Automotive Carbon Canister Market Report Scope & Overview

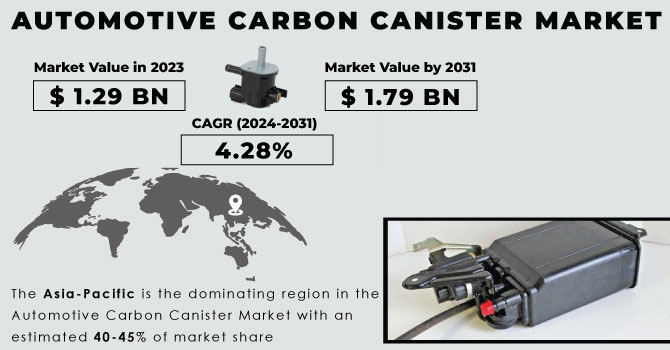

The Automotive Carbon Canister Market size was valued at USD 1.29 billion in 2023 and is expected to reach USD 1.79 billion by 2031 and grow at a CAGR of 4.2% over the forecast period 2024-2031.

The carbon canister traps and stores fuel vapor emissions from the tank while the vehicle is parked, releasing the filtered hydrocarbons back into the engine for combustion upon startup. The growth for this market is driven by increasingly stringent regulations focused on reducing vehicle emissions and a growing demand for cleaner air.

Get More Information on Automotive Carbon Canister Market - Request Sample Report

The rising concerns almost discuss contamination, stricter outflow measures around the world, and the extending popularity of fuel-efficient and low-emission vehicles are driving the market. Manufacturers are responding by integrating carbon canisters into new models to capture and store unburnt fuel vapours, preventing their release into the atmosphere. Openings are developing from the rapid advancement of the automotive industry, particularly in developing nations, as well as the rising demand for luxury cars that regularly consolidate advanced emission control technologies. The potential for technological advancements in carbon canister design and materials could lead to improved efficiency and lower costs fuels the market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising Environmental Concerns and Stricter Emission Standards Fuel Growth of Automotive Carbon Canister Market

-

Material & Design Innovations Drive Advancements in Automotive Carbon Canister Market

New materials like CFRP and advanced polymers are replacing traditional activated charcoal, making canisters lighter and more efficient. This aligns with the industry's focus on fuel efficiency and weight reduction. Additionally, design innovations are optimizing the internal structure of canisters for better vapor capture. These advancements position carbon canisters as technologically advanced solutions within emission control systems, driven by continuous R&D for eco-friendly performance.

RESTRAINTS:

-

Electric vehicles eliminate the need for traditional carbon canisters, potentially shrinking the market.

-

Complex systems and specialized equipment can make installing and maintaining carbon canisters expensive.

OPPORTUNITIES:

-

Development of lightweight and efficient materials like CFRP reduces canister weight, aiding overall vehicle fuel efficiency.

-

Advancements in internal canister design improve efficiency in capturing and storing fuel vapours

CHALLENGES:

-

Strict evolving emission standards challenge the automotive carbon canister market by demanding constant innovation and adaptation from manufacturers.

The automotive carbon canister market faces a problem of stricter emission standards. While these regulations are crucial for cleaner air, they constantly evolve, making long-term planning difficult for manufacturers. Uncertain future requirements can lead to delays in developing compliant canisters, impacting production and market responsiveness. Overcoming this challenge requires manufacturers to stay informed, invest in R&D, and collaborate with regulators to anticipate and adapt to changing emission control landscapes.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine disrupts the automotive carbon canister market by disrupting the supply chain which are causing problems for the manufacturers. Russia and Ukraine are major players in raw materials crucial for canister components. Sanctions and war-related limitations have restricted supplies, forcing manufacturers to find alternative sources. This could lead to production delays and a potential price increase of 10-15% for these components. The war exacerbates the existing global chip shortage, impacting car production by an estimated 5-10%. Since carbon canisters are primarily found in new vehicles, this production slowdown to a potential decrease of 5-7% in demand for canisters. Manufacturers might accelerate efforts to diversify their raw material sources, creating a more geographically stable supply chain. Additionally, some governments might incentivize domestic production of key materials, reducing dependence on specific countries.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown disrupts the automotive carbon canister market. Consumer spending is likely to decline with 5-10% of drop in car sales expected with discretionary purchases like new vehicles taking a backseat. This translates directly to a potential decrease in demand for carbon canisters, as they are often found in higher-end vehicles with larger profit margins. The economic uncertainty can lead car manufacturers to be more cautious about investing in new technologies, including advancements in carbon canisters. A potential 10-15% decline in research and development spending could stifle innovation and hinder the development of more efficient or specialized canisters. The slowdown might also focus on affordability among car buyers, potentially leading manufacturers to offer vehicles without carbon canisters to stay competitive. Additionally, the economic strain could disrupt the tiered supplier network for canister components, causing production delays or consolidation. While specific figures are difficult to predict, these disruptions could lead to price fluctuations in the long run.

KEY MARKET SEGMENTS:

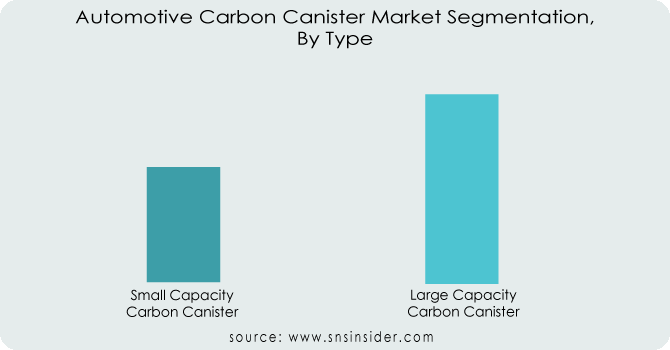

By Type:

-

Small Capacity Carbon Canister

-

Large Capacity Carbon Canister

Large Capacity Carbon Canister is the dominating sub-segment in the Automotive Carbon Canister Market by type holding around 60-65% of market share. Stringent emission regulations, particularly in developed nations, are driving the demand for larger canisters with a greater capacity to store fuel vapours. These canisters are more effective in capturing and controlling emissions from larger engines commonly found in passenger cars and some commercial vehicles.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Sales Channel:

-

OEM

-

Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Automotive Carbon Canister Market by sales channel holding around 70-75% of market share. New vehicles are mandated by law to comply with emission standards, and carbon canisters are an essential component of their emission control systems. OEMs typically install canisters during the vehicle manufacturing process, securing a dominant share in this segment.

By Vehicle Type:

-

Passenger cars

-

Commercial vehicles

Passenger Cars is the dominating sub-segment in the Automotive Carbon Canister Market by vehicle type holding around 55-60% of market share. The global passenger car market is significantly larger compared to commercial vehicles. The stricter emission regulations are often focused on passenger cars due to their higher contribution to on-road emissions. This translates to a larger demand for carbon canisters in passenger vehicles.

By Absorbing Material:

-

Charred Wood Powder

-

Activated Carbon Powder

-

Ethylene Propylene Diene Monomer (EPDM)

-

Others

Activated Carbon Powder is the dominating sub-segment in the Automotive Carbon Canister Market by absorbing material holding around 80-85% of market share. Activated carbon is highly effective in absorbing a wide range of hydrocarbons present in fuel vapours. Its high adsorption capacity and relatively low cost make it the preferred choice for most carbon canisters.

REGIONAL ANALYSES

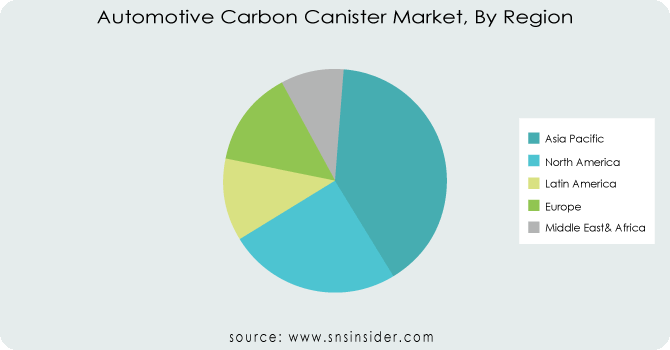

The Asia-Pacific is the dominating region in the Automotive Carbon Canister Market with an estimated 40-45% of market share, fueled by the growing automotive industry in China and India. The growing consumer demand for feature-rich vehicles with advanced emission control systems, along with stricter government regulations on vehicle emissions in these regions, further propel Asia Pacific's dominance.

North America is the second highest region in the Automotive Carbon Canister Market with 30-35% of market share. The well-established automotive industry prioritizes safety features and emission control technologies. Stringent regulations in the US and Canada mandate compliant vehicles with canisters, and high disposable income in some areas translates to a preference for newer cars equipped with these emission control systems.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Robert Bosch GmbH, HELLA GmbH & Co., Continental AG, Ingevity, Ford, Nissan, Chrysler, ACDelco, Toyota, Mopar, Roki, Futaba, Delphi Automotive PLC, Langfang Huaan Automobile Equipment, Kayser Automotive Systems, Tianjin Gelin Lifu New Technology, Hengbo Holdings, Stant, Korea Fuel-Tech, Asian Industry and other key players.

Continental AG-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In June 2020: Ingevity & Continental AG announced that they aim to capture more fuel vapor and potentially reuse it, boosting fuel efficiency. However, the rise of electric vehicles (VW, Daimler, etc.) by major automakers may challenge the long-term growth of this technology.

| Report Attributes | Details |

|---|---|

| CAGR | CAGR of 4.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Small Capacity Carbon Canister, Large Capacity Carbon Canister) • by Sales Channel (OEM, Aftermarket) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Robert Bosch GmbH, HELLA GmbH & Co., Continental AG, Ingevity, Ford, Nissan, Chrysler, ACDelco, Toyota, Mopar, Roki, Futaba, Delphi Automotive PLC, Langfang Huaan Automobile Equipment, Kayser Automotive Systems, Tianjin Gelin Lifu New Technology, Hengbo Holdings, Stant, Korea Fuel-Tech, and Asian Industry |

| Key Drivers | •Rapid urbanization and industrialization are expected to increase people's discretionary income. •The high carbon dioxide emissions, along with rising air pollution, are expected to drive the growth. |

| RESTRAINTS | •Electric vehicles are becoming more popular, which may stifle growth. •The market's expansion is projected to be hampered by the high cost of raw materials. |