Automotive Power Modules Market Report Scope And Overview:

Get more information on Automotive Power Modules Market - Request Free Sample Report

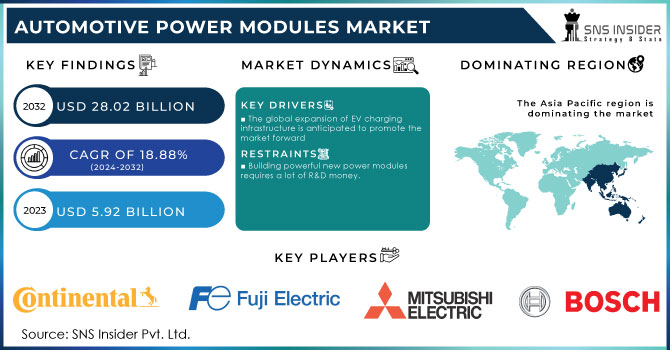

The Automotive Power Modules Market Size was valued at USD 5.92 billion in 2023 and is expected to reach USD 28.02 billion by 2032 and grow at a CAGR of 18.88% over the forecast period 2024-2032.

The auto power modules market is gaining momentum, supported by a multitude of key factors. Electrification is the main indicator, with the growing EVs and HEVs segments asking for compact and efficient power electronics. This change is evident from the 60-70% share of these vehicles in the overall power module consumption. Moreover, the advanced driver assistance system (ADAS) and autonomous driving technologies integration are meeting the need for power modules, which accounts for approximately 20-25% of the market. Stringent emission norms worldwide are forcing car manufacturers to provide fuel-efficient solutions, where power modules will go a long way in engine performance optimization. This factor makes up for approximately 10-15% of the market demand.

It becomes exposed to the global electrification trend. It is expected that, by 2030, some 75% of new vehicle sales will be electric or hybrid, which highly increases demand for these components. Again, increasing electrification of the power train requires higher power density and efficiency in the power modules. SiC technology and GaN come into the forefront; it is envisaged that, in 2025, 30% of the market share will be covered by SiC-based modules due to their enhanced thermal management systems and switching capabilities. Advanced thermal management systems should also form an integral part of a module to optimize its performance, with liquid cooling coming up as one of the preferred methods. As autonomous driving technology further matures, the demands made on the power modules will become strong and reliable since they have a critical role in ascertaining safe and efficient operation for vehicle systems.

MARKET DYNAMICS:

KEY DRIVERS:

-

The global expansion of EV charging infrastructure is anticipated to promote the market forward.

Consumer preference is shifting towards electric vehicles (EVs), driving up demand. This growth is fueled by expanding EV infrastructure like charging stations, easing concerns about range and performance. Furthermore, government programs promoting EVs in public and commercial fleets are expected to further increase demand. This surge in EVs will create a strong need for the essential components -automotive power modules-throughout the forecast period.

-

Government incentives make EVs cheaper, leading to more EV sales and a higher need for power modules.

RESTRAINTS:

-

Building powerful new power modules requires a lot of R&D money.

The development of power modules presents a financial hurdle for the market. Significant investment is needed for research and development to meet stringent performance, efficiency, and safety standards. Manufacturing adds another layer of cost due to the complex processes and specialized facilities required, particularly for modules using the latest semiconductor technology. Stringent quality control further adds to the expense. While high-quality materials and components enhance performance and reliability, they also contribute to the high upfront cost.

KEY MARKET SEGMENTS:

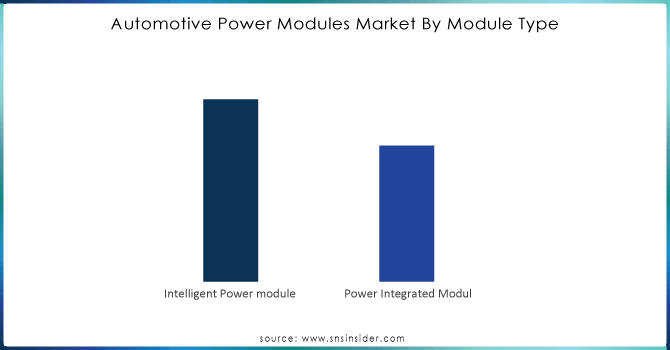

Automotive Power Modules Market By Module Type:

Intelligent Power module is the dominating sub-segment in Automotive Power Modules Market by module type due to their superior performance and advanced features. They integrate a dedicated control circuit with the standard IGBT chip, enabling more efficient power delivery and extraction. Moreover, IPMs boast built-in protection features like short-circuit, undervoltage, and overheating safeguards, enhancing overall system reliability. As the IGBT market itself flourishes, the demand for IPMs, which leverage this technology, is expected to follow suit.

Need any customization research on Automotive Power Modules Market - Enquiry Now

Automotive Power Modules Market By Propulsion:

Electric vehicles is the dominating sub-segment in Automotive Power Modules Market by propulsion. Power modules play a vital part in EVs, dealing with high-voltage power conversion in critical components like footing inverters, on-board chargers, and DC-DC converters. As the EV market proceeds its development, the demand for power modules particularly planned for electric vehicles is anticipated to reflect this trajectory.

Automotive Power Modules Market By Vehicle Type:

Passenger cars is the dominating sub-segment in Automotive Power Modules Market by vehicle type. This dominance is likely to proceed further in the future. In any case, the commercial vehicle segment is expected to experience significant development in the coming years. As governments and companies progressively prioritize sustainability, the adoption of electric buses, trucks, and other commercial EVs is anticipated to accelerate, possibly posturing a challenge to passenger car dominance in the long term.

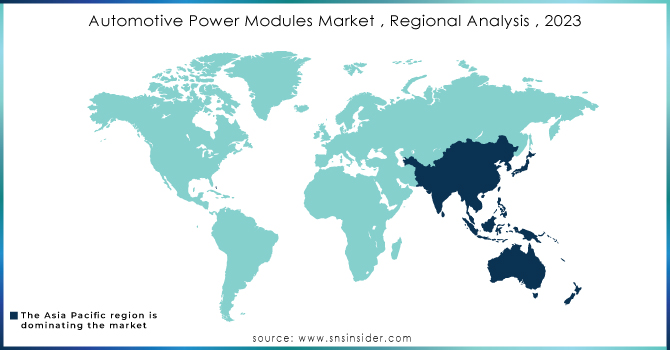

REGIONAL ANALYSES

The Asia Pacific region dominates the Automotive Power Modules Market, holding the largest share. It boasts the rising automotive industry with high vehicle production rates, particularly for EVs. The region is a major hub for automotive power module manufacturers, further solidifying its dominance.

Europe holds the second-largest market share. Stringent government regulations promoting clean energy and a growing preference for EVs are driving market growth in this region.

The North America is experiencing the rapid growth with its significant investments in EV technology and growing adoption of electric vehicles. Government incentives and increasing public interest in EVs are expected to drive the North American market forward at a rapid pace.

KEY PLAYERS:

The major key players are Continental AG (Germany), STMicroelectronics (Switzerland), Fuji Electric Co. (Japan), Infineon Technologies (Germany), ON Semiconductor (US), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Renesas Electronics Corporation (Japan), NXP Semiconductors (Netherlands), Toshiba Corporation (Japan), and Rohm Semiconductor (Japan) are other key players.

RECENT DEVELOPMENTS:

-

In October 2022- BMW committed $1.7 billion to boost electric vehicle production in the US. This includes upgrading their South Carolina plant and building a nearby battery assembly facility. Additionally, they secured battery cell supplies through a partnership with Envision AESC.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.92 Billion |

| Market Size by 2032 | US$ 28.02 Billion |

| CAGR | CAGR of 18.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Module Type (Intelligent Power Module, Power Integrated Module) • By Propulsion (Electric vehicles, ICE Vehicles) • By Vehicle Type (Passenger Cars, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), STMicroelectronics (Switzerland), Fuji Electric Co. (Japan), Infineon Technologies (Germany), ON Semiconductor (US), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Renesas Electronics Corporation (Japan), NXP Semiconductors (Netherlands), Toshiba Corporation (Japan), and Rohm Semiconductor (Japan) |

| Key Drivers | • The global expansion of EV charging infrastructure is anticipated to propel the market forward. • Government incentives make EVs cheaper, leading to more EV sales and a higher need for power modules. |

| RESTRAINTS | • Building powerful new power modules requires a lot of R&D money. |