E-Scooter Sharing Market Size & Overview:

To get more information on E-Scooter Sharing Market - Request Sample Report

The E-Scooter Sharing Market Size was valued at USD 1.29 billion in 2023 and will reach USD 6.17 billion by 2032 and grow at a CAGR of 19% by 2024-2032

The electric scooters are the sort of electric vehicles that uses rechargeable battery and electric engine instead of the gasoline motor. They can be plugged into external power source to revive the battery. Compared to the conventional gasoline-powered vehicles, electric bikes offer significant cost savings whereas delivering similar performance. An exciting development in electric scooter technology is the potential for coordination solar panels. While currently limited to electric cars, solar panels on scooters are anticipated to extend their range by 15-20%.

Driven by the worldwide push to the decreased carbon emissions, electric mobility solutions like electric scooters are gaining traction as a sustainable alternative. Governments around the world are setting the ambitious target for the adoption of electric vehicles, making a strong administrative environment. The development of the renewable energy sector provides a reliable source of clean power to charge the electric bikes, advance upgrading their natural benefits.

MARKET DYNAMICS:

KEY DRIVERS:

-

Shared electric scooters gain popularity in crowded cities as a sustainable and space-saving way to reduce traffic congestion.

Traffic congestion in cities is a major problem, especially during rush hour. To tackle this, shared electric scooters are becoming increasingly popular. Governments and scooter companies are promoting them as a sustainable commuting option. These compact scooters take up less space on roads and in parking, allowing users to rush through traffic and avoid contributing to air pollution. This eco-friendly mode of transport is useful for commuters and the environment.

-

E-scooter tech advancements like extended battery life in shared vehicles fuel market growth.

RESTRAINTS:

-

Limited range of e-scooters compared to other electric vehicles.

-

Unfavourable weather conditions impacting scooter usage and battery performance.

OPPORTUNITIES:

-

Integration of solar panels could extend e-scooter range and boost their eco-friendly appeal.

-

Incorporation of AI and IoT features can enhance safety, security, and user experience in e-scooters.

The future of e-scooter sharing is bright due to the potential of Artificial Intelligence and the Internet of Things. Coordination these technologies can move forward the security, safety, and user experience. AI can analyse riding patterns to identify potential hazards and alert riders in real-time. IoT sensors could detect malfunctions or accidents, allowing for immediate intervention and preventing further issues. Thus, AI could personalize user experiences by suggesting optimal routes based on traffic and weather conditions. This integration of advanced innovation has the potential to make e-scooters a more secure, more safe, and more enjoyable way to explore urban environments.

CHALLENGES:

-

Limited battery range can restrict trip planning and discourage users from relying solely on e-scooters.

-

Inclement weather conditions like rain and snow can impact e-scooter functionality and user comfort.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the E-scooter sharing market in several ways. The global economic disruptions caused by the conflict have led to the rise in material and production costs. This can potentially slow down the development and rollout of new e-scooter models, especially those boasting advanced features. Sanctions imposed on Russia, a significant e-scooter sharing market, have stopped operations and limited growth opportunities in the region. The pre-war projections for Russia's e-scooter market share are likely to be reduced. The war has exacerbated the global supply chain crisis, making it more difficult for manufacturers to obtain essential components for e-scooter production. This can lead to potential slowdown in market growth of around 5-10%, with a full recovery hinging on the war's resolution and global economic stabilization.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can cast a slow down the e-scooter sharing market in a few key ways. With limiting budgets, consumers might prioritize essential spending over discretionary leisure activities, potentially leading to fewer e-scooter rides. This could be reflected in a 10-15% of decline in ridership during a slowdown. The companies themselves might face financial constraints. Investment in new scooter fleets or technological advancements could slow down, hindering market growth. During economic hardship, some cities might be less receptive to expanding e-scooter programs due to concerns about potential lost revenue from parking or traffic congestion. This could lead to stagnation or even a 5-7% decrease in the number of cities offering e-scooter sharing programs.

KEY MARKET SEGMENTS:

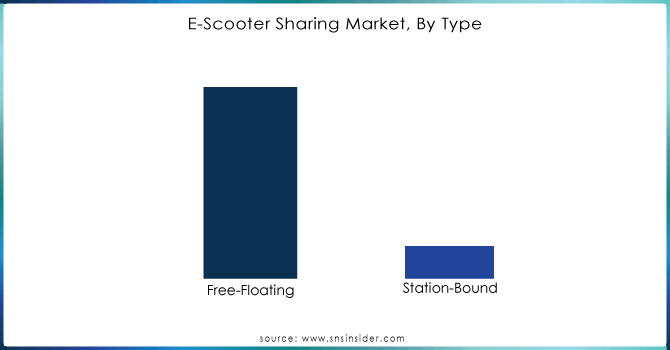

By Type

Free-Floating is the dominating sub-segment in the E-Scooter Sharing Market by type holding around 90-95% of market share. Free-floating e-scooter sharing offers unparalleled flexibility and convenience. Users can locate, unlock, and abandon scooters anywhere within the designated service area, eliminating the need to search for docking stations. This spontaneous pick-up-and-drop-off system is particularly attractive for short, unplanned trips.

To Get Customized Report as per your Business Requirement - Request For Customized Report

By Distribution Channel

Online is the dominating sub-segment in the E-Scooter Sharing Market by distribution channel holding around 80-85% of market share. Online platforms provide a seamless user experience. Booking, unlocking, payment, and real-time scooter availability and location tracking can all be done through user-friendly apps. This eliminates the need for physical interaction with kiosks or personnel, making the entire process swift and convenient.

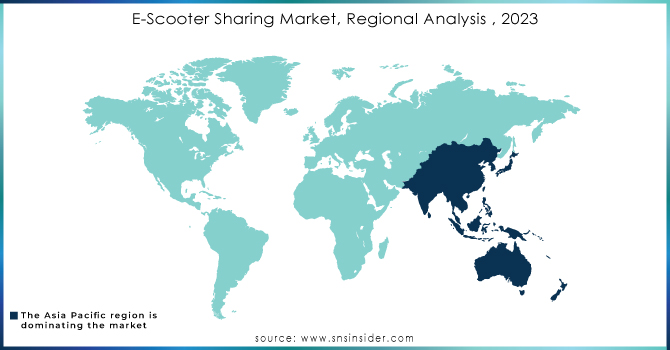

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the E-Scooter Sharing Market holding around 70-75% of market share, particularly China, due to a thriving manufacturing base, supportive government policies for traffic and pollution reduction, and dense urban environments ideal for short e-scooter trips.

Europe is the second highest region in this market with 15-20% of share, leveraging its established sharing economy with existing bike-sharing programs, environmentally conscious consumers, and a focus on sustainable transportation.

North America is experiencing the fastest growth with 5-10% of share due to increasing urbanization in major cities, heavy investment in e-scooter companies, and advancements in e-scooter technology.

KEY PLAYERS

The major key players are Neutron Holdings Inc, Cityscoot, Cooltra Motosharing SLU, Bird Global Inc, Vogo Automotive Pvt Ltd, Go To Global Mobility Ltd, Lyft Inc, VOI Technology and other key players.

RECENT DEVELOPMENT

-

In May 2022: San Francisco is testing technology with Lime, Spin, and Scoot to automatically slow e-scooters on sidewalks, prioritizing pedestrian safety and reducing the need for riders to navigate traffic.

-

In April 2022: Bird, a company offering shared electric scooters, is expanding to Indio, California, known for hosting the Coachella and Stagecoach music festivals. This move provides residents and festivalgoers with a new eco-friendly transportation option.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.29 Billion |

| Market Size by 2032 | US$ 6.17 Billion |

| CAGR | CAGR of 19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Free-Floating, Station Bound) • by Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Neutron Holdings Inc, Cityscoot, Cooltra Motosharing SLU, Bird Global Inc, Vogo Automotive Pvt Ltd, Go To Global Mobility Ltd, Lyft Inc, VOI Technology |

| Key Drivers | • Shared electric scooters gain popularity in crowded cities as a sustainable and space-saving way to reduce traffic congestion. • E-scooter tech advancements like extended battery life in shared vehicles fuel market growth. |

| RESTRAINTS | • Limited range of e-scooters compared to other electric vehicles. • Unfavourable weather conditions impacting scooter usage and battery performance. |