Automated Fare Collection Market Scope & Overview:

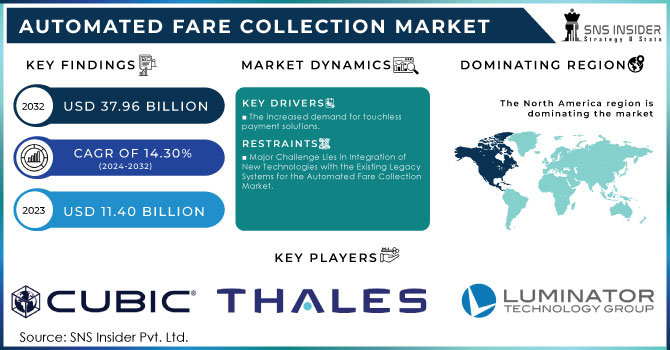

The Automated Fare Collection Market Size was valued at USD 11.40 billion in 2023 and is expected to reach USD 37.96 billion by 2032, growing at a CAGR of 14.30% over the forecast period of 2024-2032.

Get More Information on Automated Fare Collection Market- Request Sample Report

The Automated Fare Collection market is growing highly attributable to general technology advancement and growth in demand for efficient transit systems. Remarkably, as of now, about 75% of public transportation agencies use some level of AFC technology or enhanced fare management and improved user experience. Second, 65% of the operators said that contactless payment solutions have increased their ridership by 30% because the passengers enjoy the speed and convenience of the transaction. About user preference, 82% of passengers prefer mobile ticketing most. Again, it illustrates a switchover to digital fare collection. Furthermore, 58% of the transit agencies have deployed smart payment systems. With these payment systems, passengers can travel in a horizontal direction across different modes of public transport, making them more satisfied with the transport services. The deployment of smart card systems is also another notable fact as 48% of the agencies have reduced cash transactions to some extent up to 40%. Today, they have switched towards cashless fare collection. In this regard, the increasing role of automation in improving efficiency in the service, thus improving customer experience, would make the AFC market in the U.S. an integral part of the future public transportation landscape.

The AFC market is slowly evolving and growing based on the enhanced realization through technological progress coupled with the immense demand for more efficient payment in public transport. Another key trend in this industry is the rise in adoption of contactless payment systems, as 56 percent of the responding transit agencies reported increased usage of contactless smart cards and mobile applications, which is a shift towards more seamless travel experiences. Also, the increase of its usage in tandem with mobile wallets, where 48% of the transit systems have allowed riders to be able to use a digital wallet for fare payments, showing good consumer preference in convenience and speed. Open payment systems, which enable riders to use personal payment methods, are gaining traction; 42% of U.S. transit agencies report plans to implement or upgrade those systems in the next year. In addition, the push for data analytics as a call to action for operational efficiency is still imperative; 60 percent of transit agencies say they are applying data-driven insights to optimize fare collection and reduce fraud. This trend enables the creation of a better user experience with improved revenue protection and operational efficiency with the rapid transformation taking place in the transportation landscape. As it continues to advance in technology, the AFC market will further advance and bring about much more integrated solutions, which tend toward user-friendliness.

Automated Fare Collection Market Dynamics:

Drivers:

-

The increased demand for touchless payment solutions.

Need for contactless payment solutions is one of the factors driving growth in the Automated Fare Collection (AFC) market. Public transport agencies are increasingly seeking contactless payment systems intended to offer better customer experience and better operational performance, and this need has picked up specifically after the COVID-19 pandemic, as more and more customers want to avoid the inconvenience of traditional cash or card-based payments. This step is also evident by the rising number of mobile wallet and contactless smart cards adoption, which enables boarding passes without cash or card usage, thereby expelling queues and increasing optimal collection.

The shift in the option of digital payment also goes hand-in-glove with the market trend of embracing technology for convenience, hence making a transit system more likely to attract tech-friendly riders. In response to demand, transit agencies invest in infrastructure for these payment methods with enhancing ridership and revenue. More ridership also generates more revenue, and the drive toward contactless payment solutions has the end-user experience improve while supporting operational efficiencies to change the face of public transportation fare collection in the future.

Restrains:

-

Major Challenge Lies in Integration of New Technologies with the Existing Legacy Systems for the Automated Fare Collection Market.

Among the key challenges to the Automated Fare Collection (AFC) market is the integration of new technologies with existing legacy systems. Most of the transport entities run on legacy infrastructures that are not in sync with today's contactless card pay and mobile wallet payment methods. Such incompatibility can limit the smooth running of modern AFC systems, thereby increasing the cost and complexity incurred. The process of migrating to a fully integrated system may also demand much new hardware and software investment that can be quite financially expensive for agencies. Agencies operating under tight budgets may be financially burdened.

Furthermore, the integration process normally disrupts the existing operations of the agencies. Hence, it necessitates extensive one-on-one training for employees and time for riders who are accustomed to the habitual mode of payment. Many agencies will encounter resistance from different stakeholders reluctant to change long-known procedures. Issues of data security and privacy further complicate the integration process. The agencies must be sure that new systems comply with regulations and heed the sense of protecting sensitive customer information. The challenge of integrating the innovative solutions with legacy systems would slow and limit the full potential of automated fare collection technologies, even though there is a strong push for modernization in fare collection.

Automated Fare Collection Market Segmentation Analysis:

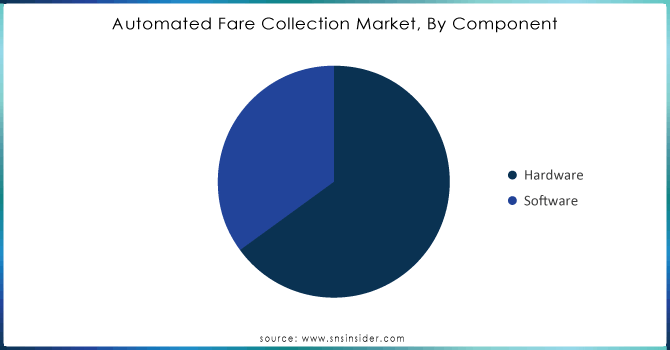

By Component:

Hardware dominated the market, holding over 60% of the total market share. It includes ticket vending machines, turnstiles, and contactless card readers, all of which are necessary to install automated fare collection. As transit agencies and parking facilities modernize their infrastructures to support seamless fare collection, demand for such advanced hardware solutions will likely skyrocket.

The other critically important category is software, which stands at around 40% of the market share. This also encapsulates fare management applications, data analytics, and payment processing, in terms of applications. Key drivers of this segment are cloud-based solutions as well as mobile application development, which ensure greater rider convenience and provide transit agencies with essential insights into ridership and revenue management.

Need any customization research on Automated Fare Collection market - Enquiry Now

By Application:

The market for AFC is bifurcated across different applications, and all of them prove to be rich sources for revenue generation in the period of 2018 to 2032. The segment of rail and transportation forms the largest share with about 45% of total revenue and is expected to increase further with the increasing demand for efficient fare systems as urban populations go up and public transit usage increases. By steadily investing in new solutions that better improve user experience and enhance the operationality of the service of the transit agency, revenue in this segment is expected to grow. The market share for the parking segment stands at about 30%, which is also gaining momentum, because cities are now focusing on streamlining both parking space and payment processes; with automated systems, there is a greater convenience and speed in dealing with customers. This segment relies on smart city initiatives that boost efficient infrastructure to increase its revenues. The second segment is theme parks, concerts, and sports venues- around 15% segment and gradually implementing AFC systems to provide greater experiences to guests.

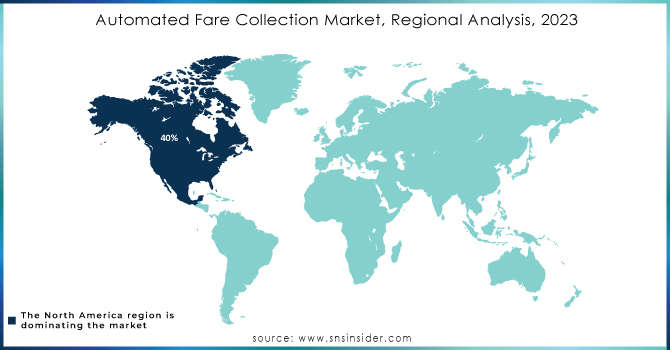

Automated Fare Collection Market Regional Analysis:

The Automated Fare Collection market has strong regional variations and is characterized by dominance from North America, Europe, and Asia Pacific. Region-wise, North America holds the greatest share, with around 40% market revenue share. This is because the region has a very robust public transportation infrastructure and a very strong focus on integrating all advanced technologies in order to improve user experiences. Such big cities as New York, Chicago, and San Francisco have modern fare collection systems that ease operations and keep up with the ever-rising demand for contactless payment.

Europe follows close behind, taking an approximate 30% of the market share. AFC technologies have been among the front-runners in European countries due to their governments' integration of various programs meant to improve efficiency and sustainability in the use of public transport. Cities such as London and Paris have managed to rollout fully-fledged automated fare collection systems, which are now role models for other geographies.

The Asia Pacific accounts for about 25% of the market share and is driving the adoption of AFC due to rampant urbanization and increasing investment in the public transportation infrastructure. Countries such as China, India, and Japan focus on the modernization of their transit system, contactless payment methods, and overall operational efficiency.

Key Players:

Some of the major key players are:

-

Cubic Corporation: (Cubic Ticketing Solutions, Cubic Fare Management System)

-

Thales Group: (Thales Transit Ticketing Solutions, Thales Contactless Payment Systems)

-

Luminator Technology Group: (SmartFare Collection System, Luminator Bus Validation Solutions)

-

Siemens AG: (Siemens Mobility Ticketing Solutions, Siemens Contactless Fare Collection Systems)

-

Genfare (a division of SPX Corporation): (Genfare Automated Fare Collection Systems, Genfare Ticket Vending Machines)

-

Kapsch TrafficCom AG: (Kapsch AFC Solutions, Kapsch E-Ticketing Systems)

-

Verifone Systems, Inc.: (Verifone Contactless Payment Solutions, Verifone Transit Fare Collection Devices)

-

NEC Corporation: (NEC Transit Ticketing Systems, NEC Smart Card Solutions)

-

Infineon Technologies AG: (Infineon Smart Payment Solutions, Infineon Security ICs for Fare Collection)

-

Parkeon (now Flowbird): (Flowbird Parking Payment Solutions, Flowbird Ticket Vending Machines)

-

Scheidt & Bachmann GmbH: (Scheidt & Bachmann Ticketing Solutions, Scheidt & Bachmann Fare Collection Systems)

-

Cennatek: (Cennatek Smart Fare Collection Systems, Cennatek Cloud-Based Payment Solutions)

-

Giesecke+Devrient (G+D): (G+D Contactless Payment Cards, G+D Mobile Security Solutions)

-

INIT Innovations in Transportation, Inc.: (INIT Fare Management Solutions, INIT Mobile Ticketing Apps)

-

Ticketer Ltd: (Ticketer Contactless Ticket Machines, Ticketer Mobile Ticketing Solutions)

-

Masabi Ltd: (Masabi Justride Mobile Ticketing, Masabi Fare Payment SDK)

-

Edenred: (Edenred Ticketing Solutions, Edenred Employee Mobility Solutions)

-

Civitas Solutions: (Civitas Fare Collection Software, Civitas Mobile Payment Solutions)

-

AEP Ticketing Solutions: (AEP Smart Fare Solutions, AEP Automated Ticket Vending Machines)

-

TransLink: (TransLink Smart Card Solutions, TransLink Mobile Payment Application)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.40 Billion |

| Market Size by 2032 | USD 37.96 Billion |

| CAGR | CAGR of 14.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component: (Hardware, Software) • By Technology: (Smart Card, Magnetic Stripe, Near-field communication (NFC), Optical Character Recognition (OCR)) • By System: (Ticket Vending Machine (TVM), Ticket Office Machine (TOM), Fare Gates, IC Cards) • By Application: (Railways & Transportation, Parking, Entertainment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cubic Corporation, Thales Group, Luminator Technology Group, Siemens AG, Genfare, NEC Corporation, Others |

| Key Drivers | • This has led to an increased demand for touchless payment solutions. |

| RESTRAINTS | • Major Challenge Lies in Integration of New Technologies with the Existing Legacy Systems for the Automated Fare Collection Market. |