TOURIST BUS MARKET KEY INSIGHTS:

Get More Information on Tourist Bus Market - Request Sample Report

The Tourist Bus Market size was estimated at USD 35.89 billion in 2023 and is expected to reach USD 69.79 billion by 2032, with a growing CAGR of 7.70% over the forecast period 2024-2032.

The rise of the tourist bus market can be attributed to the revival of tourism worldwide after the pandemic and the growing inclination towards affordable and sustainable travel solutions. Government and local authorities are also focusing on arrangements for clean public transport to minimize carbon emissions by providing incentives for electric and hybrid buses. As the buses are a perfect fit for families, tourist groups, and inter-city travelers; the demand for group travel has also accelerated. With growing infrastructure investments for transit in emerging markets, particularly within Asia-Pacific, bus operations are becoming seamless and efficient further leading to an upswing in adoption. The operation of international visitor arrivals rose by 94% in 2023 in Asia-Pacific, which contributed to the 43% share rise of the global tourist bus market in the region. The sector is getting backing from the governments as well.

For instance, India-based Tamil Nadu has been promoting tax relief programs, including in interstate tourist buses. There are also fleet expansions in the pipeline about 17% more electric and hybrid buses are to arrive in 2024, especially in developing regions like India.

Furthermore, about 45% of new travel & Tourism buses were electric or hybrid in 2023 in Europe, a trend that is expected to increase across the globe in the coming years.

Apart from these, technological innovations in tourist buses have increased their attraction level. Modern consumer comfort and reliability requirements are satisfied by features like onboard entertainment, Wi-Fi connectivity, and advanced safety systems. Mini-buses have gained popularity with travelers as the trend of small group travel burgeons, while motor coaches continue to dominate this space owing to their larger capacity and luxury features. Moreover, rising urbanization and intercity travel in emerging economies are widening the market opportunities. The industry is embracing digital ticketing systems, and real-time tracking to fulfill the expectations of tech-savvy travelers, or else to fuel the dynamic growth of the market. To improve passenger experience, more than 60% of buses in India had a Wi-Fi facility in 2023. It also revealed that over 70% of intercity tourist buses were equipped with real-time GPS tracking that could enhance safety and convenience. In addition, 28% of long-route buses have now become smart buses and general fleet management systems are helpful for the optimal routing of travel by the buses.

MARKET DYNAMICS

KEY DRIVERS:

-

Global Tourism Infrastructure Investments Driving Growth in the Tourist Bus Market with Enhanced Connectivity

The development of tourism infrastructure globally is one of the major factors for the growth of the tourist bus market. To bring more tourists both from abroad and within their own countries many governments are rushing to invest in tourism projects such as upgraded transportation systems. Similar initiatives often involve building roads, terminals, and charging points for electric buses to enhance accessibility and convenience for group travel. For example, nations across Asia-Pacific and the Middle East, to stimulate their economies, have substantially raised investment in tourism-related infrastructure. These also enhance the operations of the buses and the consumer's confidence to take buses for touristic purposes thus benefiting with the expansion of the market.

Countries in Asia-Pacific are affirming from 2023 its planned USD 2.4 trillion investment in infrastructure until 2030, a substantial part of which will be allocated to tourism-related facilities, such as upgrades of roads and terminals. For example, in 2023, USD 1.6 billion was spent solely on upgrading transportation infrastructure in South Korea.

As part of the initiative, the UAE has already spent USD 6 million on electric bus charging stations, where 200 charging stations will be established by 2024 in major cities such as Dubai. International arrivals reached 1.28 billion in the sector in 2023, up 34% from last year, leading to increased demand for group travel and intercity transport in general.

-

Rise of On-Demand Mobility Services Transforming Tourist Bus Market with Flexible Booking and Customized Routes

An additional one of the key drivers that has surfaced is an increase in shared and on-demand mobility services. Tourists looking for convenient and cost-effective travel solutions have turned to platforms with flexible booking options and real-time bus tracking. Such services address a diverse consumer need set–last mile connectivity, and group travel, making them viable substitutes for private vehicles or air travel. Furthermore, the market is witnessing an unprecedented transformation largely due to the adoption of ride-sharing technology in tourist buses that enables customized routes for travelers, along with their customized schedules. Especially in space with cost-effective visitor streams in Europe also North America, this trend happens considerably, where creative travel resolution composes up a portion of master nature. Microtransit in the U.S. saw a resurgence in 2023, with ridership growing by a remarkable 11%, and implementation in places like Wilson, North Carolina resulting in a 30% decrease in passenger wait time as well as expanding into areas previously considered underserved. Wayne County, Ohio, began a countywide microtransit program, spanning 555 square miles. Roughly 1,000 on-demand mobility services exist worldwide.

RESTRAIN:

-

Infrastructure Challenges and Competition Hindering the Growth of the Global Tourist Bus Market

The absence of sufficient infrastructure in some areas is one of the main issues in the tourist bus market. In developing regions and rural areas, the bad condition of local roads, lack of parking spaces, and lack of dedicated bus lanes limit the smooth operation of tourist buses. This is worse for electric buses and hybrid buses as they need well-established charging stations and maintenance facilities as well. This significantly hinders the adoption of sustainable buses and reduces operational efficiencies. Tourist buses have tough competition with high-speed trains, car rentals, and budget airlines. Such alternatives are usually more attractive to some travelers who promise speedier travel and more personalization. For instance, regions like Europe and Asia have high-speed rail networks that are tough competition with comparable fares offering shorter travel times. Bus operators can solve this problem by improving their service quality or utilizing technology to enable a seamless experience.

KEY MARKET SEGMENTS

BY PROPULSION

The Internal Combustion Engine (ICE) segment leads the market in 2023 with a 63% market share, primarily as a result of its established infrastructure and proven reliability. The transport sector has always relied on diesel and petrol buses, backed by a vast network of filling stations with readily available repair and maintenance services. Also, electric vehicles are generally much pricier than ICE buses to purchase, meaning they are still a more cost-effective solution for operators in both developed and developing areas. Adding to their supremacy is their ability to travel long distances while still handling tough terrains they are dominating in countries with slow development of alternative energy infrastructure.

The electric buses segment is projected to witness the fastest compound annual growth rate (CAGR) during the forecast period (2024 – 2032) owing to growing environmental regulations and the worldwide transition towards sustainable transportation. This includes government policies and incentives such as subsidies, tax exemptions, and investment in charging infrastructure designed to accelerate the market penetration of EVs around the globe. Emerging Technologies: Higher battery efficiency levels and longer driving ranges are eliminating previous concerns over the viability of electric buses for long-distance and high-capacity applications. Their long-term cost savings on both operating and maintenance also help make these vehicles an attractive investment for any fleet operator. The turnaround is especially strong in urban and tourist-heavy environments where emissions and noise are both high priorities.

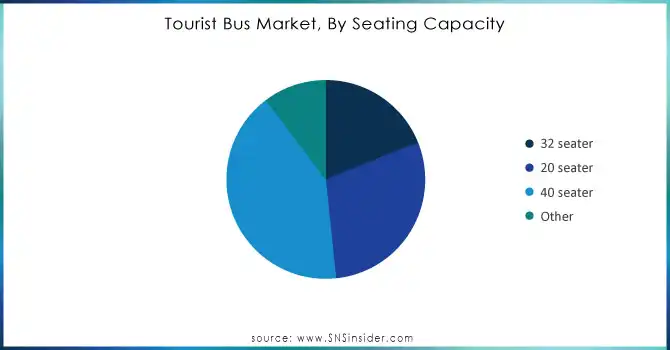

BY SEATING CAPACITY

The 40-seater segment accounted for the highest market share of 41% in 2023 as a combination of optimal seating capacity and comfort allows these tourist vehicles to be highly suited for bigger travel groups, long-distance travel, and intercity travel. With potential uses for sightseeing tours to chartered trips, the 40-seater bus can serve multiple markets and has existing infrastructure aplenty, from refueling stations to maintenance. Economies of scale work in this segment with operators able to save costs while adequate space ensures comfort for passengers; this is the reason for preference in most cases for both public and private operators in various parts of the world.

The 20-seater bus segment is anticipated to emerge as the fastest-growing with the highest CAGR from 2024-2032, owing to increasing smaller passenger travel due to growing urbanization & tourist travel. In the post-pandemic world, travelers appear to be much more interested in more bespoke travel experiences and even traveling in smaller, less rigid travel 'packs'. This is why 20-seater buses are an effective solution, being more affordable and offering better route flexibility when it comes to private charters, small group tours, and short-haul traveling around the city. Moreover, the recovery of tourism, and demand for niche, ecological, and private types of travel are expected to drive the growth of the 20-seater segment shortly.

Need Any Customization Research On Tourist Bus Market - Inquiry Now

BY APPLICATION

The Scheduled bus transport segment accounted for the largest market share of 38% in 2023. The predictability and reliability of scheduled routes for urban, intercity, and regional travel make it a segment that enjoys a certain level of demand. Limited transport services target touristic, daily trips as well as commuter traveling, providing affordable comfort. Its emergence has been complemented by the development of bus networks and urban population growth. In addition to the development of public buses, investments in infrastructure, especially bus rapid transit (BRT) systems and improved road networks, have increased the efficiency of scheduled bus services and have kept it the largest market segment.

The Private purposes segment is anticipated to grow with the highest CAGR between 2024 & 2032. The surge in demand for personalized travel experiences, especially in tourism and group travel, is fuelling this growth. Scheduled transport is not able to fulfill the needs of a certain class of travelers and as such many tourists and corporates settle for private bus services owing to the freedom of choosing routes and timelines it has to offer ensuring a tailored travel experience. Moreover, the private bus segment is experiencing fast growth due to the expansion of the on-demand facility that is gaining acceptance from consumers as a choice for individual and small groups traveling to avoid crowded public transport. Additionally, the demand for sustainable travel, luxury, and private charter services facilitates the upcoming growth of this segment.

BY VEHICLE TYPE

The Motor Coach was the leading segment in the market in 2023, accounting for a significant 63.4% market share, as it is widely used for long-distance, intercity, and tourism-based travel. Motor coaches, specifically, are perfect for bigger groups because they have a high capacity, include comfort features, and the latest amenities including Wi-Fi, onboard entertainment, and restrooms. Apart from that, they are traditional buses that are supported by various infrastructures such as roads, terminals, and maintenance services. It makes them the hub for tourists and business groups that desire a desirable traveling experience with comfort and convenience.

The growth of minibus is expected to be the fastest CAGR throughout 2024-2032. Growth in minibus demand is attributed to minibus preference for short trips, private charters, and tours, at smaller group travel inclination. They are best suited for more personalized services, small groups, corporate travel, and specific tourism activities. Minibusses are better flexible in routes and schedules than larger motor coaches, allowing for more customized and unique travel opportunities that appeal to consumers. Urban tourism and an increasing number of smaller group tours, along with new on-demand transport services are driving rapid growth in the minibus market.

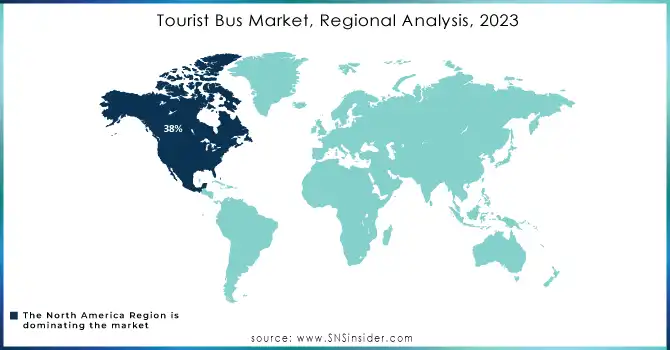

REGIONAL ANALYSIS

In 2023, North America captured the largest market share at 38% owing to the increasing demand for scheduled tourist bus transport services and private tourist bus transport services. In the United States and Canada, motor coaches and scheduled bus services are well-established modes of transportation. Take large bus providers based in the United States: Greyhound Lines and Megabus are well-known operators focused on long-distance travel, where the intercity bus is a very cheap but effective way to travel. But along the way, cities like New York City, Los Angeles, and Canada up north (Toronto) have built bus rapid transit (BRT) systems to make urban passage more fluid and accessible. Sustainability is also focusing on the development of eco-friendly buses that include electric motor coaches are developing the growth in this region Demand for motor coaches remains strong due to the established tourism industry bolstered by national parks and natural parks, cultural sites, and city tours.

Asia-Pacific is forecast to register the maximum growth rate in the tourist bus market between 2024 and 2032 due to the rapid pace of urbanization, rising disposable incomes, and increasing tourism across the Asia-Pacific region. This growth is driven especially by countries like China and India. The growing urban and intercity travel needs are also being addressed in China where investments in public transport infrastructure have accelerated, especially on environmentally friendly motor coaches such as subway work and electric motor coaches. Daimler's Mercedes-Benz buses and Yutong, for example, are scaling up electric buses in China. Back in India long-distance bus services are offered by SRS Travels, Neeta Travels, and other companies, even as a regional surge in tourism has increased demand for minibuses and smaller buses for group tours and local travel. The introduction of on-demand, flexible services as well as expansion in the charging infrastructure to develop electric buses can lend an even bigger hand to the regional market development.

Key players

Some of the major players in the Tourist Bus Market are:

-

Mercedes-Benz (Sprinter, Tourismo)

-

Volvo (9700, 7900)

-

Scania (Citywide, Touring)

-

MAN (Lion’s Coach, Lion's City)

-

Iveco (Crossway, Evadys)

-

BYD (K9, K11)

-

King Long (XMQ6117, XMQ6116)

-

Temsa (Safari, MD9)

-

Tata Motors (Starbus, Winger)

-

Ashok Leyland (Gajra, Viking)

-

Daimler (Mercedes-Benz Sprinter, Mercedes-Benz Vito)

-

Yutong (ZK6120, ZK6800)

-

Dongfeng Motor (DFH6120, DFH6120)

-

Suzhou Golden Dragon Bus (XML6127, XML6822)

-

Hino Motors (RG 6, Hino RK)

-

Nissan (NV3500, NV400)

-

Setra (S 515 HD, S 416 GT-HD)

-

MAN Truck & Bus (Lion’s Coach, Lion's City)

-

Isuzu (Erga, NQR)

-

Foton Motor (AUV Bus, BJ6129)

Some of the Raw Material Suppliers for Tourist Bus Companies:

-

BASF

-

ArcelorMittal

-

Thyssenkrupp

-

SABIC

-

POSCO

-

Dow Chemical

-

DuPont

-

3M

-

Linde Group

-

Saint-Gobain

RECENT TRENDS

-

In February 2024, Daimler Buses delivered 265 Setra and Mercedes-Benz buses to private South Tyrolean companies, enhancing the region’s transportation network. The fleet will support local and tourist travel across South Tyrol, with a focus on sustainability and accessibility.

-

In March 2024, Volvo Buses launched the new BZR Electric platform, entering the intercity e-bus segment with low-entry and high-floor configurations. The platform is designed to meet the growing demand for sustainable transport solutions in both urban and long-distance operations.

-

In October 2024, Ashok Leyland partnered with FlixBus India to enhance inter-city travel, providing advanced bus chassis and after-sales services to local operators. This collaboration aims to improve efficiency and sustainability in India’s growing bus transport sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 35.89 Billion |

| Market Size by 2032 | USD 69.79 Billion |

| CAGR | CAGR of 7.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Propulsion (ICE, Electric, Hybrid) • By Seating Capacity (32-seater, 20-seater, 40-seater, Other) • By Application (Scheduled bus transport, Intercity, School transport, Tourism, Private purposes, Others) • By Vehicle Type (Motor coaches, Minibuses, Double-decker buses) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mercedes-Benz, Volvo, Scania, MAN, Iveco, BYD, King Long, Temsa, Tata Motors, Ashok Leyland, Daimler, Yutong, Dongfeng Motor, Suzhou Golden Dragon Bus, Hino Motors, Nissan, Setra, MAN Truck & Bus, Isuzu, Foton Motor. |

| Key Drivers | • Global Tourism Infrastructure Investments Driving Growth in the Tourist Bus Market with Enhanced Connectivity • Rise of On-Demand Mobility Services Transforming Tourist Bus Market with Flexible Booking and Customized Routes |

| Restraints | • Infrastructure Challenges and Competition Hindering the Growth of the Global Tourist Bus Market |