring by GCCs compared with last year and the IT services companies project a 20-25% growth in recruitment. Significant demand for skills in software development, cloud technologies, and data engineering continues to drive these numbers.

ER&D Services is yet another fast-growing segment and is expected to grow at the fastest pace during the forecast period 2024-2032, with a projected CAGR of 17.89%. ER&D services are centered on innovation, design, product development, and research initiatives that deliver high-value solutions in industries as diverse as automotive, aerospace, healthcare, and manufacturing. The growth is driven by the rising demand for specialized engineering talent and the need for companies to innovate and respond efficiently to technological changes. India and Vietnam will also increasingly emerge as significant ER&D hubs in the coming years with major investments from global firms wanting to set up or expand R&D capabilities in the region.

Need Any Customization Research On Asia Pacific Global Capability Centers (GCCs) Market - Inquiry Now

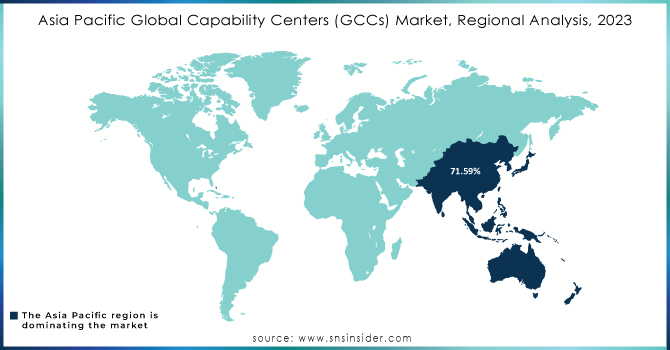

Asia Pacific Global Capability Centers Market Regional Analysis

India dominated the Asia Pacific GCC market in 2023; the country led with 71.59% market share. It is the world's largest hub for GCC operations, specifically for IT and ER&D, because of its large talent pool, state-of-the-art infrastructure, and pro-government policies like “Digital India” and “Make in India” that attract multinational corporations to the country. India is also expected to maintain this position because of the growing share of ER&D services within the country. For instance, 42% of the GCC workforce present in Bengaluru, India is working in ER&D.

On the contrary, Vietnam is likely to grow at the highest rate, in the forecast period from 2024 till 2032. The growth herein is stimulated by the growing significance of Vietnam as a manufacturing and IT outsourcing hub, government policies, and competitive labor costs.

Key Players in Asia Pacific Global Capability Centers Market

Some of the major players in the Asia Pacific Global Capability Centers (GCCs) Market are

-

Microsoft (Cloud Computing, Software Development)

-

Amazon Web Services (AWS) (Cloud Infrastructure, Data Centers)

-

Google (Search Engine Services, Cloud Solutions)

-

Cognizant (IT Consulting, Business Process Outsourcing)

-

Accenture (Digital Transformation, Technology Consulting)

-

IBM (Cloud Services, AI & Cognitive Solutions)

-

Infosys (IT Services, Business Process Management)

-

Tata Consultancy Services (TCS) (Software Services, IT Consulting)

-

Wipro (Managed IT Services, Digital Consulting)

-

Deloitte (Consulting, Risk Advisory)

-

KPMG (Audit, Business Advisory)

-

Capgemini (IT Services, Outsourcing)

-

Goldman Sachs (Financial Services, Investment Banking)

-

HSBC (Banking, Wealth Management)

-

J.P. Morgan (Investment Banking, Financial Services)

-

Standard Chartered (Corporate Banking, Treasury Services)

-

Shell (Energy Solutions, Oil & Gas Exploration)

-

Schneider Electric (Energy Management, Automation Solutions)

-

Siemens (Engineering Solutions, Industrial Automation)

-

Philips (Medical Devices, Health Technology)

RECENT TRENDS

-

October 2024: NeoSOFT remains very actively engaged in the Indian GCC landscape with critical partnerships that help companies traverse complex regulations and provide highly secure and compliant services to a global clientele. Its strategic expertise in various facets of technology has set new standards for excellence in India.

-

September 2024: The Karnataka government, on Friday, released the draft of India's first ever Global Capability Centre policy. That has been envisioned as setting up 500 new GCCs by 2029, contributing hugely to the state's economy and creating 3.5 lakh jobs, the Karnataka government said. The draft policy is now open for public comments and the government has invited inputs to refine and strengthen the policy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 81.61 Billion |

| Market Size by 2032 | US$ 310.73 Billion |

| CAGR | CAGR of 14.46 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Information Technology (IT) Services, Business Process Management (BPM), Knowledge Process Outsourcing (KPO), Engineering and R&D Services) • By Industry Vertical (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and Consumer Goods, Manufacturing and Automotive, Telecom & IT) • By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)) |

| Regional Analysis/Coverage | Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific) |

| Company Profiles | Microsoft, Amazon Web Services (AWS), Google, Cognizant, Accenture, IBM, Infosys, Tata Consultancy Services (TCS), Wipro, Deloitte, KPMG, Capgemini, Goldman Sachs, HSBC, J.P. Morgan, Standard Chartered, Shell, Schneider Electric, Siemens, Philips. |

| Key Drivers | • Rapid digital transformation and technology adoption, across the industry, is driving demand. • Affordable cost and pool of skilled labor form the biggest pull factor. |

| Restraints | • Growing automation and increasing cost of operations pressure long-term scalability. |